Thesis

The cannabis sector has a history of euphoria-driven rallies that leave fundamentals behind and take even unprofitable companies to insane valuations. In early 2021, I initially set out with the mission of researching the best players in the industry so I could add cannabis to my portfolio at the bottom of the next sector cycle. In addition to finding several cannabis companies that are worth buying for the next major rally. I found one that is extremely undervalued and has the potential to become a long-term compounder. Because of their highly competitive business model, I currently rate High Tide (NASDAQ:HITI) a Strong Buy.

The Evolving Industry

I first began studying the cannabis sector in early 2021, when most of the players were overvalued and busy using offerings to fill their war chests with cash. I knew the industry was incredibly cyclical and a majority of the players were not profitable. So instead of rushing to buy, I patiently watched most of them burn through their cash.

Some of them made better decisions with their money than others. It wasn’t long before a few things became clear. Overproduction had forced a price war in Canada’s more mature market, and the 280e tax burden was crushing cannabis operators in the United States. Both markets were experiencing extreme stress, but for different reasons. To deal with this stress, many of the companies adapted their business models. A large variety of strategies emerged, some of them gimmicky or short-sighted; some of them extremely wise.

When I began running basic Nash Equilibria models on what I thought might happen as these separate strategies interacted with each other, more revelations became apparent. The price war in Canada was producing a more competitive ecosystem than anything going on in the United States. Companies there were suffering staggering operational losses; they were far more desperate to find efficiency. Whoever survived in Canada was very likely only going to be able to do so by becoming extremely efficient. This leads me to believe that the players who survive Canada’s price war are going to have a serious efficiency advantage once the two ecosystems are finally allowed to compete against each other.

While still keeping tabs on what was going on in the United States, I shifted most of my focus to the Canadian cannabis industry. At that time, competition was so fierce that a majority of growers were selling cannabis below their cost of production. I want to make sure this sinks in… we are talking about negative gross margins, so the more revenue they generated, the more money they lost.

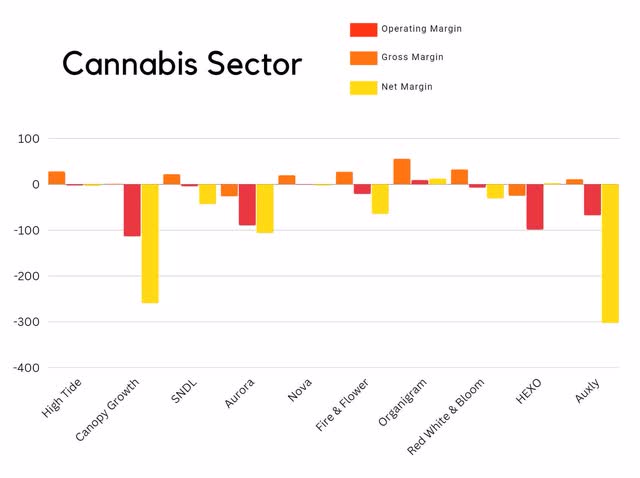

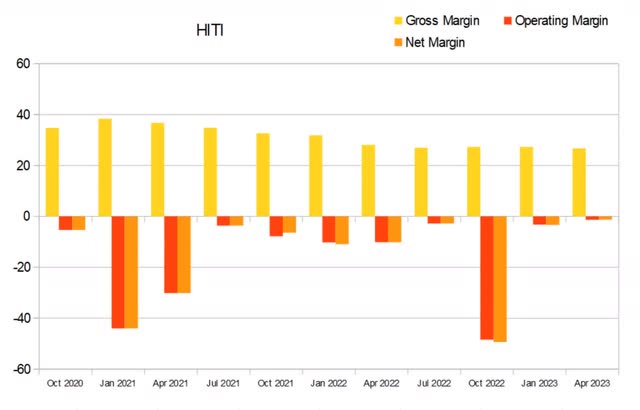

Below is a chart I made a few months ago of the quarterly margins of the highest revenue players in Canada. Most of the survivors have gone through enough cost-cutting measures to achieve positive gross margins.

Canadian Cannabis Industry As Of 3-22-23 (By Author)

Amidst this desperate knife fight in the gutter, with almost no one able to find profits by growing and selling the plant, I watched them all adapt or die. In what I still think of as separate acts of desperation, Canopy Growth Corporation (CGC) divested away all of its Canadian retail locations, SNDL Inc. (SNDL) purchased a chain of liquor stores, Tilray (TLRY) switched a significant portion of its grow operations to fruits and vegetables, and High Tide (HITI) adopted a discount model.

That made me start paying closer attention. With most of the sector already bleeding millions of dollars per quarter, High Tide shifted their business model to one which puts additional downward pressure on price. Now I had a new question I had to answer… Why?

Company Background

High Tide is a cannabis retailer headquartered in Alberta; they have operations in Canada, the United States, and Europe. Harkirat “Raj” Grover originally founded the company in 2009 under the name Smokers Corner. The original business centered around imported glassware and other smoking accessories. Starting with just $48,000, two employees, and 500 square feet; the company has since grown to over 150 storefronts operating under the name Canna Cabana. When Canada legalized recreational cannabis use, the company added flower and concentrate to their available products.

In late 2021, with the company in control of 3.6% of market share, they switched to a discount model. Because High Tide does not grow the plant, they are removed from the risk of production. This allows them to buy wholesale and then sell cannabis as a loss leader while relying on the income from high margin glassware and accessories to drive profits. Since the implementation of the discount model, the company has been capturing additional market share at a rate slightly under 1% per quarter. They currently control roughly 9.5% of the market.

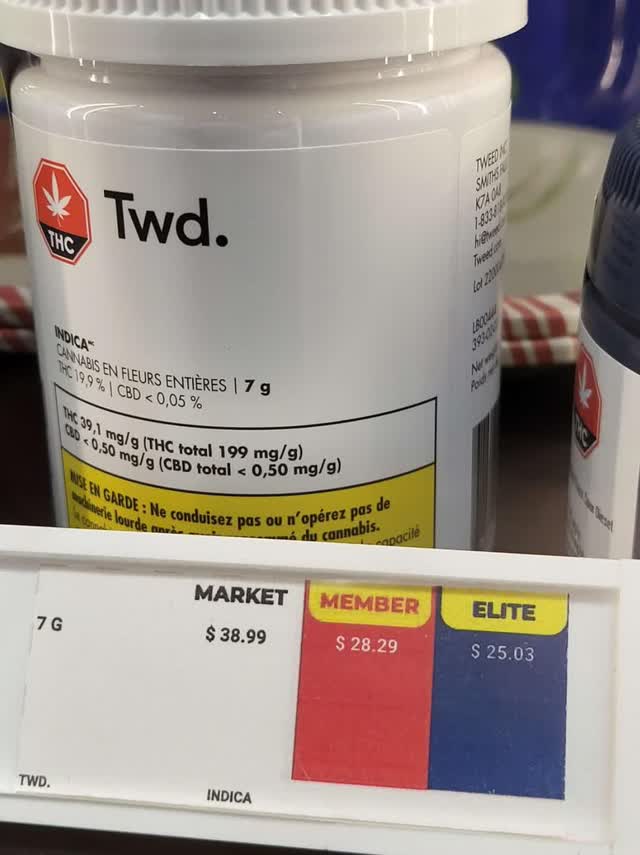

Canna Cabana Prices (Johnny Stonks)

Their discount club has proven wildly popular among consumers; they have grown their free membership program to over 1.04M members. In late 2022, High Tide rolled out a Costco (COST) style paid membership program to entice customers who are after even deeper discounts. The paid membership program has attracted 13,500 members so far. By leveraging its better margins and lack of production exposure, High Tide can thrive regardless of the price of cannabis.

Long-Term Trends

The global smoking accessory market has an expected CAGR of 6.5% until 2030. CBD is expected to experience a CAGR of 31.5% globally through 2031. The Canadian cannabis industry is projected to experience a CAGR of 13.26% through 2027. High Tide already has exposure to the United States market through several online retailers but is being forced to wait for federal laws to change before it can begin expanding its brick and mortar operations. The cannabis industry in the United States is expected to have a CAGR of 14.2% through 2030. The company also has plans to expand into Germany, the cannabis market there is expected to experience a CAGR of 14.01% until 2027.

When I started studying the cannabis sector, I built out a list of almost 300 North American companies. Because of a combination of mergers and bankruptcies, the list is now down to about 75. With a significant portion of both sectors still posting negative cash flow, I expect continued cannibalistic consolidation.

A Collection Of Edges

Before I dive into financials, you must understand them in context, and that it’s the business model that I am investing into, not their present day financials. Their business model is so competitive, I believe that it will eventually lead to extremely attractive financials.

First, the company is currently running a deep discount model. This allows them significant price flexibility. If you scroll to the picture above, you will notice the company currently sells cannabis to discount members well below the market average. Elite members, who pay an annual fee, pay even less. The picture shows a 27.44% discount for club members and a 35.8% discount for elite members. This most recent quarterly earnings report has them posting a net margin of -1.26%. This company could be net income positive on a whim if they decide to raise prices. However, this would likely hinder their ability to continue capturing market share and erode the moat their deep discounts provide. This extreme pricing power gives management additional flexibility and adds a margin of safety to this investment, one that is difficult to quantify using traditional valuation methods.

The CEO has stated on multiple occasions they are aiming to achieve 250 stores in Canada as their next planned milestone. As the company continues to gain market share, the individual pressure they put on the retail price of cannabis will grow. The producers, most of which are already struggling just to tread water, will find their already poor margins under ever increasing pressure.

The company collects metadata on the purchasing habits of customers. Not only does this give management a considerable information advantage over their competition, any of its competitors who wish to cancel out this information edge replaces it with a financial edge. This most recent quarter, selling metadata to other cannabis companies accounted for $4.83M or 5.39% of total revenue.

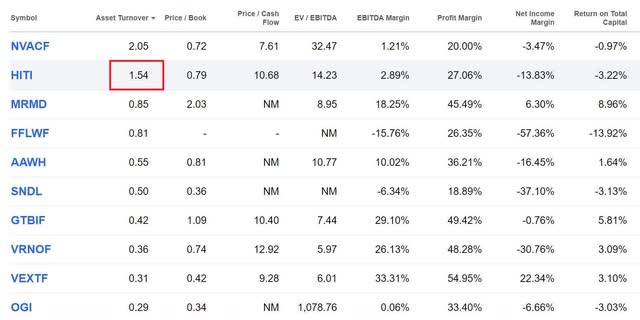

It only costs High Tide about $300K to open a new store. Instead of vertically integrating the production of the plant, High Tide decided to focus on building a vertically integrated business model centered around consumption accessories. This has left them with lower infrastructure requirements than almost every other player in the cannabis industry. All of the vertically integrated producers have to set up growing, processing, and packaging facilities when they enter a new market; High Tide does not. Because the company has already set up a global logistics chain for all of the glassware and accessories, they merely have to secure a supply of cannabis from already established local growers before they can begin saturating a new market with stores. Individually estimating the long-term cost of expansion for every single company in the industry is too daunting, so I am instead looking at Asset Turnover Ratio as a very rough indicator of how much total capital these companies might need to saturate a new market with stores. I should note that Asset Turnover Ratio is ttm Revenue/Assets, and absolutely not New Market Revenue/Cost of Expansion. But it does tell a story; one that helps make clear their cost of expansion is lower than most of their competition.

My Cannabis Stocks Worth Watching List (Seeking Alpha)

The company already has exposure to the United States and international markets through its dominance in cannabis E-commerce. High Tide owns Valiant Distribution, which is the leading wholesale supplier of cannabis consumption accessories in the United States. The company also owns Grasscity, the oldest online cannabis E-commerce accessory provider, Smoke Cartel, which caters to customers looking for high-end name brand accessories, and the Daily High Club, which offers a subscription to receive boxes of assorted smoking accessories every month. If you look at the top five highest traffic cannabis E-commerce platforms, High Tide already owns three of them. As stated in their most recent earnings call transcript, including their international markets, High Tide is up to 4.5M regular customers.

Financials

Before I continue, I should note that this is a Canadian company which reports in Canadian dollars, and all of the figures I use are in US dollars. During the Q1 earnings call, the company laid out their plan for an operational pivot from increasing revenue as quickly as possible, to improving cash flow. We are witnessing the first quarter of the transition.

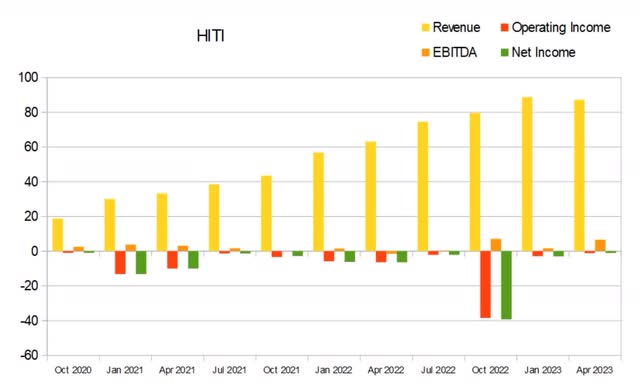

HITI Trailing CAGR (Seeking Alpha)

The Canadian cannabis industry is traditionally affected by dips in revenue every winter and elevated demand during summer months. With the company no longer opening new stores at a breakneck pace, and this most recent quarter landing in winter, High Tide’s revenue was noticeably affected by seasonality. While I mostly attribute the revenue drop to seasonality, the company also experienced an increase in its paid ‘Elite’ membership program. Elite customers pay an annual fee but transact with the company at lower revenue, so as more of them sign up, they will continue warping revenue down and EBITDA up.

The company went through a rapid expansion in 2021 and 2022, effectively doubling revenue every year. Most of the figures for the first two quarters of 2021 are skewed by this buying spree. I should also note the company took a write-down in Q4 2022, so many of the values for that quarter are not a good representation of the health of operations. As of the most recent earnings report revenue was $87.2M, EBITDA was $3.4M, operating income was -$1.1M, and net income was -$1.1M.

HITI Quarterly Revenue (By Author)

The falling price of cannabis was already applying pressure to their gross margins in 2021. As it became clear the producers were going to continue their race to the bottom, High Tide decided to play into the trend and switched to a discount model at the end of 2021. The company experienced a significant decline in gross margins as they began capturing market share. Gross margins have been fairly stable for the last four quarters. Both operating and net margins experienced lows in early 2022 but have been improving since then. For this most recent quarter, I calculated gross margins of 26.7%, operating margins of 1.4%, and net margins of -1.3%.

HITI Quarterly Margins (By Author)

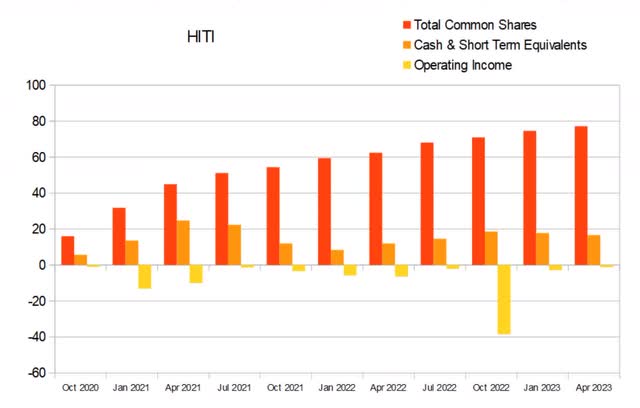

Instead of using offerings to raise cash and then using the cash to buy assets, High Tide has a history of using shares to buy assets. The company is highly selective and refuses to buy failing stores, and have managed to translate the dilution into significant revenue increases. As the company has been focused on offering the most competitive pricing possible, this has yet to lead to positive operating income.

HITI Quarterly Share Count vs. Cash vs. Income (By Author)

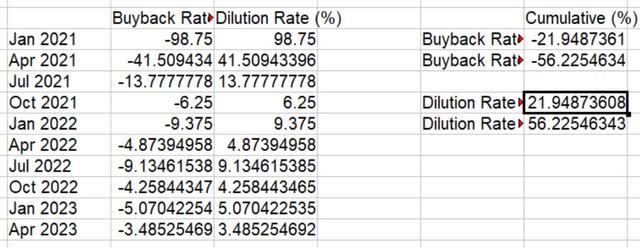

When I previously charted out the dilution rate for 2021 and 2022, I was consistently finding numbers just below 30% YoY. As of this most recent quarter the ttm dilution rate has dropped to 21.9%. The revenue increases the company was experiencing at the time were averaging slightly above doubling every year. When comparing the old revenue growth rate with the old dilution rate I was coming to the conclusion it was accretive.

(Revenue^2)/(Share Count^1.3) = Runaway Exponential Growth

As the company is presently switching gears, I expect that both the dilution rate and revenue growth will become far less eye-popping over the next couple of quarters. As the company has recently announced they are becoming even more selective in their store merger criteria, it is fair to assume that future dilution will also be accretive to revenue.

HITI Buyback/Dilution Rate (By Author)

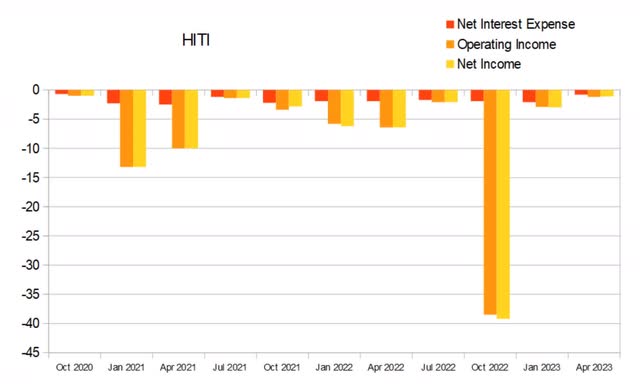

Please correct me if I am wrong, but I believe High Tide was the first cannabis company on the planet to receive a loan from a bank or credit union. This most recent quarter represented the 13th consecutive quarter of positive adjusted EBITDA and the 6th consecutive quarter of positive EBITDA. Because the company has such a high degree of control over its pricing flexibility, it also has more control when it attempts to bullseye specific financial metrics. So far, they have managed to outpace their income tax obligation with a combination of non-recurring expenses and depreciation. By controlling the pace of new store openings, they have been able to avoid taxes while maintaining both positive EBIDTA and negative net income.

The company may continue prioritizing avoiding taxes over reaching positive net income. I should note here that for two quarters now, the company has repeatedly insisted their goal is positive cash flow; they have not made the same promise about positive net income. They may make significant improvements to their cash flow and yet continue opening new stores at a pace that allows them to keep posting negative net income. As of the most recent quarter, the company had $16.7M in cash and short-term equivalents, $10.7M in long-term debt, a net interest expense of -$2.1M, an EBITDA of $3.4M, operating income of -$1.1M, and net income of -$1.1M. Even though the below chart is extremely unattractive, because of their pricing flexibility I do not feel the company is in any danger of being unable to meet its debt obligations.

HITI Quarterly Net Interest Expense (By Author)

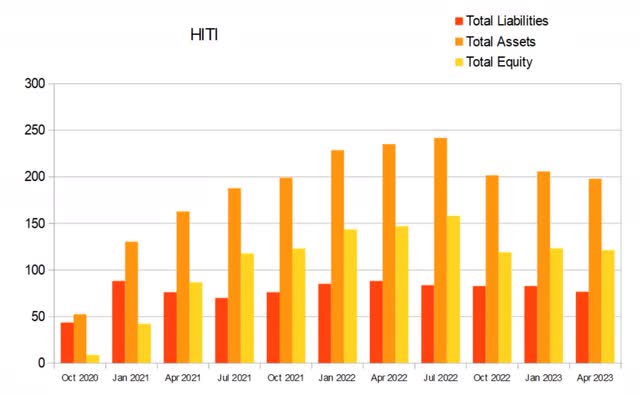

Total equity was steadily rising before leveling off after the company took a write-down to its CBD division. Because CBD is more fungible than not, it is basically impossible to build brand loyalty. It is also a product with a long shelf life and low consumption rate, so a single bottle will last most users quite a while. When inflation soared, consumer demand shifted as discretionary purchases fell. Not every discretionary good was affected to the same degree, but demand for CBD fell through the floor. High Tide’s CBD subsidiaries make products that come with some of the best ratings and reviews in the industry, so when demand for CBD returns, I expect the lost revenue will as well.

HITI Quarterly Total Equity (By Author)

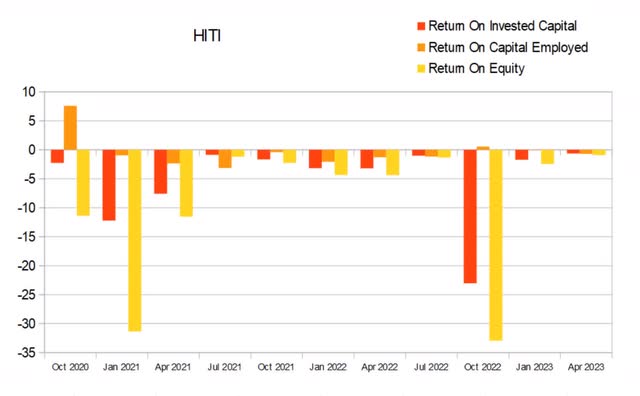

Returns have been steadily improving since their low in mid-2022. When I read through High Tide-oriented message boards, one of the most frequently proposed ideas is that after most of the rest of the sector dies in Canada, High Tide will raise prices. I remember what Walmart (WMT) did to grocery, clothing, and toy stores when it decided to blanket the Midwest with new stores in the 1980s and 90s. So, in addition to returns pushing into the positive due to a combination of cost-cutting and revenue growth, they may also eventually realize some assistance from price raises. As of the most recent quarter ROIC was -0.64%, ROCE was -0.70%, and ROE was at -0.91%.

HITI Quarterly Returns (By Author)

Valuation

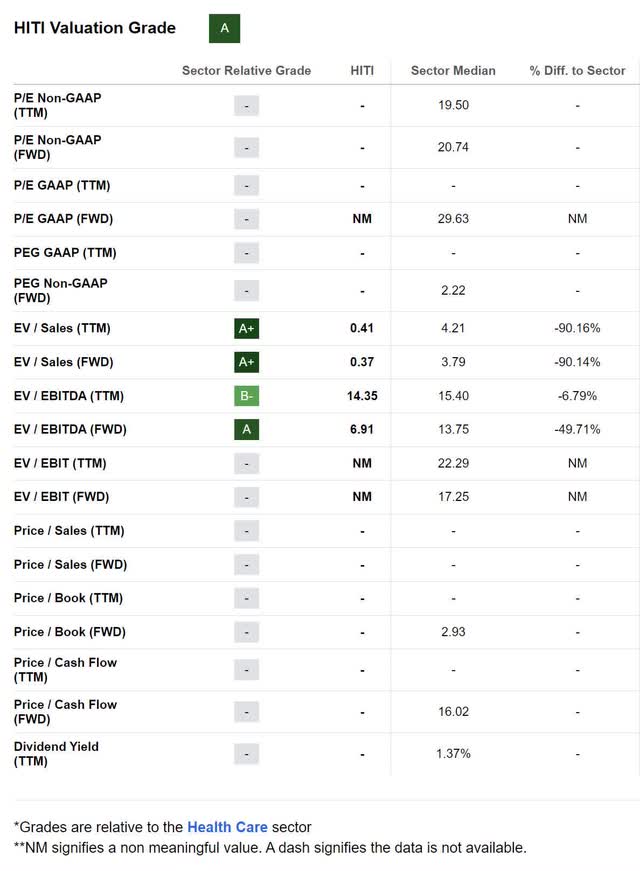

As of July 24th, 2023 High Tide had a market capitalization of $94.31M and traded for $1.20 per share. Without projecting any future growth, their present quarterly revenue of $87.2M produces a Market Capitalization/Annual Revenue ratio of 0.27x. With a forward EV/Sales of 0.37x, and forward EV/EBITDA of 6.91x, I presently consider the company undervalued.

HITI Valuation (Seeking Alpha)

I should note that the sector averages and difference vs the sector comparison above are both in reference to the entire Health Care sector, not the rest of the cannabis industry.

Risks

Before we move into actual risks, I need to bring up the possibility that the United States delays for several more years before it approves adult recreational use. The company does not need legalization; further delay in the United States will actually help the company over the long term. The larger and more established High Tide is before the time comes to expand into the United States, the better armed the company will be to go fight another price war.

As Warren Buffett has been known to use as a baseline: could another actor with $1B come in and steal their customers and drive the business into irrelevancy? And the answer to that is still presently a yes. Although the company has already dug extremely effective moats, they aren’t yet imposing enough to be unassailable to someone with deep enough pockets. However, I do feel that the company has already passed the point where anyone would be willing to challenge it; the cost-benefit analysis would be extremely unfavorable. It would be far easier for an outside player to just buy High Tide rather than to compete against it, so although I consider this a real risk, I think it has an incredibly low probability of happening.

I believe it is far more likely that a major alcohol or tobacco giant decides to try to buy High Tide. Specifically, I believe companies Phillip Morris (PM) or Altria Group (MO), which are both blessed with strong operating income yet stuck in a sunset industry, are very likely going to try and extend their business life cycle by expanding into cannabis once rescheduling arrives. This actually presents two risks. First, it is possible the company is bought at an unfavorable price. However, through multiple interviews the CEO has hinted, but not declared, that any such deal would likely be based more on market share, retail footprint, and their established accessory infrastructure; and less on things like operating and net income. The second risk is that the new owners replace High Tide’s management with actors who do not understand the industry as well as present management.

The CEO-founder Harkirat “Raj” Grover built this company all the way up from a single store with two employees in 2009, to 153 stores pulling in a quarterly revenue of over $85M. His business prowess is the primary reason this company is the diamond in the rough that it is today. If something were to happen to him where he was no longer able to perform, it would be a cause for major concern.

High Tide refuses to produce its own cannabis. This removes them from the risk of production. This allows them to sell cannabis as a loss leader, putting a downward pressure on its price and capturing market share. This two-fold effect of stealing customers while forcing prices lower is a recipe for driving everyone else into bankruptcy. This is the single most powerful competitive edge a cannabis company can have, if High Tide ever decides to start growing cannabis they lose it.

Many people believe cannabis is discretionary and fear what might happen during a recession. During hard times, people buy more cheap emotional pick-me-ups, not less. While I do believe most of the accessories they sell are fairly discretionary, I consider the flower and concentrate as far less so.

Catalysts

The single largest and most obvious upcoming catalyst is rescheduling. On October 6th, President Biden issued a statement asking the DHHS and the Attorney General to look at the presently available evidence and then reassess cannabis present schedule 1 status. Most people are expecting it to be rescheduled into the 3 to 5 range, but it is also possible they give it the same treatment as alcohol or tobacco and remove it from the list entirely. My personal speculation is that they are going to assign it something in the 3-5 range and tell the states they can allow adult recreational use if they want to. This is likely going to produce a situation where some, but not all of the states are available to High Tide for an expansion of its brick and mortar operations. Because of the history of euphoria-driven cannabis rallies, I expect that the news of rescheduling will immediately cause a major industry-wide rally.

The passage of some version of the SAFE Banking Act would be a boon to all of the U.S.-based operators and also has an incredibly high likelihood of causing an industry-wide rally. When Biden was elected after making campaign promises about cannabis reform, the industry rallied. During that rally, High Tide reached a price to sales ratio of 12x; it is currently trading at a 0.26x.

Germany also has plans to legalize for recreational use. High Tide has already loudly announced its plans to begin establishing a footprint of stores as soon as the laws change. They formed a relationship with Berlin-based Sanity Group to help them execute a rapid expansion of brick and mortar operations there.

The company has spent the last two quarters focusing on cash flow improvements. As their cash flow-based metrics improve, so should their valuation.

This company is attempting to stay relevant by constantly innovating and adapting. It has a culture of innovation and is busy building multiple diverse revenue streams. High Tide has been developing a series of digital kiosks under the name Fastendr. Currently, the company is placing them in their stores to help reduce labor costs. As the product continues to be fine-tuned, modified versions of it can be leased to other retailers. I believe this technology may eventually lead to the company launching a line of vending machines capable of verifying the age of the customer before the sale. This technology could find applications with not just cannabis, but also for tobacco and alcohol. The company is increasing the number of white label products they have available and has plans to continue expanding their high margin revenue streams. This culture of innovation marks High Tide as the type of company Mohnish Pabrai would refer to as a spawner.

The Elite membership program is busy digging an incredibly deep Costco (COST) style moat. After customers pay the annual fee for access to even deeper discounts, they are unlikely to buy cannabis or accessories anywhere else. As more of their customer base transitions from their already very ‘moaty’ free discount program into the paid membership program, their brand loyalty will only grow in strength.

The company currently trades on extremely low volume and is unloved by the masses. During the last major sector rally, High Tide was much smaller than it is today. Unlike many other cannabis companies, it failed to achieve meme-stock status. When the next sector rally arrives, with High Tide holding the most dominant position in Canada, I expect it to receive considerably more attention.

Most of the cannabis industry is still focused on trying to find a business model that makes money by growing and selling the plant. I believe this is not a wise strategy. With basically every other commodity on the planet, producing the good is not as profitable as selling it to end use customers. There is a good reason Starbucks (SBUX) only grows a tiny fraction of the coffee they sell. As the global cannabis industry matures, I believe the price of flower will continue to fall. The shift in thinking is going to take time, a couple months ago The Dales Report interviewed Bruce Linton and now that Bruce has had the chance to leave the game and become an outside observer, he has changed his stance on the direction of the industry. “Canna Cabana and those guys, Raj gets it” – Bruce Linton Former CEO of CGC. 6/7/2023

I believe the CEO is incredibly competent, but I have come across others who shy away from the company because he is non-traditional. Raj grew up immersed in his father’s import/export business; this gave him hands-on experience from a very young age. His entrepreneurial drive led him to found his first business at age 20; after exploring multiple businesses, he settled on importing high margin smoking accessories. Many people with degrees and certifications belittle the capabilities of those without. I have six degrees from three different colleges and certifications that let me put letters after my name. I teach circuit analysis for a living, and I can tell you from personal experience that being internally motivated to learn actually matters far more than whether your education was formal or not. I have had too many self-taught engineering students show up already knowing the material to underestimate those who are driven.

While far from singlehandedly responsible for it, the downward pressure they put on price is helping to produce an environment where buying opportunities are opening up for High Tide.

And lastly, a cluster of insider buying occurred following their announcement about the operational pivot to improving cash flow. Insiders will sell for many reasons, but when groups of them all buy together, they are effectively telling everyone they are confident that the fundamentals of the business are improving.

Conclusions

Unlike most of its competition, High Tide has met every one of its declared operational goals since I began watching the industry two years ago. Now, they are telling everyone they think they can achieve positive free cash flow by the end of 2023. Looking over their financials, I believe that it’s possible they achieve it without having to expand margins by reducing discounts.

This company has an extremely competitive business model; I believe it is the most competitive in the industry. Because of its underdog mentality, and the extremely competitive environment it was raised in, it has adaptation and innovation hard-coded into its DNA. It is perpetually looking for new sources of high margin revenue, this is one of the most important qualities to look for when searching for long-term compounders.

When cannabis is rescheduled and the federal restrictions to shipping it across state lines go away, just like what is already happening in Canada, I expect a price war to break out in the states that do not set up import protections. Because the U.S. multi-state operators are vertically integrated and used to operating in low competition environments, they are just as unprepared for a price war now as the Canadian producers were when Canada first allowed recreational use in 2018. I only see one company in either country with a business model that doesn’t care what the price of the commodity is. Because their cost of expansion is so low, and because they refuse to produce while putting a downward pressure on price, I expect this company to be able to capture significant market share in any ecosystem they are allowed to enter.

Not only does the company look like it is set up to become a long-term compounder, it is also blessed with existing in an industry that is prone to euphoria-driven rallies. During the highs of the last major sector rally in early 2021, High Tide reached a price to sales ratio of about 12x; it is currently trading at a 0.27x. While I don’t want to use that as a price target, it does give a clear indication of what might be possible. As much as I am planning on holding for many years, if the next sector rally carries it into double-digit P/S ratios I will be forced to sell a portion of my position early. I believe High Tide has the potential to become a multibagger, and because of its present valuation, price flexibility, and growing market dominance, I view the risk vs. reward here as extremely attractive.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here