Summary

Graphic Packaging Holding Company (NYSE:GPK) is a leading provider of paper-based packaging solutions, mainly for the food, beverage, and consumer product segments. It specializes in the design and manufacturing of folding cartons, foodservice packaging, and other paper-based products.

As a direct result of GPK’s third quarter results, which reported declining sales and margins, its forward P/E was trading at a steep discount to peers’ medians. However, when I dive deeper into their metrics, GPK is performing in line with peers in terms of outlook and margins. Thus, I believe GPK was oversold due to the negative news. Keep in mind that as GPK operates in the packaging sector, it is natural for its business to be cyclical and in response to macro conditions. Although current demand is weak, management expects it to recover in 2024. In addition, GPK has been taking proactive steps to prepare itself for growth when the macro landscape improves. It has invested in a new recycled paperboard machine that is expected to improve its margins. It has also acquired one of the largest independent packaging companies that specializes in folding cartons. With these in mind, I am recommending a buy rating for GPK.

Financials

Historically, GPK’s revenue has seen robust growth. Its CAGR over the last 4 years was around 11%. Its gross margin has been improving gradually, from 2018 15.8% to 2022 19.46%, and this shows that it is effectively managing its COGS. In terms of operating margin, it also echoes the same strength. It has improved from 2018 8.12% to 2022 11.17%. This is the same for its net margin, which improved from 2018 3.67% to 2022 5.53%. Overall, GPK is a well-managed company; not only is it able to grow revenue, but it has also managed to improve its margins.

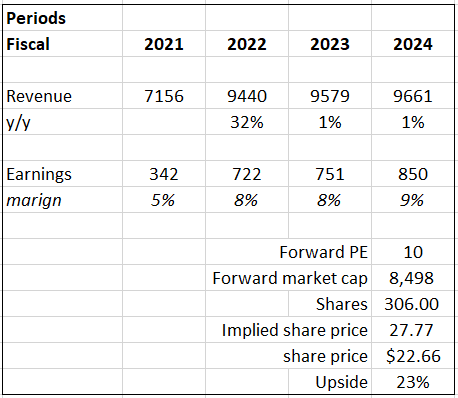

Valuation

Based on my view of the business, I anticipate a 1% growth in GPK’s revenue for FY23 and FY24, aligning with the general market consensus. This projection is influenced by the weak demand reported in the third quarter, which negatively impacted its revenue and net income. The demand is expected to remain flat for the next quarter. However, in the long term, management expects volume to recover. Its investment in the new recycled paperboard machine is expected to bring in margin expansion as it is much more efficient and operates at a lower cost. With its acquisition of Bell, it provides GPK with access to the fiber-based packaging market, which is expected to grow robustly. However, due to challenging macroeconomic conditions such as high inflation, which leads to lower demand, this is creating headwinds for GPK’s growth in the near term. As a result, management guided 2023 net sales to $9.6 billion, which indicates approximately 1% growth. I believe that only when the macro conditions improve will GPK see the benefits from its new K2 machine and Bell acquisition

Based on author’s own math

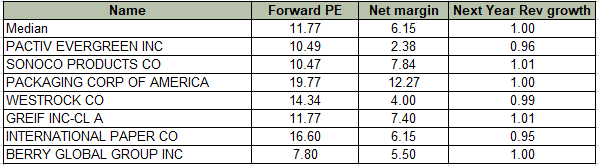

Peers overview:

Factset

GPK now trades at 7.8x forward P/E, which I expect to rise closer to peers’ median of 11.77x because GPK’s financial indicators are in line with peers’ median. GPK’s net margin of 6.63% is in line with peers’ 6.15%; GPK’s next year growth outlook is 1% vs. peers’ 0%. Therefore, there is no basis for GPK to be trading so much lower than its peers. By using 11.77x, the upside potential is 23%, hence I am recommending a buy for the company.

Comments

In the third quarter of 2023, net sales were down 4% year on year, and net income was down 12% year on year. Demand is generally still weak but getting better. Even though GPK doesn’t have an immediate overview of volumes, October’s performance is in line with the organic volume guide for the fourth quarter. Furthermore, management also noted and identified that some clients have increased their promotional efforts and spending, which should help boost demand.

The fourth quarter is not expected to see an improvement in open market sales tons, which is a measure of volume. However, management expressed confidence that US retailer destocking has been completed, which will help alleviate some of the pressure volumes are facing. Furthermore, an easier year-on-year comparison for the next quarter will help with the downward pressure on volume as well. Therefore, for the next quarter, although management is not expecting to see improvements in volume, the completion of destocking and easier comps will help to sustain it, so I don’t foresee any more declines in it. In the longer term, management anticipates that volume will return to its long-term goal of 1 to 2% in 2024, assuming a flat market with new products and recent business wins driving the growth.

On the flip side, the 550 kiloton [kt] K2 recycled paperboard machine at Kalamazoo is now fully ramped and functioning as planned. This is good news, as it has increased its net CRB capacity by 70,000 tons. Over the long run, I expect these newer K2 to improve GPK’s expenses, as its previous paperboard machines were less efficient and operated at a higher cost. Although it is running at a lower cost, K2 machines are operating at a higher level of efficiency and quality. Therefore, I expect margins to improve as the new machines are able to produce more at a lower cost.

GPK also announced the completion of the Bell acquisition, one of the largest independent packaging companies that specializes in folding cartons. One of Bell’s key markets is fiber-based mailers, and in this segment, it has a long supply partnership with the US postal service. Furthermore, e-commerce giants are shifting away from plastic to fiber-based mailers in an effort to go green and promote sustainability. Thus, this acquisition gives GPK access to the fiber-based mailer market, which is starting to gain popularity. The fiber-based packaging market is expected to reach $527 billion from the current $377 billion. With such robust growth, I believe the acquisition of Bell will drive GPK’s long-term revenue growth. In addition, the acquisition effectively increases GPK’s market share in the packaging market.

Risk & conclusion

If inflation worsens, it will severely weaken retail spending. GPK’s business has a direct correlation to the strength of the overall market. If GPK continues to report weaker-than-expected results, its current low P/E could remain at that level. In the worst-case scenario, its P/E might contract further.

GPK’s third quarter decline was mainly driven by weak demand. However, demand is recovering slowly. Its open market sales tons are expected to recover in 2024 as US retailer destocking has been completed. On a brighter note, its new K2 recycled paperboard machine is fully functional, and it has added more capacity for GPK. In addition, this new machine is expected to reduce costs without sacrificing efficiency or quality, so I expect it to improve GPK’s margin. The acquisition of Bell has positioned GPK well in the fast-growing fiber-based packaging market, as many companies, especially e-commerce giants, are switching to fiber-based packaging in order to be sustainable. Overall, I am recommending a buy rating for GPK.

Read the full article here