Griffon Corporation (NYSE:GFF) is a rather small but diverse company that has a market capitalization of $2.58 billion and two different operating segments. The first of these, Home and Building Products, is a producer and seller of garage doors and rolling steel doors throughout North America. The other segment is known as Consumer and Professional Products and, according to management, it offers up a variety of brands centered on consumer and professional tools, industrial and commercial fans, home storage and organization products, and other related items.

Although I never purchased shares of the business, I do have a pretty solid track record when it comes to deciding whether or not it represents a solid investment opportunity. Back in March of this year, for instance, I wrote an article in which I rated the enterprise a ‘strong buy’. From that time until I wrote about the company again at the end of August, shares generated a return for investors of 43.5% compared to the 13.1% seen by the S&P 500. In my August article, I mentioned that the easy money had been made but that the stock still offered upside potential. This led me to downgrade the firm to a ‘buy’. And since then, things have gone better than I could have anticipated. While the S&P 500 is up only 2.4%, shares of Griffon have generated upside of 25.8%, bringing total upside since my March article of 82.4% relative to the 16.3% seen by the broader market.

Fast forward to today, and we are seeing some deterioration of the firm. The good news is that bottom line results look to be setting up for a rather solid 2024 fiscal year. Revenue should still fall from here, but the bottom line is what matters most. To be clear, I do think the stock is riskier than it was previously and upside is definitely more limited. But when you factor in the expected improvement in profitability and how cheap shares currently are, I would argue that additional upside exists from here.

A mixed picture

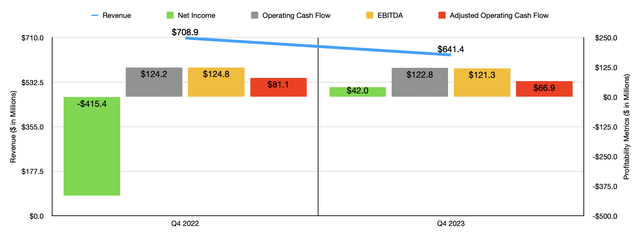

When I last wrote about Griffon, we only had data covering through the third quarter of the company’s 2023 fiscal year. Today, we now have data covering the final quarter as well. So it might make sense to start off there. Revenue for the fourth quarter came in at $641.4 million. That represents a drop of 9.5% compared to the $708.9 million the company generated one year earlier. The big pain for the company during the quarter came from the Consumer and Professional Products segment, with sales dropping 13.2% from $284.8 million last year to $247.3 million this year. Management attributed this largely to decreased volume across all product channels and geographies in which the company operates. Weak customer demand and high customer inventory levels were key contributors.

Author – SEC EDGAR Data

But this doesn’t mean that there wasn’t weakness elsewhere. The Home and Building Products segment reported a 7.1% drop in sales from $424.2 million to $394.1 million. A decrease in residential volume more than offset an improvement in commercial volume. To some extent, Griffon’s fortunes for this side of the business should be tied to the residential housing market. As I have written about in prior articles, demand for housing had plummeted for a few quarters. But we are already starting to see some major improvements in that space. So I would definitely view the weakness here as very temporary. In fact, I wouldn’t be surprised if we start seeing some improvement in the next one or two quarters.

On the bottom line, the picture has been somewhat mixed. The company went from generating a net loss of $415.4 million in the final quarter of last year to generating a net profit of $42 million this year. This massive swing was driven by a meaningful decline in goodwill and intangible asset impairment charges this year. For the final quarter of 2023, they totaled only $9.2 million. By comparison, in the fourth quarter of 2023, they came in at $517 million. Other profitability metrics make the company look worse. Operating cash flow, for instance, ticked down modestly from $124.2 million to $122.8 million. If we adjust for changes in working capital, we get a decline from $81.1 million to $66.9 million. And finally, EBITDA dropped from $124.8 million to $121.3 million.

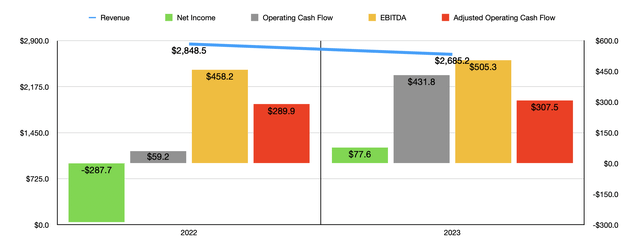

Author – SEC EDGAR Data

As you can see in the chart above, financial performance in 2023 in its entirety was largely better than what the company saw in 2022. Revenue did manage to fall, but all profitability and cash flow metrics ended up coming in higher year over year. Interestingly enough, management seems to think something similar will occur this year. For 2024, revenue is expected to come in at only $2.6 billion. If that comes to fruition, it would represent a 3.2% drop year over year. However, management is forecasting EBITDA of $525 million. That would represent a nice improvement over the $505.3 million the company generated in 2023.

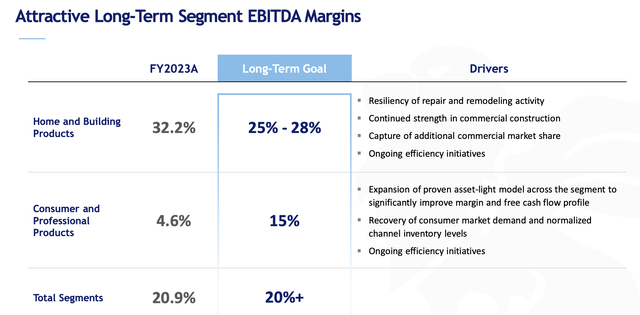

Griffon Corporation

While this might sound far-fetched, it’s important to note that management has been working hard on reinventing some of the company’s operations. In May of this year, for instance, the company decided to expand its global sourcing strategy to include different types of products, including long handled tools. This will cost the company between $120 million and $130 million. But the expectation is that, in the long run, this will help increase the firm’s EBITDA margin for the Consumer and Professional Products segment from the 4.6% calculated for 2023 to 15%. At the same time, the Home and Building Products segment is expected to see a reduction in its EBITDA margin from 32.2% to between 25% and 28%. But on the whole, the bottom line for the company should grow. Unfortunately, no other guidance was given when it came to profitability metrics. But based on my own estimate, adjusted operating cash flow should be around $319.5 million.

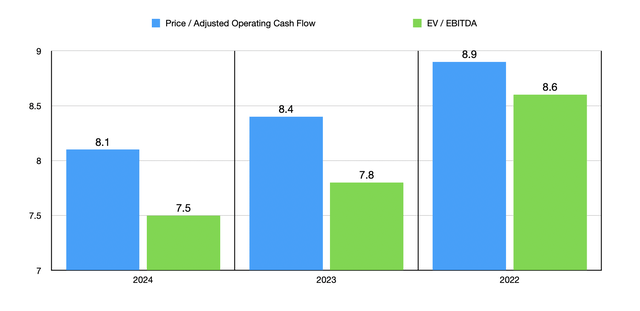

Author – SEC EDGAR Data

Using these estimates, I was able to value the company as shown in the chart above. As you can see, the stock continues to get cheaper year after year. This comes even as revenue is expected to decline year after year. Clearly, the firm’s initiatives to cut costs are bearing fruit. I then compared the company to five similar firms in the table below. And when it came to both profitability metrics, two of the five ended up being cheaper than it.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Griffon Corporation | 8.4 | 7.8 |

| Gibraltar Industries (ROCK) | 8.2 | 12.6 |

| Janus International Group (JBI) | 9.4 | 7.5 |

| PGT Innovations (PGTI) | 10.7 | 10.1 |

| CSW Industrials (CSWI) | 17.3 | 16.0 |

| Apogee Enterprises (APOG) | 6.5 | 6.7 |

Takeaway

From all that I can see, Griffon might be struggling from a revenue perspective. Some of its recent cash flow figures might also be discouraging. But on the whole, the company seems to be growing its bottom line and, even though shares have rocketed higher, the stock looks attractively priced. This is true both on an absolute basis and relative to similar firms. Upside potential is far from what it was previously. But when you factor in all of these positives to the equation and add on top of that the recently-announced $200 million share buyback program management made public, I would still wager that shares should outperform the broader market for the foreseeable future. So because of that, I do still think Griffon stock is worthy of a soft ‘buy’ rating at this time.

Read the full article here