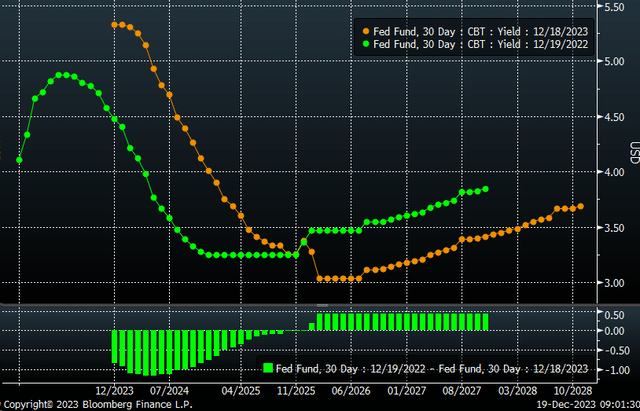

Stocks have screamed higher due in part to mechanical flows and in part due to this crazy belief that the Fed will be aggressively cutting rates in 2024. At this point, it is too soon to know how much the Fed will cut rates in 2024; after all, last year, the market was pricing in a peak Fed’s Fund rate of 4.9%, and today rates are at 5.35%.

Bloomberg

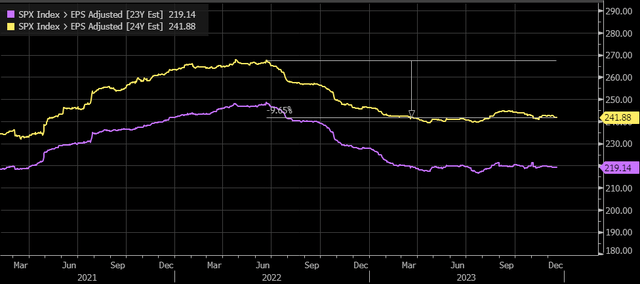

It is just another sign that the market is again out of step with the Fed, which has pushed stocks to the edge. More importantly, earnings estimates for next year are still 9.7% off the high, yet the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) sits less than 5% from an all-time high. Which means the entire rally has been based on multiple expansion.

Bloomberg

So, at this point, the market is betting on two things happening in 2024: deep rate cuts and better-than-expected earnings estimates. Both are possible, but the market has done an abysmal job of predicting over the past few years.

Betting On A Decline

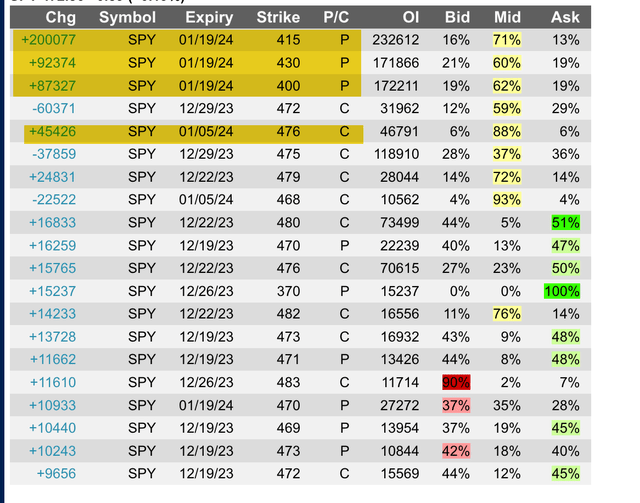

This could have led a trader or traders to make some pretty bearish bets that the rally would fail in a big way by the January 19, 2024, expiration date. This could be a hedge, but from our perspective, it still means that someone sees an elevated risk of a significant market pullback.

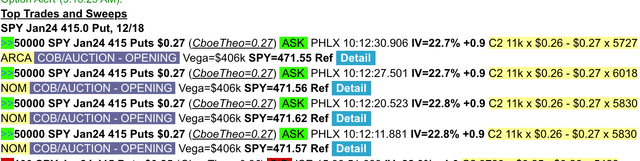

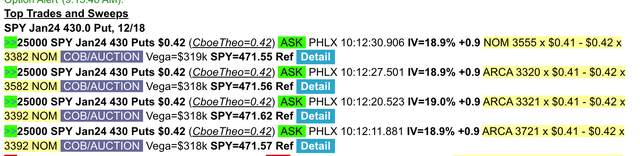

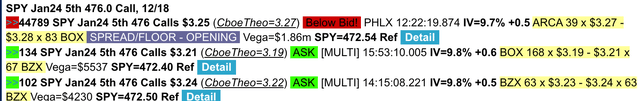

The chart below shows the open interest changes for the SPY ETF as of December 19 for the January 19 expiration date puts for the $400, $415, and $430 strike prices, which increased by 87,327, 92,374, and 200,077 contracts each, respectively. Additionally, the $476 calls for January 5 increased by 45,426.

Trade Alert

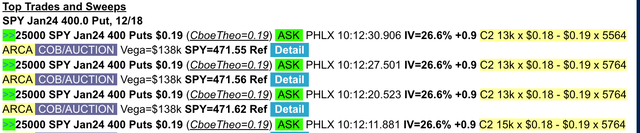

The data shows that the $400 puts for the January 19 expiration date were traded on the ASK, indicating they were bought for about $0.19. This means that a trader paid about $1.7 million in premiums based on the increase in the open interest.

Trade Alert

The data shows that the $415 puts were also traded on the ASK, and these contracts were bought for about $0.27 per contract. In this case, the trader paid a premium of $5.4 million to create this position based on the increase in the open interest.

Trade Alert

The data shows that $430 puts were bought for $0.42 on the ASK and paid a premium of $3.9 million based on changes in the open interest.

Trade Alert

Meanwhile, the $476 calls for expiration on January 5 were sold, with the trader collecting $3.25 per contract. This means that a trader took in a premium of $14.5 million based on the block trade list below, and is betting that the SPY is below $476 by the expiration. This trade was not tied to the three SPY puts trades.

Trade Alert

Based on the timestamps, all of the puts were executed around the same time span, which would suggest that the puts were the same trader. It would appear the selling of the calls is a different trader, given the calls were sold later in the day.

Extremes

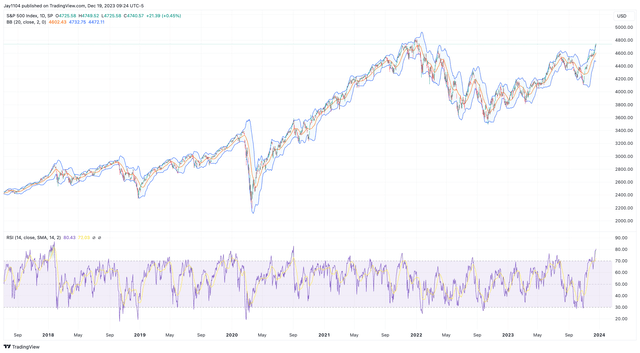

Meanwhile, the S&P 500 (SP500, SPX) is highly overbought, with an RSI over 80 and an index trading above its upper Bollinger band. This does not happen often, with the last time being in September 2020, along with similar conditions in January 2018. In both cases, the index fell by more than 10%. This time, it would take the SPX back to around 4,250 in such a case.

Trading View

The SPY doesn’t need to fall to the levels for the trader of the puts options. If the index were to drop, rising implied volatility and a declining ETF value would push the put values up, allowing the options trader to exit the trades earlier than January 19.

The index has run on pretty shaky assumptions that the market has done an abysmal job predicting the past, and it doesn’t seem so clear that the market is about to get that right this time, either.

Read the full article here