Thesis

I am perpetually searching for appealing long-term compounders. When looking for companies with the potential to maintain attractive returns over an extended period of time, The Home Depot (NYSE:HD) shows up more often than most. After looking over their financials, I believe Home Depot is attractive to patient investors looking for high yield-on-cost. Unfortunately, their current valuation does not present any margin of safety, so I cannot consider buying. I currently rate Home Depot as a Hold.

Company Background

Home Depot is a home improvement retailer headquartered in Atlanta, Georgia. They were founded in 1978, and currently operate over 2,300 stores across North America. The company also assists with installation, maintenance, and repairs.

The company revealed earlier this year that every hourly associate in the U.S. and Canada would receive a wage increase in 2023; those increases started in February. This summer, they also announced a goal for battery-powered products to represent 85% of their outdoor lawn equipment sales by 2028.

Long-Term Trends

DIY & hardware stores are expected to experience a CAGR of 2.63% until 2028.

Annual Financials

Before I go over their financials, I need to note that their annual statements land at the beginning of the following year. This results in most of the business for a given calendar year being labeled as occurring in the following year. This is why 2023 shows up on the charts; it covers operations from January 2022 to January 2023. References within this section are always as the years are labeled and not how they fall on the calendar year.

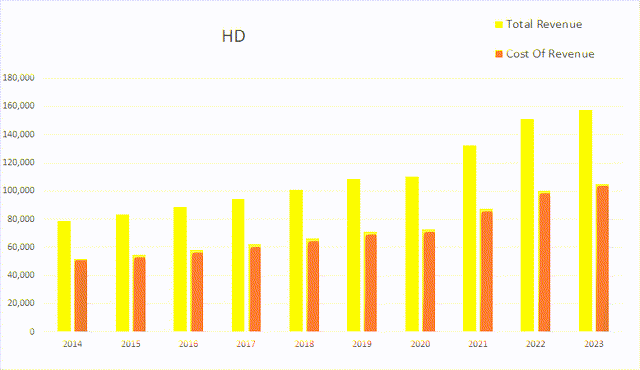

Before the pandemic, Home Depot was already steadily growing revenue. When aggregate consumer purchasing habits shifted, the rate of revenue growth inflected higher. As purchasing habits are renormalizing, the rate of revenue growth has inflected back down. In 2014 they had an annual revenue of $78,812M; by 2023 that had grown to $157,403M. This represents a total rise of 99.72% and an average annual rate of 11.08%.

HD Annual Revenue (By Author)

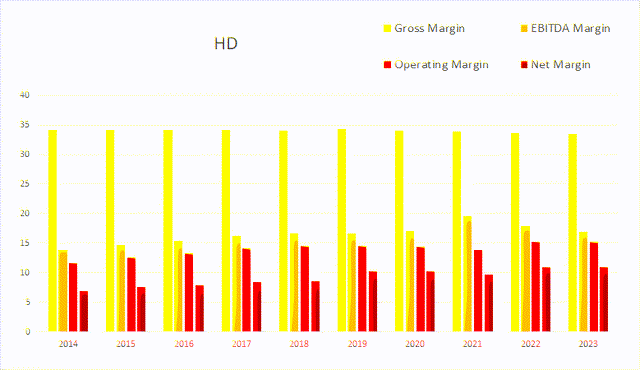

Home Depot has spent most of the last decade improving its margins. The additional foot traffic they were able to capture during the lockdowns shows up as a temporary margin expansion. Margins have since renormalized back into their previous trend. As of the most recent annual report, gross margins were 33.53%, EBITDA margins were, 16.96%, operating margins were 15.27%, and net margins were 10.87%.

HD Annual Margins (By Author)

Companies which do not have new markets to expand into tend to resort to share buybacks as an efficient way to improve long-term shareholder value. Home Depot has experienced significant improvements to its operating income while buying back shares. Total common shares outstanding was at 1,380M in 2014; by 2023 that fell to 1,016M. This represents a -26.38% decline in share count, and comes out to an average annual rate of -2.93%. Over this same time period operating income rose from $9,166M to $24,039M, or 162.26%. This comes out to an average annual rate of 18.03%.

HD Annual Share Count vs. Cash vs. Income (By Author)

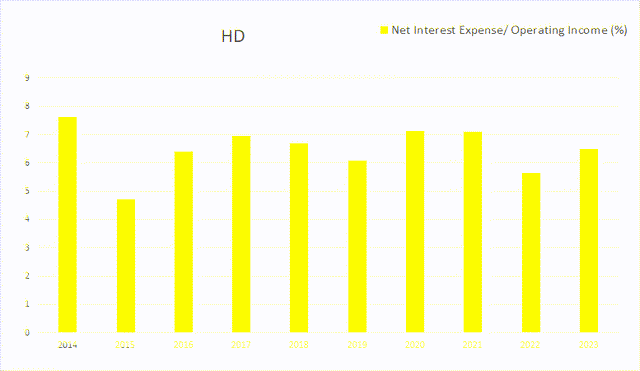

As of the 2023 annual report 6.50% of their operating income was consumed by their net interest expense. This appears to be a manageable debt obligation.

HD Annual Interest Expense vs. Income (By Author)

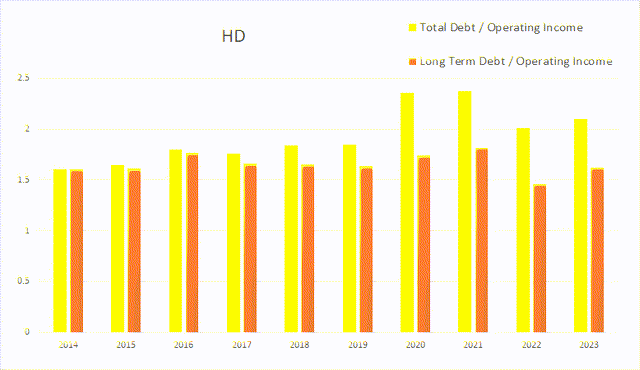

I tend to treat annual debt to income ratios above 3x as unappealing, and ratios below 1x as appealing. As of the most recent annual report total debt to operating income was 2.10x, and long-term debt to operating income was 1.62x.

HD Annual Debt vs. Income (By Author)

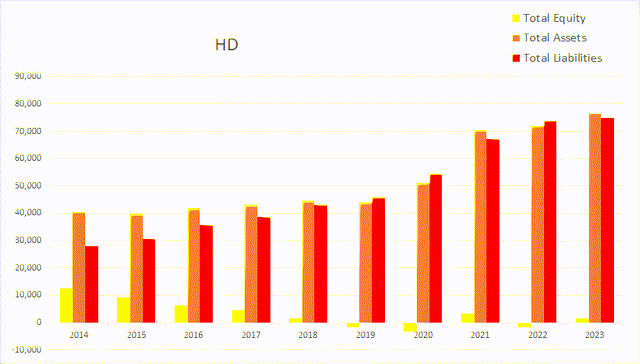

Their total equity has been oscillating around zero for the last several years. As their operating income has risen, the company has been able to take on ever larger amounts of debt while still keeping its overall situation relatively healthy. Normally, declining equity is alarming. However, when it also comes with rising income and easily sustainable debt levels, I prefer to see it as an indicator that management is confident they can maintain their healthy financials.

HD Annual Total Equity (By Author)

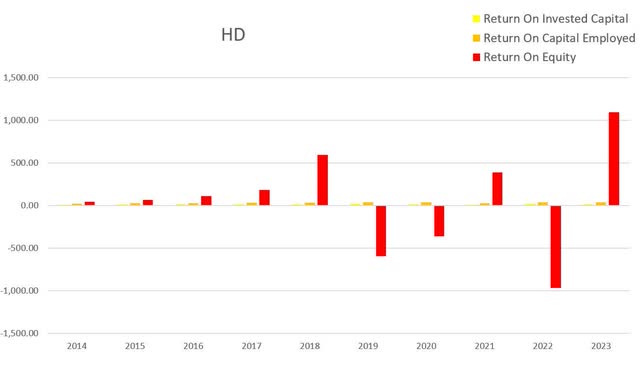

Their equity situation is producing Return on Equity values that I have to treat as outliers. As of the most recent annual report, I calculated values for ROIC of 17.70%, ROCE of 36.99%, and their ROE was 1,095.07%. The company posted an ROIC of 44.6% using a different non-GAAP method. I am using the ROIC = (net income – dividends) / (debt + equity) method.

HD Annual Returns (By Author)

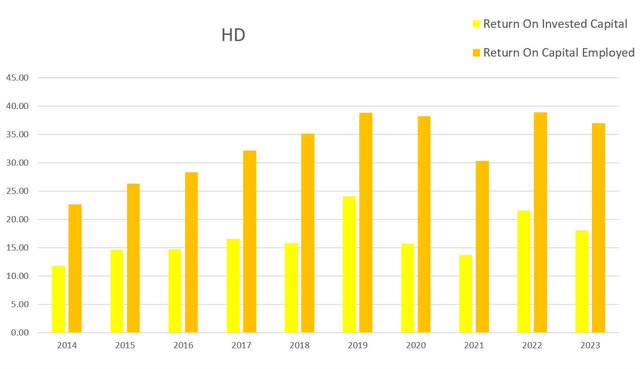

Here is the same chart with ROE removed. ROIC steadily rose until it reached a peak in 2019. Their ROCE also rose until 2019 and has stabilized above 35% most years since then. The one year there was an exception to this was 2021; Home Depot had an uncharacteristically large amount of cash on hand and this temporarily skewed their ROCE value.

HD Annual ROIC vs. ROCE (By Author)

Quarterly Financials

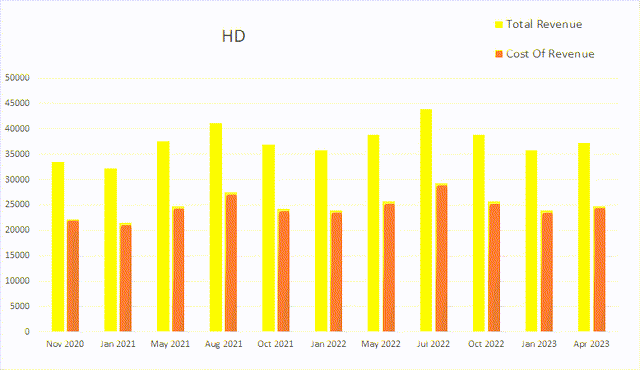

Their quarterly financials are affected by seasonality. The company experiences elevated revenue during warmer months and lower revenue during winter. Revenue appears to be leveling off as buying habits continue to renormalize. Eight quarters ago Home Depot had a quarterly revenue of $37,500M. Four quarters ago that had grown to $38,908M. By this most recent quarter revenue was at $37,257M. This represents a total two-year decrease of 0.68% and an average quarterly rate of -0.08%.

HD Quarterly Revenue (By Author)

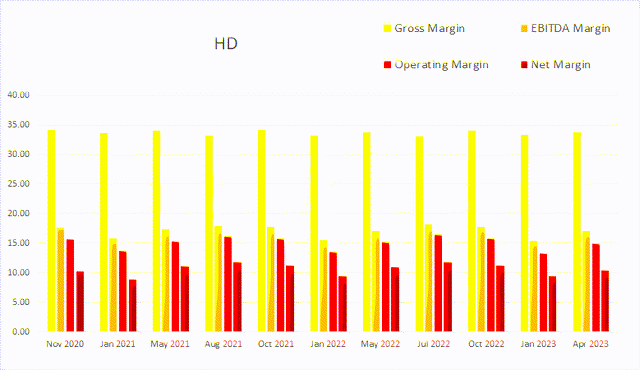

The same seasonality shows up here as muted. Although their revenue varies significantly throughout the year, their margins are relatively more stable. As of the most recent quarter gross margins were 33.70%, EBITDA margins were 17.03%, operating margins were 14.90%, and net margins were at 10.40%.

HD Quarterly Margins (By Author)

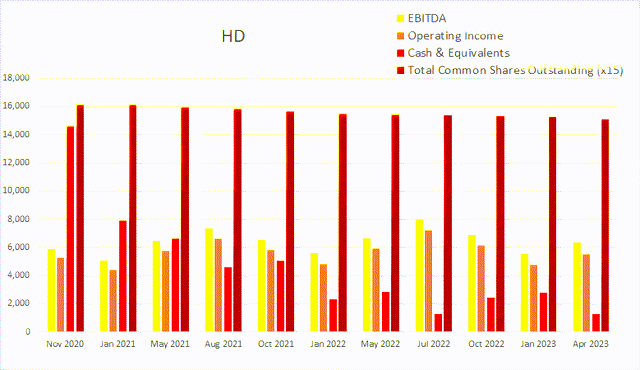

The company is clearly keeping less cash on hand in 2022 and 2023 than it was in 2020 and 2021. I read this as a sign that their pandemic-related uncertainty waned during 2021. As of the most recent quarter, cash and equivalents were $1,260M, and quarterly operating income was $5,551M.

HD Quarterly Share Count vs. cash vs. Income (By Author)

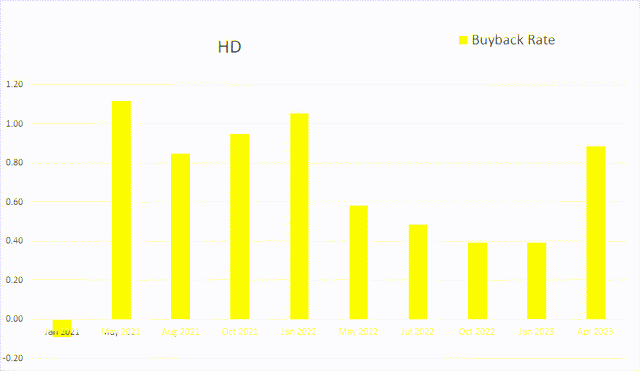

Their buyback rate varies from quarter to quarter. The sum of their last four quarters of buybacks comes to 2.15%.

HD Quarterly Buyback Rate (By Author)

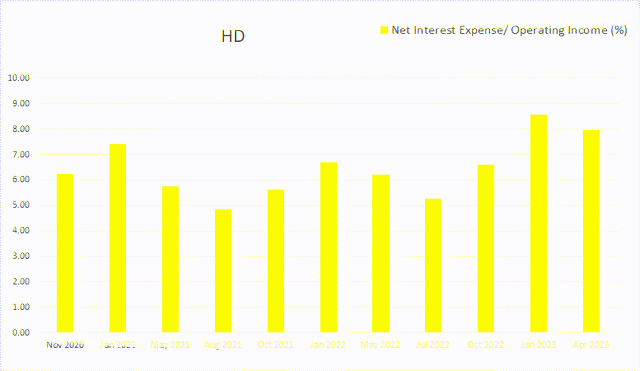

When looking at in on a quarterly basis the ratio of their net interest expense to their operating income is still quite healthy. This most recent quarter Home Depot had $-441M in net interest expense, $5,551M in operating income, and $3,873M in net income.

HD Quarterly Net Interest Expense vs. Income (By Author)

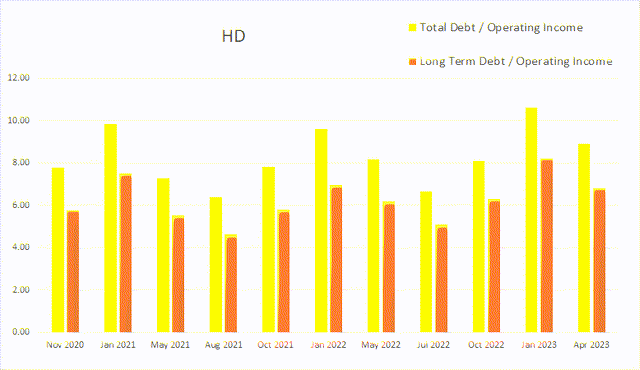

When viewing debt to income ratios on a quarterly basis, I shift my thresholds from 1x and 3x, to 4x and 12x. Although their debt to income ratios do seem to be slowly rising, they are both still below 12x. As of the most recent earnings report total debt to quarterly operating income was 8.90x, while long-term was 6.82x.

HD Quarterly Debt vs. Income (By Author)

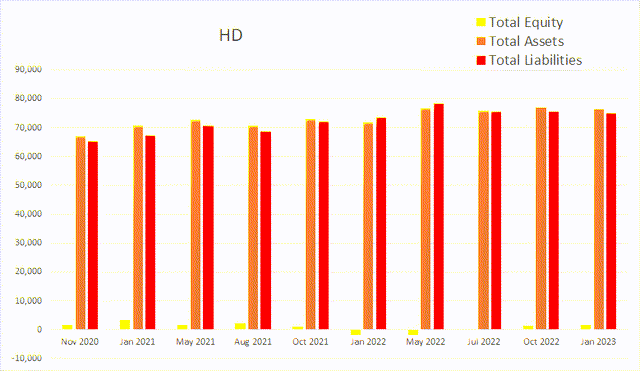

Their quarterly values for total equity continue to oscillate around zero.

HD Quarterly Total Equity (By Author)

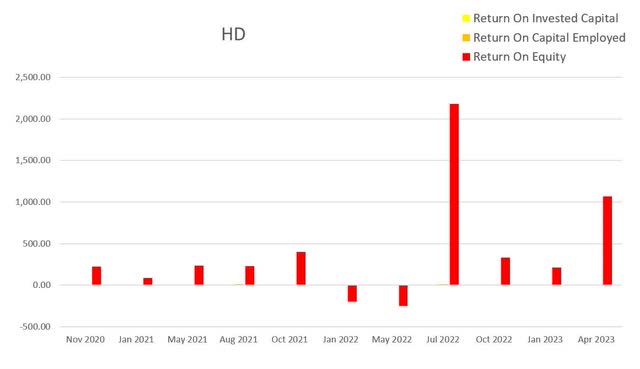

Similar to their annual returns chart, their equity situation is skewing their ROE values. As of the most recent earnings report ROIC was 3.55%, ROCE was 8.56%, and ROE was at 1,069.89%.

HD Quarterly Returns (By Author)

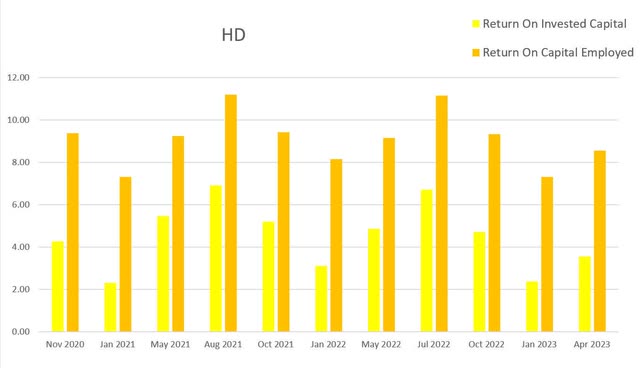

By removing ROE we can see the behavior of ROIC and ROCE on a quarterly basis. The fairly consistent pattern caused by seasonality implies the company should be posting values next quarter that will be comparable to their values for Aug 2021 and Jul 2022.

HD Quarterly ROIC vs. ROCE (By Author)

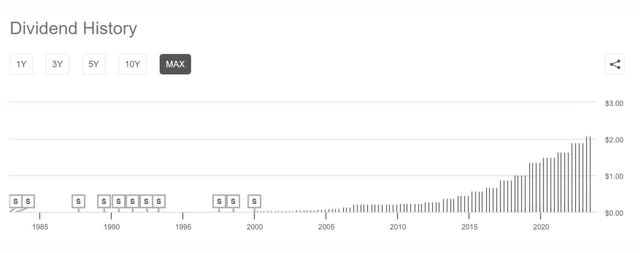

Home Depot has been offering a dividend for over twenty years. From 2011 to 2015 the slope of their dividend growth inflected upward. It appears to have stabilized into an extremely attractive growth rate. This should lead to high yield-on-cost for long term holders.

HD Dividend History (By Author)

Valuation

As of July 6th, 2023, Home Depot had a market capitalization of $312.47B and traded for $302.02 per share. Using their forward P/E of 20.76x, their EPS Long-Term CAGR of 8.55%, and their forward Yield of 2.69%, I calculated a PEGY of 1.85x and an Inverted PEGY of 0.54x. As the PEGY value is above 1, I view the company as presently overvalued.

Risks

Their business model has plenty of supplier diversity, and the company has strong brand recognition. However, they do exist as a sort of quasi-duopoly with Lowe’s (LOW), and experience constant competitive pressure from them. Both companies have already demonstrated that they are adaptable enough to keep up with any developments the other makes. Any profitable improvements one makes will quickly be adapted by the other. This is similar to the situation with Coca-Cola (COKE) and Pepsi (PEP), where neither appears to be able to establish any meaningful dominance over the other; at least not to the point where one can drive the other into irrelevancy. The risk here is if this somehow changes. If Lowe’s were to ever make a meaningful improvement to its business model that Home Depot was unable or unwilling to respond to, it would be an indicator of a loss in competitive edge.

The Home Depot Foundation distributes grants meant to improve the homes and lives of U.S. veterans, however not all of their actions have been well received by the public. The foundation made a contribution to the planned project often referred to as “Cop City”, in which a future Atlanta Police training center is being set to replace the Atlanta Welaunee Forest. The Welaunee Forest is referred to as one of the “four lungs” of Atlanta. In recent months protesting has become tense and bloody at the project site. Protests have also targeted Home Depot stores. The threat of a larger and more organized boycott against the company is low, but real.

Catalysts

The same competitive risk that affects Home Depot, also affects Lowe’s, Menards, and the rest of their competition. If any of them fall behind in their ability to keep attracting customers, they will lose market share and slip into irrelevancy. Home Depot is well positioned to benefit from any loss in market share their competition experiences.

Their habit of buying back shares with spare change should steadily improve their per-share metrics and will help support continued dividend raises. While not exactly major catalysts by themselves, the sum of continued buybacks over long time frames has the potential to produce outsized gains for long-term holders. Even without further increases in income, the buybacks are likely to lead to EPS improvements.

First Hand Experiences

In addition to several smaller hardware stores, I have both a Lowe’s and a Home Depot within a 15 minute drive of me. The only reason I frequent Lowe’s more is because it’s a shorter drive. Both companies offer a large variety of quality products and have excellent customer service.

Conclusion

Overall, Home Depot appears to be an excellent long-term investment. Their culture of buybacks coupled with increasing income has the potential to produce ever more attractive per-share metrics. The company has established itself a dominant player in its already mature industry and faces little risk of losing its long-term competitive edge.

Unfortunately for potential buyers, Mr. Market appears to have caught wind to this so Home Depot is currently trading at an elevated valuation…. and has been for a while. Home Depot regularly trades at P/E ratios above 20x. Because it is a widely held belief that this is a good company, even small dips are likely to be bought up quickly. Anyone determined to buy into Home Depot should consider dollar cost averaging into a small position while holding off on growing it into a large position until price falls closer to fair value.

HD 10 Year P/E (Seeking Alpha)

Read the full article here