IBM reports its Q2 ’23 after the closing bell on Wednesday, July 19th, 2023. Analyst consensus per IBES data by Refinitiv is expecting $2.01 in earnings per share on $15.57 for an expected year-over-year or decline of 13% in earnings per share on 0% growth in revenue.

This (in my opinion anyway) was a good preview of IBM’s quarter by BofA which was posted to Seeking Alpha last Thursday, but readers should note there is typically a seasonal or sequential component to IBM’s earnings anyway, with the 4th quarter of every year typically being the highest EPS print every year (or that was the case pre-Kyndryl spinoff).

In Q1 ’23, revenue was flat y.y, operating income fell 4% and EPS was down 3%, so the expected EPS drop of 13% for Q2 ’23 is a little tougher than last quarter’s results.

Declining Capex is Really Paying the Dividend:

Without writing “War & Peace” and burying the lead, here’s the issue with IBM as I see it today:

| cash-flow ($) | capex ($) | FCF ($) | Div % of FCF | |

| 4-qtr trail avg | $9.2 bl | $1.8 bl | $7.4 bl | 80% |

| 12-qtr trail avg | $13.5 bl | $2.2 bl | $11.3 bl | 51% |

| 20-qtr trail avg | $14.0 | $2.5 bl | $11.5 bl | 50% |

| 40-qtr trail avg | $15.4 | $3.1 bl | $12.3 bl | 45% |

* Cash-flow from ops, capex and free-cash-flow (FCF) are calculated off the “trailing 4-quarter or trailing twelve-month” average, e.g. the $9.2 billion cash-flow-from operations number is a 4-quarter average of the trailing twelve month cash-flow-from-ops number to smooth annual volatility.

The annual dividend in dollars today for IBM is nearing $6 billion, which with a $7.4 billion free-cash-flow average, is the primary reason IBM hasn’t repurchased any stock for 14 quarters, and even the prior 9 quarters before that saw smaller share repurchases.

The ironic aspect to this is that IBM’s “free-cash-flow yield” at 6% still looks pretty healthy, down from 10% in 2018, although it’s a function of a stagnant dividend in dollars and a declining market cap.

One thing readers should take note of is IBM’s dividend history and the fact that – after years of healthy dividend increases through 2019 – the Board of Directors has boosted the dividend by only $0.04 a year since then, or the last 5 years.

When IBM bought RedHat (closed in July 2019), long-term debt jumped to $58 billion, and has since dwindled to $53 billion, leaving IBM with a 40% debt-to-capital ratio, with the long-term debt rating by Standard & Poor’s A-2 and Moody’s A3. At least IBM is still rated at the low-end of the “A” tier, which means the tech giant could issue additional debt, but without growth in revenue and earnings and cash-flow, you’d think the rating agencies would take a hard look at the rating with any further material boost in debt outstanding.

How’s the Stock Performed?

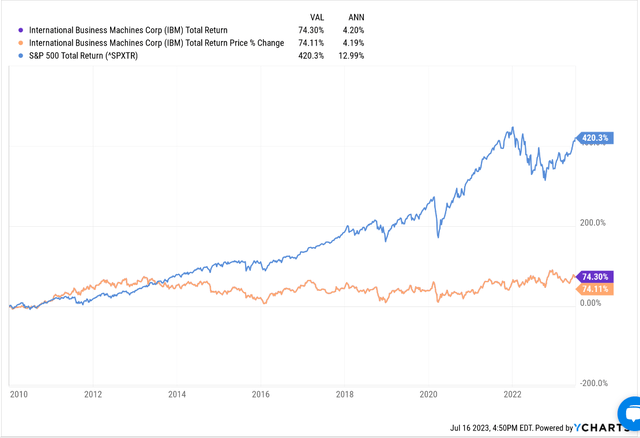

IBM vs SP 500 from 1/1/10 to 6/30/23 (YCharts )

IBM shares peaked in April – May 2013, although this total return chart takes the reader back to 1/1/2010.

Since peaking near $215 per share in early 2013, the opportunity cost of holding IBM has cost IBM shareholders significant shareholder value during a robust bull market.

RedHat and the “hybrid cloud” were supposed to cure a lot of IBM’s ill’s as data management gradually eroded, but while IBM has made some progress on the integration, it hasn’t been the “game-changer” many thought it would be.

Now with “AI” becoming the latest hot technology and “next big thing”, IBM is expected to try and capitalize on that, but my suggestion for readers is wait until you see some material revenue, operating income and cash-flow growth before committing to the stock.

Valuation:

With IBM trading at 13x – 14x EPS and expecting 3-4% EPS growth and 4% revenue growth from 2023 to 2025, the stock never looks that expensive, but that’s probably due to its underperformance and lack of any meaningful catalyst in the last 10 years.

I can’t recall the name of the analyst at Morgan Stanley in early 2016, but after a nasty correction in the stock market, when crude oil plummeted to $28 per barrel in early, 2016, the Morgan Stanley analyst put a strong buy on the stock at $115 per share during the market swoon. 8 years later, IBM is trading just $15 higher than it was on that much-publicized upgrade.

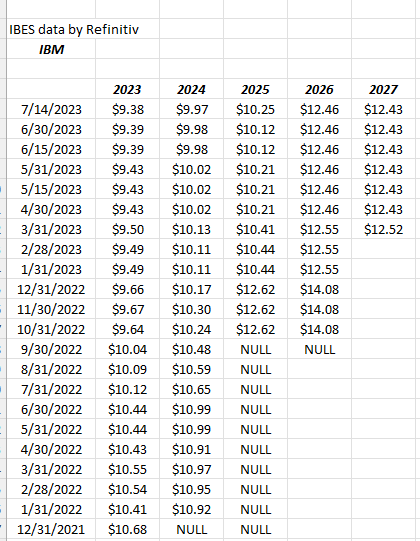

IBM EPS estimates are still declining:

IBM EPS estimate revisions last 18 months (IBES data by Refinitiv )

Summary/Conclusion:

Readers probably underestimate the importance of scrutinizing dividend policy, particularly for mature businesses, and the recent paltry increases in the IBM dividend in the last few years is telling.

IBM’s dividend (in dollars) now accounts for 80% of IBM’s free-cash-flow dollars, and as that percentage increases, it could cause a serious issue for IBM.

The tech giant is one of America’s storied technology giants, but like AT&T (T), and Walgreens (WBA) and other iconic American businesses, IBM has used the last 10 years to go absolutely nowhere from a shareholder return perspective, and has generated no growth or very little growth over that time period.

IBM is not completely lost, but the company has to do something to generate meaningful revenue, operating income and cash-flow growth eventually.

Looking at my quarterly notes for Q4 ’23, it appears Morningstar noted the “weaker cash-flow guide wasn’t expected”. Morningstar has been leery of the RedHat merger by IBM and has consistently thought the integration value was over-hyped.

The only reason I spend the personal time to track IBM’s results and update the numbers is that, eventually, companies can make a turnaround. Look at Apple (AAPL): Apple traded down to $3 per share in late 1998, in the Long-Term Capital Crisis, and then with Steve Jobs coming aboard, and within 3–5 years, a great American titan was created.

It’s difficult to achieve, but turnarounds can happen, however I’m beginning to doubt it will ever happen.

IBM reports after the closing bell on Wed, July 19, ’23

Read the full article here