Dear readers/followers,

My first take on Grifols, S.A. (NASDAQ:GRFS) was poorly timed. The company declined immediately after my piece, and my initial stake went down a bit. I did, however, buy some more, and this balancing of capital has led to my current position being a zero loss/profit after the 1Q23 report, which came in a few days ago.

In this article, I’m going to walk you through 1Q, I’m going to remind you of fundamentals, and I’m going to give you my reasoning for a significant upside for this company – eventually.

Grifols is a speculative stock. The reasons for this are clear – the sub-par B+ rating, the debt which is at over 50% its debt/cap, the company’s zero-yield, and the historical volatility – you can use many arguments why this company deserves perhaps only cursory consideration from conservative investors such as myself.

Still, I’m also an investor in great fundamentals. And while the road ahead for Grifols may be rocky, it’s also potentially very rewarding with triple-digit profitability at the end of it.

Let me show you why.

Grifols – Risks and Rewards, 1Q23 report

As I said in my initial article, Grifols is without a doubt a good business. It employs well over 25,000 people here, invests billions in R&D, and generates over €4.5B in revenues on an annual basis.

How can I say that a volatile company with declining margins in every KPI is a good business?

Because it’s profitable.

Grifols takes that €5-6B in annual revenue and runs it through a business model that consumes 63% ~COGS and 25.2% operating expense. That means its gross margins are over 36%, and the operating margins are over 11%, with a 6% pre-tax and a 3.4% net income margin.

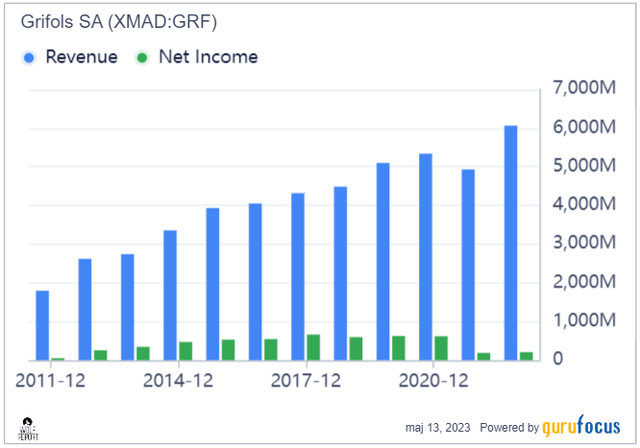

Grifols makes money. And that is more that can be said for a lot of biopharma businesses out there. And while margins for net have been declining since COVID-19, Grifols is a company with a track record of significant revenue growth.

Grifols IR (GuruFocus)

The company is also profitable, despite all of the lower margins you see above. ROIC net of WACC comes to nearly 3% in 2022, which means that even in today’s environment, the company manages to stay above the water. Grifols also generates plenty of growing shareholder equity, and the relationship to assets has stayed fairly consistent over the years. Once we understand that the company is in fact profitable, what remains is understanding its current troubles and how the company may get out of them.

It of course helps if the company’s product or service has some sort of moat or leadership – and without this, I would not be touching Grifols. But Grifols does have market leadership. It is by far the largest company in the Blood Plasma market. And given the importance of this market, I am not only positive, but I’m also excited about investing in Grifols – without allowing it to cloud my judgment.

Blood plasma is a liquid component of blood that doesn’t have blood cells, but it has proteins and other parts of whole blood, in suspension – and it’s about 55% of our body’s blood volume. Plasma is used for two things, primarily – plasma medicines and blood components. It’s vital, and our modern medicine does not work sans plasma.

Now that we understand it’s profitable, and its products and services come with appeal and even a bit of a moat due to scale advantages, what are the challenges?

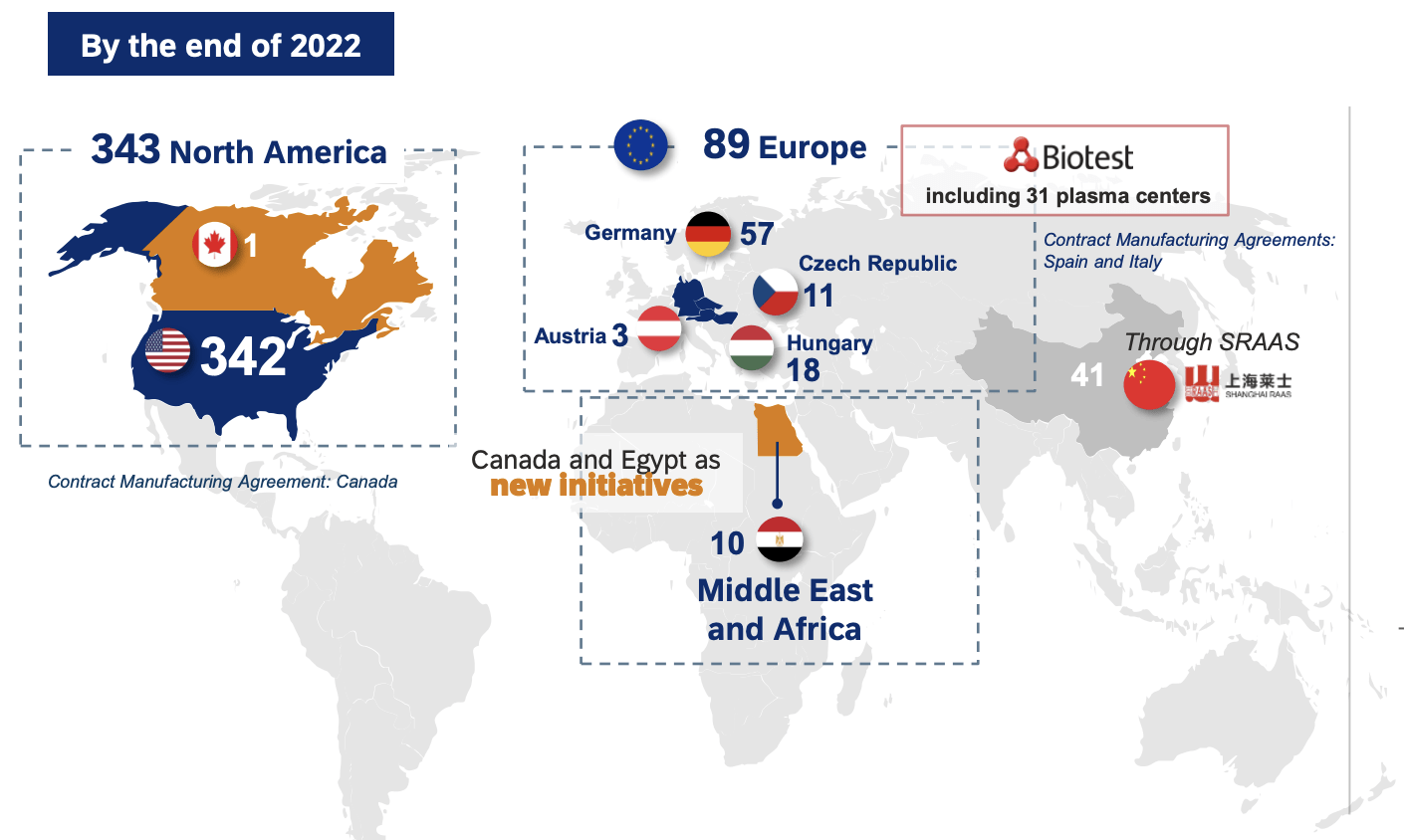

The company’s issues are high-level and related to the international complexity of resource management and donations. You see, the legality of donating blood for money is extremely complex – with most European nations not allowing such things. Here is a good description of where the company operates, usually related to the legality of that.

Grifols IR (Grifols IR)

A typical Grifols blood donation nets you around $50-$90 depending on where you do it – as long as it’s done in one of the above-mentioned geographies that actually allows plasma for cash.

The transformation program has been eating into the margins, and the pandemic was a huge problem because people are not likely to donate blood when they’re afraid to leave the house.

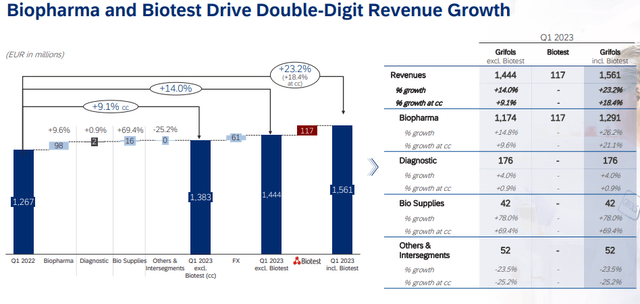

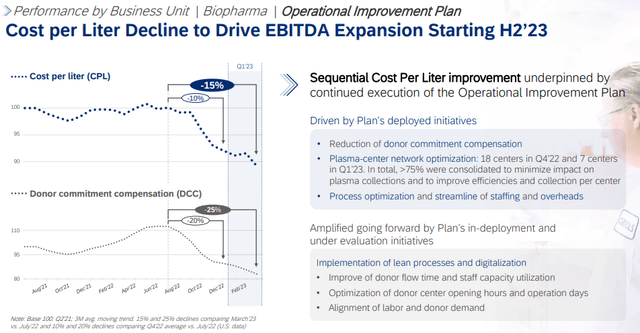

Grifols IR (Grifols IR)

However, these numbers are quickly reverting, and I’m of the crowd that believes in substantial improvement in this field simply due to necessity. You see, there is a massive global shortage of blood plasma – especially in the EU, due to the complex legal nature of the question. Also, Grifols owns almost 30% of all worldwide open plasma centers, as well as nearly a quarter of the worldwide volume of plasma. This means that not only has the company positioned itself for dominance, but it’s ready to go into nations if they legalize cash-for-plasma.

Grifols IR (Grifols IR)

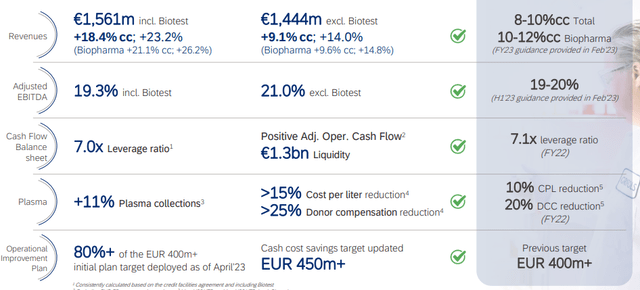

Recent results for the company highlight the ongoing recovery in fundamentals and operations. The company saw a YoY revenue growth of 18.4%, with biopharma expanding results by 26.2%. More importantly, profit margins increased to 21% adjusted EBITDA, with a 19% EBITDA increase, which is really what I was looking for when checking out Grifols.

The fact that the company also increased its annual guidance by 22% for FY23 in terms of EBITDA confirms to me that management sees the same sort of positives and trends on an annual basis that we currently see on quarterly.

Grifols IR (Grifols IR)

Plasma collection is up 11%, with cost per liter down 15%, with donor compensation down due to the availability of donors – all good signs on the operational side, resulting in a positive net profit of €26M, on a quarterly basis at a run rate of over €100M – though this is adjusted and includes one-time non-recurring restructuring costs, which drove reported/IFRS profit down into the negative.

As I said, Grifols is a company in the midst of a restructuring. This needs to be taken into account when investing – you need to allow the company “room to breathe”, and room to recover.

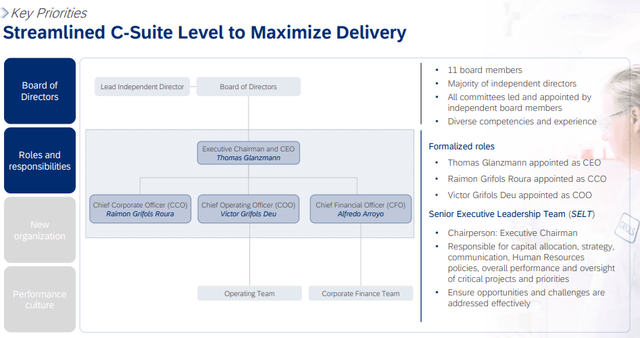

Grifols IR (Grifols IR)

One of the primary issues, debt, saw a decline – but it’s still at 7x, which explains the B+, but the company has liquidity of over €1.3B available to it, with the target to drive leverage down to 4x by the end of 2024E. This would enable the company to pay dividends and to really ratchet up its operations further.

The question becomes if we should “BUY” the company in this phase, or wait for what I view to be inevitable improvements and upward potential.

Let’s look at the valuation thesis.

Grifols – The valuation is compelling and allows for massive, triple-digit outperformance.

Grifols is not a company in distress. It’s a company in the midst of a transformation, but also in the midst of a recovery that’s giving us positive indicators.

Because of this, I am willing to overlook some flaws. Add to this the company’s market share and scale advantages as its semi-moat, and I believe that there is a non-trivial upside to the company over the next few years as more of these positives crystallize in earnings and the market wakes up to Grifols as a potential.

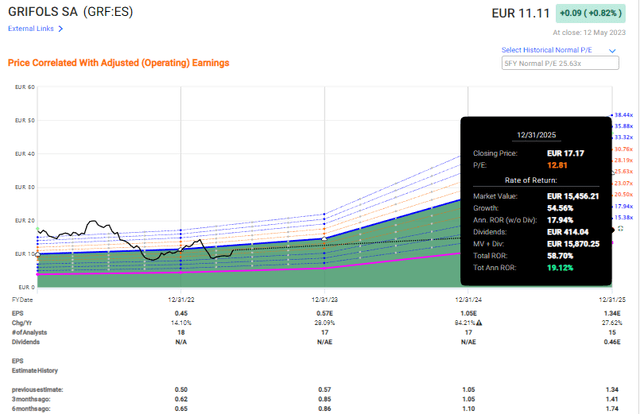

Grifols has long traded at significant premiums. The valuation we’re seeing today is somewhat atypical, given the growth potential in there. When I say growth potential, I am speaking of an upside based on an EPS growth of no less than 29% in 2023, which we’re seeing materialize, and almost triple digits in 2024, followed by another 20-30% in 2025E.

My thesis to you is this.

If this is even close to happening, and if the company trades at even close to the P/E multiples you would give a 30-50% growing company in terms of annual EPS, then your upside is at least 58%, or 19% annually, based on a 12.8x forward P/E for 2025E.

That might not sound exciting relative to the risk I just told you that you’re taking – B+, no yield, leverage out the wazoo – but this is the lowest I would be willing to consider.

F.A.S.T graphs Grifols Upside (F.A.S.T Graphs)

If we’re talking about realistic and historically relevant multiples, we need to talk at least 18-25x P/E – and that entirely changes the picture. At 18x, we’re talking 120% RoR, or 35% per year. At 20x, we’re talking over 150% RoR or 41% annually.

And in the case of full normalization to 25x P/E, which is the 5-year average when the company has been “working as intended”, well then you’re looking at an RoR of 200%, or 54% per year.

That is the range I consider relevant if the company’s forecasts, demand, and performance specifics hold – and that is the key as to why I am positive, but speculative, on Grifols. It’s why I own shares, and why I’m slowly adding more shares. The latest bounce after 1Q is only a small bounce in the bigger picture because the company is capable of more – much more.

My price target of €17/share, based on this assumption, is actually extremely conservative, given that 25x 2025E P/E is more along the lines of €34/share. Just so you know what sort of conservative assumptions I’m baking into the thesis here.

Risks do exist. We need to keep a very close eye on results, indicators, volumes, and margins. Biopharma is notoriously volatile as a segment, and investing in it requires patience. If the company’s targets are not met, we could be down at these levels for months or years – and given the zero dividends, that’s unprofitable.

However, I am convinced enough that there is a substantial upside here, that I am keeping my stance on Grifols intact.

I am not changing my PT – I’m confirming it.

I’m not changing my rating, I’m confirming it.

Grifols is a “BUY” with the following fundamentals.

Thesis

- Grifols is the world leader in Plasma and plasma-related biopharma. This gives the company a clear advantage. However, overleverage has driven credit rating to a B+ and canceled the company’s relatively acceptable dividend, which impacts what we should pay for the company.

- I can only call this non-yielding business a speculative “BUY”, despite an upside in the double digits and an “easily” forecastable upside of over 20% per year until 2023E if the company’s expectations materialize.

- I’m still at a €17/share native PT, which means that I’m positive, and own the stock, but I’m staying very conservatively exposed to make up for the risk I see here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I argue that the only issue is really the dividend since the B+ cannot be said to be equal to not being conservative, given the company’s market position. That makes it a “BUY”.

Read the full article here