Investment outlook

The case for allocating to international equities is garnering more support as we sift through this latest market cycle. Investors are seeking higher returns in a more challenging economic environment, one that lends itself to higher yields, tighter money, flatter earnings growth and a narrower market breadth.

In many instances, global equities—provided the assets are of quality, especially those in developed markets—offer a compelling risk/reward profile with multiple sources of value, ranging from capital gains to investment income. Not to mention the diversification benefits. With the US in a large fiscal deficit, and several ongoing geopolitical risks, investors may want to consider opening up the potential for international holdings on the long side of the book.

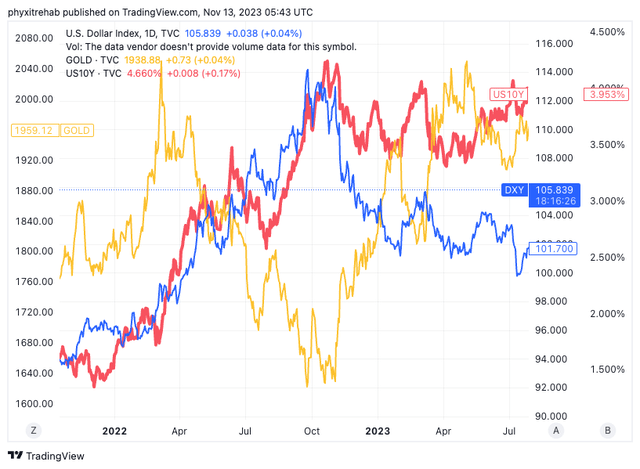

Naturally, one of the issues of companies operating in multiple jurisdictions (and with heavy exposure to the USD) is the foreign exchange risks that come with a strengthening dollar. Such has been the case over the last 24 months or so. Investors have shifted capital in a flight to quality as key macro risks moved from the background to the foreground. Consequently, the dollar’s performance in 2022 was largely correlated with the rise in 10-year yields. However, this relationship had diverged when equity markets began to rally again in October 2022 (Figure 1).

We now have a situation with:

- “Higher for longer” policy rates in the US,

- Growth potential emerging in global equities,

- A strengthening USD against many foreign currencies,

- Highly concentrated US indices,

- Potential earnings drift in high-growth sectors,

- Stretched US market valuations.

Consequently, investments geared to global markets are worth the thoughtful analysis.

Figure 1. Dollar index vs. UST 10-yr yield + Gold

Source: Tradingview

For investors seeking exposure to global equities—and to keep a rolling forex hedge in place—the iShares Currency Hedged MSCI EAFE ETF (BATS:BATS:HEFA) is a compelling instrument that provides the solutions to one’s equity risk budget.

The fund is reasonably diversified, and its unique structure plays into this as well:

(1). HEFA is simply the currency-hedged version of The iShares MSCI EAFE ETF (NYSEARCA:EFA). BlackRock (BLK) even advocates to combine the pair as one holding to “tailor currency risk”, and “tap into the scale of the underlying EFA holding”.

(2). EFA invests in equities domiciled in Australasia, Europe, and even the Far East. HEFA therefore does the same (by owning EDA), whilst hedging exposure to volatility of each holding’s local currency to the USD.

(3). EFA’s (and therefore HEFA’s) top 10 holdings make up 15% of the total portfolio, of which there are 825 securities.

So HEFA is a diversified holding with a currency hedge overlay, adding another layer of protection to investor risk capital.

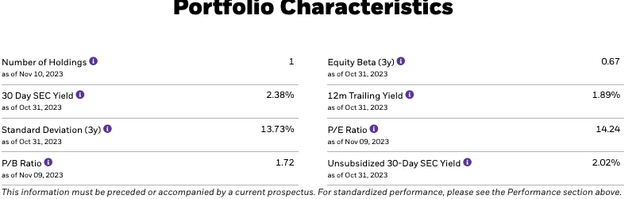

It has $3.6Bn in assets under management and charges an expense fee of 35 basis points on this amount. Its cousin EFA has $46Bn in AUM. Dividends have been lumpy in recent years however, investors were treated to a $6.56 special dividend due to gains on swap contracts last year.

Figure 2.

Source: BlackRock

HEFA is an noteworthy holding in my opinion, because it provides direct exposure to a tremendously diversified holding in EFA, albeit at half the unit cost, and with a currency hedge in place without having to do this yourself. These are quite attractive economics and potentially deserve their spot in one’s equity portfolio.

Plus, with the emergence of non-US equity factors starting to catch a stronger bid in the back end of 2023, there is scope to allocate to high-quality investments that lend the investor exposure to the global theme without having to build an entirely new portfolio themselves. ETFs such as HEFA are the cost-effective solutions investors can employ to achieve this. Starting valuations are also attractive and sit within a reasonable valuation bend of 13x earnings and a 7.5% earnings yield.

In that vein, my recommendations across all three investment horizons is as follows:

Fundamental:

- Bullish across short-term to long-term. Valuations, growth outlook are supportive factors.

Technical:

- Bullish across short to long term.

Net-net, I rate HEFA a buy for the reasons discussed in this report.

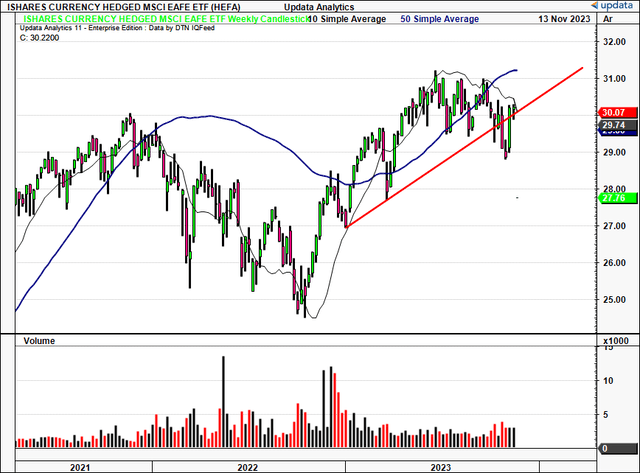

Figure 3. HEFA long-term price evolution

Data: Updata

Talking points

Four critical themes support the notion for potential allocation to high-quality global investment alternatives: sustained US outperformance; premium earnings growth in foreign + emerging markets; the sustainably high USD; and valuations. Given instruments such as HEFA provide the necessary platform and liquidity, these things are directly relevant to the fund.

(1). Sustained US outperformance—is it so?

The US had a tremendous period of economic and capital growth over the last decade or so. For example, in that time, US returns on equity (“ROE”) for S&P 500 companies increased by 4.8%, versus just 3.7% and 3.1% for European and Japanese benchmark companies, respectively. US ROE stood at nearly 21% at the end of the 2nd quarter of 2023. This is a structural phenomenon stemming from the fact US companies have maintained a diligent focus on increasing profitability, helped by the use of leverage.

However, many would argue that the period of wide outperformance from the US might be difficult to repeat over the next decade as well. In fact, the crowd at Goldman Sachs (GS) acknowledge that it likely won’t be repeated, thus “underscoring the case for diversification”. The firm cites the concentration of performance in both the economy and financial markets, and potential changes to investor and consumer behavior in the current higher-rate environment. These risks, it says, increase the scope for foreign nations to eclipse US GDP. It notes:

It is important to put the US’ economic outperformance over the past 10 years in context. Although the US economy has grown faster than most DM economies (2.3% vs. 1.8%), it has not kept pace with global growth (3.1%). This has owed to the contribution from EM economies which—through a variety of major economic shocks—have maintained income convergence, growing consistently faster than their DM peers.

Over time, EM GDP outperformance is also likely to imply stronger equity earnings growth.”

This has implications for the outlook of relative performance in global equities over the next 1 to 3 years. Whilst the US is likely to still perform strongly during this time, for those seeking global diversification, the bedrock is undoubtedly there in the investment logic in the first place.

2. Premium earnings growth in foreign markets

Another point to consider is that the premium earning growth force fed to us by the technology sector has shown signs of fading in the post-pandemic cycle. This has seen the reemergence of “old economy” stocks, such as industrials and utilities, who provide predictable and stable cash flows, usually with investment income tied into the economics. Earnings growth is not the forte of these particular segments.

In fact, GS illustrates in its research that since the pandemic era, those in the STOXX 600 index have outgrown S&P 500 companies in EPS, reversing a decade-long trend that had been in continuation since the GFC. This has led the firm to increase its Q4 growth forecast for China to 5.5%, and renew its optimism that goods production and trade in Asia will continue to tick higher.

For context, analysts at the firm project an average 2.1% growth in GDP over the next 10 years, and forecast a 3.8% growth for emerging markets in the same time. This trend will drive incomes to converge towards US levels, and global income distribution will shift towards these markets, potentially making their equity offering relatively attractive.

(3). High USD remains a factor

There have been multiple cycles of strength and weakness over the last 50 years. At the extremes of each cycle the economy appears to have adapted well. A general slowdown in the rate of business, when times were frothy, has done the job of maintaining the dollar’s growth.

GS notes that “[p]rovided slack exists, growth can continue uninterrupted while inflation and rates stay low, such that the Dollar can continue to depreciate. In contrast, limited slack, tight labor or commodity markets, and so higher inflation (or the perception of such) prevent a sustained Dollar weakening.” Consequently, the scope for USD strength remains high when factoring a long-term view. This does pose a risk to global investments whose currency is not in USD (especially in the case of dividends denominated in foreign currency).

GS believes that USD strength will also remain in situ given the fact there is no major alternative to the dollar as a global reserve currency. “While plenty of countries may want to move away from the Dollar,” it says, “the arguments to do so are not economically driven, and the alternatives are limited”.

This is a tremendously bullish factor for owning HEFA in my opinion, given that the currency risk is hedged away by professional money managers who are paid a fee as a percent of AUM, and therefore have the fund’s best interests aligned with their own.

(4). Starting valuations

Next 12 months’ returns are heavily impacted by the starting valuations the investor pays to acquire his or her asset. HEFA trades at 13x earnings, well below the S&P 500 constituents, well below the high growth and high beta segments of the market, and a shade above the ETF category average. You are buying a weighted average 7.5% earnings yield when paying this multiple and greatly enhancing the prospects for coming 12 months’ returns based on the valuation differential to US equity benchmarks. This cannot be overlooked and plays heavily to investment recommendations. Combined with the constructive outlook overcoming 1 to 3 years, a buy rating on HEFA is supported over this entire frame.

Technical factors for consideration

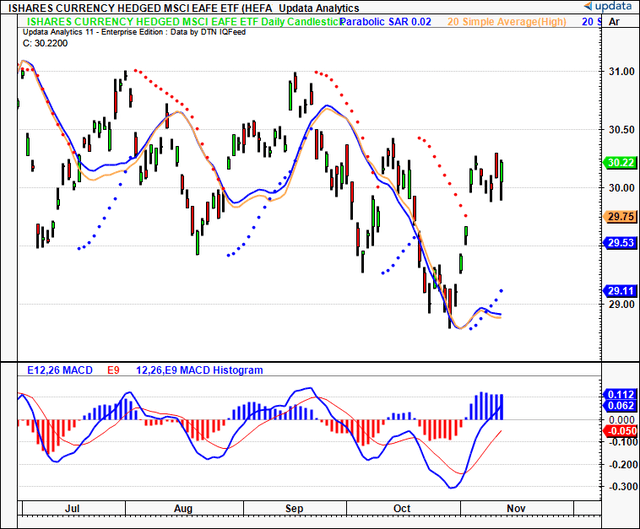

1. Regarding momentum

There has been a clear change in character for HEFA in the last few weeks in unison with what we’ve seen in global markets generally. The fund has bounced off its low and crossed the 20-day moving average high and low with conviction, having gapped up two times to its current range. The bullish MACD cross was an early signal, and the parabolic SAR has added some validity to the short-term rate of change.

Figure 4.

Data: Updata

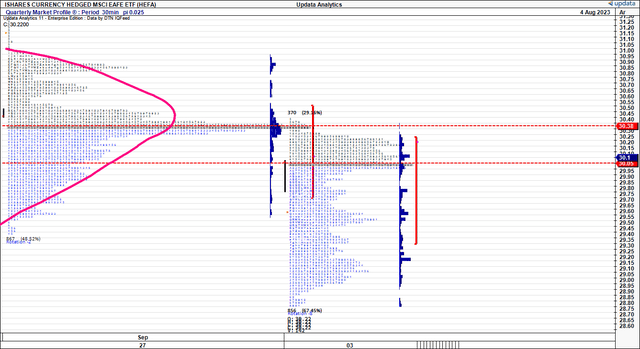

2. Skew, price distribution

Observations: We compressed the bell curve completed last quarter, so we were searching for a directional move in Q4. We extended the distribution lower, having escaped from the balance to the downside moving into October. There is heavy price competition at the $30s, and investors look to be forming a match at the upper bound of the current profile. This could be to match the ledge found at the auction of the last profile. We are testing the auction high with several prints building the shelf at that level. The lower edge is in the $28s and could be the lower support bound. Given the pockets of the usage sit above of where the current price control is, there is scope that investors could extend the distribution and the price could escape to the upside.

Key levels: watch a break from the $30s as confirmation for a long-term upside move. If we don’t break the $30s, I would be for price to rotate between the high and low of value.

Figure 5.

Data: Updata

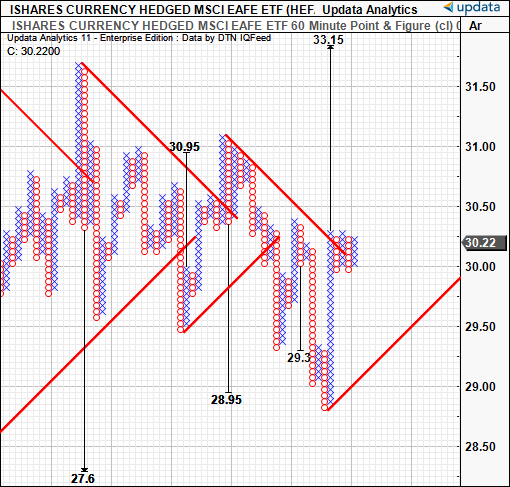

As a bullish factor we have upside targets to $33 on the point and figure studies. These do a terrific job at removing the intra-trend volatilities and provide a clean of view of reversals and extensions. After a double top formation (bullish in point and figure language), the target of $33 is the next short-term objective to keep an eye on.

Figure 6.

Data: Updata

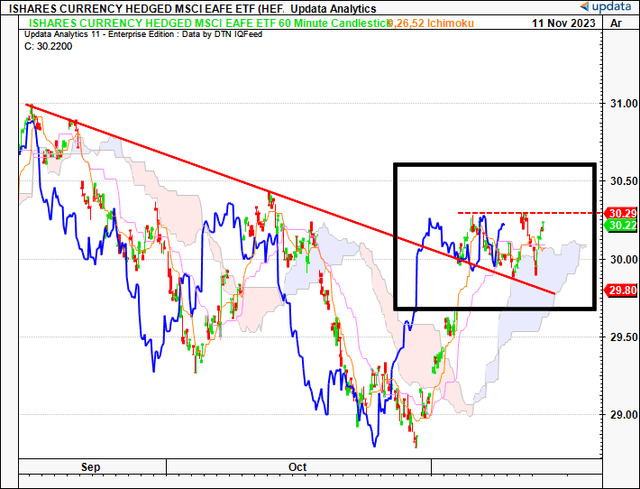

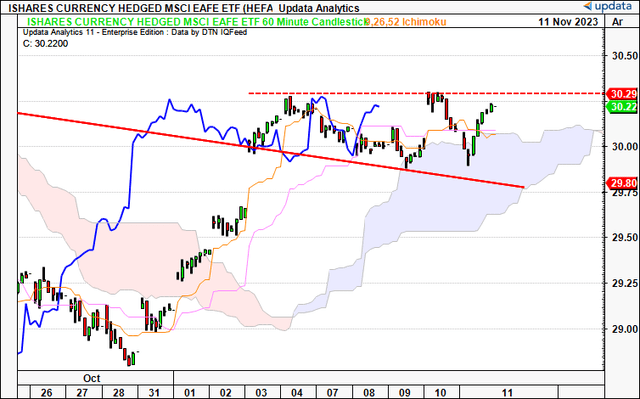

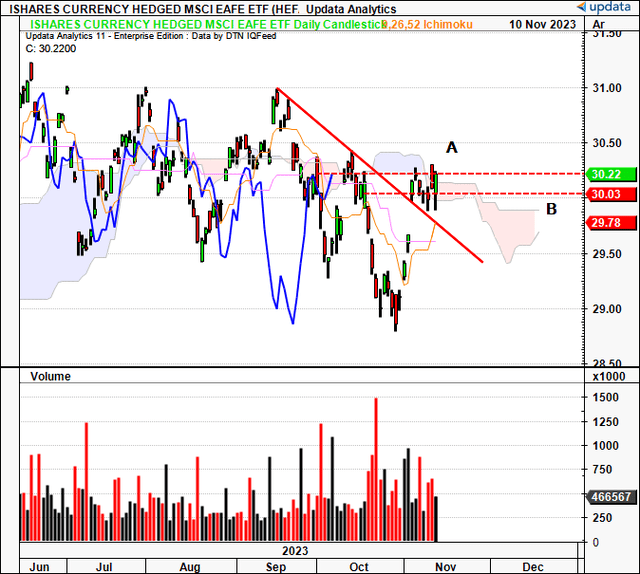

3. Directional bias of trends

As to the directional bias on trend action, the following series of charts captures the market’s sentiment well.

Looking at the hourly chart, which looks out to the coming days, we can see HEFA testing a key support level that is formed from a longer-term resistance line that was broken last week (see the insert in Figure 7a). Figure 7a.

Data: Updata

We are bullish above the cloud with price and lagging line in situ. The price line is currently testing the top of the cloud and has support well formed in the $30s, as seen on the price usage chart earlier. The top of the cloud and the point of control on the market profile are aligned.

Figure 7.

Data: Updata

On the daily chart, which looks to the coming weeks, we have broken above the cloud top which was a key level at the $30s. We are now compressing into congestion and filling the cloud sideways. There are three critical levels. One is the cloud base at around $30 neat, the other is the marabuzo line from mid-October at B, and the resistance line in this instance is the marabuzo line from September shown at A. We have support at the garage at $30 until the end of November, at which point support will drop to $29.80 throughout December. Right now, we have a battle for price control, with a bullish candle that is currently testing $30.20. The next direction move will be critical, therefore.

Figure 8.

Data: Updata

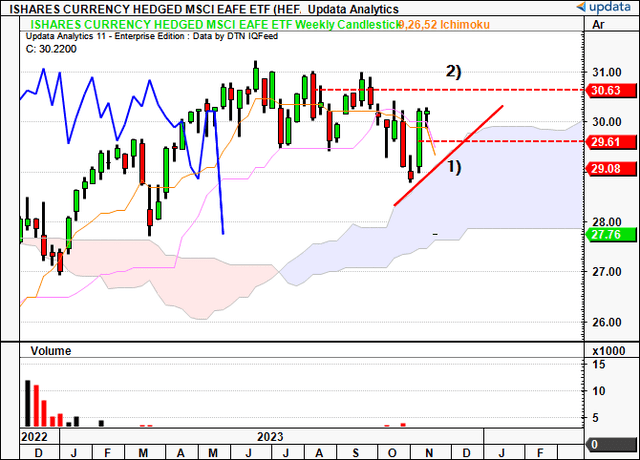

Finally on the weekly chart, which looks to the coming months, we are currently testing the cloud top, having bounced from this level three weeks in a row now. The morning star formation at 1) that was solidified by the bullish engulfing candle that took out the previous 2 weeks of closing range signified the reversal. The next level to cross is the $30.60, coinciding with the marabuzo line from July when equity markets began to roll over. If we retake this level, we would be pressing to new highs. Support is at the $30s until January next year. In the meantime, we are bullish above the cloud.

Figure 9.

Data: Updata

Discussion Summary

Insured there is compelling evidence to warrant potential allocation to regional opportunities outside of the US. whilst the US still offers an incredibly generous growth outlook, one cannot ignore the benefits of diversification geographically and forming multiple sources of value from various jurisdictions. This obviously comes with its select of risks, risks that HEFA does an excellent job at quashing for the investor’s portfolio. Critically, the mitigation of currency risk should be seen as a different differentiating factor which 1) saves investors a great deal of effort and cash flow, and 2) provides an exciting entry to control a set of highly diversified non-US assets. Based on the number of supporting investment facts raised in this report, I rate HEFA a buy.

Read the full article here