Investment Thesis

Great Elm Capital Corporation (NASDAQ:GECC) suffered from portfolio write-downs and underperformance last year. Since then, the company has improved their portfolio diversification and increased their investment weighting to 1st Lien debt. As a result, the company has posted better financial results and the stock is looking undervalued to peers.

Company Summary & Sector Dynamics

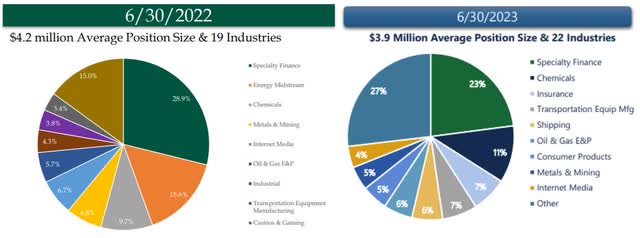

Great Elm Capital Corporation is a business development company, making debt investments into middle market companies and primarily focusing on income generation and capital appreciation opportunities through corporate credit and specialty finance. As of Q2 23, GECC has a portfolio fair value of ~$236 million, and NAV of ~$93 million, consisting of 66 investments in 47 companies across 22 industries.

The company ran into significant trouble and underperformance in 2022, including a significant write-down and realized losses in a major investment in a satellite operator, Avanti. Since then, GECC management have reset their strategy and results have stabilized and started to improve in 2023. Despite the stock underperformance since 2022, GECC looks to have turned a corner, as the stock is up ~14% year-to-date. In this period, it has also outperformed the broader S&P 500 Financials Index, which is flat so far this year.

GECC Share Price 2022-2023 (Bloomberg) GECC vs. S&P 500 Financials Index (Bloomberg)

Disregarding the company’s individual performance, GECC is positioned in the positive and growing financial segment of Private Credit. The long-term trend since the financial crisis has shown that larger banks have retreated from direct lending to small and middle market firms, primarily due to stricter capital regulations and reduced risk appetite to this segment. This has allowed firms such as GECC to step in and cater to this client base. At the same time, the nature of these investments are generally floating rate loans, which benefit from the higher interest rate environment that we have experienced since last year, following the Federal Reserve’s monetary tightening program. Whilst returns look increasingly attractive, BDCs also look to protect their risk by structuring their investments primarily into 1st and 2nd lien debt that offer security through collateral and covenants.

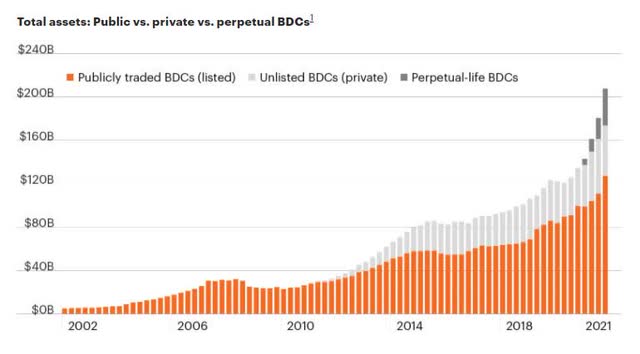

The sector growth for BDCs has been impressive. Mayer Brown indicates that since 2020, private and non-traded BDC AUM has increased from ~$34 billion to ~$118 billion. A similar growth trend has also been experienced in the publicly traded BDC space in recent years. The growing size and importance of this market should act as a positive for GECC, as long as it continues executing on its turnaround plans.

Public & Private BDC Total Assets (FS Investments )

Positive Financial Results

GECC released Q2 23 results earlier this month and they showed promising signs, reporting better than expected results. Quarterly adjusted EPS was $0.44, beating the consensus estimates of $0.38, Gross Revenues came in at $8.98 million, surpassing estimates by 10.7%, and Adjusted Net Income came in at $3.4 million, above the $2.9 million Bloomberg consensus figure.

On a quarter-on-quarter basis, Net Revenues increased by ~34%, Net Income rose by ~21%, and EPS improved by ~19%. As per the below Bloomberg Financial Analysis Summary, year-on-year improvements were significant, indicating that the business is in a much better place than the trouble it experienced last year.

GECC Financial Summary (Bloomberg)

These improvements in their financial position indicate that GECC is on a positive trajectory and the stock should prove to be good value for a long-term recovery play for its price to be trading at higher levels.

Strong Dividend Yield

Whilst I believe GECC is currently undervalued, the stock has a strong income component to add to the picture. On both a trailing twelve months and a forward-looking annualized basis, GECC is paying a highly attractive dividend yield, significantly above the peer group median and average of comparable stocks. This makes GECC a great addition to your portfolio from an income perspective.

Dividend Yield (Bloomberg)

Portfolio Composition

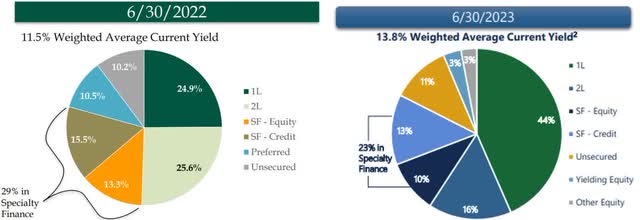

As part of the management strategy turnaround, we can see positive developments in the portfolio mix, both in terms of investment type and diversification of sectors. Comparing the Q2 23 mix versus the Q2 22 equivalent, we see GECC has significantly increased its investment exposure to 1st Lien debt investments. This offers greater protection through covenants and collateral, and place the company in a stronger position in the event of underperformance by their portfolio companies. At the same time, we can see that the average position size has decreased, as well as the investments being spread across more industries in a more diversified manner. Both of these developments should give confidence that the management team have learnt from past mistakes and that the stock should be recapturing higher value.

Investment Type Mix (GECC Investor Presentation) Sector Diversification (GECC Investor Presentation)

Valuation

Using the valuation and peers multiples data on Seeking Alpha, GECC looks significantly undervalued. GECC’s P/E Ratio (GAAP FWD) currently sits at 3.59x, at a discount of ~64% to the sector median of peers. The stock’s EPS estimate for FY 2023 is 1.70, which if we apply to the sector median P/E Ratio (GAAP FWD) of 10.04, we can calculate a target price of $17.07 for GECC. This represents a potential uplift of ~77% from the latest price, and would take the stock to levels last seen at the start of 2022 prior to the portfolio troubles. Even if the stock only recoups a fraction of this undervaluation, the prospect of combining a significant capital appreciation + double digit dividend yield income, could make this stock an important contributor to your portfolio.

GECC P/E Valuation (Seeking Alpha)

Positive Shareholder Buying

I always look to affirm my thesis by analyzing the buying and selling patterns of top institutional players in the stock. Looking at the Top 20 Shareholders, we see multiple names either increasing their positions or recently initiating new positions in GECC. This gives me comfort that these institutional players also see an undervalued play and have the view that there is room for a price recovery, given the recent low levels.

Top 20 Shareholders (Bloomberg)

Risks

Despite the positives above, it is important to highlight two risks. Firstly, on a micro level, there may still be lingering concerns that the GECC portfolio and management execution suffers from underperforming investments similar to last year’s write-down in Avanti. This would result in another sell-off in the stock and hurt its recovery prospects. So far, I believe the executive team have shown enough progression in a relatively short amount of time to indicate otherwise.

Secondly, on a macro level, higher rates are benefitting the portfolio, but it is a fine balancing act. If rates continue to be raised by the Fed or are held at elevated levels for a long period of time, we may see stress at the portfolio level in terms of underlying borrowers having reduced ability to service this more costly debt due to GECC. Again this could lead to restructurings, loss provisions, write-downs, and portfolio underperformance.

In Conclusion

GECC is a strong income stock that ran into trouble last year. Since then, it is clear to see that the management team have rebalanced the portfolio to be more diversified and skewed towards safer debt investment types, which implies that GECC is turning the business around. At the same time, financial results have improved notably in 2023, and the business also benefits from participating in the rapidly growing sector of BDCs/private credit. As a result, the current stock price looks undervalued and warrants regaining some upside and should be trading at levels last seen in early 2022.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here