Ideas are easy. It’s the execution of ideas that really separates the sheep from the goats.” – Sue Grafton.

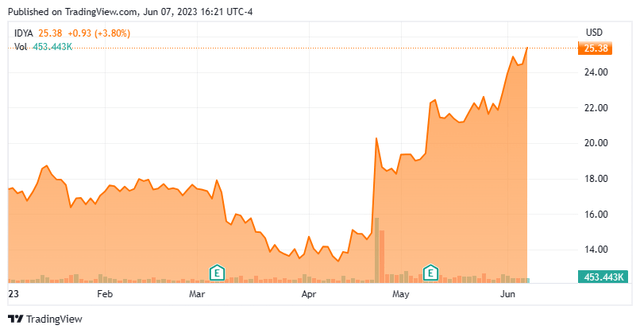

Today, we put Ideaya Biosciences, Inc. (NASDAQ:IDYA) in the spotlight for the first time. The company’s stock has been on a roll recently and is up some 45% year-to-date. The company has an intriguing development approach and is advancing myriad drug candidates within its pipeline. An analysis follows below.

Seeking Alpha

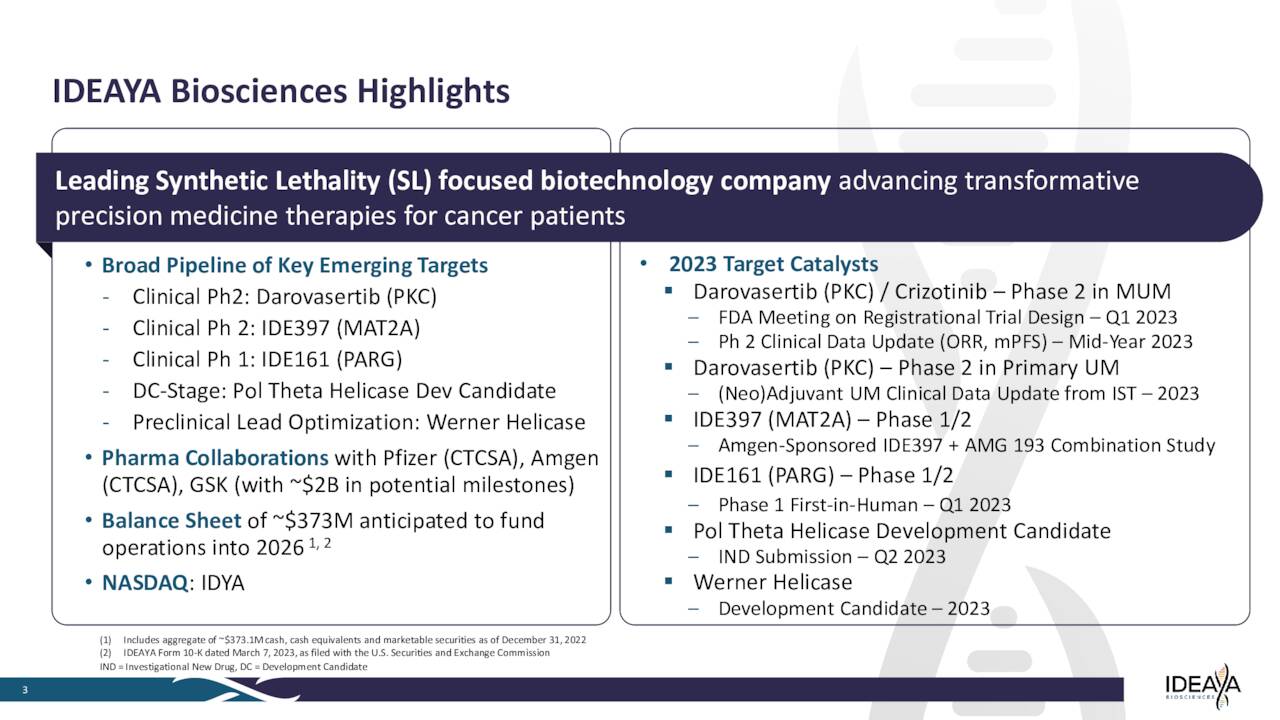

Company Overview:

This clinical-stage biotech concern is headquartered in South San Francisco, CA. The company is focused on the development of targeted therapeutics for patient populations selected using molecular diagnostics. IDYA stock trades just north of $25.00 a share and sports an approximate market capitalization of $1.4 billion.

March 2023 Company Presentation

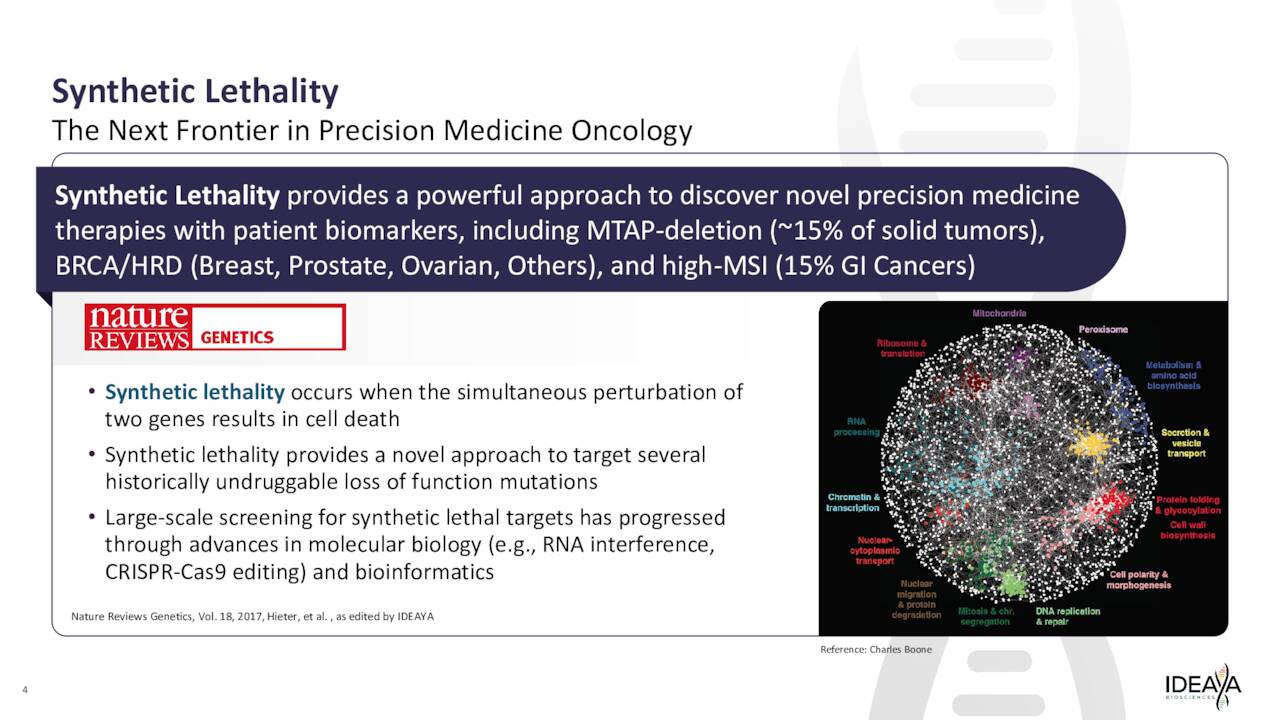

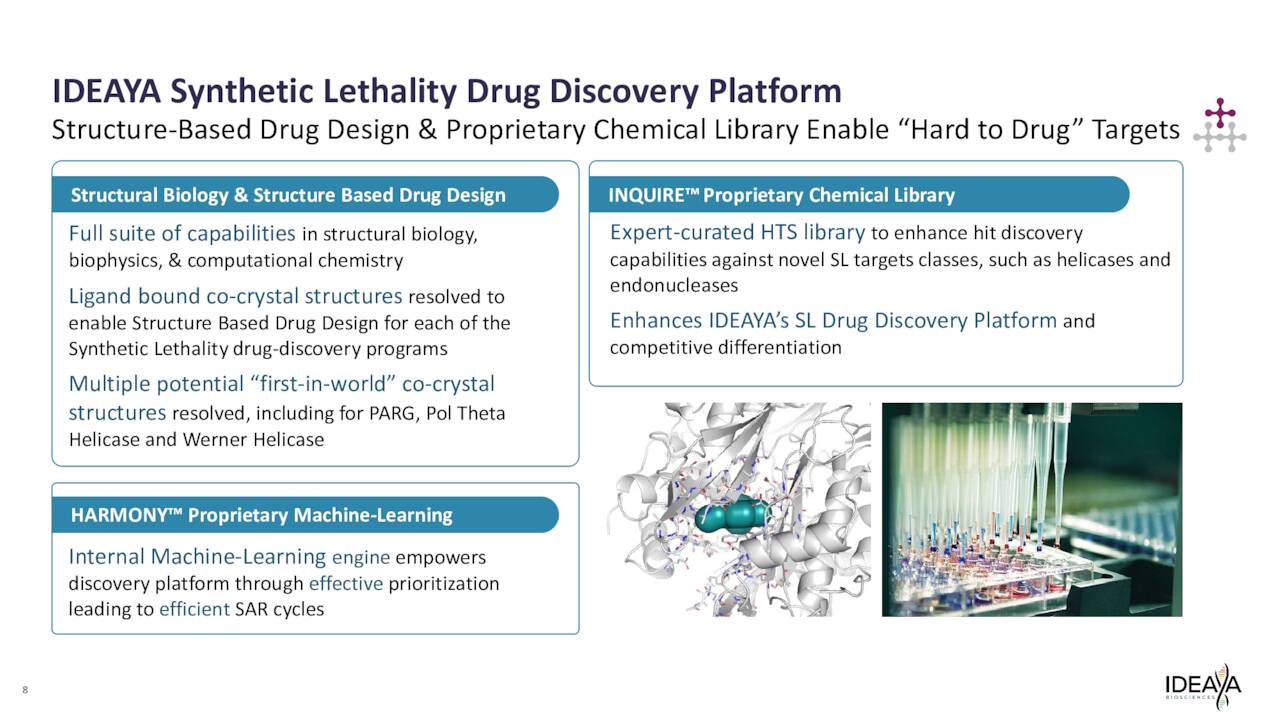

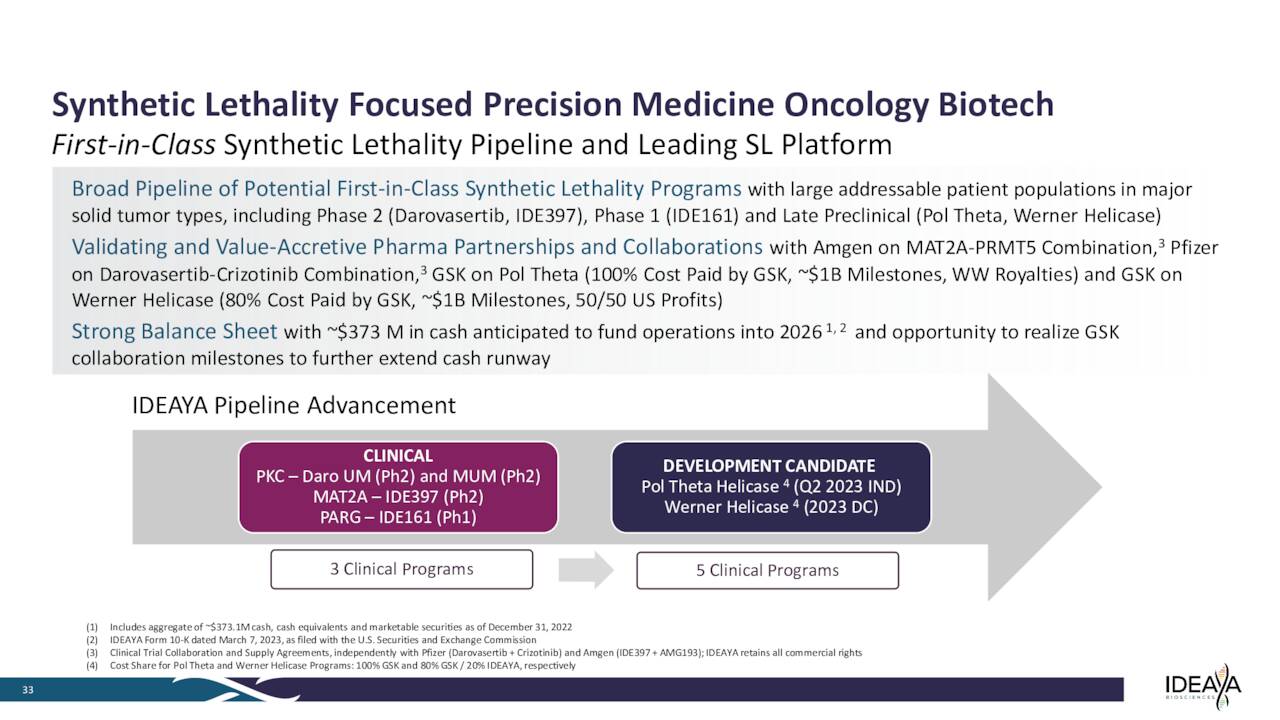

The company development approach and platform are designed around “synthetic lethality,” which IDEAYA Biosciences describes thusly on its website:

March 2023 Company Presentation

Synthetic Lethality is an emerging area within precision medicine oncology, presenting an opportunity to deliver the next generation of targeted therapies for patients. Advancements in molecular biology research, including genetic knockdown and editing capabilities, are enabling the identification and validation of novel biological targets.”

March 2023 Presentation

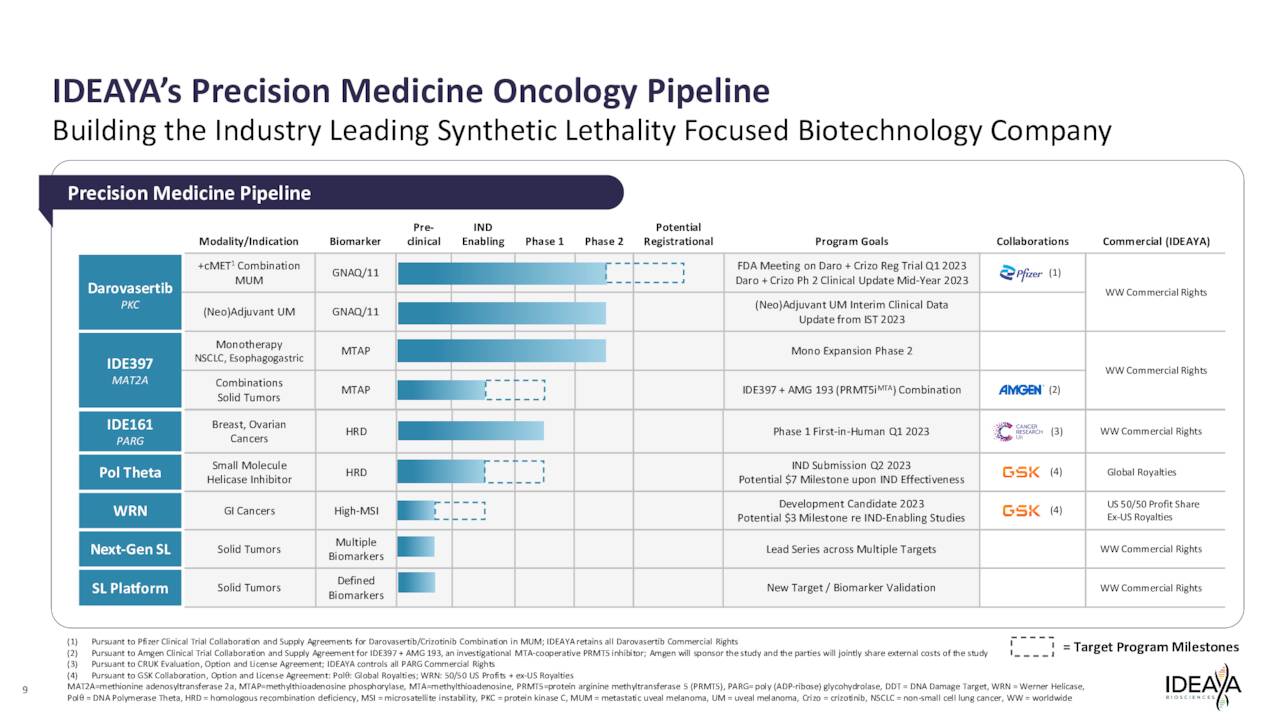

The company has several drug candidates in development within its pipeline. We will focus on this concern’s two most advanced programs within this analysis.

March Company Presentation

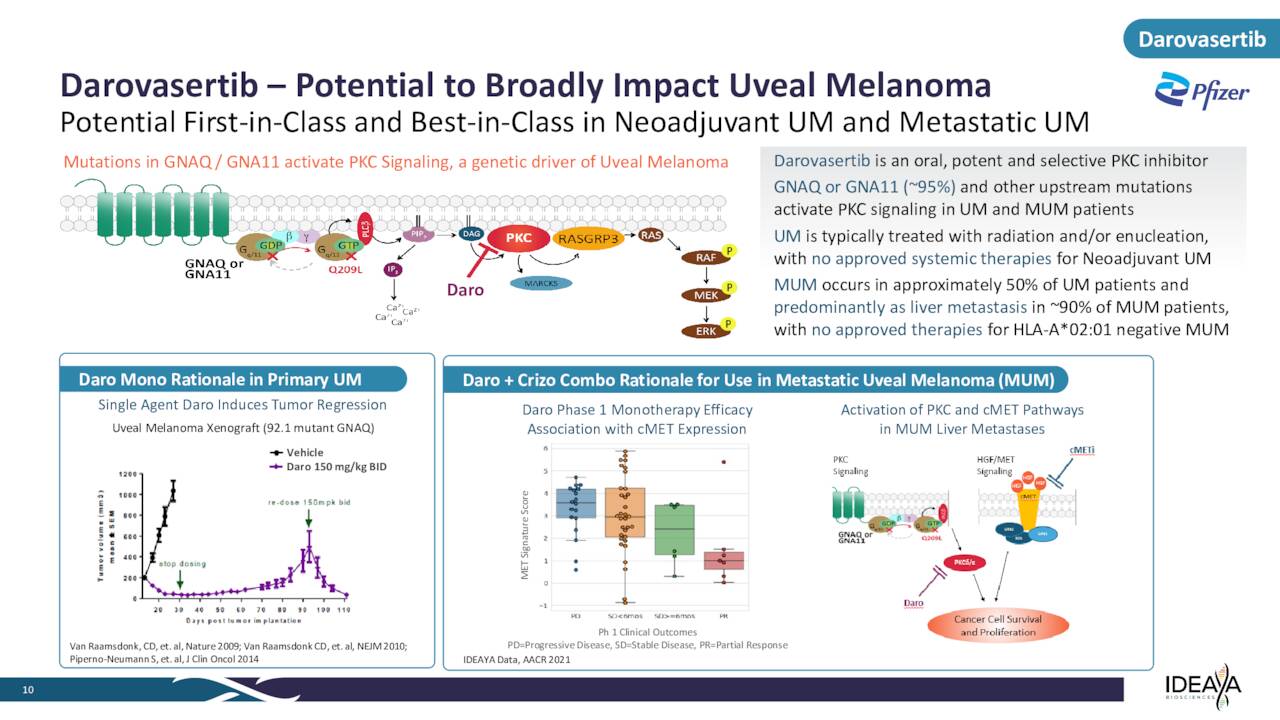

Ideaya Biosciences’ primary drug asset at this time is called Darovasertib, or IDE196, which it has licensed from drug giant Novartis (NVS). Darovasertib is described as a “potent and selective small molecule inhibitor of PKC, a protein kinase that functions downstream of the GTPases GNAQ and GNA11.”

March 2023 Company Presentation

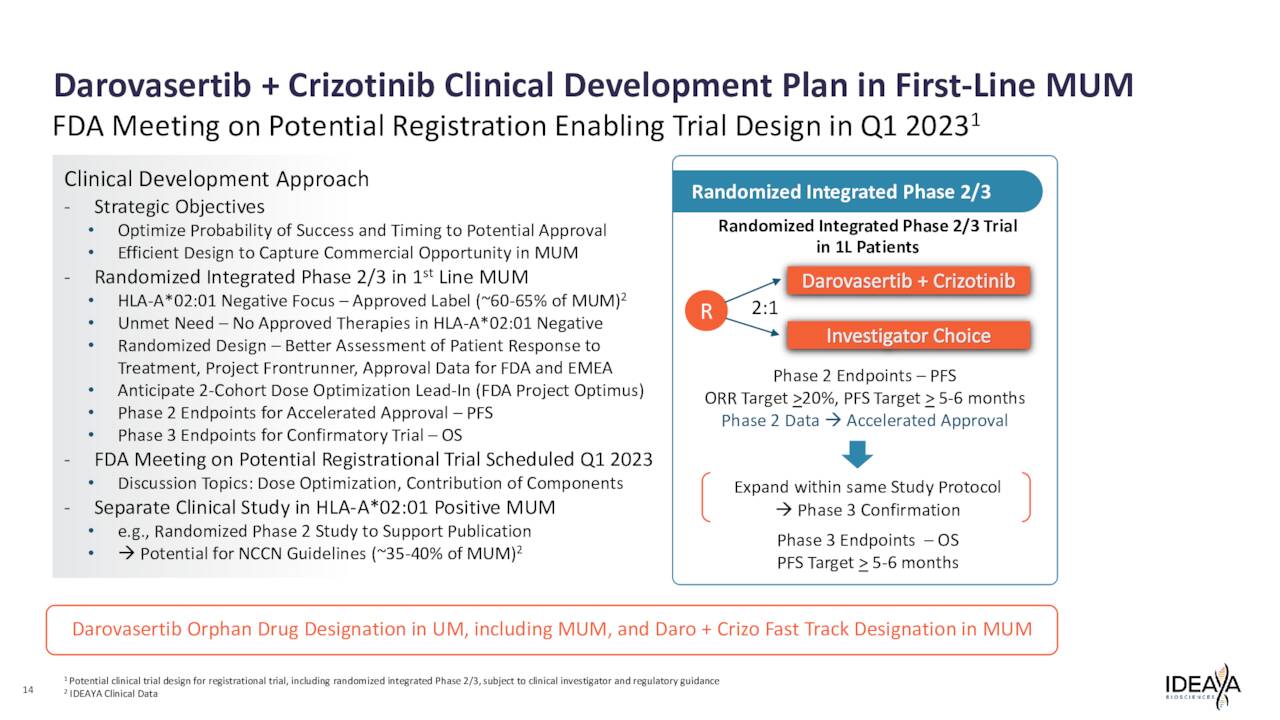

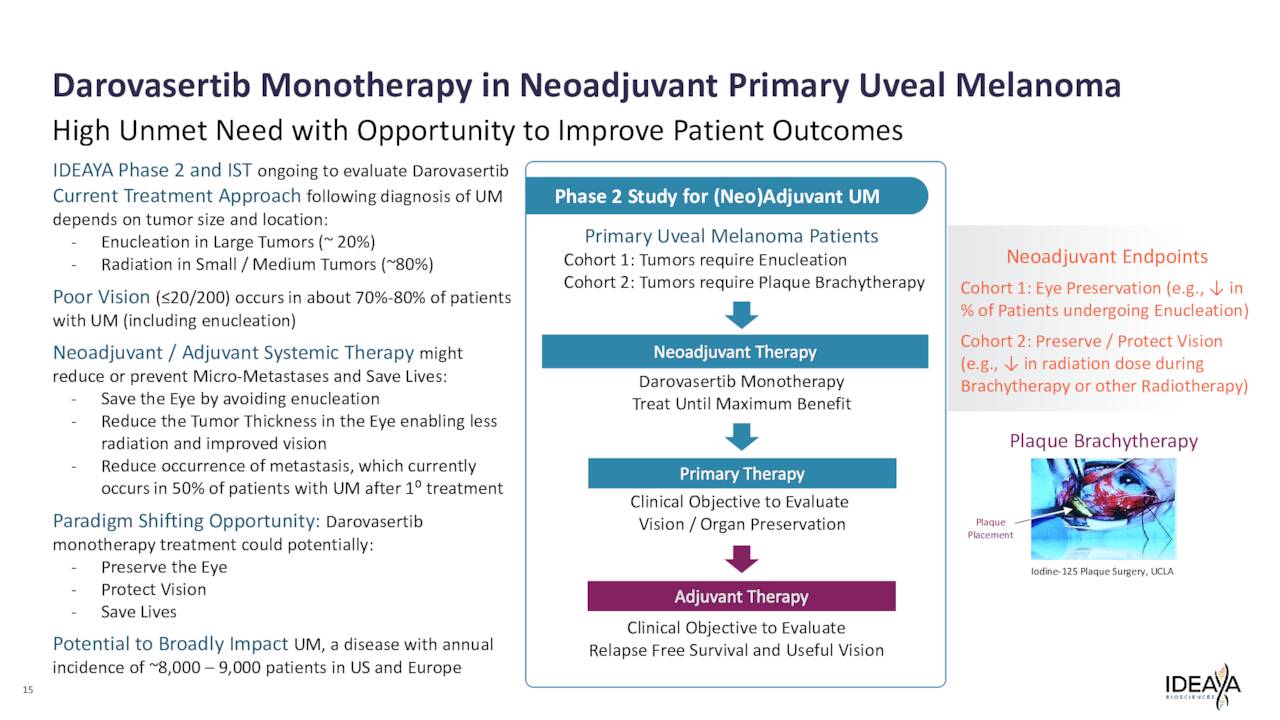

Currently, IDEAYA is evaluating this compound to treat patients with solid tumors harboring GNAQ or GNA11 mutations. The company is studying darovasertib both as a monotherapy neoadjuvant therapy and adjuvant therapy in primary uveal melanoma or UM as well as part of a combination therapy with crizotinib, an investigational cMET inhibitor, to treat metastatic uveal melanoma or MUM. It is partnered with Pfizer, Inc. (PFE) in these efforts, as the drug giant is developing crizotinib.

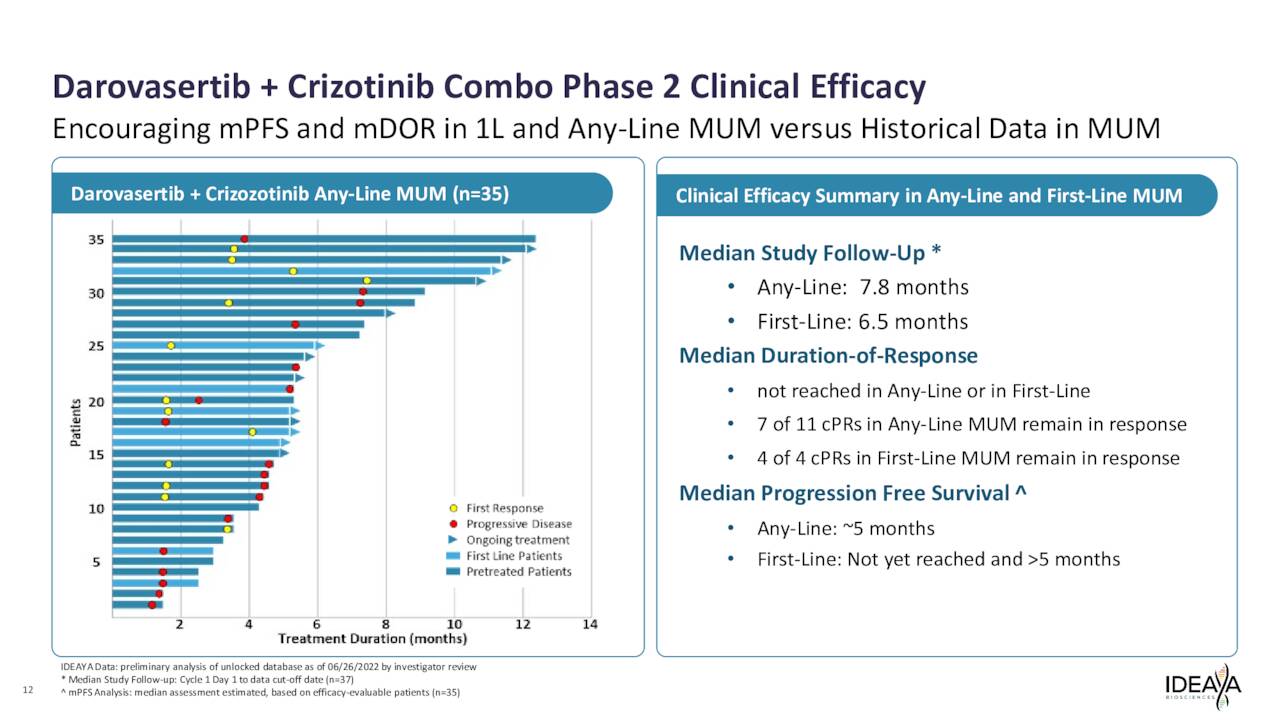

The company is in the process of initiating a Phase 2/3 registrational trial of this combination in First-Line HLA-A2 negative MUM. The primary endpoint for this potentially pivotal study median PFS as a primary endpoint with the goal being accelerated approval upon successful results. In a Phase 2 study around clinical efficacy, the combination produced what management has called “compelling” data.

March 2023 Company Presentation

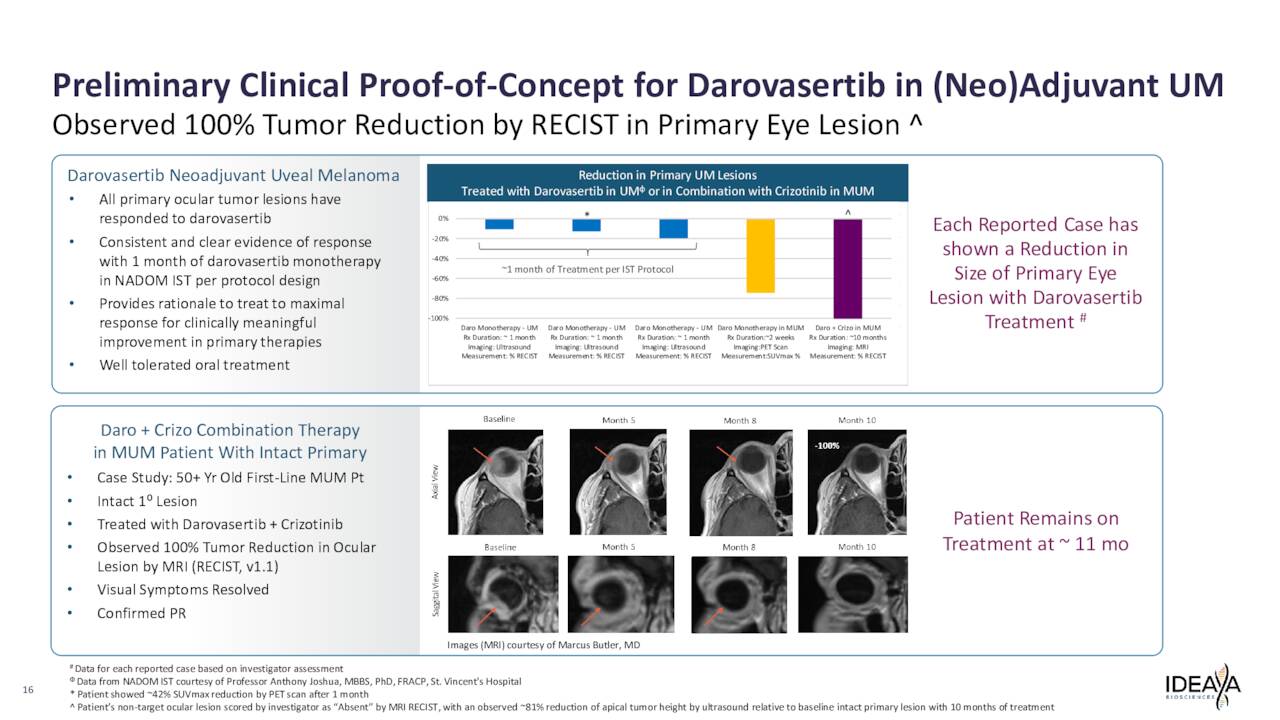

Ideaya Biosciences has also reported solid clinical proof-of-concept (PoC) data for the use of darovasertib as neoadjuvant therapy in primary, non-metastatic UM patients.

March 2023 Company Presentation

The company is also developing IDE397. This wholly owned compound is targeting MTAP-deletion solid tumors. IDE397 is a methionine adenosyltransferase 2a, or MAT2A, inhibitor. Again, from the company’s website:

In MTAP null patients, pharmacologically inhibiting MAT2A modulates key protein methylation function, leading to cancer cell death. MTAP-null cells lack the ability to metabolize 5-methylthioadenosine, or MTA, which is an essential step in a biochemical pathway involved in salvaging metabolite S-adenosyl methionine, or SAM. Increased levels of MTA partially inhibit the methyltransferase PRMT5 for which SAM is the substrate. This partial inhibition renders MTAP-null cells more dependent on the activity of methionine adenosyltransferase II alpha or MAT2A, an enzyme that is responsible for the synthesis of SAM. Because of this dependence, loss of MTAP results in synthetic lethality when MAT2A is pharmacologically inhibited. MTAP deletions are prevalent in approximately 15% of all human tumors across various tumor types. Genetic profiling tests for the deletion of MTAP or for the commonly co-deleted gene CDKN2A are commercially available.”

Currently, the company is studying IDE397 within Phase 1 monotherapy dose escalation cohorts in patients having tumors with MTAP deletion and is working to evaluate in Phase 2 monotherapy expansion cohorts. The company is also partnering with Amgen (AMGN) to evaluate IDE397 in combination with the drug giant’s AMG 193, the Amgen investigational MTA-cooperative PRMT5 inhibitor targeting MTAP deletion tumors. The companies are working on site activation for a Phase 1/2 study to evaluate the combination after the FDA signed off on its Investigational New Drug or IND application in May.

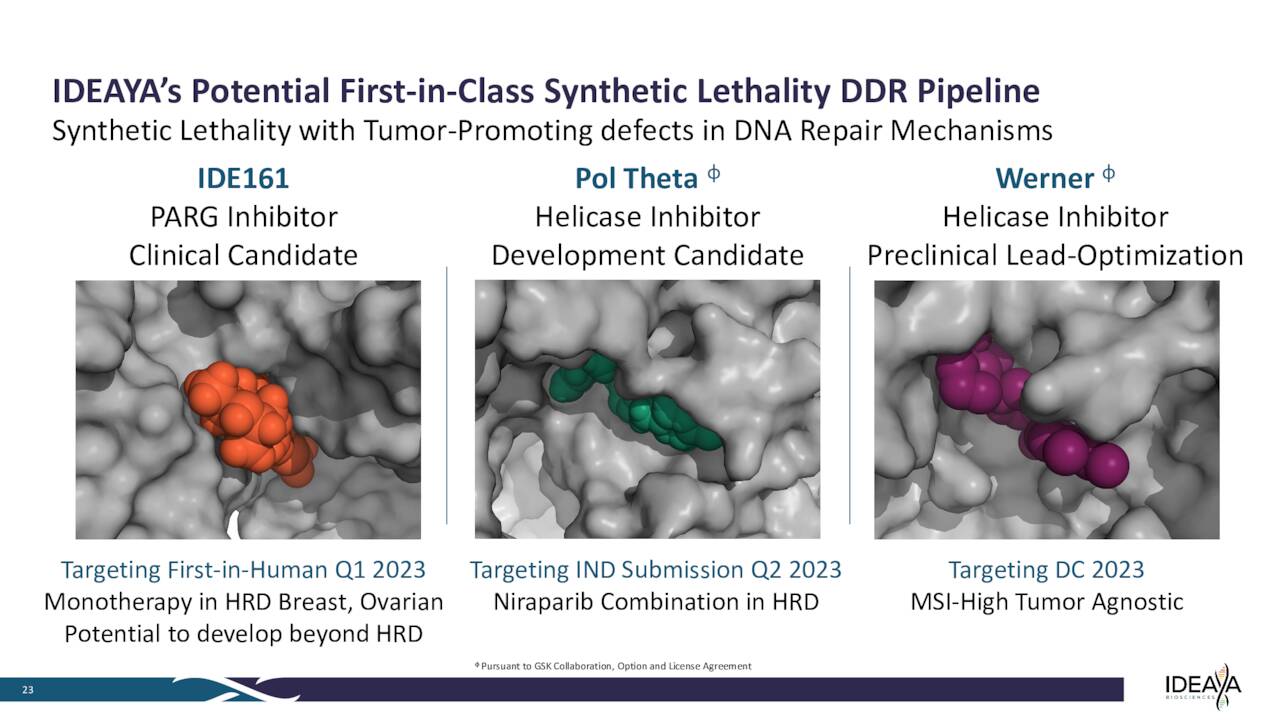

Here is a quick profile of some of the company’s other earlier stage candidates that were not germane to this analysis.

March 2023 Company Presentation

Analyst Commentary & Balance Sheet:

Just over nine percent of the outstanding float in the shares are currently held short. In late May, the company’s Chief Legal Officer sold just over $100,000 worth of the shares. That is the only insider activity in this equity since late 2021. At the end of the first quarter, the company had just over $350 million in cash and marketable securities. IDEAYA Biosciences, Inc. then raised nearly $190 million via a secondary offering in late April. Management has now stated it has funding in place to fund all planned operations into 2027.

Since the company executed that capital raise, five analyst firms including RBC Capital and JPMorgan have reiterated Buy/Outperform ratings on the stock. Price targets proffered range from $24 to $40 a share.

Verdict:

March 2023 Company Presentation

Ideaya Biosciences, Inc. has several “shots on goal” and many trial milestones on the near-term horizon. The most important of which is the Phase 2/3 registrational trial evaluating darovasertib as part of a combination therapy, as that could lead to the company’s first FDA approval down the road.

March 2023 Company Presentation

In addition, darovasertib has potential as a monotherapy for UM and could change the competitive landscape to treat that indication if successful in development and eventually approved for UM.

March 2023 Company Presentation

Finally, Ideaya Biosciences, Inc. has recently addressed its funding needs for the next few years. While some time off from potential commercialization, Ideaya Biosciences seems to more than merit a small “watch item” holdings within a well-diversified biotech portfolio for now.

An idea that is not dangerous is unworthy of being called an idea at all.” – Oscar Wilde.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here