Coming off another solid beat and raise quarter, Southeast Asian consumer service ‘super app’ Grab Holdings (NASDAQ:GRAB) looks poised for a great year ahead. Having survived the steepest rate hike cycle in decades, Grab is now a leaner, meaner machine. And backed by a growing net cash position, management is gearing up for further share gains at the expense of competitors, many of which are facing significantly narrowed runways.

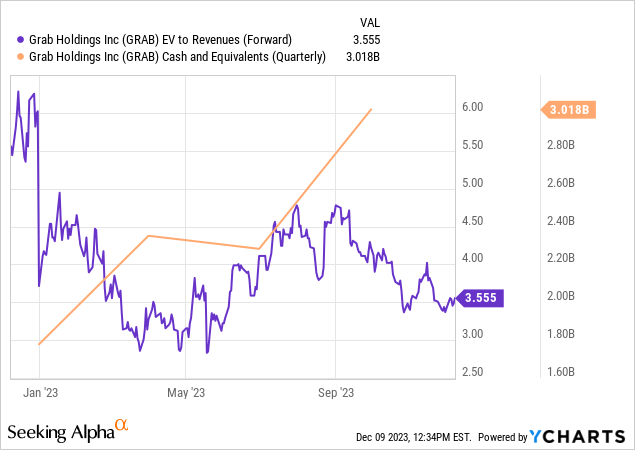

Now that management has delivered on its positive adj EBITDA promise as well, the company has set its sights on turning positive free cash flow next year – a feat that, while ambitious on paper, looks well within reach as more operating leverage benefits kick in. Yet, the stock is slightly down since I last covered the name (here and here), reflecting skepticism on the company’s outlined path to free cash generation. For patient, long-term oriented investors, current historically discounted valuations offer a compelling entry point into Southeast Asia’s internet economy leader. With rate cuts on the horizon as well, Grab is a prime re-rating candidate.

Growth Across the Board; Adjusted EBITDA Turns Positive

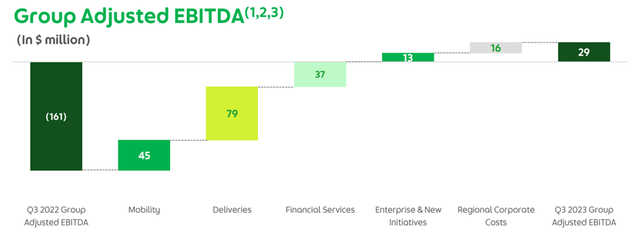

Grab ended Q3 on a high across all its core businesses. Mobility (i.e., ride-hailing) adjusted revenue growth reached +31% YoY, driven by increased tourism-driven demand in Southeast Asia, as well as higher domestic activity. This time around, the company also successfully improved driver supply in response to demand, boosting the top line. Segment-adjusted EBITDA rose +33% YoY as a result, underpinning a low teens % EBITDA margin (up sequentially from Q2 2023).

Growth was even higher in its Delivery segment, where revenue growth surged to +79% YoY despite cutting back on incentives. Adjusted segment EBITDA also moved further into the black, showing ~70bps of margin expansion to 3.4%. Across both segments, higher user engagement and activity from the increased penetration of Grab’s value-based GrabUnlimited subscription offering is also boosting overall P&L numbers.

Grab Holdings

Outside its core business segments, enterprise and new initiatives are also growing strongly (albeit off a low base) at +83% YoY. The key here is the strong performance advertising momentum, a key management focus in recent quarters, as Grab looks to monetize its trove of user and transaction data throughout Southeast Asia. Elsewhere, losses from financial services (i.e., payments and digital banking) are narrowing, helped by an increasingly variable cost structure post-optimization initiatives this year. Given Grab had also been on the verge of another major digital bank launch in a Southeast Asian country during the quarter, keeping its costs well-contained was impressive. Net-net, group level adj EBITDA turned profitable at $29m in Q3, and quarterly GMV hit a new record – far outpacing consensus estimates on all counts.

Grab Holdings

Guidance Raised; Growth and Profitability in Focus

Following a solid Q3 beat, Grab has moved its full-year guidance bar higher. Specifically, 2023 revenue has been revised higher to a $2.31bn-$2.33bn range (up from $2.2bn-$2.3bn prior). Adjusted EBITDA losses have also been pegged at a lower $20m-$25m (down from $30m-$40m of adj EBITDA losses prior) after Q3 turned positive adjusted EBITDA for the first time.

Grab Holdings

While management hasn’t yet outlined post-2023 numbers, commentary on the Q3 call suggests there are levers available to unlock more margin expansion and free cash flow – without sacrificing growth. Given this year’s performance, I have no issue underwriting more top and bottom-line gains in 2024 across the core Mobility and Delivery segments. As more digital banks launch, however, financial services might add some income statement volatility before the segment’s recent trend of lower losses resumes. Advertising revenue is probably the most exciting high-margin/high-growth opportunity in the pipeline, though, as penetration is coming off a very low base and comes with limited incremental costs.

More broadly, the full extent of benefits from this year’s corporate cost cuts has also yet to flow through to the P&L, so there’s still ample operating leverage upside available. From the Q3 call:

“With Grab now achieving positive adjusted EBITDA, we will manage the business with three key financial guardrails: first, by continuing to generate sustainable adjusted EBITDA; second, achieving our next milestone of positive free cash flow; and third, continue to drive operating leverage in the business.”

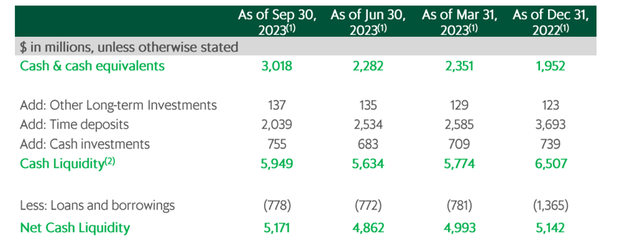

Backed by a net cash balance sheet, management should have no issues balancing profitability with growing the business via internal or external investments. In contrast, many of its peers in the ride-hailing and food delivery space are facing capital crunches, offering potential consolidation opportunities down the line (e.g., recent news flow regarding a Foodpanda acquisition from parent company Delivery Hero (OTCPK:DLVHF)) – key in ‘winner-take-all’ categories. Alongside the growing platform synergies available to Grab, the company has a clear path to strengthening its foothold in Southeast Asia.

Grab Holdings

The Quest for Free Cash Flow Begins

Grab continues to fire on all cylinders, delivering another beat and raise in Q3. The key change this year, though, is the company’s evolution from another ‘growth at all costs’ story built on fast-growing Southeast Asian addressable markets to a potentially very profitable company over time. Helped by a more benign competitive environment and a rightsized cost structure, this ‘super-app’ now has a clear path to delivering free cash flow next year. From a market perspective, cash-rich Grab is also on track to consolidate its key categories in Southeast Asia, with smaller competitors heading for the exit. The stock may not screen cheaply on trailing numbers, but investors willing to underwrite the growth runway a couple of years out should find a lot to like here.

Read the full article here