The iShares Interest Rate Hedged High Yield Bond ETF (NYSEARCA:HYGH) is a useful instrument that can be used to express a view on the situation in credit spreads. Currently, credit spreads are in line with some of the most placid times in markets, like in 2017. We think there are several genuine reasons for markets to be worried about the weaker corporate balance sheets out there, seeing the slow pickup in restructuring is a counter-indicator to the performance of this ETF which will decline on increased credit risk perception. We would be wary of this ETF for the time being, since we think credit spread revisions may come soon.

HYGH Breakdown

HYGH has no duration. That’s the point of it, it takes out the duration risk and leaves only the credit risk in the ETF. This ETF provides an ongoing yield consistent with zero-duration bond instruments of high-yield risk.

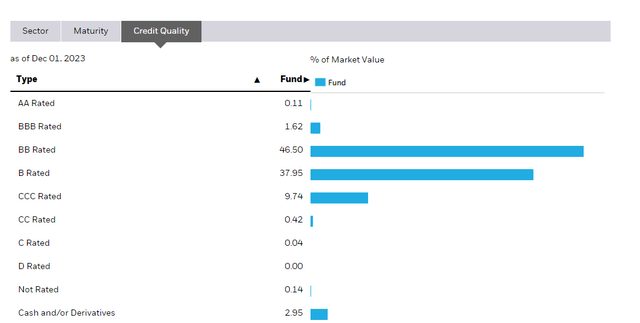

Credit Rating (iShares.com)

The credit ratings are quite weak, mostly junk, as consistent with the purpose of the ETF. The distributions are monthly, supported by the high yield and low credit rating, and pay out around 8% or more annually.

The expense ratio is currently 0.51%, net of a fee waiver through February 2027, where it will reset back to 1.11%, unless it’s changed. That’s not bad for an ETF with a hedged component, which of course will come at its own cost.

If credit spreads rise, it’s not good for this ETF.

Bottom Line

Let’s begin with some data on credit spreads.

Spreads (FRED)

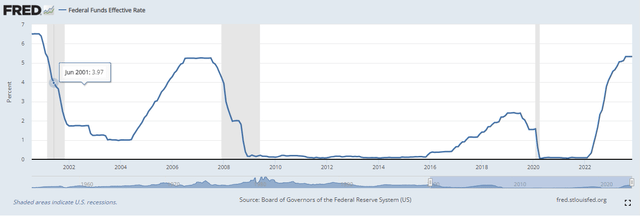

And also some data on the general state of Fed monetary policy over the last 20 years or so.

Fed Funds Rates (FRED)

Just to sample some data, current rates are twice as high as they were in early 2019, but the credit spread is the same. The only sound argument for this is that now that the Fed has raised rates to high levels, it at least has the tools to combat a recession: it can just lower rates again. To some extent, this Fed put might limit the need for credit spreads to rise now. However, fundamentally, the Fed put isn’t really available when the tool to fight a recession would also fan the flames of inflation, which are already too high and could anchor causing a permanent inflation problem at what is naturally a more unstable level than just at 2% or less, being at 3% now.

On this basis alone, we are cautious that credit spreads are too low, and that the fundamentals for financial distress are of course going to be higher with rates at their current levels.

There are more reasons to be concerned, and some of the reasons can already be observed empirically. Restructuring activity is beginning to pick up at advisory shops, and that signals that issues are becoming more pronounced. Also, we still don’t know how badly the economy will look once corporate income is slashed by the maturity walls in 2024 and 2025. The tides might be going out before the tsunami of rolled-over fixed rates.

Sure. Restructuring is quite robust right now, and our business is doing quite well. We’re very busy and as you said, there’s a lot of liability management going on and there is out of court restructurings as well as from our standpoint, both the debtor and the creditor side advisory work. I think that that velocity continues and will continue. Interest rates going up does actually impact restructuring.

And we think that, as there’s a maturity wall coming in 2024 and 2025 and also with higher rates if there are more companies that have capital structures that we’ll need to basically get advice and to actually restructure some. So I think our restructuring business is quite robust and we think the prospects of it will continue even if the merger market picks up.

John Weinberg, Evercore CEO

The final reason we think credit spreads may be due for upward revision is the fact that we have not yet seen evidence that inflation has been defeated. 3% is still too high, and while it’s on a slow decline, with jobs data also signaling a modicum of slowdown, inflation has a lot to do with expectations and could be sticky even in the face of much larger slowdowns. The only tool really to combat this, other than conceding that maybe the policy rate should be 3%, but that would undermine Fed credibility for the next time, would be even higher rates, or to keep pressing on with the currently high rates for longer. Distress will only get worse, especially if it changes the expectations that lenders have when they start providing capital for corporates to refinance on these maturity walls.

In all, a credit spread that is consistent with averages from more placid times seems too small. Corporate risks are quite significant at the moment. Even just a revision of high yield spreads to the October 2023 level, just some months ago, could lead to around a 10% decline in the ETF, although the yield keeps coming.

HYGH is a solid instrument, we like what it does for a portfolio, including the yield that it provides. But this dimension of credit spreads seeming a little low means there are probably more pointed ideas out there.

Read the full article here