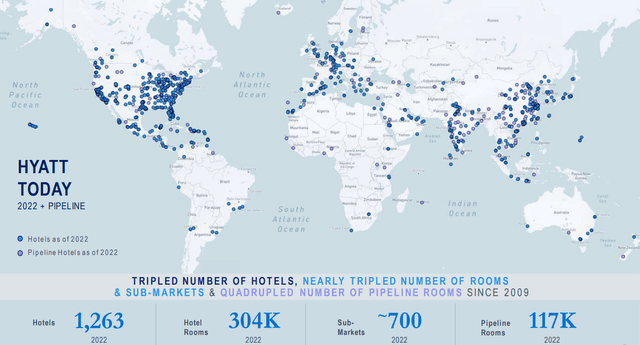

Hyatt Hotels Corporation (NYSE:H) is a Chicago, Illinois-based multinational hospitality company which operates across luxury and business-oriented hotels, resorts, and vacation properties.

As of current, Hyatt maintains 1,263 hotels across the world, with a major presence in the US, Europe, India, and China.

Hyatt 2023 Investor Day

Through these activities, Hyatt recorded Q1 revenues of $1.68bn- a 31.35% YoY increase- alongside a net income of $58.00mn- a 179.45% increase- and a free cash flow of $195.00mn, a 42.34% increase largely driven by rising operational cash flows.

Introduction

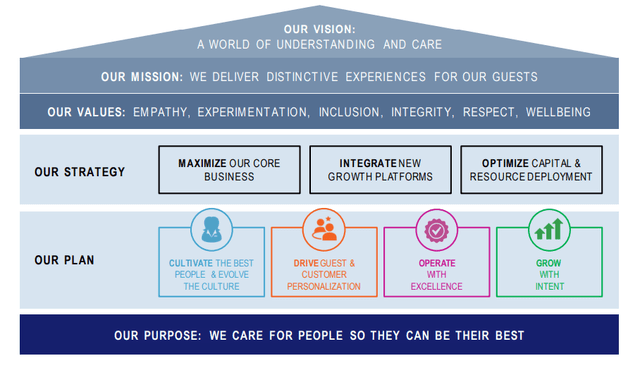

At the core of Hyatt’s scale growth has been its threefold macro strategy, which emphasizes maximal efficiency and profit extraction from its core business, the synergetic integration of all the company’s verticals, and an optimized capital deployment strategy which balances reinvestment and M&A with shareholder returns through its dividend and opportunistic share repurchases.

On a more micro level, the firm aims to execute the said strategy by cultivating a corporate culture of success and workforce retention, supporting superior client experiences, enabling operational excellence, and material scale and margin growth.

Hyatt 2023 Investor Day

Hyatt’s aggressive organic and inorganic footprint growth. combined with the firm’s margin-expanding focus on efficiency, macro tailwinds, and an overall undervaluation leads me to rate Hyatt a ‘buy’.

Valuation & Financials

General Overview

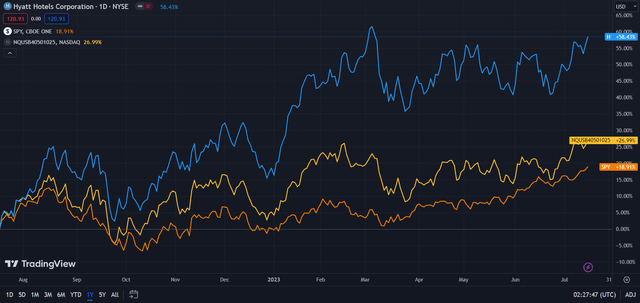

In the TTM period, Hyatt’s stock- up 58.47%- has experienced superior price action to both NASDAQ’s Benchmark Hotels & Motels Index- up 26.99%- and the broad market, as represented by the S&P 500 (SPY)- up 18.91%.

Hyatt (Blue) vs Industry & Market (TradingView)

Above all else, the outperformance of both Hyatt and the hotels index can be attributed to a broad COVID-19 recovery theme, especially pronounced with the later economic re-opening of China.

I believe Hyatt has beaten the rest of the hospitality industry largely due to its superior margin figures, with Hyatt’s reversion being more significant than the rest of the industry, as well as portfolio growth through accelerated M&A of distressed or otherwise discounted firms.

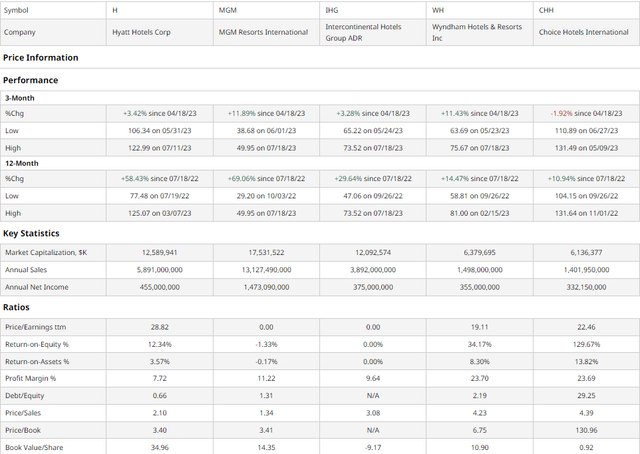

Comparable Companies

In the wake of the COVID-19 pandemic and ensuing pressures, the hospitality industry is more consolidated than ever. As such, there remains a smaller amount of mid-large cap firms, that are directly comparable to Hyatt. These firms include the entertainment-focused, Paradise, Nevada-based MGM Resorts International (MGM), InterContinental Hotels Group (IHG), a highly diversified British hospitality firm, New Jersey-based hotel and motel firm, Wyndham Hotels & Resorts (WH), and Quality Inn-owner, Choice Hotels International (CHH).

barchart.com

As demonstrated above, Hyatt has experienced the second-best annual price performance among peers, giving way to relatively abysmal quarterly performance. Despite strong general growth, however, on both a multiples-basis and when considering the firm’s growth capabilities, Hyatt still has room for growth.

For instance, Hyatt maintains the second-lowest P/S ratio, alongside the lowest P/B ratio. In conjunction with the highest BV/share, this manifests Hyatt’s commitment to high-quality assets and a fortress balance sheet.

This proposition is augmented by Hyatt’s peerless debt/equity which enables additional reinvestment and long-run cash flow growth.

Hyatt 2023 Investor Day

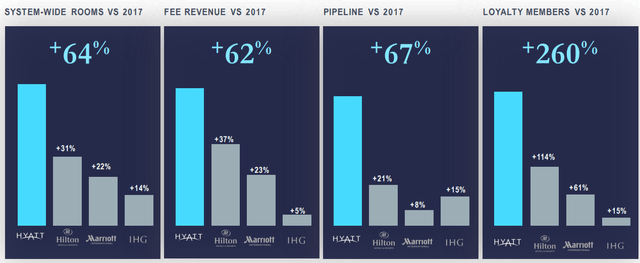

The said strategy of aggressive growth has supported Hyatt in experiencing the superior expansion of room numbers, fee-based revenues, and member loyalty, securing development.

Accompanied by Hyatt’s $2bn in combined share repurchases and dividends over the trailing 5Y period, investors can expect enticing returns.

Valuation

According to my discounted cash flow analysis, at its base case, the net present value of Hyatt is $144.62, meaning, at its current price of $118.98, the stock is undervalued by 18%.

My DCF model, calculated over 5 years without perpetual growth, assumes a discount rate of 9%, balancing Hyatt’s debt-light cap structure with a higher equity risk premium due to uncertain demand levels. Additionally, lower the historic 5Y growth rate of 18.96%, I estimate an average annual revenue growth rate of 10%. The said revenues I anticipate will be driven by continued M&A, synergetic growth across geographies, and enhanced margins.

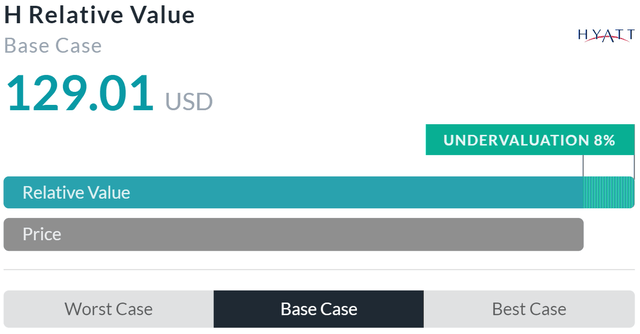

Alpha Spread

Alpha Spread’s multiples-based relative valuation supports my thesis on undervaluation, estimating a base case undervaluation of 8%, meaning the stock’s relative value is $129.01.

Thus, averaging out my projected NPV and Alpha Spread’s relative valuation, Hyatt’s fair value should be $136.82, with the stock undervalued by ~13%.

Hyatt’s Well-Optimized Portfolio Supports Parallel Scale & Margin Growth

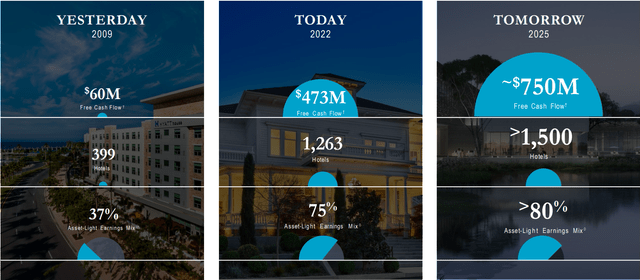

As previously discussed, Hyatt has prioritized aggressive scale growth above all else, through both reinvestment and expansion of geographic and segmented operations and through horizontal M&A activity. Through this, Hyatt anticipates the growth of FY2022 FCF from $473mn to ~$750mn in FY2025, accompanied by the addition of 250+ hotels and increased levels of asset-light earnings.

Hyatt 2023 Investor Day

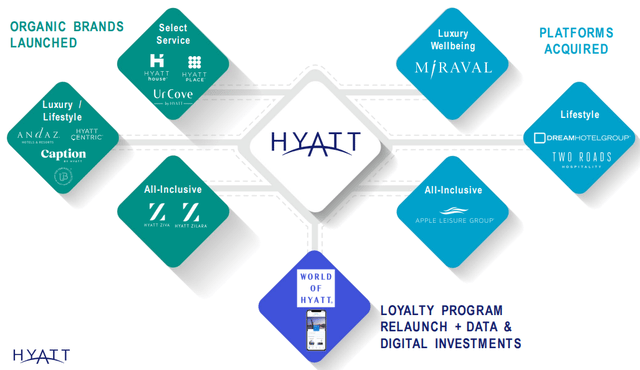

This dynamic is further emphasized by Hyatt’s integrated organic branding and platform acquisition strategy, all of which feed into its ‘World of Hyatt’ objective, seeking an upgraded loyalty program alongside superior data collection and analytics for cost efficiency and client satisfaction. For example, the firm’s acquisition of Dream Hotel Group or Miraval, while anatomically different from Hyatt’s core brand identity, enables a larger geographic and segmented footprint, offering consumers greater choice and incentivizing greater buy-in to the ‘Hyatt World’ strategy.

Hyatt 2023 Investor Day

All of this is supported by material industry tailwinds, with tighter hotel supply enabling greater margin expansion, younger demographics and wealthier demographics being more experience-oriented, the accelerated recovery of travel demand in the APAC region, greater attractiveness of Hyatt’s all-inclusive products, and low-cost conversions of independent hotels, coupled with subsequent synergies all leading to scale and margin growth.

Hyatt 2023 Investor Day

Wall Street Consensus

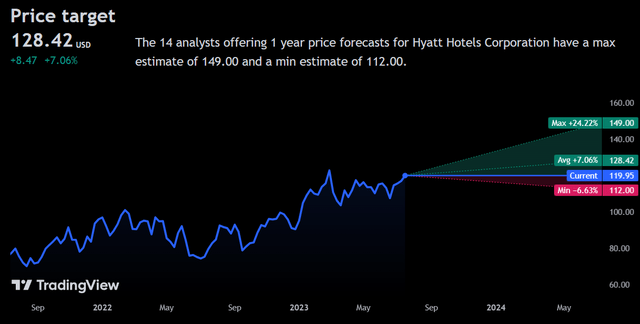

Analysts largely support my positive view of Hyatt, estimating an average 1Y price target of $128.42, a 7.06% increase.

TradingView

Even at the minimum projected price of $112.00- a 6.63% decline- analysts see Hyatt as well-insulated, essentially becoming a wealth preserver relative to the volatility of peers.

I believe this sentiment reflects bullish investor attitudes on hotel and hospitality pricing as a whole, believing the market to be overreacting to the long-run pressures from macro headwinds.

Risks & Challenges

Demand Side Pressures Remain Steadfast With High Rates & Inflationary Pressures

Although COVID-19 has long passed in terms of reduced hospitality demand, the subsequent inflationary pressures and rising interest rates have reduced both the purchasing power of consumers and Hyatt’s ability to maintain higher prices. Sustained reductions in demand may require Hyatt to reduce its aggressive expansion and lower medium-run revenue growth and cash flow generation capabilities.

Aggressive Expansion Introduces Regulatory Complexity & Reduced Core Focus

As I have extensively covered, Hyatt remains in scale-above-all mode, meaning the company is assertively expanding across a range of hospitality verticals while expanding its geographic footprint. However, this also means that Hyatt is privy to rising compliance costs from different regional regulatory systems which may lead to reduced profitability due to Hyatt’s inability to focus on core offerings, which may take a backseat to expansion.

Conclusion

Going forward, Hyatt continues to expand its segmented and geographic offerings through aggressive organic and M&A-driven growth, which supports long-run price reversion and growth.

Read the full article here