Investment thesis

Our current investment thesis is:

- Hormel owns a wide variety of food brands, providing a broad range of services and benefiting from a vertically integrated business model. This gives the company a highly diversified revenue profile.

- The company has the potential to benefit from improved growth, with product development, greater exposure to snacking and healthy/food-forward products, international expansion, and M&A.

- The business is facing near-term headwinds, contributing to declining growth and margin constraints.

- Although the business performs modestly relative to peers, we do not currently see upside at its current share price.

Company description

Hormel Foods Corporation (NYSE:HRL) is a leading American food company headquartered in Austin, Minnesota. The company produces and markets a wide range of consumer-branded food products globally. Hormel’s diverse portfolio includes iconic brands such as Hormel, SPAM, Skippy, Jennie-O, and Applegate, offering products in various categories like meat, poultry, and deli items.

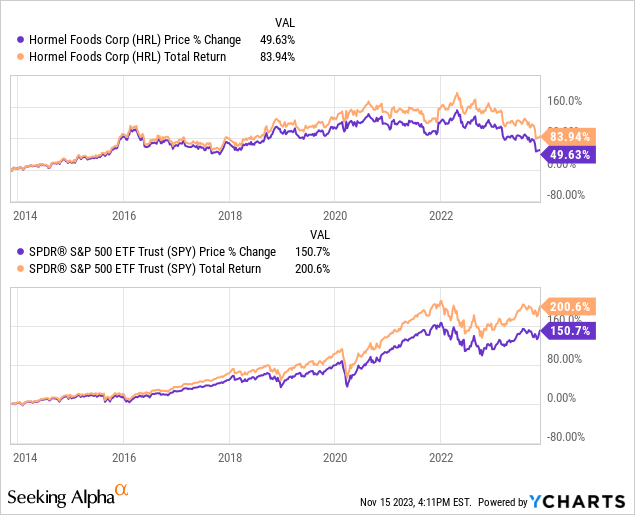

Share price

Hormel’s share price has performed well, although has lagged behind the market. This growth has been driven by gradual financial performance during the period.

Financial analysis

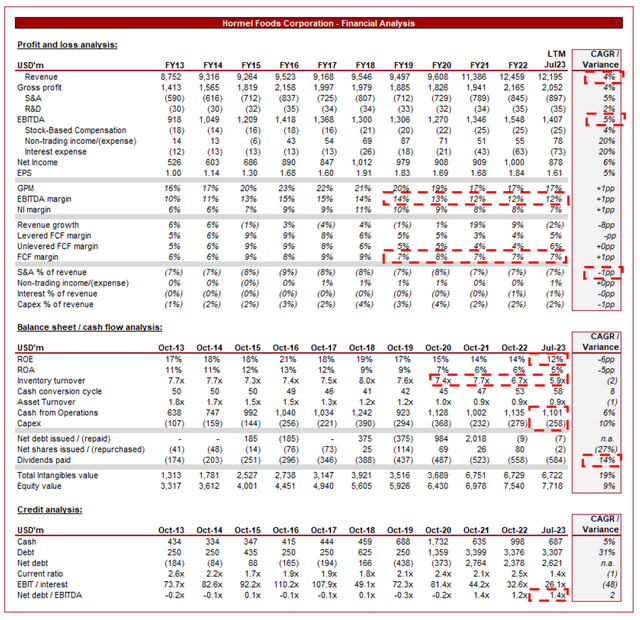

Hormel Financials (Capital IQ)

Presented above is Hormel’s financial performance for the last decade.

Revenue & Commercial Factors

Hormel’s revenue has grown at a CAGR of 4% in the last 10 years, with generally consistent growth throughout the period. The business has faced 3 fiscal years of negative growth but the overarching trajectory is positive. Supplementing growth during this period is acquisitions, with the following notable transactions in recent years:

- Planters ($3.4bn) – snack business.

- Sadler’s Smokehouse ($270m) – meat business.

- Columbus Craft Meats ($850m) – meat business.

Business Model

Hormel boasts a diverse portfolio of iconic and well-established brands, including Hormel, Spam, Jennie-O, Skippy, Planters, Applegate, and many more. These brands are recognized and trusted by consumers, providing Hormel with a strong competitive advantage in the market. This allows the business to price at a premium while enjoying consistent returning customers.

Hormel’s business model emphasizes product diversification across various food categories. The company offers a wide range of products, including fresh and processed meats, frozen foods, peanut butter, chili, soups, and various prepared and ready-to-eat meals. Further, the business has shown an eagerness to drive growth through product development, such as the launch of Maple flavored Spam and new Planters cashew items. This is one of the company’s core strategic priorities of “Protecting and growing its core brands”. This diversification allows Hormel to reach different consumer segments and adapt to changing consumer preferences over time, while remaining within its area of expertise.

Hormel Foods operates on a vertical integration model, where it controls various stages of the supply chain, from sourcing raw materials to processing and distribution. This is a natural development for a business so engrained in the food industry, allowing the business to maximize its returns from its end user.

Hormel has a robust distribution network that spans both retail and foodservice channels. Its products are available in grocery stores, mass merchandisers, convenience stores, and restaurants, making them accessible to a wide range of consumers. Similar to the above, this wide distribution network maximizes the company’s end-user reach and diversifies its revenue.

The glaring characteristic of Hormel based on the factors discussed is safety. The business is low risk and has high diversification, with a defensible position. With this comes difficulty achieving attractive organic growth. For this reason, the business has strategically acquired complementary businesses and brands to expand its product portfolio and market reach. We are generally supportive of this approach, especially as Hormel is remaining within its area of expertise and is focused on the achievability of synergies and accretive returns.

Supported by M&A, Hormel has expanded its international presence (One of its strategic priorities). This global expansion allows the company to reach new markets and consumers outside of the US, further enhancing its growth potential. Planters and Skippy in particular have a strong presence in Brazil and China (among other countries in the region), providing the business with exposure to developing nations.

Food Industry

Hormel Foods faces competition from other food companies in various segments such as Tyson Foods, Inc (TSN), Kraft Heinz Company (KHC), Conagra Brands (CAG), Mondelez (MDLZ), Kellogg (K), Dole (DOLE), Associated British Foods (OTCPK:ASBFY), and Nestlé S.A (OTCPK:NSRGY).

We are currently seeing shifting consumer preferences towards healthier food options, as greater awareness of health implications and wellbeing encourages a change in diet. This is increasing the demand for natural and fresh foods, positioning Hormel well to exploit this growth based on its current portfolio (one of its strategic priorities). Further, its acquisition of Applegate Farms has increased its exposure to this segment, as the business is a producer of natural and organic meats.

In conjunction with the above, we are also seeing increasing demand for plant-based meat alternatives and sustainable protein sources. This is in response to the health and wellness movement, alongside the push for sustainable practices. Hormel is developing its expertise in this segment but is positioned well due to its strong meat brands. The business currently offers Plant-based and blended foods under the “Happy Little Plants” and “Hormel Fuse” brands.

Finally, there has been a notable uptick in the demand for snacks, as consumers increasingly rely on convenient food options to support a busy lifestyle. If we combine this trend with the above points, snacks such as Nuts are well placed to be highly popular, which looks to be the case with Planters. We believe it is a shrewd decision to increase its exposure to snacking (one of its strategic priorities), a segment the market is valuing at a premium to food as observed by Kellogg’s plans to split its business.

Margins

Hormel’s margins have traded flat in the last decade, with a period of gains and declines. The business currently boasts an EBITDA-M of 12% and a NIM of 7%.

The lack of operating cost leverage driving margin improvement is slightly disappointing, although the wider issue is the erosion in recent years. The business has been impacted materially by inflation. Management has taken pricing action to offset this, but it has not been sufficient to generate gains.

Our expectation is for margins to improve incrementally in the coming quarters, as inflationary pressures subside. This said, the business faces difficulty with returning to its peak levels (EBITDA-M of 15%) but is possible over a 5-10 year period.

Quarterly results

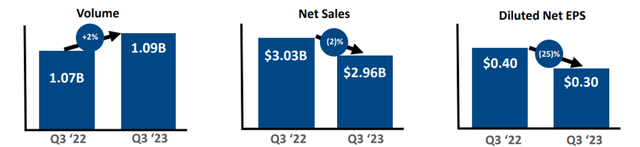

Q3 (Hormel)

Presented above is Hormel’s most recent quarterly results.

Current economic and macro conditions are weighing heavy on the business, with volume and sales struggling to achieve consistent growth. Consumers are increasingly incentivized to trade down, and are now seemingly exhausted by the persistent inflationary price increases, increasing elasticity.

The key takeaways from Q3 are:

- The impact of Avian flu on the availability of turkey is subsiding, having impacted both supply and costs in prior quarters.

- Net sales is a reflection of the subsiding elasticity benefit. The business has been unable to maintain its heightened pricing across product ranges. Although volume has returned to positivity, this has not been sufficient.

- Challenging conditions in China weighing on underlying profitability. The expectation is for this to subside as the need for lockdowns falls away. Further, the company has been negatively impacted by an adverse arbitration ruling (total ~$70m).

Overall, it is likely that things will worsen (/stagnate) before they get better, with the business facing the crossroads between softening demand at a volume level and an inability to offset this with pricing.

Balance sheet & Cash Flows

Hormel’s inventory turnover remains below its pre-pandemic level, particularly in Jul23, contributing to a slight reduction in cash flows relative to its potential. The expectation is for this stock to unwind in the coming quarters, and for this ratio to move above 7x.

Despite the various transactions, Hormel remains conservatively financed, with an ND/EBITDA ratio of 1.4x. Further, the company’s FCF conversion from margins is impressive and seemingly bulletproof. At this level, the business is well-placed to conduct further M&A and distribute well to shareholders. The long-term quality of this company remains despite the near-term concerns.

Industry analysis

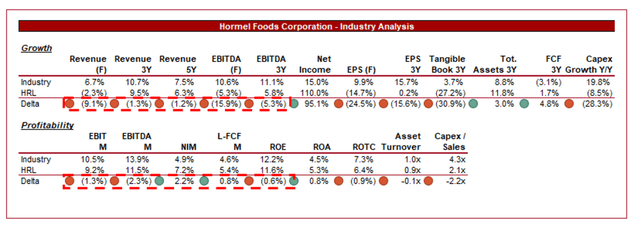

Packaged Foods and Meats Stocks (Seeking Alpha)

Presented above is a comparison of Hormel’s growth and profitability to the average of its industry, as defined by Seeking Alpha (39 companies).

Hormel performs well relative to its peers, although is slightly lacking. The company’s key area of weakness is growth, with a small revenue delta in the 3Y and 5Y periods. As discussed, the business is a safe option but has struggled to achieve organic growth beyond LSD (outside of M&A). Its margins are comparable to the average, with a particularly strong performance in FCF and ROE.

Based on this, we would suggest a small discount to the industry average multiple to value Hormel. This would reflect its slightly lower growth while acknowledging its moderate profitability.

Valuation

Valuation (Capital IQ)

Hormel is currently trading at 15x LTM EBITDA and 14x NTM EBITDA. This is a discount to its historical average.

A discount to Hormel’s historical average is unwarranted in our view, although we do not consider a premium justifiable either. Although the business is facing near-term headwinds, it is also benefiting from greater scale, new brands, broader industry tailwinds, and greater scope for improved growth. With consistent FCF and its improved base, Hormel is positioned well to generate healthy long-term returns for shareholders. Confirming this for us is its NTM FCF yield, which is currently ~5%.

Hormel is currently trading at a small premium to its peer group on an LTM EBITDA basis and NTM FCF basis. This is more difficult to justify given the inability to clearly achieve financial superiority. This metric is more bearish in our view.

Based on this, there is seemingly no material upside at the current share price. Analysts concur with this view, with a target upside of ~6% and 8/9 hold ratings (Source: Capital IQ).

Final thoughts

Hormel is a solid business. The company owns a range of high-quality brands, has strong global exposure, is benefiting from industry tailwinds, and is performing comparably to its peers. We believe the company’s strategic priorities have the potential to improve its growth trajectory and margins while supporting its defensive position.

Although the company has a good dividend and cash flow yield, we believe the business is fairly valued (small upside at the top-end), suggesting a hold is appropriate.

Read the full article here