Over the past few months, I have written a number of cautious articles on John Hancock (“JH”) closed-end funds (“CEF”), namely, the John Hancock Investors Trust (JHI), the John Hancock Preferred Income Fund II (HPF) and its sibling funds. One common theme with these JH fixed income funds is that they tend to be amortizing ‘return of principal’ funds that I believe investors should avoid.

In this article, I will analyze the John Hancock Tax-Advantaged Dividend Income Fund (NYSE:HTD), to see if it also suffers from the same issues plaguing the JH fixed income funds.

Fund Overview

The John Hancock Tax-Advantaged Dividend Income Fund aims to provide after-tax total returns from dividend income and capital appreciation. It primarily invests in dividend-paying equity securities, although the HTD fund may also invest in corporate bonds it deems attractively.

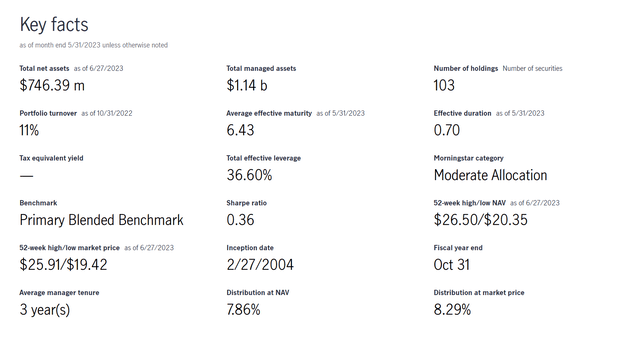

The HTD fund may also use leverage to enhance portfolio returns. As of June 27th, 2023, the HTD fund has $746 million in net assets and $1.14 billion in managed assets for 36.6% effective leverage (Figure 1). The HTD fund charges a 1.09% management fee and a 2.04% net expense ratio.

Figure 1 – HTD fund overview (jhinvestments.com)

Portfolio Holdings

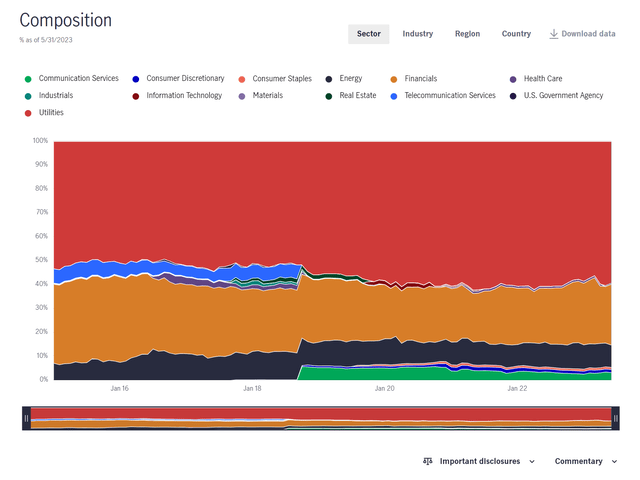

Figure 2 shows the sector allocation of the HTD fund. The largest sector weight is Utilities at 59.3%, followed by Financials at 25.5% and Energy at 9.3%.

Figure 2 – HTD sector allocation (jhinvestments.com)

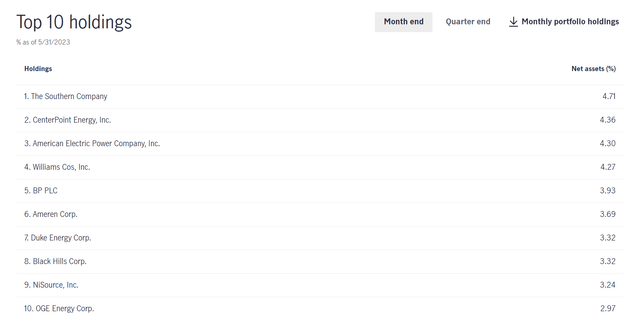

The HTD fund’s top 10 holdings are shown in Figure 3. 9 of the top 10 holdings are utilities or energy midstream companies, with the sole exception being BP PLC (BP).

Figure 3 – HTD top 10 holdings (jhinvestments.com)

Modest Returns Over A Cycle…

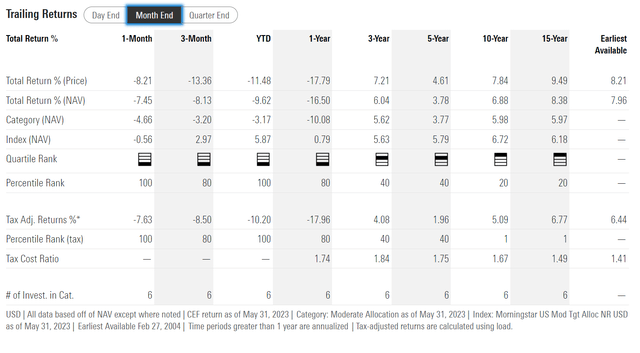

Figure 4 shows the HTD fund’s historical returns. HTD has delivered modest long-term returns, with 3/5/10Yr average annual returns of 6.0%/3.8%/6.9%, respectively, to May 31, 2023.

Figure 4 – HTD historical returns (morningstar.com)

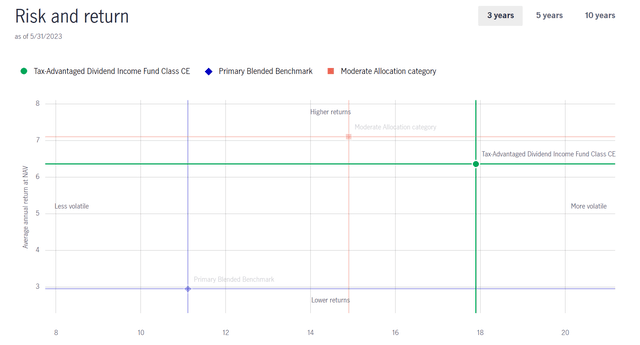

Overall, HTD’s strategy appears to be aimed at delivering mid-single-digit returns over a cycle with higher than benchmark volatility (Figure 5).

Figure 5 – HTD risk vs return (jhinvestments.com)

…Appears Sufficient To Fund Distribution

The HTD fund’s mid single digit total returns over a cycle backstop a generous distribution yield, which has been maintained at $0.138 / month since 2017, yielding 8.3% on current market price. On NAV, the HTD fund is yielding 7.9%. The HTD fund also pays out periodic special distributions of realized gains.

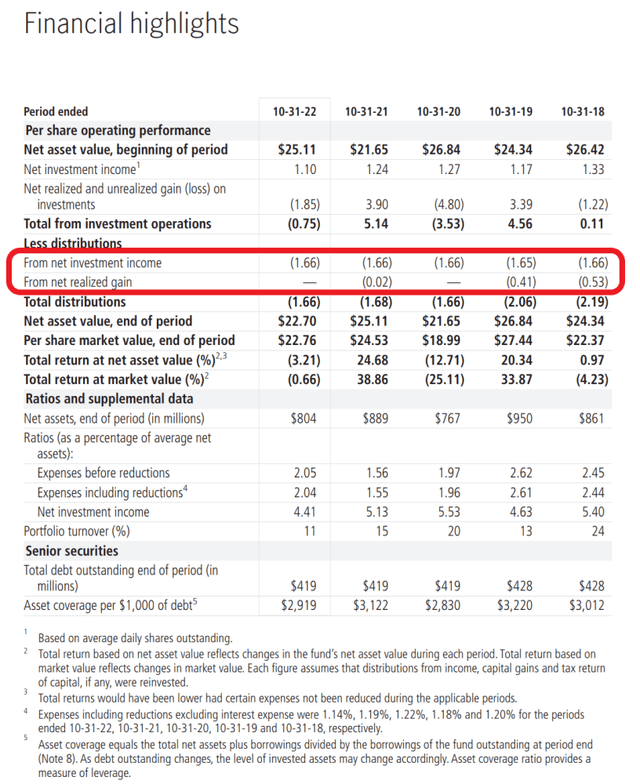

Historically, the HTD fund has been funding its distribution out of net investment income and realized gains (Figure 6).

Figure 6 – HTD fund financial summary (HTD 2022 annual report)

Viewing the HTD fund from a ‘return of principal’ lens, I believe the fund’s long-term average annual total returns of 6.9% over 10 years should be able to fund its distribution yield, if barely.

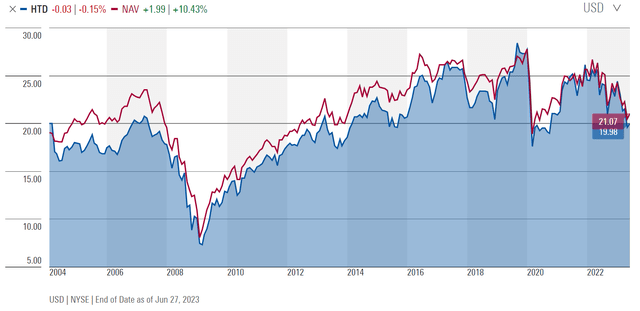

This conclusion is supported by an analysis of HTD’s historical NAV profile, which does not show the long-term amortization pattern characteristic of ‘return of principal’ funds (Figure 7).

Figure 7 – HTD historical NAV over time (morningstar.com)

HTD Vs. Peers

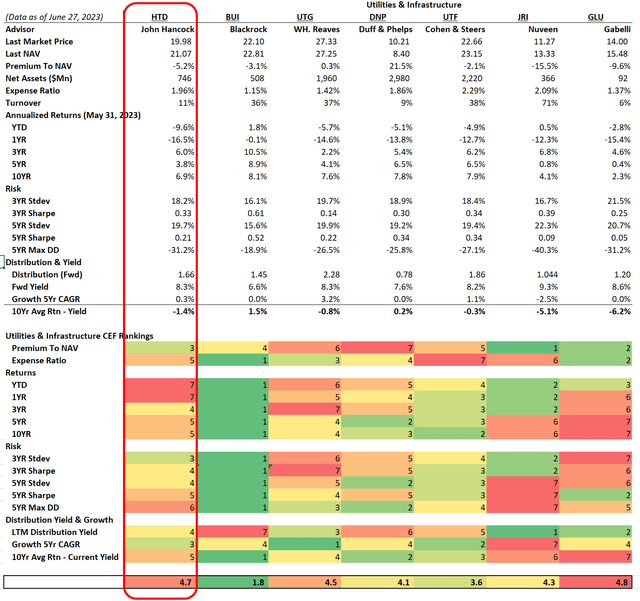

Figure 8 compares the HTD fund against peer CEFs that focus on the utility sector including the Reaves Utility Income Trust (UTG), the DNP Select Income Fund (DNP) and the Cohen & Steers Infrastructure Fund (UTF).

Figure 8 – HTD vs. peers (Author created with data from Seeking Alpha, Morningstar, and company reports)

First, on the fund structure, the HTD fund is middle of the pack in terms of fees, but it does trade at a 5% discount to NAV, which is cheap compared to its peers.

In terms of returns, the HTD fund is shaving a poor 2023 YTD, ranking dead last compared to peers. However, its longer-term returns have been middle of the pack.

Similarly, HTD’s risk metrics do not stand out, with volatility and Sharpe ratios ranking in the middle of the pack. It does rank poorly in maximum drawdown in the past 5 years, which may indicate poor risk management.

Finally, in terms of distribution yield, the HTD fund again does not stand out, as its 8.3% forward yield ranks 4th.

Overall, the HTD fund is a run-of-the-mill utilities-focused equity fund with mediocre returns and risk metrics compared to peers.

Conclusion

On the positive side, I am happy to report that the John Hancock Tax-Advantaged Dividend Income Fund does not appear to be an amortizing ‘return of principal’ fund that liquidates NAV to fund distributions. The HTD fund provides an attractive 8.3% distribution yield that is mostly covered by its total returns, although recent fund performance has been poor.

However, compared to peers, the HTD fund does not stand out except for a poor 2023 YTD return and a large maximum drawdown, neither of which is endearing.

For yield-seeking equity investors, I suggest they consider better performing utilities-focused CEFs that I have listed above like the BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI) and the Cohen & Steers Infrastructure Fund (UTF) that ranks better against the peer group.

Read the full article here