IBM (NYSE:IBM) separated its managed infrastructure services business to become an independent company named Kyndryl (KD). After the separation, IBM’s core growth is driven by its Hybrid Platform & Solutions and Consulting businesses. I expect it can generate 4-5% revenue growth going forward. I initiate with a ‘Buy’ rating and a fair value of $180 per share.

Portfolio Shift After Kyndryl Spun-off

After spinning off the legacy managed infrastructure services business, IBM’s software and consulting business accounted for 75% of group revenue, and more than half of its group revenue is recurring in nature. In addition, the spinoff benefits its future growth.

IBM 10Ks

I would argue that IBM has transformed into a much better company after the spin-off. Firstly, the managed infrastructure services business was not experiencing growth while it was part of IBM. It primarily offered outsourcing and other infrastructure modernization and management services for its customers. The business suffered from the impact of cloud transformation, with the demand for on-premises management infrastructure services sharply declining as more workloads moved to the cloud.

Secondly, in the current IT environment, hybrid cloud, consulting, and AI are key growth areas. After the spin-off, IBM can allocate more capital and resources to these growth areas, such as software and consulting.

Lastly, IBM has acquired around 37 companies over the past four years, focusing on hybrid cloud and data analytics. These acquisitions position IBM to accelerate topline growth. Without the burden of legacy businesses, it becomes relatively easier for IBM to leverage acquisitions and make a significant impact on group performance.

Acquisitions Review

Regarding major deals, IBM acquired Red Hat for $34 billion in 2019 and Apptio for $4.6 billion in 2023. I believe these acquisition deals make strategic sense and could accelerate their topline growth going forward.

The acquisition of Red Hat enabled IBM to capture the growth of the hybrid cloud platform. Red Hat OpenShift runs on top of their operating system, Red Hat Enterprise Linux. Red Hat’s hybrid cloud solution assists enterprises in transitioning their workflows to a hybrid cloud infrastructure. Additionally, Red Hat supports various applications and software to manage these infrastructures, positioning it well within the Red Hat Linux ecosystem. Red Hat delivered 17.5% revenue growth in FY22 and 29.6% in FY21, making it a truly growth-oriented business for IBM.

In 2023, IBM acquired Apptio, a software-as-a-service business with over 1,500 customers and partnerships with cloud companies, including Amazon and Salesforce. Apptio’s business has been experiencing low-teens growth, and the acquisition is expected to strengthen IBM’s Red Hat, consulting, and AI-related businesses.

Financial Analysis and FY24 Outlook

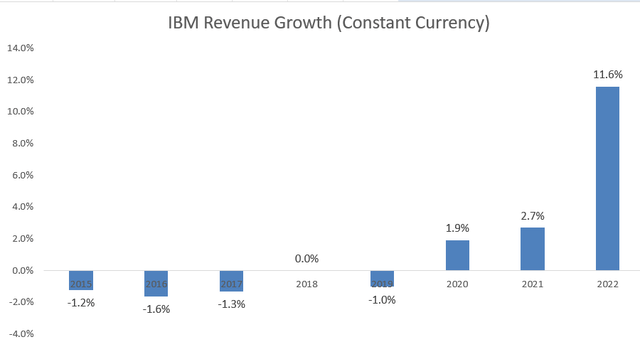

IBM experienced no growth before FY20, primarily due to its legacy business in managed infrastructure services and mainframe related business. However, after the separation of Kyndryl in 2021, the company began to show some topline growth, driven by its software and consulting business. The growth in their software components has also contributed to an improvement in operating margins in recent years.

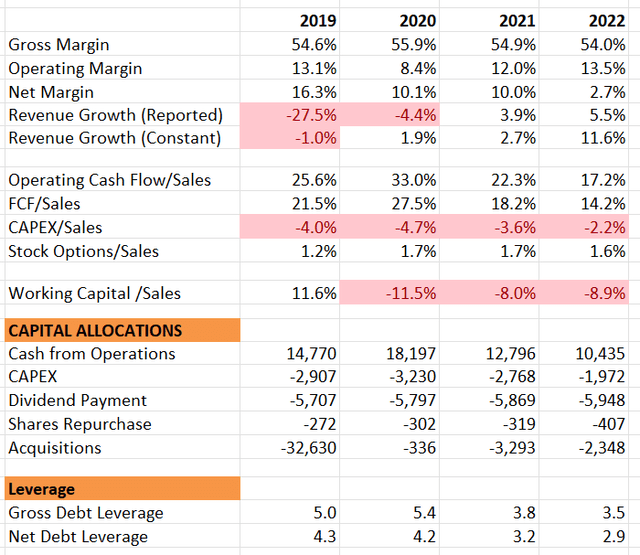

On the balance sheet, IBM reported $11 billion in cash and cash equivalents and $55 billion in debts at the end of Q3 FY23. With a net debt leverage close to 3x, it is slightly higher compared to other software companies. The company has allocated most of its cash to acquisitions and dividends. Despite the relatively high debt level, I believe their capital allocation policy is suitable, especially given their reliance on acquisitions to generate future growth.

IBM 10Ks

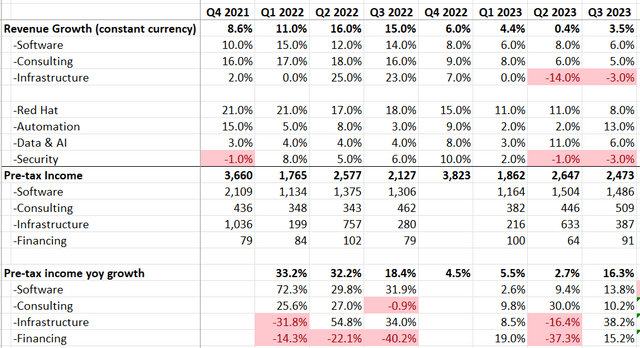

During Q3 FY23, IBM delivered 3.5% revenue growth in constant currency and 16.3% pre-tax income growth year-on-year. They are maintaining their full-year guidance of 3-5% revenue growth in constant currency and expect to generate $10.5 billion in free cash flow. The company anticipates foreign exchange to pose about a one-point headwind to revenue growth.

IBM quarterly earnings

More specifically, the forecast for software indicates growth at the high end of the mid-single-digit model, while consulting is expected to grow in the 6% to 8% range, and infrastructure is projected to be in the 3-5% range. Given their performance in the past three quarters, there are no expectations of surprises in their Q4 results.

IBM is scheduled to announce its Q4 results on January 24. Regarding their FY24 guidance, it’s anticipated that they would guide for 4-5% revenue growth, implying 5-6% growth in software and consulting, and around 3% growth in all other business lines. The 4-5% type of growth is seen as a potential new pattern for their future growth, and credit is given to their past acquisitions for steering the company in a positive direction, in my opinion.

Their core growth areas, the Hybrid Platform & Solutions and Consulting business, constitute around $37 billion or 70% of total revenue. If the core grows at a mid-to-high single-digit rate, it would contribute around 5% to the top-line growth.

Valuation

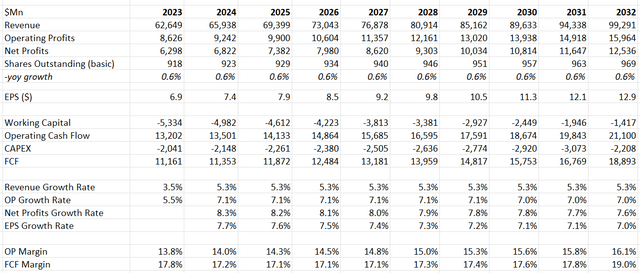

For FY23, the model assumes 4.5% constant revenue growth, accounting for a 1% headwind from foreign exchange, aligning with their full-year guidance. For the normalized period, an assumption of 4% organic revenue growth and 1.3% acquisition growth is made. As discussed previously, there’s confidence that IBM can deliver a 4-5% type of top-line growth, primarily driven by their hybrid cloud and consulting businesses.

IBM DCF – Author’s Calculation

Their software and consulting segments are growing at a faster rate with a better margin profile; therefore, the mix shift is expected to contribute to their margin expansion. According to my calculations, they should be able to expand their margin by 20 basis points annually. The model uses a 10% discount rate, 4% terminal growth, and a 15% tax rate. The fair value is calculated to be $180 per share.

Key Risks

Weak consumption-based services within Red Hat: Red Hat experienced 8% growth in Q3 FY23, a departure from the single-digit growth in the past quarters. For Red Hat, 80% of revenue is recurring, derived from subscription-based services. The remaining 20% of revenue comes from consumption-based services, which are of short duration and more susceptible to the impacts of the macro environment.

AI competition: IBM is contending with robust AI competition from major players such as Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL). With over 20,000 data and AI consultants, IBM is heavily investing in WatsonX, a venture that demands substantial operating and capital expenditures. In comparison to its rivals, I guess IBM may face some challenges in attracting AI talent.

Conclusion

I believe IBM can deliver a 4-5% type of growth going forward, with their hybrid cloud and consulting businesses continuing to drive both topline growth and margin expansion. I initiate with a ‘Buy’ rating and a fair value of $180 per share.

Read the full article here