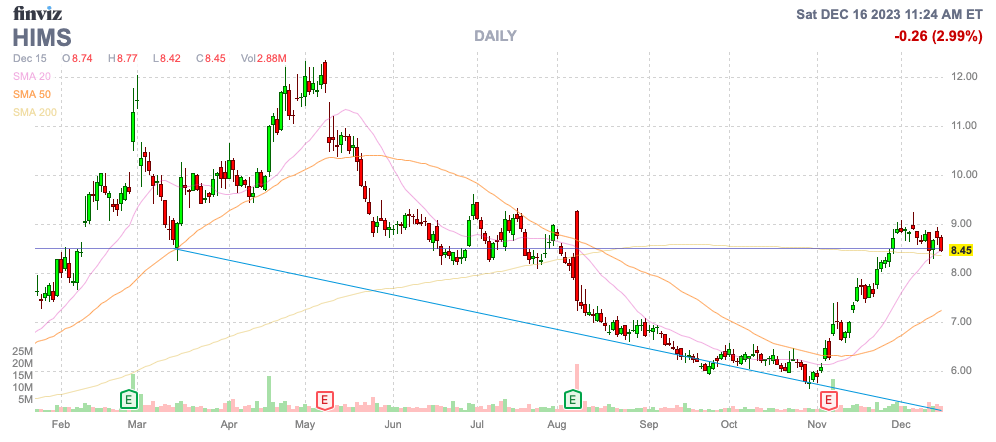

Hims & Hers Health (NYSE:HIMS) has seen the stock snapback with the company continuing to report strong quarterly results and improved profits. The online health and wellness platform is also moving into AI based medical services along with a push into crucial weight loss management considering the soaring costs of related medicine. My investment thesis remains ultra Bullish on the stock after Hims has reported exceptional growth since the stock topped out over $10 about 6 months ago.

Source: Finviz

Cheap Share Repurchase

Going into 2023, investors thought Hims was a former SPAC that wouldn’t even generate profits. Now, the company is generating the type of cash flows to allow for share buybacks.

Along with the Q3’23 earnings report, the BoD approved a $50 million share buyback. Hims reported revenues again smashed consensus targets with a $6.4 million beat and most importantly, cash flows from operations were $25 million.

The company ended the quarter with a cash balance of $212 million. The market cap is approaching $2 billion to reduce the benefit of a stock buyback, but the very fact Hims has the cash flows to even pursue a buyback changes the investment equation.

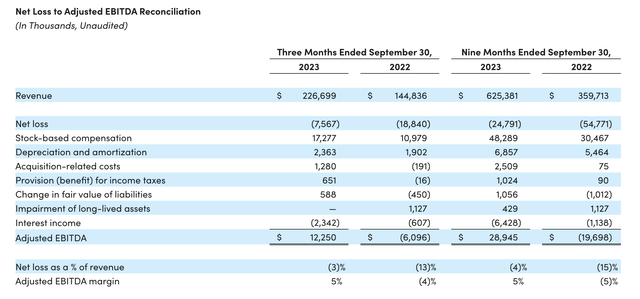

Hims has forecast adjusted EBITDA to reach $100 million by 2025, up from the updated goal for $45 million this year. The cash flows should follow considering the vast majority of the boost to adjusted EBITDA are non-cash costs. The company should actually label the amount as adjusted EPS.

Source: Hims & Hers Health Q3’23 earnings release

In fact, the adjusted EBITDA metric actually excludes over $2 million of interest income. If anything, this charge is somewhat offset by income taxes and legitimate depreciation to generally arrive at an adjusted income metric.

A stock reporting 56% revenue growth in the last quarter would probably be viewed far more favorably with adjusted profits, not just adjusted EBITDA that too many people write off.

AI And Weight Loss

A main reason Hims is an intriguing stock is the move beyond just selling ED pills online. The company has aggressively moved to develop an AI based service and weight loss management tools.

MedMatch is a proprietary AI based service to provide personalized treatment solutions for patients based on historical learnings from a vast patient database. Hims has launched MedMatch for patients seeking support for mental health with the hope of alleviating months of trial and error by utilizing the collective knowledge of the entire Hims platform.

The weight loss management market is heating up with the launch of costly, but very effective weight loss drugs. Corporations are looking for solutions to manage costs for productive outcomes when GLP-1 drugs like Wegovy and Zepbound can cost up to $1K a month.

Health care plans and corporations want tools to track patients diet and exercise before giving access to costly obesity medicines. Hims just launched their program called Weight Loss by Hims & Hers. The tool helps patients with weight-loss goals via personalized and affordable clinical programs that combine medication management, digital tracking tools and customized educational content

Ananth Balasubramanian, a Teladoc Health (TDOC) executive, highlighted the current market approach:

Employers and health plans are now increasingly more willing to cover them, with the right programs in place.

Both of these areas provide long-term catalysts for Hims to utilize a large database of patients to direct better outcomes for patients and/or lower costs for corporations. As an example, Truist analyst Jailendra Singh projects that the market for virtual obesity drug management could reach $700 million in 2024 based on a $30 per member per month fee leading to a long-term market hitting $9 billion.

Even after the recent rally, Hims only trades at less than 2x 2024 sales targets of $1.1 billion. The stock is still relatively cheap considering growth rates are forecast to top 20% for years.

Takeaway

The key investor takeaway is that Hims is still incredibly cheap considering the massive growth reported on the online health and wellness platform since going public via a SPAC deal at $10 years ago. Investors should continue to take advantage of the stock trading below this valuation and at a cheap valuation.

Read the full article here