The Dry Bulker Investment Thesis Proves Compelling After The Deep Pullback

We previously covered Golden Ocean Group (NASDAQ:GOGL) in March 2023, highlighting the early hints of the dry bulker recovery, attributed to its promising FQ2’23 TCE rates.

In the recent earnings call, GOGL reiterated its excellent FQ2’23 Capesize TCE rates of $20.01K (+46.9% QoQ/ -19.3% YoY) and Panamax TCE rates of $14.6K (-12.2% QoQ/ -38.3% YoY).

FQ3’23 looks even more promising at $22.3K (+11.4% QoQ/ -27.2% YoY) and $19.6K (+34.2% QoQ/ -28.9% YoY), respectively. These numbers look stellar indeed, compared to the latest spot rates of $15K and $12.5K by July 05, 2023, respectively.

Based on the contracted rates, we may see GOGL generate an average TCE of $17.08K in FQ2’23 (+14.4% QoQ/ -41.9% YoY) and $20.68K in FQ3’23 (+21% QoQ/ -10.1% YoY), suggesting a massive improvement from pre-pandemic averages of $16.53K in 2019 and $12.37K in H1’19.

While these numbers remain a distance away from 2021 averages of $27.58K and 2022 averages of $24.26K, we are not overly concerned, due to the potential improvement in the dry bulker’s cash flow moving forward.

For example, thanks to GOGL’s efficient cash breakeven of $14.3K for Capesize, $10.5K for Panamax, and younger average fleet age of 6.5 years, the dry bulker has guided an annualized $229M of Free Cash Flow generation based on an average TCE rate of $20K.

Most notably, the dry bulker’s more fuel efficient fleets have been able to command higher TCE rates of $14.92K in FQ1’23, in comparison to Eagle Bulk Shipping Inc. (NYSE:EGLE) at $12.91K and Genco Shipping (GNK) at $13.94K at the same time.

GOGL’s number is nearly in line with Star Bulk Carriers’ (SBLK) TCE rates of $14.19K as well, due to the latter’s fully scrubber-fitted vessels and lower fuel pricing.

Meanwhile, GOGL’s balance sheet remains more than decent, with cash/ equivalents of $118.42M (-13.5% QoQ/ +10.3% YoY). While it may record elevated debt and finance lease liabilities of $1.3B (+8.3% QoQ/ -7.1% YoY), these are mostly attributed to its fleet renewal through new Castlemaxes and Kamsarmaxes, scheduled for deliveries through the next few quarters.

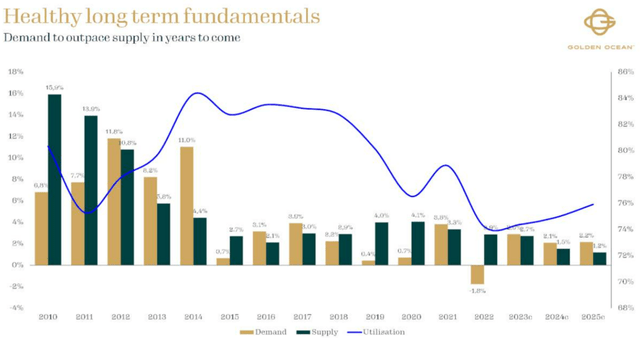

Dry Bulker Supply & Demand Imbalance

GOGL

As a result of the prudent ship-building strategy at a time of peak recessionary fears, we believe that GOGL is well positioned to take advantage of the global economy reopening once the peak recessionary fears are moderated by 2024.

Additionally, the global dry bulk fleet supply may remain tight through 2025, potentially boosting its fleet utilization to 75% then, closer to pre-pandemic levels of 80%. These optimistic developments may boost the dry bulker’s top and bottom line, supporting its variable shareholder returns as well.

Then again, GOGL investors must also rein in their expectations for FQ2’23, since the management expects 6 ships to dry dock, naturally increasing its off-hire days. In addition, its interest expenses may continue to rise in the intermediate term, with an annualized sum of $82M already reported by the latest quarter (+16.4% QoQ/ +103.9% YoY).

These factors may pose further headwinds to its profitability, since it is unknown when the Fed may pivot with the fight toward a 2% inflation rate still ongoing. Lastly, the hyper-pandemic TCE rates and dividend payouts are unlikely to occur again, with things likely to decelerate to a new normal.

As a result, GOGL investors may want to reset their expectations accordingly.

So, Is GOGL Stock A Buy, Sell, or Hold?

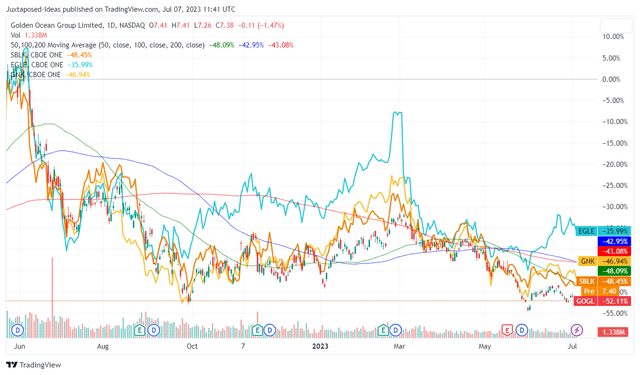

Dry Bulker’s 1Y Stock Price

Trading View

For now, thanks to the baked-in pessimism from the rising inflationary pressures and Powell’s commentary of two more rate hikes in 2023, it is unsurprising that many dry bulkers’ stock prices, including GOGL, have underperformed for the past year.

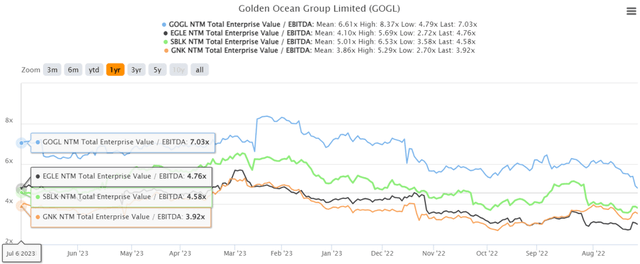

GOGL NTM EV/ EBITDA Valuation

S&P Capital IQ

Then again, we suppose the pessimism has been overly done, since the GOGL stock now trades at NTM EV/ EBITDA of 7.03x, compared to its pre-pandemic levels of 8.75x. The same has been observed with its dry bulker peers as well.

This is despite the market analysts’ optimistic projection for the former, with FY2023 adj EBITDA of $389.77M (-31.8% YoY) and FY2024 of $405.95M (+4.2% YoY), compared to FY2019 levels of $212.5M.

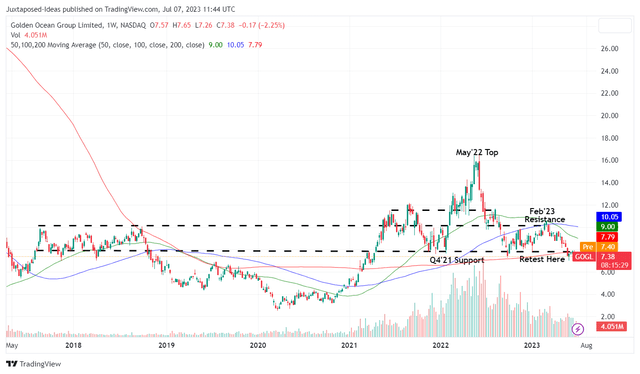

GOGL 6Y Stock Price

Trading View

Combined with the robust support levels at $7s, we are cautiously rating GOGL as a Buy here. Naturally, the stock is only suitable for income investors who are comfortable with variable dividends, due to the highly cyclical (and volatile) nature of the dry bulk industry.

These depressed levels also offer excellent forward dividend yields of 5.34% against the sector median of 1.65%, EGLE at 0.85%, and GNK at 4.27%, though lower than SBLK’s at 8.07%.

Read the full article here