Editor’s note: Seeking Alpha is proud to welcome KM Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction

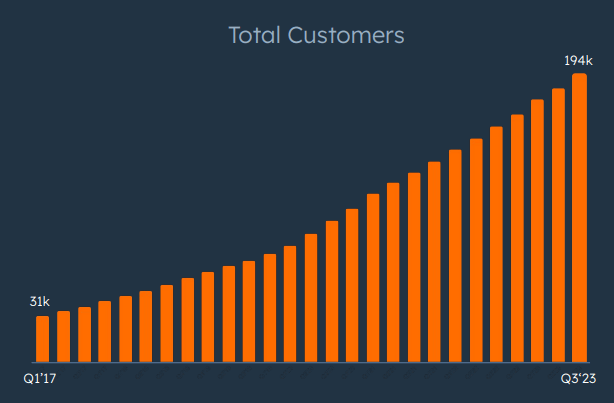

HubSpot (NYSE:HUBS) grabbed my attention because of its exponential customer base growth, which usually means high appeal of the company’s services. The company’s revenue moves even faster than its customer base expansion which means that cross-selling opportunities are exercised, another quality sign for a SaaS company. The management prioritizes investing in developing artificial intelligence (“AI”) capabilities, which will highly likely pay off in the form of new upselling opportunities. Wide gross margin together with strong cash position gives me confidence that HUBS has enough resources to keep up with the AI trend. Last but not least, this high-quality business with bright prospects and impressive revenue growth momentum trades around 35% lower than November 2021 highs, which makes the stock a “Buy” at the current market cap.

Fundamental analysis

HubSpot provides a smart customer relationship management (“CRM”) Platform comprised of Marketing Hub, Sales Hub, Service Hub, content management system Hub, Operations Hub, and Commerce Hub. That said, HubSpot’s Platform represents a well-rounded integrated ecosystem for business teams. Most of the company’s revenue is generated from subscriptions to the Platform, which accounted for 98% of the total revenue in the last reportable quarter. As of September 30, 2023, HubSpot had almost 200,000 customers across 120 countries.

HubSpot

In the above chart, we can see that HubSpot’s number of customers has been growing exponentially over multiple years which highly likely means the superiority of its Platform compared to competing offerings. Indeed, success of the American Big Tech companies indicates that customers prefer seamless ecosystems. According to Gartner, CRM software market is expected to grow over 14% through 2025. This is good information for HUBS because the company has solid history of capturing favorable industry trends in the past, which we can see from the impressive customer base expansion.

HubSpot

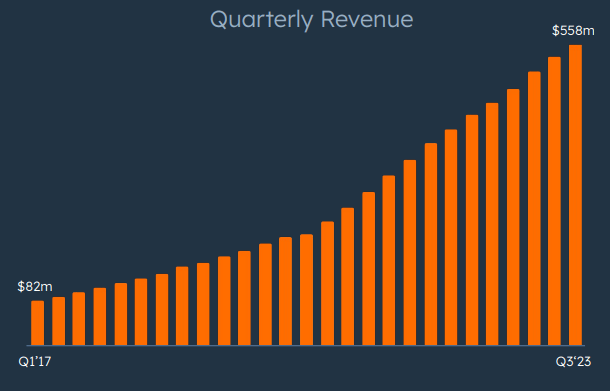

It is important that HubSpot converts customer base growth into revenue growth, which has also been exponential since Q1 2017, according to the latest quarterly investor presentation. Interesting detail, in Q3 2023 HubSpot’s revenue grew by 24% compared to Q3 2022, outpacing the number of customers growth by two percentage points. This means HUBS succeeded in increasing value of each customer, i.e., the company successfully exercised its cross-selling potential. I consider the ability to cross-sell crucial for any SaaS company to be able to achieve the land-and-expand effect. Considering HubSpot’s rapid customer base expansion together with wide geographic presence, I think that the company is on the right path from a strategic perspective.

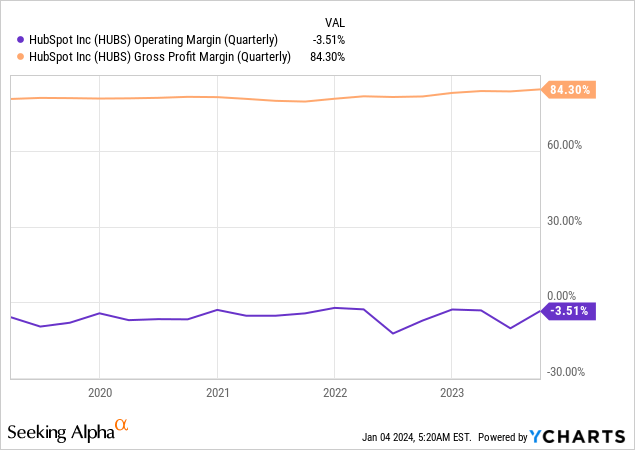

I am not an accounting guy, but investing taught me that profits matter a lot over the long term. Therefore, let us look at the dynamic of the company’s profitability margins over the last five years. It will be important to assess whether HubSpot balances between growth and profitability or just strives to grow at all costs. The good part is that HUBS earns 84% in gross margin, which means that out of every $100 generated in sales, the company has $84 left to reinvest in business development. This is a significant proportion of revenue and the negative operating margin suggests that the company indeed invests a lot in research and development (“R&D”) and in promoting its ecosystem Platform.

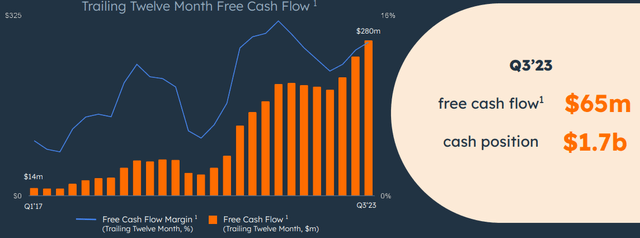

Since so far, the company demonstrated exponential customer number growth together with the same trajectory of revenue growth, it means that investments in R&D and promotion were quite efficient. Apart from wide opportunities to invest in R&D provided by wide gross margin, it is also crucial to acknowledge that the company is positive in terms of free cash flow generation and it was in a strong $1.7 billion cash position as of the latest reporting date. Having such a large liquidity position means the company has sufficient reserves to sustain under potential temporary challenges due to weak environment without sacrificing investments in R&D.

HubSpot

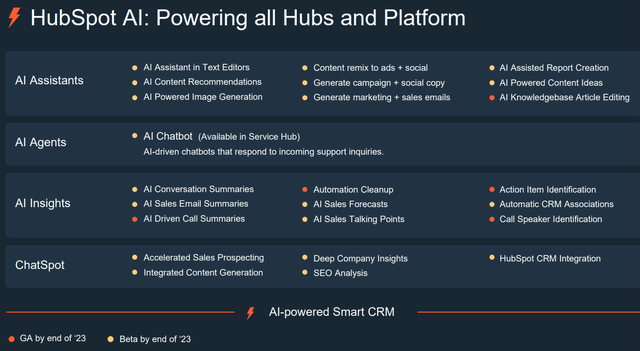

Strong efficiency of investing in R&D is crucial in the current environment of the emerging artificial intelligence (“AI”) trend. It seems that software companies are facing the “now or never” moment to incorporate AI capabilities into their offerings if they want to survive in the rapidly evolving environment. The good part for HubSpot investors is that the management recognizes the importance to keep up with technological trends as the AI topic has been central during the latest HubSpot Analyst Day held in September 2023. The company aims to make its Platform AI-powered across all dimensions and I am optimistic about such a firm commitment to keep up.

HubSpot

HubSpot’s business model looks highly efficient both at the operating and strategic levels. The exponential pace of customer base expansion is the most important evidence of the high quality of the company’s Platform and the significant value it delivers to HubSpot’s subscribers. The expected growth in demand for CRM solutions gives me optimism about HubSpot’s further growth prospects. Moreover, it is important to underline that new AI-powered capabilities that are planned for launch will add more value for customers and highly likely provide HubSpot with more monetization opportunities. During the latest Analyst Day, the management emphasized plans to expand monetization of AI with add-ons, which aligns with the land-and-expand approach. Considering HubSpot’s success in increasing each customer’s value in the past, I think that the probability that the company will be able to successfully monetize AI features is high as well.

HubSpot

Altogether, HubSpot looks like a very promising business and its future growth prospects are backed by impressive performance demonstrated in rapid customer base expansion and achieving profitable growth.

Valuation Analysis

Fundamentals look very strong and I am not surprised that the stock significantly outperformed both S&P 500 and Nasdaq in 2023. However, despite around 80% rally in 2023, the current stock price is still about 35% lower than all-time high achieved in November 2021. At the same time, 2023 revenue is forecasted by consensus at $2.2 billion, almost 70% higher than the FY2021 revenue. The current TTM levered free cash flow is around 60% higher than the one generated in FY 2021. The balance sheet also improved significantly over the last two years. Therefore, I think that the current stock price is attractive, and the recent target price upgrade from Piper Sandler is another evidence that HUBS is undervalued.

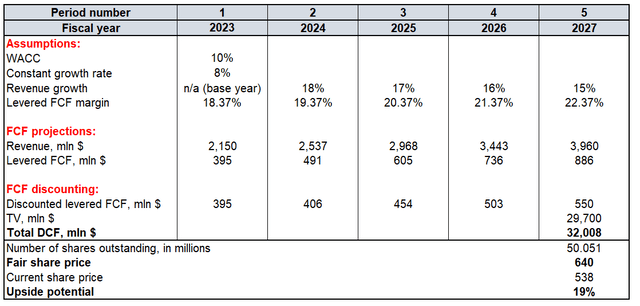

Let me also add my own calculations of the stock’s fair price based on the discounted cash flow (“DCF”) approach. The DCF method is the most suitable for a growth company like HUBS because of the optimistic consensus revenue growth expectations and no stable profits yet. To conduct the DCF simulation, I have to select underlying assumptions, which require professional judgment from me. First, I have to determine the discount rate and I select a midpoint of the weighted average cost of capital (“WACC”) range recommended by finbox.com, which is 10%. Second, I have to derive free cash flow projections. I have HUBS levered free cash flow margin of 18.37%, which is currently almost four percentage points higher than the five-year average. That is, it would be fair to expect that by FY 2027 it can also expand by four percentage points more, i.e., by 100 basis points per annum. I use an 18% revenue growth for FY 2024, which is a consensus estimate of 30 Wall Street analysts, which is a representative sample in my opinion. For years after FY 2024, I expect revenue growth to decelerate by one percentage point each year as comparatives will grow. To calculate terminal value (“TV”), I use the classical formula. An 8% constant growth rate to calculate TV looks conservative enough considering HubSpot’s growth profile.

Calculated by the author

Simulating HubSpot’s DCF model provides me with the total present value (“PV”) of future cash flows at $32 billion. There are slightly above 50 million HUBS shares outstanding at the moment. To calculate fair value of the company’s stock I have to divide total PV by the number of shares outstanding, which gives me $640 per share. This is 19% higher than the current share price, which means HUBS is undervalued.

Risk Factors

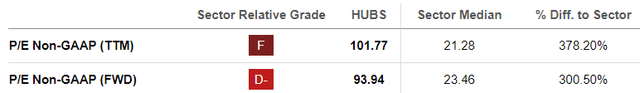

At the same time, readers should also understand that, as a growth company, HubSpot’s market cap significantly depends on the ability to deliver the expected by Wall Street analysts’ revenue growth pace and the free cash flow generation stability. Around a hundred TTM and FWD P/E ratios mean that very aggressive profitability growth expectations are already priced in and any disappointing earnings release or guidance downgrade will highly likely make the stock price to plunge. To underline HUBS’ substantial volatility I will just write that the stock price decreased by more than two times within six months between November 2021 and April 2022. Therefore, HUBS will not be a good choice for investors who are not ready to tolerate high volatility and potential deep drawdowns in the short-term horizon.

SA

High-quality growth companies delivered massive rallies in 2023, which increases the probability that investors might start realizing their profits in 2024. This might be the case because of the political and geopolitical uncertainties which will highly likely peak this year. Presidential election in the U.S. seems to be the number one political event for the whole world and that will highly likely weigh on investors’ confidence. Let’s also not underestimate the importance of presidential elections in Russia and Ukraine in 2024, which might significantly influence how the war in this region will unfold. This military conflict also has direct impact on the U.S. stock market because of significant influence of Russian exports on commodities prices and volumes of financial and military aid for Ukraine provided by the U.S. which affects governmental spending. Therefore, in light of the expected highly elevated level of political uncertainty in 2024 together with the last year’s rally in growth stocks, investors might seek safer harbors this year. This could adversely affect valuations of aggressive growth stocks, including HUBS.

Conclusion

I think that HubSpot operates a highly efficient business model and its success across all key metrics supports my opinion. Future growth prospects are promising because of industry trends where high-quality CRM offerings are in high demand. The management’s plans to continue investing substantial part of revenue in innovation are important to keep up with the emerging AI trend. After the company adds all planned AI features to the Platform, HUBS will have more opportunities to sell add-ons to customers, a critical success factor for a SaaS company. The stock trades 35% below all-time highs even despite significant improvements in financial performance, which indicates that the current stock price is attractive. To conclude, HUBS deserves a “Buy” rating.

Read the full article here