Editor’s note: Seeking Alpha is proud to welcome Hinde Group as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

To My Partners

The performance of our portfolio for the first quarter of 2025 and since inception is summarized below.

| 1578Partners,LP | S&P 500 | ||

| Gross | Net | Total Return | |

| 2025: | |||

| Q1 | -0.50% | -0.87% | -4.27% |

| Since Inception (08/01/15): | |||

| Annualized | 20.42% | 18.61% | 12.69% |

| Cumulative | 502.47% | 420.60% | 217.27% |

After taking office on January 20th, Trump wasted no time implementing his policy agenda. Unfortunately, the only consistent thing about that agenda is how ill-conceived and harmful to U.S. interests and prosperity most of it is.

Trump’s proposed trade policies in particular weighed on financial markets during the first quarter. During February and March, Trump announced a 25% tariff on all imports from Canada and Mexico, an incremental 10% tariff on imports from China — later raised to 20% only weeks after the initial announcement — and an across-the-board 25% tariff on steel and aluminum imports, among other, less significant tariffs. Along the way, he sprinkled in a variety of pauses, postponements and exemptions, leaving everyone guessing what the result would eventually be. Trump also declared his intention to implement a far broader set of “reciprocal” tariffs, the details of which were ultimately announced just days after the end of the quarter on April 2nd.

The S&P 500 (SP500, SPX) hit the skids as the curtain rose and the full extent of the tariff circus came into view. After peaking on February 19th, the S&P 500 fell 8.6% through the end of the quarter, ending down 4.3% from its level at the beginning of the year.

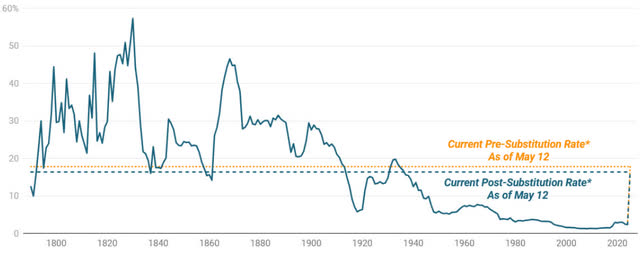

Things went from bad to worse after the end of the quarter. The “reciprocal” tariffs announced on April 2nd — Trump’s so-called “Liberation Day” — proved far broader and more significant than anyone had expected. According to estimates from the Yale Budget Lab, the tariffs announced through April 2nd brought the average effective U.S. tariff rate to 22.5%, up from 2.4% at the beginning of the year. That represented the highest average effective U.S. tariff rate since 1909 and above the level reached after the enactment of the infamous Smoot-Hawley Tariff Act in 1930. The S&P 500 plunged more than 10% in the two days following “Liberation Day,” and the CBOE Volatility Index briefly spiked to a level only hit during the most acute moments of the COVID pandemic and the Global Financial Crisis.

Exhibit 1: U.S. Average Effective Tariff Rate Since 1790 Customs duty revenue as a percent of goods imports

*Assumes revised April 9 tariffs stay in place. Created with Datawrapper.

It is hard to say what the impact of Trump’s trade policies on the economy will ultimately be. No one — Trump included — even knows what Trump’s trade policies themselves will be next week, much less when all is said and done. In general terms, tariffs are taxes on imports that reduce living standards and economic efficiency before even considering adverse, second-order effects, such as retaliatory measures by trading partners and diminished attitudes among foreigners toward American products and services. While some domestic manufacturers may benefit from protection against foreign competition, many that rely on imported raw materials, like steel and aluminum, and intermediate goods will end up worse off, devastatingly so for some. Tariffs will raise some revenue for the government, but the amount raised will be limited by substitution and pale in comparison to the loss in overall welfare. The reduction in living standards typically takes the form of higher prices. The Yale Budget Lab estimates that the stated policies as of this writing will result in the average U.S. household paying $2,800 per year more to simply maintain its standard of living; for U.S. households in the top 10 percent of disposable income, that figure rises to $6,060 per year. Unemployment will increase and economic growth will slow as the economy adjusts to the new tariff regime, ultimately settling in at a lower level of productivity and growth for as long as the tariff regime remains in place.

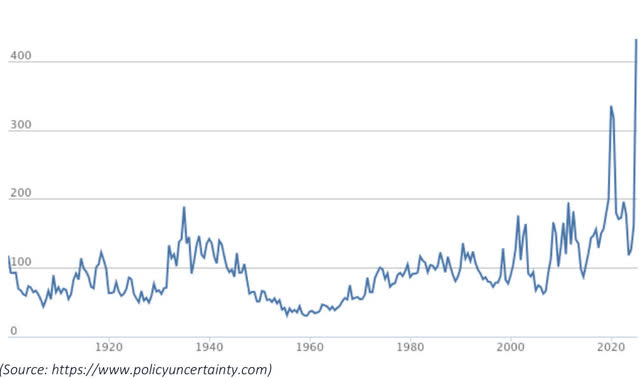

Exhibit 2: Monthly U.S. Economic Policy Uncertainty Index

The profound uncertainty surrounding Trump’s trade policies will have its own adverse effects on the economy entirely separate from — and in addition to — those of the tariffs themselves. Businesses and households will delay important spending decisions in the face of economic policy uncertainty that by some measures has never been higher.

The big question on everyone’s mind is whether Trump’s tariffs will push the U.S. economy into a recession. Although the odds of a near-term recession have increased, the economy was in rude health when Trump took the reins. Growth will slow, unemployment will edge up, and we will all be worse off, but there seems to be a better than even chance that the U.S. economy will avoid an official recession solely from the impact of Trump’s tariffs.

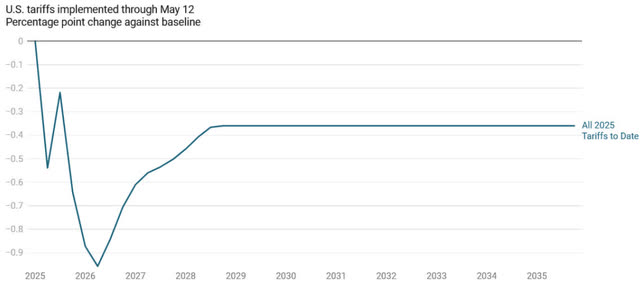

Based on the tariffs implemented through May 12th, the Yale Budget Lab estimates that by 4Q25, U.S. real GDP will be 0.6% smaller than it otherwise would have been. That figure peaks at a 1.0% shortfall by 2Q26. In December, the Fed expected the U.S. economy to grow by 2.1% for 2025. The Yale Budget Lab’s estimated hit from Trump’s tariffs would still leave the U.S. economy bigger at the end of 2025 than at the beginning.

Exhibit 3: Yale Budget Lab Estimates of U.S. Real GDP Level Effects of 2025 Tariffs to Date

Financial markets also seem to be only flashing “yellow” signals for the economy, not red ones. High yield credit spreads are a helpful — if indirect and imperfect — barometer for the market’s perceived risk of a recession in the near-term. Credit losses increase broadly in a recession, so credit investors demand higher yields over treasuries when the perceived risk of a recession is elevated. At the moment, the ICE BofA US High Yield Index Option-Adjusted Spread sits at 3.16%. Although credit spreads have widened since Trump began rolling out his trade policies, that figure still sits at roughly the 12th percentile of the historical distribution going back through 1997. High yield credit spreads at that level simply do not point to a looming recession. Moreover, much of the increase in high yield credit spreads recently likely reflects the disproportionate effect Trump’s trade policies will have on certain companies and industries as opposed to broader economic stress.

Exhibit 4: U.S. High Yield Credit Spreads

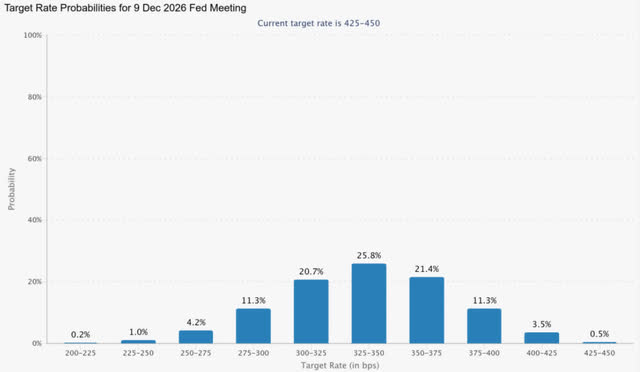

The market for futures on the federal funds rate tells the same story. The market currently believes the targeted range for the federal funds rate will most likely end 2025 at 3.75% – 4.00%, or 50 basis points below its current level, and end 2026 at 3.25% – 3.50%, just 50 basis points lower than where it is expected to end 2025. Both of those anticipated ranges for the federal funds rate are modestly above the level the Fed considers neutral, 3.00%. While it is more difficult than usual to gain confidence in the Fed reaction function the market is pricing in and thereby gain a sense of the key economic variables (i.e. unemployment, inflation, etc.) implied by market pricing, it is unlikely the Fed would keep monetary policy above neutral — what is currently being priced in for 2025 and 2026 — if the unemployment rate were to increase meaningfully above the level the Fed’s estimate of a long-term equilibrium level, 4.2%.

Exhibit 5: Futures Market Implied Probabilities for the Targeted Federal Funds Rate

Even if Trump’s tariffs are not by themselves sufficient to push the U.S. economy into a recession, their impact will nonetheless leave the U.S. economy far more vulnerable to any further headwinds and adverse shocks that may come along the way. While economic doom does not seem imminent, neither are the economic skies clear and bright.

Our portfolio outperformed the S&P 500 during the first quarter. It outperformed the NASDAQ Composite (COMP:IND), which registered a -10.3% total return for the quarter, to an even greater extent. Our position in Uber Technologies, Inc. common stock (UBER) rebounded from being our largest detractor during the fourth quarter of 2024 to being the top positive contributor during the first quarter of 2025. UBER gained 20.8% for the quarter. Our positions in Alphabet Inc. class C capital stock (GOOG) and Interactive Brokers Group, Inc. class A common stock (IBKR) were notable detractors from our performance. GOOG and IBKR fell 18.0% and 6.3%, respectively.

Performance Attribution

Positions that had a material impact on the portfolio’s mark-to-market performance for the quarter are outlined below.

| 1Q 2025 | |

| Uber | 3.49% |

| Alphabet | -2.63% |

| Interactive Brokers Group | -1.96% |

| Other | 0.60% |

| Gross Performance | -0.50% |

Portfolio Composition

The composition of the portfolio at the end of the quarter is depicted below.

| Equities-Long | 88.0% |

| Cash | 12.0% |

During the quarter, we reduced our positions in Amazon.com, Inc. common stock (AMZN) and Netflix, Inc. common stock (NFLX) and added to our position in Uber Technologies, Inc. common stock (UBER). At the end of the quarter, our portfolio included seven long equity positions and cash.

On the whole, the positions in our portfolio are highly insulated from the adverse impacts of the global tariff war Trump ignited during the first quarter. The updates for this quarter provide a brief overview of how — and the extent to which — the top four positions in our portfolio might be affected by Trump’s tariffs. As of this writing, those positions collectively account for roughly 95% of the portfolio’s equity exposure; no other positions exceed 2.5% of the portfolio’s value.

Interactive Brokers Group, Inc. (IBKR)

Interactive Brokers is a highly automated global securities firm that specializes in routing orders and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than 150 electronic exchanges and market centers around the world. Interactive Brokers custodies and services accounts for hedge and mutual funds, registered investment advisors, proprietary trading groups, introducing brokers and individual investors. More than two-thirds of IB’s customers are based in Europe and Asia and an even greater share of its new customers come from those regions.

Interactive Brokers has no material, direct exposure to any tariffs on goods. The company’s revenues mainly come from commissions and net interest income, neither of which is directly affected by tariffs. The primary components of IB’s cost structure are transaction-related fees, such as fees paid to electronic exchanges, clearing houses, and market data providers, employee compensation, rent, communications expenses, advertising costs and professional services fees. Tariffs don’t apply to most of those costs. Any increase in costs that Interactive Brokers may face due to Trump’s tariffs, such as higher costs for computers and data center equipment, will be insignificant relative to the company’s overall cost structure and will impact the company only gradually as new equipment is purchased. Interactive Brokers is further insulated from any direct impact from Trump’s trade war due to the global nature of its revenues and expenses, as well as its high profit margin.

Interactive Brokers should also prove resilient to any adverse effects Trump’s trade war will have on the global economy. IB’s business is diversified across customers, customer segments, geographies, products, product types, and market centers. Churn among its customers is low. Although customer trading activity and net interest income fluctuate somewhat in the short term with changes in financial market conditions, those variables are predictable over the long term. IB manages its credit, interest rate, and liquidity risks very conservatively. The Global Financial Crisis and COVID pandemic are about the most severe stress tests anyone could design for a financial services company like Interactive Brokers. IB sailed through both of those periods. IB’s pre-tax income grew each year from 2006 through 2011 and from 2019 to 2023.

Uber Technologies, Inc. (UBER)

With operations in more than 10,000 cities across 72 countries and gross bookings expected to exceed $180 billion this year, Uber is one of the largest transportation network companies in the world. Each month, Uber helps more than 170 million users meet their mobility and delivery needs by connecting them with more than 7 million independent drivers and couriers. Uber’s mobility and delivery services are enabled by a highly sophisticated and efficient technology platform that automatically manages and optimizes demand prediction, matching & dispatching, routing, pricing, and personalization, among other functions. Uber has a leading category position in eight of its top ten mobility and delivery markets.

Like Interactive Brokers, Uber has no material, direct exposure to Trump’s tariffs or the associated retaliatory tariffs. Major components of Uber’s cost structure include insurance, credit card processing fees, data center and communications expenses, employee compensation, advertising expenses and rent. Tariffs only directly impact Uber’s cost structure in minor ways. Uber may have to pay more for computers and data center equipment, but the impact will be insignificant in the context of the company’s overall cost structure and will phase in gradually over time.

The indirect effects of Trump’s trade policies on Uber should also be limited. First, vehicle-related costs will increase for Uber’s drivers and couriers, but the cost of personal car ownership will increase as well. Uber could benefit from higher vehicle costs on balance if enough people delay or forgo purchasing a first or second car due to tariff-driven price increases. Second, the U.S. may experience an ebb in international tourists for a while, but many of those tourists will likely end up traveling to other countries in which Uber has a significant presence. Finally, Uber should prove to be a highly recession-resilient business over time for a variety of reasons and is well positioned to weather any adverse impact on the global economy from the trade war Trump has launched.

Northeast Bank (NBN)

Northeast Bank is a Maine state-chartered bank with $4.2 billion of assets and $468 million of equity as of March 31st. Led by industry veteran Rick Wayne, Northeast Bank originates and purchases commercial real estate loans nationwide. Wayne executed a similar strategy for nearly two decades as CEO of Capital Crossing Bank, a bank he founded with a partner in 1988, took public in 1996, and sold to Lehman Brothers in 2007 for nearly ten times its IPO price.

Trump’s trade war will have only indirect effects on banks in general, but indirect does not necessarily mean immaterial. Weaker economic growth will slow loan originations and increase credit losses to some extent. The creditworthiness of borrowers in industries directly impacted by the new tariffs will deteriorate, increasing eventual credit losses for their lenders. The creditworthiness of many households will suffer too as those households struggle to maintain their standard of living in the face of higher prices. Consumer loans will perform worse than they otherwise would. Finally, any decrease in the expected path of the federal funds rate due to a weaker economic outlook could put pressure on net interest spreads and margins for asset sensitive banks.

Northeast Bank is not immune to the headwinds that Trump’s trade war will create for banks, but it is well-positioned to weather them. First and foremost, Northeast Bank’s loan portfolio is conservatively underwritten. The portfolio’s weighted average loan-to-value ratio was 50% as of March 31, 2025. The part of Northeast Bank’s loan portfolio where credit losses would most likely materialize is the unguaranteed portion of SBA loans that Northeast Bank holds on its balance sheet. The weighted average LTV for those loans was 81% as of March 31, 2025; however, those loans totaled just $92 million and represented just under 2.5% of the overall portfolio. Even a significant increase in credit losses in Northeast Bank’s SBA loan portfolio would represent only a modest headwind to the Bank’s overall profitability. Northeast Bank’s loan portfolio is also well diversified by collateral type, with limited exposure to loans, borrowers and collateral types most likely to be directly and materially impacted by tariffs, such as consumer loans and loans against certain types of retail properties.

Second, Northeast Bank’s interest rate sensitivity is relatively neutral at the moment. In its most recent 10Q, Northeast Bank estimated that a 200 basis point parallel increase in interest rates would decrease net interest income by 0.04% in the first year, and a decrease of the same amount would increase net interest income by 1.80%. Northeast Bank could also benefit materially from a sharp fall in interest rates if a significant portion of its purchased loan portfolio were to be paid off through refinancing. Northeast Bank carried a net discount on purchased loans of $194.6 million, or roughly $23 per share, on its balance sheet as of March 31, 2025. The Bank would recognize that amount as a component of net interest income if all its purchased loans were to be paid off through refinancing.

Finally, Northeast Bank’s management team has an incredible track record of taking advantage of the opportunities created by periods of uncertainty and disruption. If history is a guide, any negative effects that the Bank experiences from the current episode of economic disruption will be more than offset by the benefits it realizes from the opportunities Rick Wayne and his team capitalize on.

Alphabet Inc. (GOOG),(GOOGL)

Alphabet is the holding company for Google, one of the preeminent businesses in the world, as well as a collection of other, smaller companies, such as Access (broadband internet), Calico (life sciences), Verily (life sciences), and Waymo (autonomous vehicles), among others. Google has numerous core products used regularly by more than a billion users around the world, including Google Search, Android, Chrome, Gmail, Google Maps, Google Play Store, Google Photos and YouTube. Google accounts for more than 99% of Alphabet’s revenue and profits.

Trump’s trade war will directly impact Google in a few ways. Tariffs will likely hit the technical infrastructure Google uses to run its business, such as servers and networking equipment. Tariffs will also likely apply to the devices that Google designs and sells, such as Nest home products and Pixel books and phones. Although costs for purchasing those items will increase, the impact on Google’s results should be relatively limited. Expenses related to depreciation of technical infrastructure and the cost of devices sold combined likely account for less than ten percent of Google’s revenue currently. Moreover, Google should be able to pass on most of whatever increased costs it faces.

Another possible direct impact on Google from Trump’s trade war could be retaliatory measures implemented by foreign governments that explicitly target large, U.S.-based technology companies. For example, several leaders in the European Union have suggested targeting companies like Google in response to Trump’s tariffs, including by using the European Union’s relatively new Anti-Coercion Instrument. Given that Google has significant operations in Europe and other international markets and serves global advertisers, it is unclear how exactly any such targeted retaliatory measures would work and to what extent those measures would apply to Google’s revenue in Europe. Google generates just under a third of its revenue from the combined Europe, Middle East & Africa region. Revenue from the European Union alone probably accounts for less than twenty percent of Google’s total revenue, mitigating the threat from retaliatory measures to some degree.

The indirect effects of Trump’s trade war on Google will likely be more significant than the direct ones, though still manageable overall. Advertisers directly impacted by tariffs will likely pull back on their ad spending. Google does not disclose its advertising revenue by type of advertiser, but companies directly affected by tariffs, such as retailers, consumer packaged goods companies, consumer electronics manufacturers, car dealers and automotive OEMs, probably collectively account for around 30% of Google’s overall ad revenue. Google has particularly benefited recently from aggressive ad spending by two China-based e-commerce retailers, Temu and Shein. The business models of those two companies in part center on exploiting the De Minimis Tax Exemption, which allows shipments valued under $800 (per person, per day) bound for American businesses and consumers to enter the U.S. free of duty and taxes. Trump’s trade policies have directly targeted such low-value shipments from China. Ad spending by those two companies has already slowed significantly. At the same time, headwinds to global economic growth created by Trump’s trade war will further weigh on global ad spending. With just under half of its revenue coming from the United States, Google’s revenue growth could slow by a few percentage points due to these adverse, indirect effects of Trump’s trade war.

Of the top positions in our portfolio, Alphabet is the most exposed to Trump’s trade war. It is far less exposed than the typical company, though. Alphabet’s revenue growth may face some headwinds, but the company should continue to grow, earn substantial profits and generate prodigious cash flow. Alphabet’s stock is priced to deliver attractive returns even considering the headwinds it may face from Trump’s trade war.

Our portfolio is well-positioned to navigate the turmoil and uncertainty facing the global economy. Moreover, periods of disruption and uncertainty tend to create the most lucrative investment opportunities. I am focused on ensuring the value of our portfolio ultimately ends up higher for going through this period of turmoil and uncertainty than it otherwise would have been.

Thank you for your continued confidence and support.

Regards,

Marc Werres, Managing Partner

|

The performance figures depicted herein relate to 1578 Partners, LP. This account serves as the model account for the taxable accounts Hinde Group manages. The performance of investor partner accounts may differ from the figures depicted herein for several reasons, including, but not limited to, cost basis differentials, the timing of account inflows, and tax considerations. 1578 Partners, LP’s gross results reflect the deduction of trading commissions and other fees charged by Hinde Group’s broker. Net results reflect the hypothetical deduction of management fees (1.5% of AUM per annum billed quarterly in advance). 1578 Partners, LP’s inception date is August 1, 2015. The statistical data regarding the performance of the S&P 500 was obtained from the website of S&P Dow Jones Indices. The S&P 500 returns shown do not represent the results of actual trading of investible assets/securities. Past performance is not necessarily indicative of future results. All investments involve risk, including the loss of principal. The views expressed herein are those of Hinde Group as of the date indicated and may change without notice. Hinde Group may buy or sell any security at any time and is under no obligation to provide updates to the information contained herein. This is not a recommendation to buy or sell any security. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here