Co-authored by Treading Softly

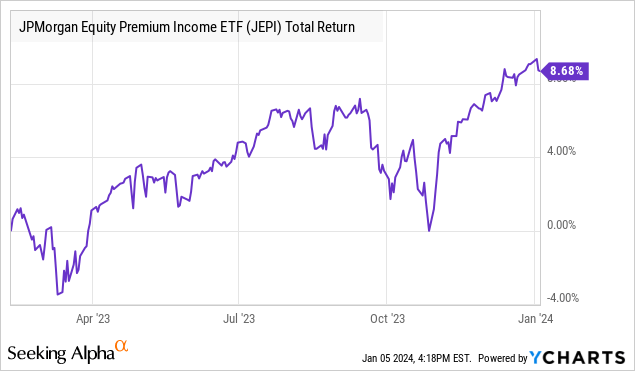

Back in February, we took time to sit down with Seeking Alpha’s Daniel Snyder and discussed whether we liked the JPMorgan Equity Premium Income ETF (JEPI). We explained that even though it showed a nice double-digit yield that wasn’t a real yield, the return would likely be somewhere in the 7 to 9% range this year. There were a lot of comments that we received on that podcast once the transcript came out, people not believing us when we estimated that to be their returns. Looking back from the date that podcast was released until now, we can see that JEPI provided an 8.7% total return.

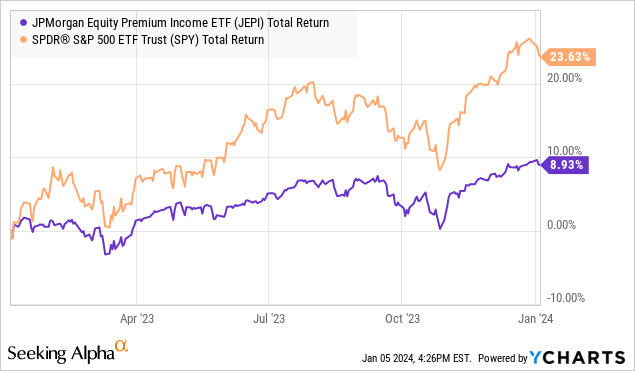

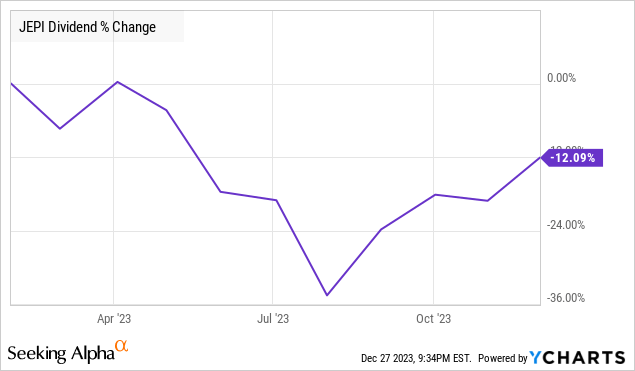

The biggest risk we highlighted was that if the market rallied in 2023, JEPI’s dividend would decline. This is because of their equity-linked note structure, capping off their upside to reduce downside.

This means that their participation in a rally would be reduced, but it also means that JEPI’s dividend does better and is larger when the market is declining. We can see that JEPI was only roughly 1/3rd of the return of the overall market. Because the S&P 500 (SPY) has done exceptionally well last year as a whole, JEPI’s dividend has fallen.

As a professional income investor, I am willing to accept non-market beating returns in the short run to accept larger income in the long run.

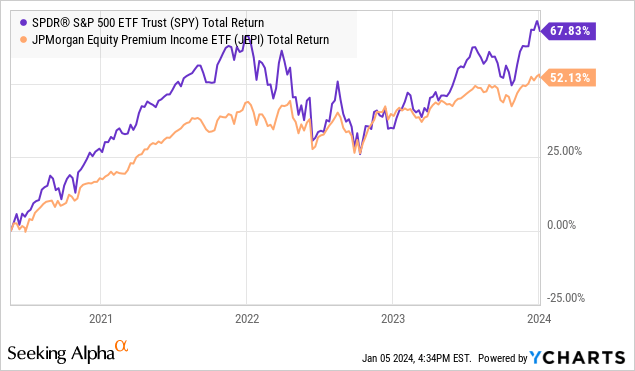

JEPI hasn’t been able to pull this off over its inception when factoring in all of its dividends. A key reason for this continued struggle to outperform is based inherently on its structure. The market historically climbs more than it declines. And because of this, if you have a strategy that is designed to benefit you when the market falls or protect you when it falls, but also to fail to participate when it climbs, it means that overall you are banking on losing. The history of the market is one of an incline, although not a steady, stable, continuous incline. There are sharp periods of decline in there, but overwhelmingly, the market rises more than it falls. So, the inherent equity-linked note structure of this fund causes it to fail.

Being a professional income investor, I have no issues with using funds to maximize my income but also try to reduce my risk. But I want those funds to have a structure that is designed to win with a market climb. I want to look at a fund that has historically kept pace with the market over longer periods while providing me with an excellent income and an easily predictable income stream.

Why I Love USA

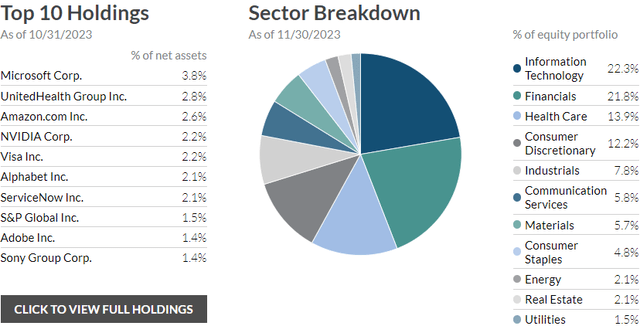

Liberty All-Star Equity Fund (USA), yielding 9.9%, is a diversified CEF with a slight bias toward “Value” stocks. USA divides its assets equally among five different managers; three follow Value strategies, and two follow Growth strategies.

USA has a variable rate dividend policy, and it distributes 2.5% of NAV each quarter. This variable distribution ensures that the fund does not overdistribute, eating too far into NAV when prices are down. At the same time, it ensures that shareholders get to participate in upswings with a larger dividend.

Investments like USA play an important role in income portfolios. As income investors, we tend to find ourselves in certain classes of investments that pay higher yields. We aren’t likely to invest in stocks that have very low or no dividends like Microsoft (MSFT), Amazon (AMZN), or NVIDIA (NVDA). While they might be great investments with spectacular returns, they don’t meet our income goals.

USA holds these, along with many other stocks that are not a fit for our portfolio goals: Source

USA Website

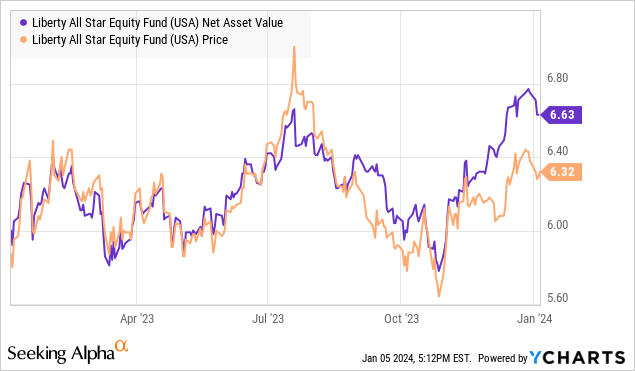

USA takes the returns from these investments and converts them into an income stream that fits our goals. Right now, the market is giving us an opportunity to buy USA at a discount to NAV. USA’s portfolio shot up in price, but its share price didn’t keep up.

It is time to add a few more shares before the market catches up!

Conclusion

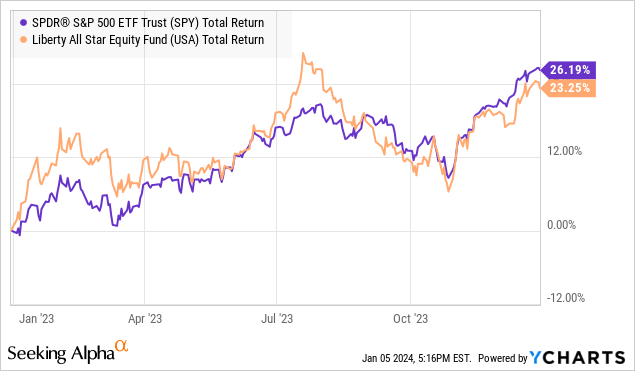

When we look over 2023, USA has kept up steadily with the market in general, all while providing outstanding returns.

While many investors are happy to buy a passive market ETF and watch its value change over time, it can cause great consternation when they need to start selling those shares to unlock cash. Instead of having to have the stress and worry of what to sell, why not be able to look at your account and see that you are swimming in dividends from the market? All while having to do nothing more than simply hold the shares. That’s one beautiful thing about USA. You can sit back and hold it and know that for decades, it has existed paying out outstanding income and generating excellent returns for its shareholders – never destroying itself because of its dividend policy.

Yes, the income will be variable. When the fund climbs, the dividend will climb. When the fund declines, the dividend will decline. Unlike JEPI, it’s designed to win when the market wins, and overwhelmingly, the market wins over its history more than it loses.

When it comes to retirement, the last thing that you want to do is carry around a negative, pessimistic mindset. Studies have shown that optimists outlive pessimists. Interestingly, having a positive outlook and attitude can lead you to live a better, longer life. But when it comes to financial matters, there’s nothing more positive than having excess money in your account after you have paid your bills or your expenses, so that you have money left over to do whatever you want, such as to be able to enjoy hobbies, enjoy delicious food or spend time with loved ones. We expect the market to potentially face some pressure in 2024 but also to see a strong recovery as interest rates decline. So this year, why not sprinkle some high-yield income into your portfolio and enjoy seeing those dollars roll in?

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here