Single best investment

A popular book in my library on dividend investing is Lowell Miller’s The Single Best Investment. In the book, he lays out a clear strategy on how to put together a long-term dividend portfolio with the goal of income and capital appreciation. His basic rules are simple:

- High quality

- High current dividend

- High growth of dividend

High quality along this logic is referencing a strong balance sheet with a debt-to-equity ratio not crossing 50%. In addition, interest expense should be covered by operating cash flow by at least 3X.

A high current dividend according to Lowell is typically in the 3-5% range. Shooting for higher than this could lead to some risky stocks, lower and you are reducing the quality of your compounding machine.

Finally, a high yield growth. Aim for 10% but at the very least make sure the growth rate is higher than inflation. If a company’s yield growth can’t beat inflation, TIPS might be a better choice. We want our dividend growth to outpace fixed-income alternatives.

Going through some screeners hunting for these criteria, HP Inc. (NYSE:HPQ) is a compelling buy at these levels. With Warren Buffett and Berkshire Hathaway (BRK.B)(BRK.A) still in this one to the tune of about $3 Billion, I’m liking this bet following the Berkshire management team. I would also point out that the stock has screened highly on Joel Greenblatt’s Magic Formula screener for the past 12 months in the large-cap category as seen here in my previous article, Magic Formula Dividend Portfolio For April.

The market has soured on HP Inc. but it appears a good buy at these levels in my opinion.

High quality

HP Inc.’s capital makeup :

Data courtesy of Seeking Alpha

| Market Cap | $29.428 B |

| Total Debt | $12.16 B |

| Cash | $1.77 B |

| Debt-to-equity | 41.3% |

With a debt-to-equity ratio under 50%, HP Inc. checks the first box. Let’s take a look at HP. Inc’s interest expense and cash from operations.

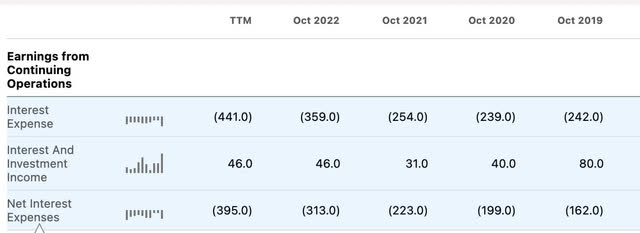

Seeking Alpha

The net interest expense for HP Inc. is -$395 million.

Here we’ll take a look at the company’s un-levered free cash flow as it represents the cash flow before interest payments.

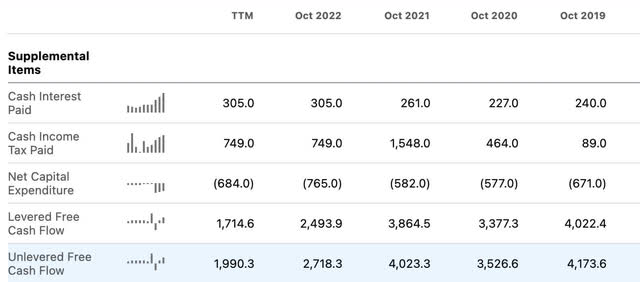

Seeking Alpha

At $1.99 Billion in un-levered free cash flow, that’s an interest expense coverage of 5.037 X. Although these numbers have been trending downwards, there’s still a big buffer to work with.

High dividend

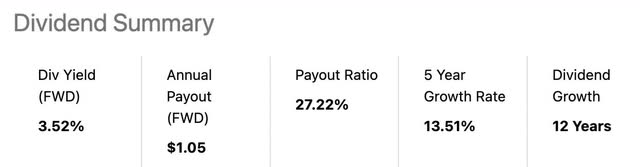

Seeking Alpha

With a forward yield of 3.52% and a payout ratio of earnings of only 27.22%, this dividend is both large and well covered. With the forward payout being $1.05 a share and only 985 million shares outstanding, this is a forward dividend liability of $1.034 Billion. Not only covered well by earnings but covered almost 2 X by free cash flow.

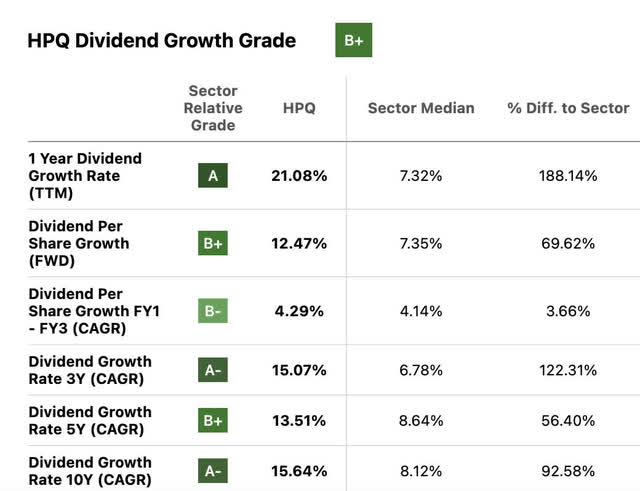

High growth

At 12 years of growth and a 5-year growth rate of 13.51%, the growth in the yield is well above inflation. The company is halfway to being a dividend aristocrat and has been buying back shares like mad over the past 5 years to make sure the growth can continue. Just take a look at this share reduction.

Seeking Alpha

Since October 2016, the float has been reduced by almost half. This combined with a high return on equity and a high return on invested capital are two things Warren Buffett adores.

Valuation

Seeking Alpha

Wow! For a company that sells at a discount on every valuation metric to their peers, I’m surprised analysts, authors, and quant all have hold ratings on the stock. I get it, it doesn’t have great momentum, but the stock is cheap and rarely gets mentioned as a solid dividend play. Throw a dart at any one of these and we can derive a reason why it’s cheap. Let’s also take a look at their dividend growth rate versus the peers:

Seeking Alpha

Simply assigning a 15 X multiple to GAAP EPS of $3.34 gets us to $50 a share. I see expected revenue dropping off, but that’s lumped into a bunch of industries at the moment. The well-covered dividend can still grow until the economy recovers.

Compound dividend model

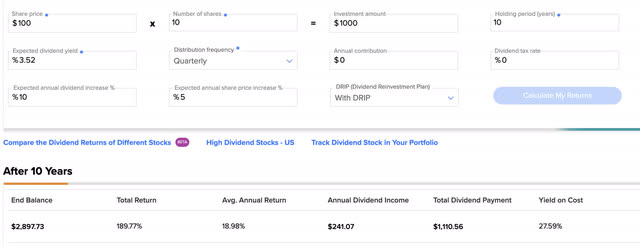

Tip Ranks

Putting in some very conservative assumptions for HP Inc., this model uses the following:

- 3.52% starting yield

- 10% annual increase in yield

- 5% price appreciation

- 10 years with a $1,000 investment

The 10% annual increase is lower than HP Inc.’s forward or trailing dividend growth rates combined with a modest average 5% capital appreciation. This gives us an average annual return of 18.98%,and a total return of 189.77%. Holding for 10 years would turn $1,000 into $2,897 with these assumptions on DRIP.

The story up to here

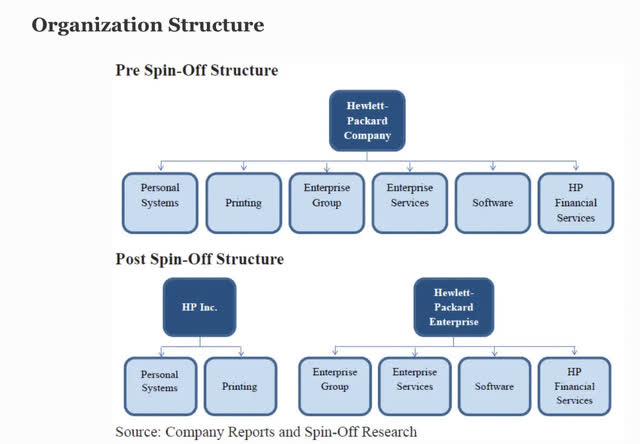

investor.hp.com

Firstly, the company reinvented itself in 2015 when the company split in half, one half being HP Inc. and the other being HP Enterprise (HPE), the division of the companies looks like this:

Forbes

What you are now getting in HP Inc. versus the fully integrated company is the personal and printing systems. The laptops and the printers.

From the most recent HP Inc. 10-K:

Personal Systems groups its global business capabilities into the following business units when reporting business performance:

•Notebooks consists of consumer notebooks, commercial notebooks, mobile workstations, peripherals, and commercial mobility devices;

• Desktops includes consumer desktops, commercial desktops, thin clients, displays, peripherals, and retail POS systems;

• Workstations consists of desktop workstations, displays and peripherals; and

• Other consists of consumer and commercial services, Poly products and services as well as other Personal Systems capabilities.

Printing groups its global business capabilities into the following business units when reporting business performance:

•Commercial consists of office printing solutions, graphics solutions and 3D printing and digital manufacturing, excluding supplies;

•Consumer consists of home printing solutions, excluding supplies; and

•Supplies comprises a set of highly innovative consumable products, ranging from ink and laser cartridges to media, graphics supplies and 3D printing and digital manufacturing supplies, for recurring use in consumer and commercial hardware.

The company saw a big uptick in its business fortunes during the “covid era”, when personal computers and printers were sold in massive quantities, floating all boats. Things have cooled a bit, but a bet on HP Inc. is a bet on the home office. They provide goods to fit the needs of both the large corporation and the new work-from-home employee in equal amounts.

Getting back to the company’s final goal of providing predictable cash flows and return of capital to shareholders is my favorite of them all. They are focusing on maintaining and growing that nice juicy dividend.

Berkshire continues to hold

whalewisdom

Buffett continues to hold this one with an average purchase price of $36.94. It falls into the #10 slot for Berkshire Hathaway.

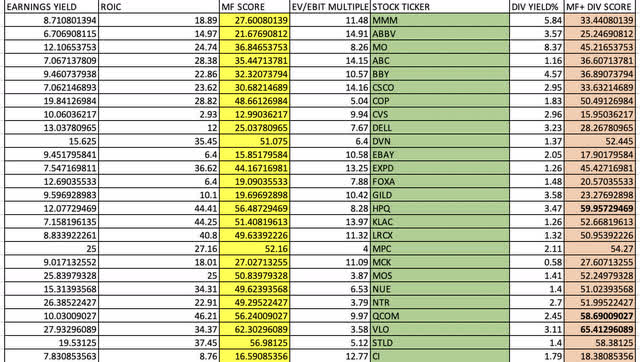

Magic formula

As mentioned at the beginning of the article, this stock screened exceptionally well in my Magic Formula dividend indicator for large caps. This scoring system used the ROIC + Earnings Yield + Dividend Yield. Here were the results:

my own excel sheet

HP Inc. came in second place amongst all the stocks in the large-cap category. However, ROIC is most likely a trailing indicator in this case and is now tapering off. Nonetheless, in the right environment, HP can operate at the top of the market when conditions are in their favor. Cycles come and go and HP Inc. is one of the best operators in a good economy.

Risks

Revenue is expected to continue to decline post covid combined with the discretionary nature of their products, this will realign some of the valuation metrics. That being said, the valuation metrics have such a huge margin between fair value and where they are today, the stock remains a good value even in a bad environment. As this is slowly becoming a reliable dividend growth stock, a rumor mill that the dividend has cuts on the horizon would add a leg down. Not seeing that in the future, but you never know how tight the US consumer is going to tighten their budget.

Catalysts

Even without covid, people don’t want to work in the office. Setting up more and more fresh home offices seems to play to HP Inc.’s advantage. I’m hearing the trend just continuing to gain steam from my immediate environment. Now the cat is out of the bag, and everyone knows that working from home can be effective, most employees would choose the work-from-home option if given the choice.

Secondly, watch the semiconductors. HP Inc. uses AMD (AMD) and Intel’s (INTC) semiconductors in their products. Once their fortunes turn, that can be a good leading indicator that the personal product division in PCs is about to pick up steam. For now, the cyclical semis have not turned and we can expect lower revenues in PCs and printers in the meantime. These industries are joined at the hip.

Summary

This is a dividend growth stock that checks all the right boxes. Going down the list of Lowell Miller’s recommendations, the stock is looking solid on all fronts except earnings growth. Buffett continues to hold this at Berkshire and the stock looks well on its’ way to being a dividend aristocrat in the future with a solid 12 years of dividend growth. It has also consistently been a high screener on the Magic Formula screener when setting the market cap above $15 Billion. I own this stock and will be adding to it at these levels as long as the well-covered dividend remains above 3% and continues to grow. HP Inc. is a buy for the conservative long-term investor.

Read the full article here