In practical and material terms, the American dream has long centered around agricultural land ownership further in our past, and home ownership is the modern-day manifestation of this political touchstone. In our increasingly divided society, it is also what the political scientist John Rawls would call part of the American “overlapping consensus.”

In other words, it doesn’t matter what walk of life you come from or what you believe; if you’re a homeowner, you have a standard set of needs wherever you are, and if it is easier to upgrade and maintain your home, well then you will be more likely to engage in such commercial activity. This is the value proposition that had made Home Depot one of the most successful companies in modern American history.

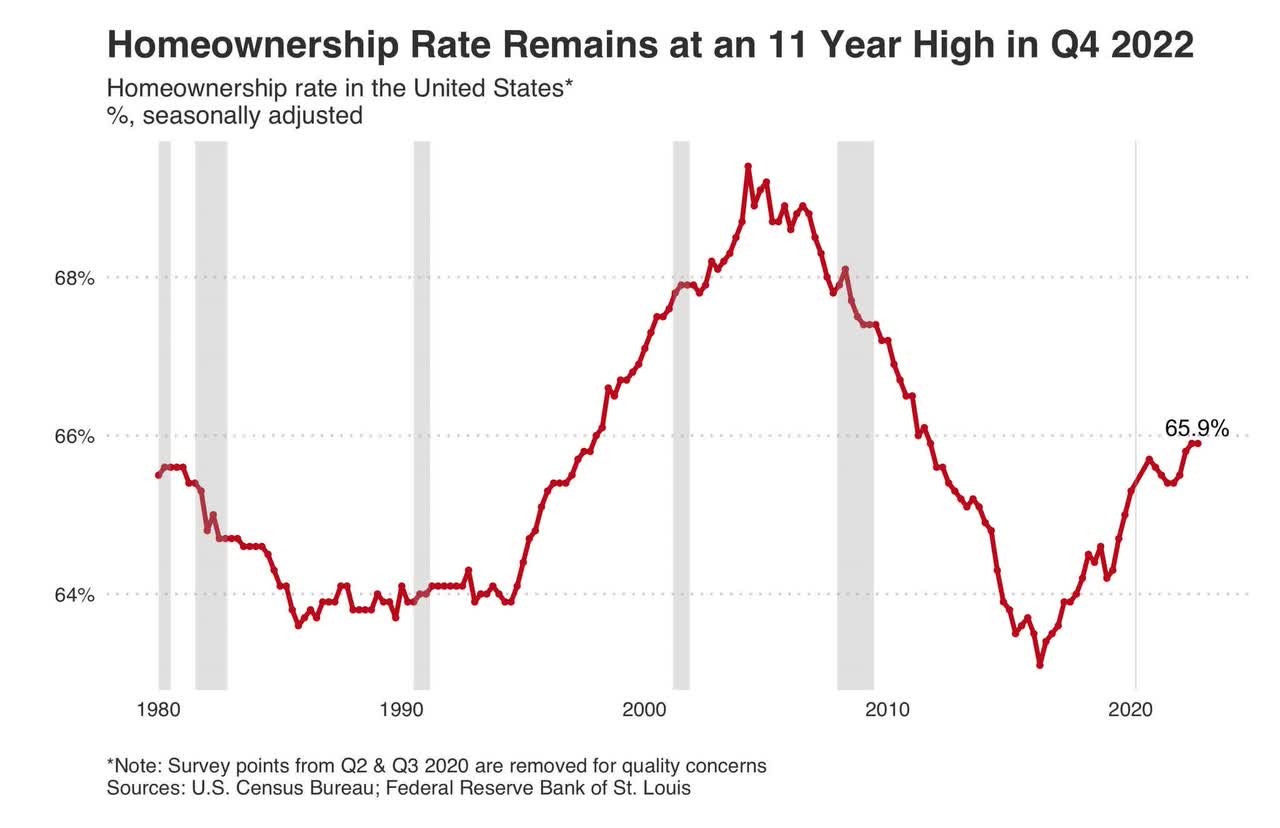

Financial Samurai

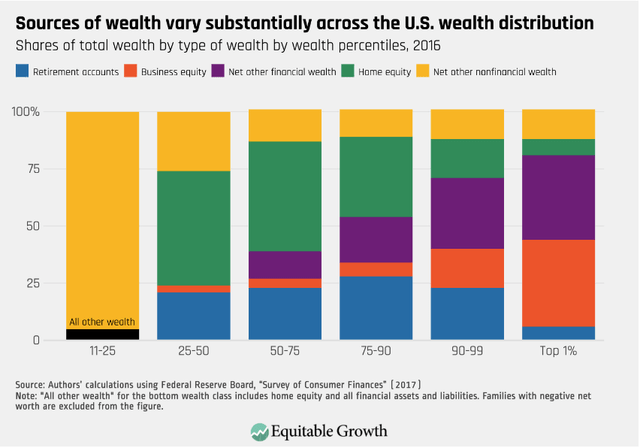

Taking care of a home isn’t easy, and a company there to help you through the frustration, stained clothes, broken glass, and other pitfalls of DIY rightfully earns a unique and memorable place in the consumer’s heart. Home ownership is a crucial part of economic and political identity in the United States, and it is often the cornerstone of accumulated wealth.

So the company that assists consumers in being a proper steward of their most valuable asset is almost serving a similar economic function to wealth managers, who help steward other mostly non-physical assets to build wealth.

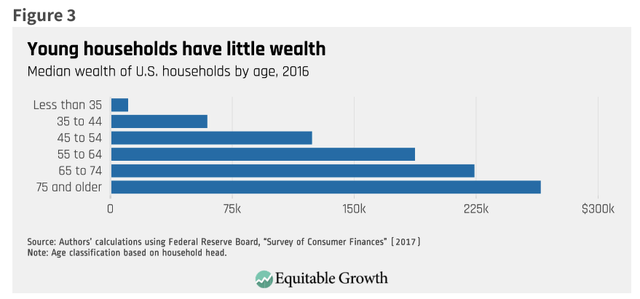

One thing that we equity enthusiasts may forget from time to time is that most Americans build wealth with a different kind of equity; home equity. And when you consider this fact, the crucial role that Home Depot (NYSE:HD) plays in our allowing tens of millions of Americans to easily maintain, improve, and augment the value of their most precious asset.

Washington Center for Equitable Growth

There are some companies increasingly threatened by political polarization, and some even fear that certain aspects of our unified market are eroding. If that is true, one of the last holdouts of the common and unified American market will be Home Depot.

Americans of all stripes love this company, as do the people working that work there. Of course, the shareholders do as well, and this is one of the best-run companies in the country as far as I’m concerned. It’s hard to find a good entry into it because it is rightfully coveted by discerning shareholders. But remember, the stock market really gives you a flashing entry for quality stocks like this one, and given the potential upside in the economy, I think it is a buy right now.

Seeking Alpha

Here’s a powerful thing about this company and about the brand value they’ve created. I don’t know about you, but I get a positive feeling when I see a Home Depot. You probably do too, and this is not an accident. The company has a culture oriented around putting the consumer above all else and it leaves an impression. They will guide customers of all skill sets to ensure they have what is necessary to complete their project.

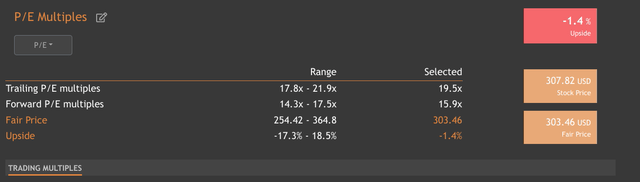

Valuation And Dividend

This company is a high-quality stock, a quintessential blue chip. This means you can feel comfortable owning it for a long haul, and initiating a position largely becomes a question of making sure the entry point is advantageous from a risk/reward perspective. Given the quality of the stock and the premium it has rightly earned, it does appear overvalued on metrics like the Peter Lynch Fair Value model and the Dividend Discount Model.

valueinvesting.io

The multiples look roughly fairly valued though, and there are also other valuation methods that suggest this should be a good time to start a position that you should build over time.

Home Depot is a stalwart of the Dow Jones Industrial because it is a large company, one of the biggest employers in the country, and it pays about 1% of all taxes paid by corporations in the United States.

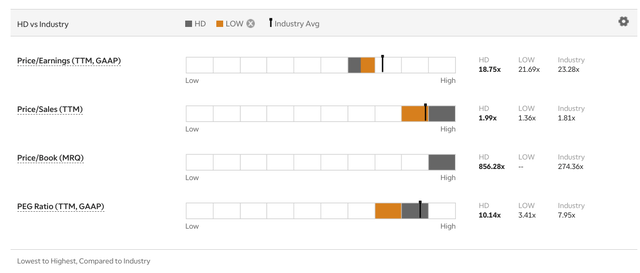

Thus, the company is massive and is an extremely good barometer of economic activity. The stock was normally closely tied to economic cycles, but of course COVID threw this off. But valuation relative to peers looks good right now:

TD Ameritrade

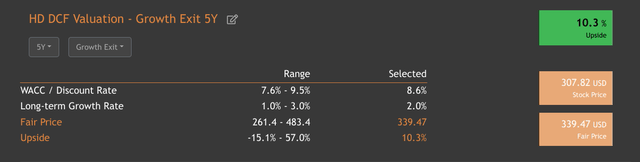

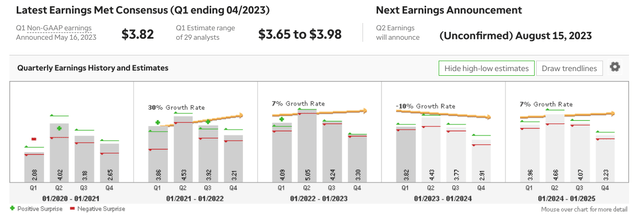

Like so many other stocks, the analysts have been somewhat thrown off by anomalous demand patterns caused by the pandemic. However, a lot of the COVID hangover is now gone, and if we are indeed entering an economic expansion and bull market, then Home Depot’s recently curtailed guidance should be pretty easy to beat. The firm is currently undervalued with a 5-year discounted cash flow model.

valueinvesting.io

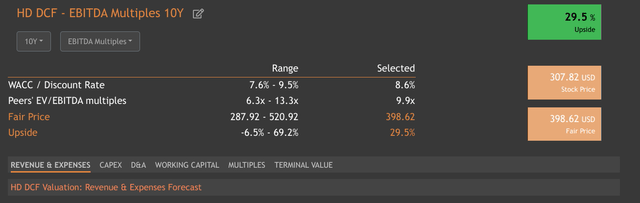

The intrinsic upside is even more advantageous when you stretch out the time period covered by the model. The upside on the ten-year growth exit model shows more than three times as much upside as the five-year model. The long-term upside is confirmed by using a model based on EBITDA multiples as well. This is why I’m comfortable entering this quality stock at these current levels given the increasing potential for an economic soft landing.

valueinvesting.io

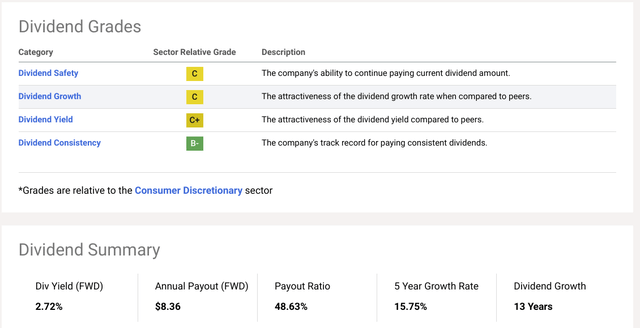

While I’m not bullish on this stock strictly due to the dividend, it is certainly nice to have and it provides an additional margin of safety. When you have a company like this with such an established brand that so many Americans love, I think that also effectively adds to your margin of safety.

Seeking Alpha

The payout ratio is approaching 50%, which can definitely be a warning sign. But I am confident that management has properly manged expectations in a way that supports the dividend. Some great analysis from one of my fellow Seeking Alpha Analysts also makes a great case for this assertion.

You can feel safe buying this stock and while the upside might not match the newest AI thing on a price level, it’s important to remember how well this company is managed and that in terms of increasing profitability, on some metrics, it beats even Apple.

The company is certainly tied to the fortunes of the US consumer, and there are growing signs that the consumer is becoming beleaguered, but there are also increasing green shoots in the economy particularly in the vital area of housing. Obviously, housing activity is a primary bellwether for Home Depot.

Housing Strength And Demographic Tailwinds Should Converge To Home Depot’s Benefit

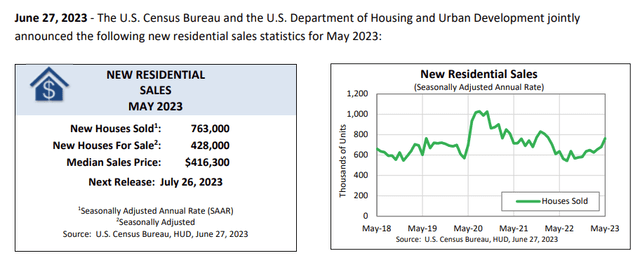

There are two different trends in the housing market. Pre-owned sales are down, why new sales are ripping higher. The strength in housing is pretty remarkable given the high rates and I’d say this strength is one of the more compelling points for the bulls arguing that an economic expansion might be possible after the current slowing we’re experiencing.

US Census Bureau, HUD

Remember, that despite tough talk from the Fed, the June “dot plot” shows economic projections that show the coveted “soft landing” as the most likely scenario. That’s right. Official Fed projections are that we avoid recession.

Another thing about Home Depot that is nice, is that is largely insulated from the storm clouds in CRE. But the main reason for my bullish thesis is pretty simple and I will lay it out:

- The stock’s valuation is relatively appealing compared to peers and on an intrinsic basis

- Consensus expectations for an economic slowdown are overdone and there’s increasing evidence that the economy may be “slipping into an expansion,” to quote my former boss.

- This provides a nice risk/reward for a quality name whose assumptions and guidance largely appear based on a recession materializing.

- Thus, the company may be able to significantly outperform current Wall Street expectations, and downward revisions may have bottomed.

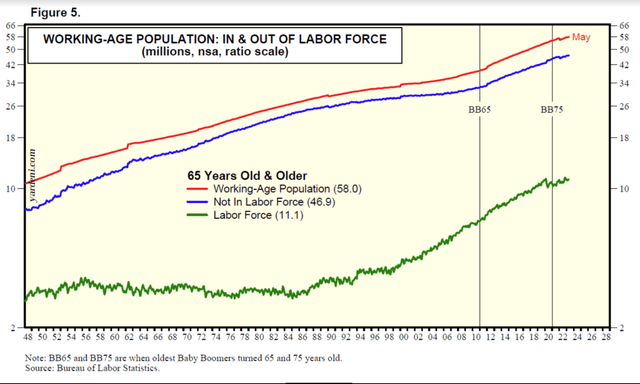

I think this is what makes Home Depot a buy, and of course there are many things that could derail the thesis. However, I’m increasingly confident we’ve entered a bull market. To get even more specific on housing though, I’m very optimistic because Homebuilder stocks have been ripping. Long-term demographic drivers should support demand for Home Depot’s wares as well, as the baby boomers retire their millennial heirs have some catching up to do.

Washington Center for Equitable Growth

Thus, when the baby boomers start transferring massive amounts of wealth to the millennials, they will have some major catching up to do. They will likely both modify existing property and buy new homes, as data suggests has already begun. This could be part of the reason demand is so strong in the face of such powerful headwinds from rates, but this could be reversing as well.

Dr. Ed Yardeni

There’s also growing signs the Fed could be done. The bond market seems to have called Powell’s bluff and many feel that the FOMC will engage in less hikes than it currently forecasts as I predicted immediately after the last Fed meeting. Economic strength has been building across the economy.

The incredible thing about the current strength of the housing demand is that existing home sales are still being suppressed by rates. When the upward pressure comes off rates, even if they remain high this should provide additional strength to an already hot housing market since demand is already going up at the same time rates are. This indicates a latent strength that will show itself even more as the tightening cycle comes to a close.

Risks And Where I Could Be Wrong

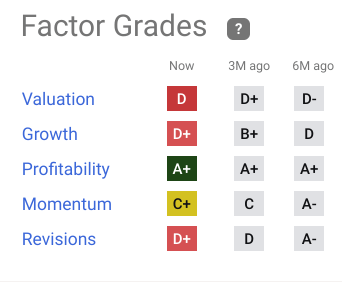

Look, I am someone who analyzes markets who has strong views but I also always respect the other side of the argument. The Bears are bringing up a lot of good points about major risks from a deteriorating geopolitical environment to the potential for a Fed policy error. Valuation is getting stretched by some measures. The company has several bad Quant grades as well.

Seeking Alpha

There are compelling arguments on these points and others, but I think we should all remember that bear markets begin on pessimism, and once the crowd gets out of control it’s hard to stop. Any of the following risks blowing up would derail my bullish thesis, which rests on a soft landing occurring:

- CRE blowup freezes credit markets

- Inflation

- Worse-than-expected recession

- US Consumer Confidence Falls

- Healthcare-specific risks get worse

- Management damages brand value

There could be unique weakness in housing and Home Depot’s demand projections could be off based on the difficulty of passing “the puppy through the python” of anomalous COVID demand.

Supply chain issues are a problem for the company, and further geopolitical issues could complicate this key risk. The firm’s attractive policies toward employees and labor help it mitigate that risk, but given its scope and scale this could bite the firm as well.

Conclusion

Apple went public in 1980 at 10 cents per share. IRR through May 31, 2022 with dividends: 19.7%. Home Depot went public in 1981 at four cents. Rate of return with dividends: 29.4%.” Its profitability tops Apple’s. Need I say more?

Ken Langone, Co-Founder and former CEO of Home Depot

There’s a difference when anomalous COVID demand effects a company with a proven business model and culture that not only has a proven track record but that sets a sterling example for other companies to emulate. Home Depot does a lot to integrate their employees into profit sharing, bonuses, and stock ownership. The firm has made thousands of former employees millionaires who started off at the lowest level.

To me, this is a major reason you can feel safe owning the firm. It has a superior culture and strategy oriented around the customer that transcends generations and beliefs and provides an undeniable value proposition to the American homeowner.

TD Ameritrade

The firm has had struggles since COVID demand waned, but all indications are that this is in the rearview mirror. It looks as if earnings should accelerate over the next year. Earnings will likely grow more if they converge with simultaneous economic and demographic tailwinds.

There is an increasingly vocal portion of consensus that has missed out on Tech’s rally. Rather than chasing Tech, many lagging fund managers will return to stalwart stocks that will benefit from economic expansion that have proven models and management teams.

Buying a high-quality company that is at the center of the world’s most powerful economic engine at a reasonable price and holding it is a time-tested strategy for building wealth. Home Depot’s current price and the increasing economic fortunes in the United States seem to provide such an opportunity. This is a stock you want to own. Hold it for at least three years.

Read the full article here