The earnings of Horizon Bancorp, Inc. (NASDAQ:HBNC) will most likely dip this year due to pressure on the margin. I’m expecting the company to report earnings of $1.63 per share for 2023, down 24% year-over-year. Compared to my last report on the company, I’ve slashed my earnings estimate mostly because I’ve decreased my margin estimate. The year-end target price suggests a very high upside from the current market price. Further, Horizon is offering a high dividend yield. As a result, I’m maintaining a buy rating on Horizon Bancorp.

Loan Growth to Decelerate Because of Deposit Constraints

Horizon Bancorp’s loan portfolio grew by 2.2% in the first quarter of 2023, which exceeded my expectations. Loan growth is likely to remain at a decent level in the second quarter of this year because the pipeline remains at a healthy level. Management mentioned in the presentation that the commercial pipeline was at $130 million at the end of March compared to $134 million at the end of last year.

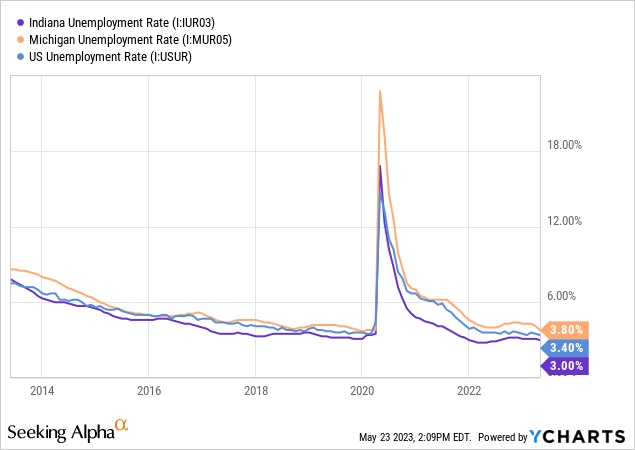

Further, the regional labor markets are currently quite strong when compared to the past. Horizon Bancorp operates in the states of Michigan and Indiana, both of which currently have very low unemployment rates in a historical context.

On the other hand, pressure on the deposit book will hurt loan growth. Horizon’s deposit book shrank by 2.7% in the first quarter, partly because of monetary tightening in the economy. In my opinion, this tightening will keep deposits under pressure through at least the middle of this year. Funding loans through borrowings isn’t always feasible as borrowings are costlier than deposits. Therefore, despite demand for its credit products, Horizon may become selective in its lending so that it doesn’t have to resort to costly borrowings that could shrink the margin.

Considering these factors, I’m expecting the loan growth to slow down from the first quarter level. I’m expecting the loan book to grow by 5.8% and the deposit book to increase by 0.3% in 2023. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 2,996 | 3,619 | 3,810 | 3,553 | 4,108 | 4,346 |

| Growth of Net Loans | 6.3% | 20.8% | 5.3% | (6.7)% | 15.6% | 5.8% |

| Other Earning Assets | 827 | 1,078 | 1,325 | 2,731 | 3,029 | 3,054 |

| Deposits | 3,139 | 3,931 | 4,531 | 5,803 | 5,858 | 5,875 |

| Borrowings and Sub-Debt | 588 | 606 | 590 | 791 | 1,259 | 1,471 |

| Common equity | 492 | 656 | 692 | 723 | 677 | 735 |

| Book Value Per Share ($) | 12.8 | 15.1 | 15.7 | 16.5 | 15.5 | 16.8 |

| Tangible BVPS ($) | 9.4 | 11.0 | 11.7 | 12.5 | 11.6 | 12.9 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin Trend Likely to Improve in the Second Half of the Year

Horizon Bancorp’s net interest margin contracted by 18 basis points during the first quarter of 2023, which is a third consecutive quarterly dip. The first quarter’s decline was greater than I had previously anticipated. The margin will likely remain under pressure in the second quarter of 2023 because of the hike in interest rates and because the balance sheet is currently unfavorably positioned for said rate hikes. The following points show why the income stands to take a hit from higher interest rates.

- Variable/adjustable rate interest-bearing deposits made up a majority, i.e. 60%, of total deposits at the end of March 2023. Therefore, deposit costs will surge immediately after every rate hike.

- The securities portfolio had an effective duration of 6.58 years, which means only a small portion of the portfolio will re-price this year. Hence, securities will hold back the average asset yield as market rates rise.

- Only around 32% of total assets will re-price over the next twelve months, as mentioned in the conference call.

I’m expecting the pressure on the margin to taper off once the up-rate cycle ends. This is because the re-pricing of loans will outlast the re-pricing of deposits.

Further, new loan production can be expected to significantly raise the average asset yield. This is because Horizon has been able to originate loans at a much higher rate than the average portfolio yield. As mentioned in the earnings presentation, the new production yield for commercial loans was around 175 basis points and the new yield for consumer loans was around 140 basis points higher than the paydown/payoff yields during the first quarter.

Considering these factors, I’m expecting the margin to decline by five basis points in the second quarter and then rise by ten basis points in the second half of the year. Compared to my last report on the company, I’ve slashed my estimate mostly because of the poor performance in the first quarter.

Slashing the Earnings Estimate to $1.63 per Share

Earnings will most likely dip this year because of pressure on the net interest margin. On the other hand, moderate loan growth will likely lift earnings. Overall, I’m expecting Horizon Bancorp to report earnings of $1.63 per share for 2023, down 24% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 135 | 161 | 171 | 182 | 200 | 184 |

| Provision for loan losses | 3 | 2 | 21 | (2) | (2) | 3 |

| Non-interest income | 34 | 43 | 60 | 58 | 47 | 41 |

| Non-interest expense | 103 | 122 | 131 | 139 | 143 | 139 |

| Net income – Common Sh. | 53 | 67 | 68 | 87 | 93 | 71 |

| EPS – Diluted ($) | 1.38 | 1.53 | 1.55 | 1.98 | 2.14 | 1.63 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Compared to my last report on the company, I’ve slashed my earnings estimate mostly because I’ve reduced my margin estimate.

Risks Appear Manageable

In the current environment, the two major sources of risk are a potential run on the bank and the realization of as-yet-unrealized losses, as discussed below.

- A quarter of the deposits were uninsured or uncollateralized at the end of March 2023, totaling $1.4 billion. In the worst-case scenario of a deposit run on the bank, Horizon can easily cover these uninsured/uncollateralized deposits thanks to its sources of available funding. According to details given in the earnings presentation, available funding totaled $2.7 billion at the end of March 2023. Therefore, Horizon Bancorp will most likely survive any run on the bank. However, its earnings can take a hit because replacing cheaper deposits with costlier borrowings will raise interest expenses.

- Gross unrealized losses totaled $121.8 million at the end of March 2023, which is around 17% of the total equity book value. Unrealized losses have already declined over the first quarter, and are likely to decline even further as investments pay down and mature. Moreover, I’m expecting interest rates to start declining from next year, which will also reverse the unrealized mark-to-market losses. In any case, I believe an unrealized loss that is 17% of equity book value is not a big deal, especially considering that the market value of Horizon Bancorp’s stock has already plunged by 36% since March 8, 2023, when the banking crisis started.

Overall, I believe Horizon Bancorp’s riskiness appears manageable.

High Upside, Dividend Yield of 6.7%

Horizon Bancorp is offering a dividend yield of 6.7% at the current quarterly dividend rate of $0.16 per share. The earnings and dividend estimates suggest a payout ratio of 39% for 2023, which is above the five-year average of 29%, but still easily sustainable. Therefore, the dividend payout appears secure.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Horizon Bancorp. Peers are trading at an average P/TB ratio of 1.04 and an average P/E ratio of 7.86, as shown below.

| HBNC | MCBS | SMBC | THFF | CPF | BFST | Peer Average | |

| P/E (“ttm”) | 4.48 | 7.07 | 9.55 | 6.25 | 5.93 | 6.23 | 7.01 |

| P/E (“fwd”) | 5.77 | 7.83 | 10.53 | 6.84 | 7.12 | 7.00 | 7.86 |

| P/B (“ttm”) | 0.59 | 1.19 | 0.96 | 0.83 | 0.90 | 0.74 | 0.92 |

| P/TB (“ttm”) | 0.78 | 1.19 | 1.18 | 1.02 | 0.90 | 0.92 | 1.04 |

| Source: Seeking Alpha | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $12.90 gives a target price of $13.40 for the end of 2023. This price target implies a 40.9% upside from the May 23 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.84x | 0.94x | 1.04x | 1.14x | 1.24x |

| TBVPS – Dec 2023 ($) | 12.9 | 12.9 | 12.9 | 12.9 | 12.9 |

| Target Price ($) | 10.8 | 12.1 | 13.4 | 14.7 | 16.0 |

| Market Price ($) | 9.5 | 9.5 | 9.5 | 9.5 | 9.5 |

| Upside/(Downside) | 13.8% | 27.3% | 40.9% | 54.4% | 67.9% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $1.63 gives a target price of $12.80 for the end of 2023. This price target implies a 34.5% upside from the May 23 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 5.9x | 6.9x | 7.9x | 8.9x | 9.9x |

| EPS 2023 ($) | 1.63 | 1.63 | 1.63 | 1.63 | 1.63 |

| Target Price ($) | 9.5 | 11.2 | 12.8 | 14.4 | 16.1 |

| Market Price ($) | 9.5 | 9.5 | 9.5 | 9.5 | 9.5 |

| Upside/(Downside) | 0.3% | 17.4% | 34.5% | 51.6% | 68.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $13.10, which implies a 37.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 44.4%. Based on this high price upside and my analysis of risks, I’m maintaining a buy rating on Horizon Bancorp.

Read the full article here