Greenidge Generation Holdings (NASDAQ:GREE)(NASDAQ:GREEL) is a US-based Bitcoin (BTC-USD) mining operator that is trying to dig out of a fairly large debt hole. In recent weeks, the company has provided its full year 2022 performance, preliminary Q1 2023 numbers, and announced a partnership with Core Scientific (OTCPK:CORZQ). In this article, we’ll look at recent updates and try to assess whether this is a miner that can survive crypto winter.

Brief Introduction

Greenidge has historically operated a vertically integrated mining facility in New York and a second facility in South Carolina that utilizes a power purchase agreement with a third party. Crypto winter hit this one hard and the company has been trying to sell off assets in an attempt to pay down debt. In addition to asset liquidations, there has been a debt restructuring plan that has taken place over the last several months.

This debt restructuring has forced GREE to adapt its business model a bit from a vertically integrated operation to one with more of a hybrid model. Greenidge has both a self-mining operation and now a hosting business.

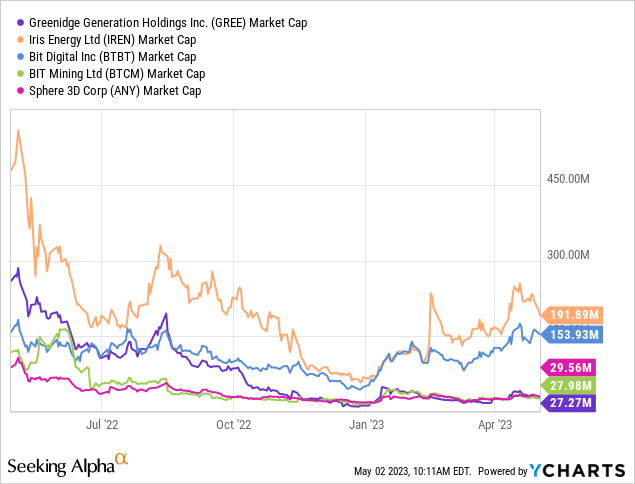

At a market cap of just $27.3 million, the company has a seen its valuation decline below other distressed miners like Sphere 3D (ANY) and BIT Mining Ltd (BTCM).

Debt Restructuring

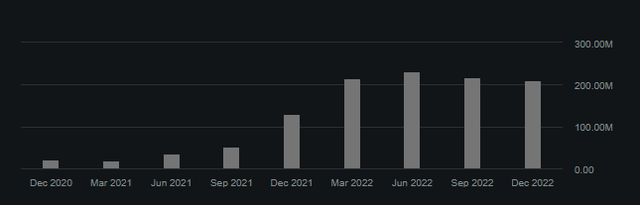

At the end of 2022, Greenidge had $211 million in total liabilities.

GREE Total Liabilities (Seeking Alpha)

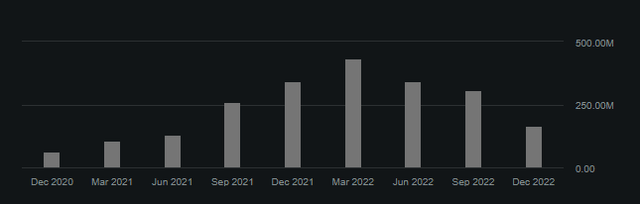

While that figure had come down from a high of $233 million at the end of June 2022, but there was a larger decline in the company’s total assets from $343 million at the end of June to just $164 million at year end.

GREE Total Assets (Seeking Alpha)

The company is clearly distressed and has taken several recent steps to reduce debt and raise cash. In recent months, GREE has announced restructurings with NYDIG and B. Riley (RILY) that reduces their obligations with each of those lenders:

These agreements have effectively reduced our secured debt balances with these lenders from approximately $87 million to approximately $26 million and have the strong potential to allow us to further reduce our debt.

For B Riley, Greenidge has reduced a promissory note obligation from $11 million down to $9 million. The key detail here is how the payment schedule has been modified. Greenidge doesn’t have to start paying back that loan until June of this year. However, if it pays down $6 million in principal before June 20th, it will see a reduction in monthly payments from $1.5 million to just $400k.

Pertaining to NYDIG, that restructuring resulted in Greenidge transferring the majority of its mining machine ownership to NYDIG. Those machines have a potential mining capacity of 2.8 EH/s and are now operated by Greenidge through a hosting agreement with NYDIG.

Beyond debt restructuring, the company is also trying to sell assets to raise capital. In January it brought in $2.6 million from the sale of assets owned by support.com, a Greenidge-owned subsidiary. That business also appears to be in trouble after the company disclosed that support.com’s largest customer did not renew its contract at the end of 2022.

Additionally, Greenidge owns land that it does not need for mining operations at its South Carolina facility and is actively trying to sell it. If the company can successfully liquidate that asset, the proceeds go straight to B. Riley per the restructuring agreement:

The Company estimates that it would repay approximately $6 to $7 million of the Promissory Note if it were to complete a sale of the excess real estate

Preliminary Q1 Performance

According to the company’s preliminary Q1 results, these moves have helped bolster Greenidge’s balance sheet. At the end of March, GREE has $17 million in cash – up from $15.2 million at the end of Q4-22. Greenidge also cites just $97 million in debt still outstanding and an $8 to $9 million net loss for the quarter.

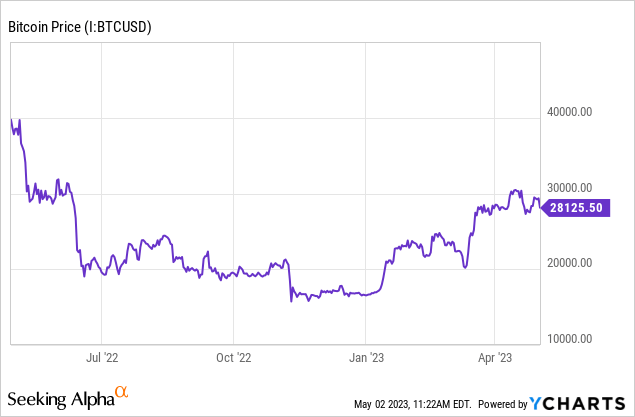

Revenue is stated to be $15 million and broken out by three segments. Of the full quarter performance, $7 million came from hosting services, $6 million came from self-mining, and $2 million was power and capacity revenue. Given the 285 BTC mined during the period, the simple math indicates Greenidge achieved an average Bitcoin selling price of a little over $21k in the quarter.

Given Bitcoin’s price history, it would appear most of these sales came in the first half of Q1. I believe this indicates fairly limited revenue upside for Greenidge if the BTC price continues higher but it could possibly insulate the company somewhat well if BTC declines.

However, last week Greenidge announced an additional agreement for hosting. This one sees Greenidge as the buyer rather than the seller of capacity. Through the one year agreement, approximately 1 EH/s of mining capacity from Greenidge-owned machines will be hosted by Core Scientific.

It’s not clear exactly how much revenue this mining capacity will generate for Greenidge, but if we assume efficiency numbers that are similar to what we saw from the preliminary Q1 results, I think we can reasonably expect 90-95 BTC per EH/s each month.

| BTC Price | $25,000 | $27,500 | $30,000 | $32,500 | $35,000 |

| Self-Mined Rev/Qtr | $6,750,000 | $7,425,000 | $8,100,000 | $8,775,000 | $9,450,000 |

Source: Author Calculations at 90 BTC per EH/s

That could provide Greenidge anywhere from $6.8 to $9.5 million in monthly revenue from that hosted exahash at Core. However, it is important to mention that Greenidge did say there is a proceed sharing component to the agreement and this recent initiative will add $7 million in incremental profitability annually.

“No” On The Common, “Maybe” on the Senior Notes

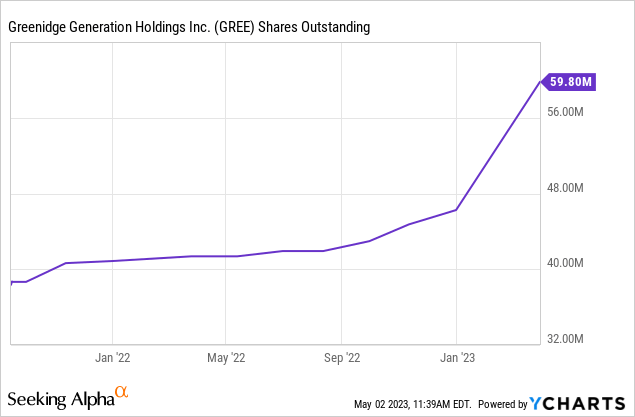

Part of the plan in debt restructuring has resulted in common share issuance. B. Riley received 1.3 million in early February. Between October 1st, 2022 and March 30th 2023, more than 16.3 million shares were created:

This increased the total shares of the GREE common stock outstanding by 34% from the end of Q3-22. In the event that the company fails, the common is going to get wiped out. In the event the company succeeds in digging out of its debt burden, the common could also get wiped out through dilution. There is possibly a better play here if you want to bet on Greenidge coming out of crypto winter alive, at that’s the senior note shares:

GREEL (Seeking Alpha)

Back in 2021, Greenidge sold $72.2 million of 8.50% senior notes due October 2026 and those notes trade under the ticker symbol GREEL. Given the market expectation of a Greenidge bankruptcy, those senior notes traded all the way below $1 in December. The recovery in those shares year to date had been impressive as the notes are now trading at $5.25 as of article submission. While that’s still almost 80% below par and very indicative of a market that understands what Greenidge is up against, the $0.531 quarterly payment might be attractive to yield seekers with a high threshold for volatility.

Summary

I think the risks in this name are entirely apparent at this point. That said, Greenidge appears to be doing everything it can to dig out of the hole that it is in. It’s a good sign that the company’s lenders seem willing and able to work with Greenidge. I don’t personally have exposure to this company, but if one wants to wager on its survival, the senior note shares are actually pretty interesting.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here