Introduction

A big part of my long-term macro thesis is consumer weakness. Prolonged above-average inflation, energy supply issues, food inflation, and other issues are toxic for consumer spending, which is a major driver of economic growth in developed nations.

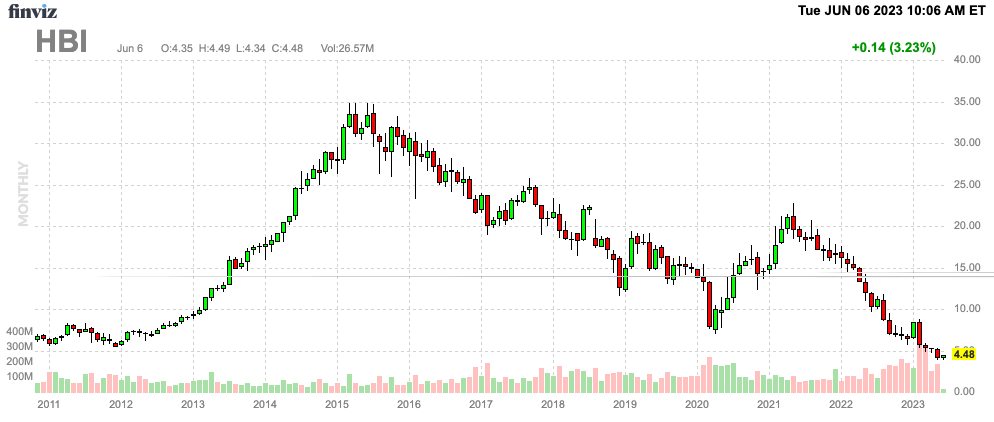

However, I underestimated how bad things would get for Hanesbrands (NYSE:HBI), which is one of the world’s largest apparel companies. The stock is down 30% year-to-date. It’s 62% below its 52-week high and down 88% from its all-time high.

On top of that, the company has suspended its dividend.

The good news is that the company is making progress. It’s reducing debt, focusing on margins, and investing in its business, including smooth supply chains.

When (not if) it gets support from stronger consumer sentiment, the stock price is likely to take off. The problem is finding an entry, as the company isn’t out of the woods yet.

So, let’s dive into the details!

What’s Hanesbrands? And Why Does It Matter?

I have no investments in industries that are based on trends. For example, I do not invest in apparel retail stores or luxury brands.

Not only do I hate shopping, but I’m also not going to try to predict the next fashion trend – let alone depend on it with my hard-earned money.

However, Hanesbrands is different.

Hanesbrands isn’t a company that thrives on fashion trends – at least not the kind of trends other companies are dependent on.

With a market cap of $1.6 billion, Hanesbrands is a company that markets everyday basic innerwear and activewear apparel under various well-known brands, including Hanes, Champion, Bonds, Maidenform, Bali, Playtex, Wonderbra, and more.

Hanesbrands

The company operates in three segments: Innerwear, Activewear, and International.

- The Innerwear segment includes men’s and women’s underwear, socks, and intimate apparel.

- The Activewear segment focuses on T-shirts, fleece, performance apparel, and sports accessories.

- The International segment sells a wide range of products across different regions, including Australia, Europe, Asia, and the Americas.

The company operates globally, selling its products through mass merchants, department stores, specialty stores, e-commerce sites, and its own retail locations and websites.

Essentially, it’s a company that produces affordable yet high-quality apparel for a wide audience. People who need good clothes without having the need to post them on Instagram. I’m painting with a very broad brush here, but I think readers understand what I’m saying here.

HBI is more dependent on general consumer confidence than fashion trends.

The company’s growth strategy, called the Full Potential plan, focuses on four pillars:

- Global expansion of the Champion brand,

- Targeting younger consumers with appealing innerwear products,

- Building e-commerce excellence, and

- Streamlining the global portfolio.

Furthermore, to support this growth, the company has launched a cost-savings program and is investing in initiatives aligned with its Full Potential plan.

When looking at the HBI stock price, we see a huge rally between 2012 and 2015. These were the best years for the (global) consumer. Rates were declining, inflation had peaked, and the housing market made a stunning comeback. After 2015, consumer sentiment weakened a bit and investors had no interest in owning a company like HBI. In 2020, the pandemic hit, which resulted in temporary store closings and an implosion in in-store spending.

FINVIZ

However, it was followed by a steep rally as stores reopened and people went out to spend. Inflation was low, government support helped fuel spending, and most goods were in short supply.

Then, after 2021, inflation skyrocketed, supply chains were damaged, and consumer sentiment started to implode.

It caused HBI to suspend its dividend while its stock price fell below 2012 levels.

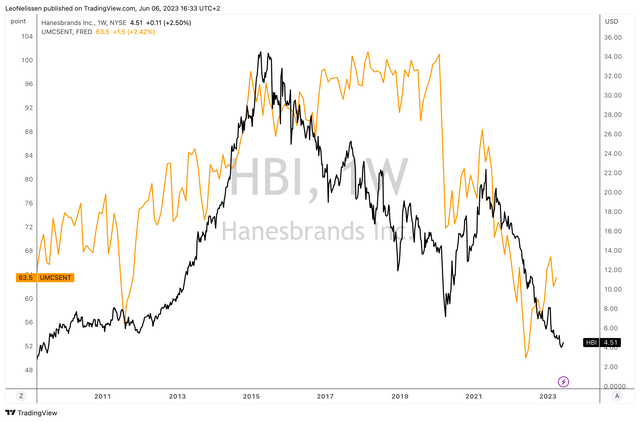

This is what it looks like when comparing the HBI stock price to the University of Michigan consumer confidence:

TradingView (HBI, Michigan Consumer Confidence)

Now, the question is:

How Is Hanesbrands Doing?

While its year-to-date stock price may not suggest it, HBI is improving its business.

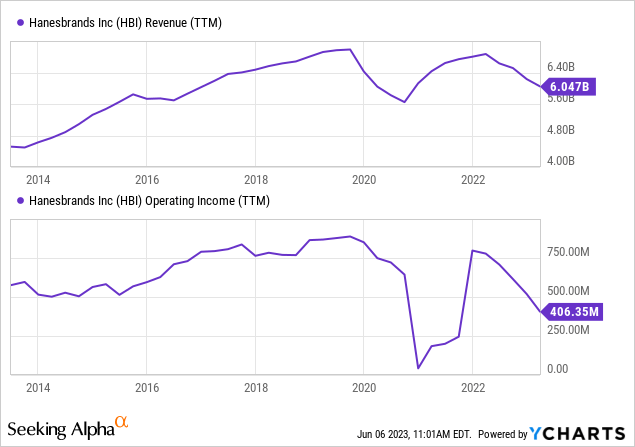

In the first quarter, Hanesbrands demonstrated progress toward its near-term goals. The company achieved revenue, operating profit, and earnings per share that were in line with its outlook.

While the company achieved its goals, numbers were still impacted by severe consumer weakness on a large scale.

- Sales declined 12% Y/Y, mainly due to a macro-driven slowdown in consumer spending in the US and Australia.

- The international business saw a constant currency sales decline of 3%, primarily driven by lower innerwear sales in Australia and reduced sell-in shipments of Champion in China.

- Adjusted gross margin stood at 32.7%, down 440 basis points Y/Y, impacted by cost inflation and sales volume mix.

However, Hanesbrands reiterated its full-year guidance, including net sales of $6.05 to $6.2 billion, adjusted operating profit of $500 to $550 million, adjusted EPS of $0.31 to $0.42, and operating cash flow of roughly $500 million.

The company successfully refinanced its 2024 maturities and experienced benefits from initiatives aimed at unlocking working capital.

Notably, inventory declined sequentially, and positive operating cash flow was generated, bucking the historical trend of cash usage in Q1.

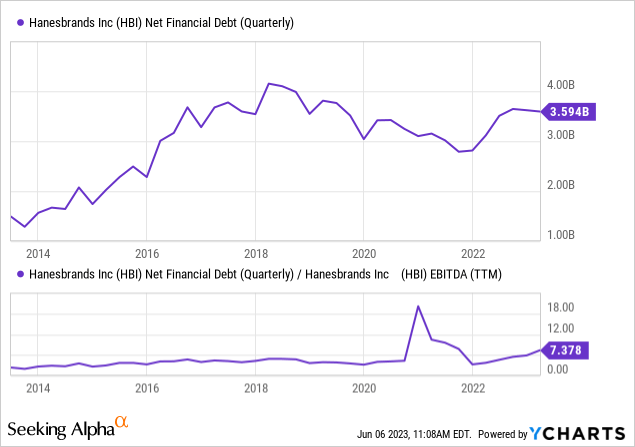

Unfortunately, debt reduction has not resulted in lower leverage, as lower EBITDA has caused the net leverage ratio to jump to 7.4x.

When it comes to the company’s long-term growth targets, Hanesbrands’ growth strategy centers around becoming a more consumer-centric and data-driven organization while enhancing efficiency and profitability.

In the 1Q23 earnings call, CEO Steve Bratspies shared his first-hand experience visiting Hanesbrands’ operations in Australia and world-class manufacturing facilities in Vietnam, Thailand, and Honduras.

As expected, he expressed confidence in supporting the company’s growth in the direct-to-consumer (“D2C”) model, highlighting investments in technology, automation, and distribution center efficiency.

Hanesbrands is leveraging data analytics and machine learning to improve output, drive innovation, and optimize marketing investments through loyalty programs.

Not only is direct-to-consumer an emerging trend, which should allow the company to improve margins on a prolonged basis, but the company is also improving its supply chain using the aforementioned levers.

For example, Hanesbrands implemented the Skip Flow initiative, directly shipping products from factories to customers’ warehouses, reducing costs and increasing delivery speed.

Valuation

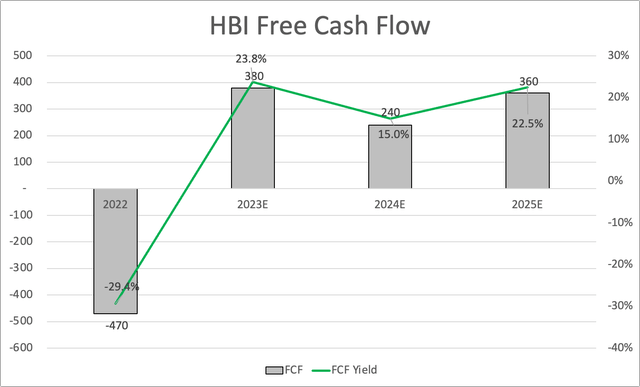

Patience is key. Hanesbrands is expected to grow its free cash flow from negative $470 million in 2022 to positive $380 million in 2023. If everything goes right, the company will be able to keep its free cash flow close to that level, which implies a >20% free cash flow yield. This is also good for the return of shareholder distributions at some point in the future.

Leo Nelissen

Speaking of the dividend, the company has eliminated its dividend to reduce its debt, which means most of its money will go toward debt reduction.

This year, net debt is expected to fall to $3.3 billion, which implies a net leverage ratio of 5.5x EBITDA. In this case, 2023 EBITDA is expected to be $600 million.

Next year, net debt is expected to fall to $3.0 billion, which would be 4.2x 2024E EBITDA of $710 million (+18% versus 2023E).

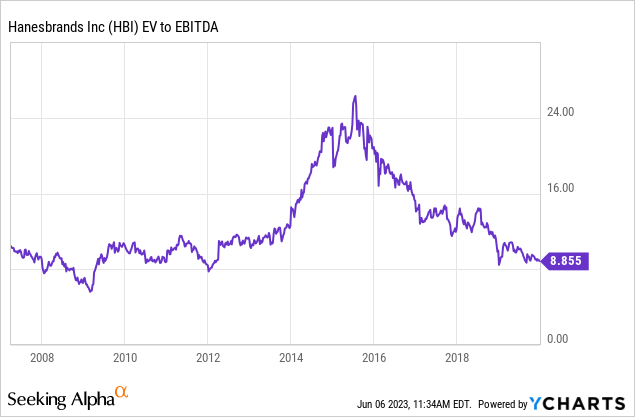

So, using 2024 numbers, the company is on a path to an EV/EBITDA multiple of 6.5x.

If the economy rebounds, I believe HBI will trade close to 8x EBITDA again.

Using these numbers, there’s a path for HBI to trade at $7.50 again in the next 24 months.

The problem is estimating when the stock might take off. Right now, I’m not necessarily expecting another implosion.

However, given that I expect commodities to do well on a long-term basis (as explained in this article – and many others), I’m not betting on a quick recovery in consumer-focused stocks.

Hence, I expect HBI to trade in a volatile sideways trend for at least two to four more quarters. After that, it needs to be seen if improving consumer sentiment can give HBI the boost to what looks like to be a much higher fair value.

Needless to say, investors looking to buy HBI or any of its peers need to be careful and incorporate high risks of prolonged volatility.

Takeaway

Hanesbrands, a major apparel company, has faced significant challenges due to prolonged consumer weakness caused by inflation, energy supply issues, and food inflation.

The stock has experienced a sharp decline, down 30% year-to-date and 88% from its all-time high, leading to the suspension of its dividend.

However, the company is making progress by reducing debt, focusing on margins, and investing in its business, including improving supply chains.

The stock’s future prospects depend on a recovery in consumer sentiment, which could potentially lead to significant growth.

Unfortunately, despite signs of improvement, caution is advised as HBI is not yet out of the woods, and investors should consider the high risks of prolonged volatility in consumer-focused stocks.

Patience may be key, with a potential path for HBI to trade at $7.50 again in the next 24 months, although estimating the timing of a stock turnaround remains uncertain.

So, I wouldn’t call it a dumpster fire, but it’s definitely a wildcard investment that needs to be handled with caution.

Read the full article here