Thesis

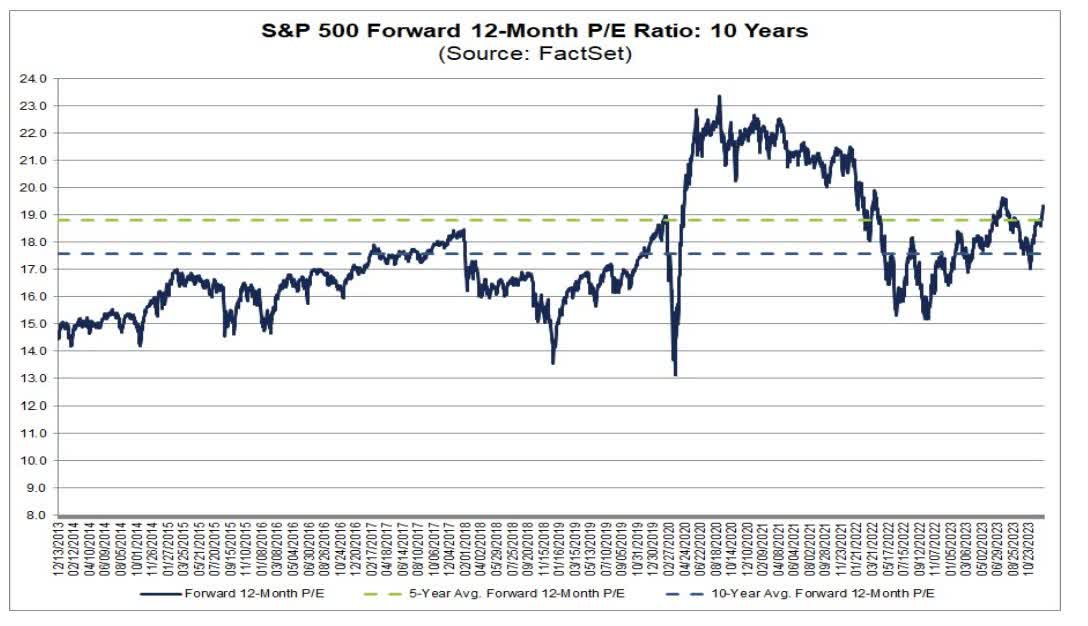

‘Valuations, valuation, valuations’ those words should be front and center in any investor’s mind as we enter 2024. With a forward P/E ratio that is now above its 5- and 10-year averages, the S&P 500 is no longer cheap:

S&P 500 P/E Ratio (FactSet)

A retail investor should not follow the herd but instead focus on sourcing ‘cheap’ assets when valuation is considered. Buying low and selling high is the golden standard of investing, irrespective of the asset class. With the S&P 500 on the pricey side, we are going to look into an often-forgotten sector, namely international dividend equities.

With global rates most likely peaking, this often-forgotten asset class is starting to look very appealing, especially after factoring in dirt-cheap valuation metrics. The ALPS International Sector Dividend Dogs ETF (NYSEARCA:IDOG) is an exchange-traded fund covering this sector, and we are going to have a look at its valuation.

Rates are peaking

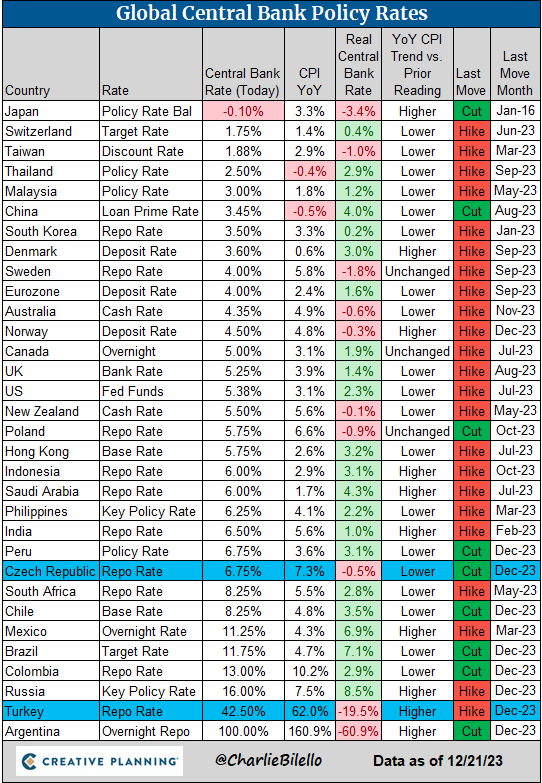

If we look at a table of global rates, we can notice a trend:

Rates (Creative Planning)

Most hikes occurred in the beginning and middle of 2023, with the latest central bank actions being rate cuts (as in Czech Republic in December and Poland in October). For the purpose of our analysis, we can ignore EM countries such as Turkey and Argentina with acute structural issues compounded by years of political decisions rather than economic ones. In the developed world, however, we believe cuts are coming, which means bond and dividend stocks will be favored going forward.

Rates are a tool employed by central banks to tame inflation in a standardized monetary environment. As inflation as measured by CPI trends lower, rates will ultimately also trend lower. Each central bank will make its own decision regarding the timing of rate cuts and target inflation figures, but the trend is for lower rates in the future.

Valuations are cheap

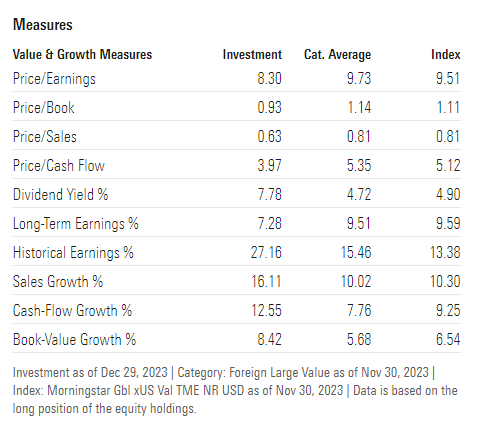

The fund holdings have extremely attractive valuation levels:

Portfolio Valuations (Morningstar)

With a blended P/E ratio of only 8.3x, the fund components are priced on the lower side of the valuation spectrum. What is surprising is the fact that the equities are also trading with a price below book value on average, with the P/B ratio at a blended 0.93. By looking at the prior valuation metrics an investor would think there is negative growth embedded in the respective equities, but in fact, they have a cash-flow growth percentage of 12.55%. While not overly exciting, the underlying companies are still growing, which should command a better valuation factor.

Valuation entry points are very important because most of investor’s returns are driven by P/E expansion. Even for growth companies actual revenue generation comes in second to investors’ perception of forward earnings and the subsequent bidding-up of P/E ratios. Buying a financial instrument at peak valuation levels can only result in poor long-term results. Think about having bought ‘safe’ long-duration Treasuries in 2021. Long-term Treasuries are risk-free because the U.S. government guarantees the return of principal and payment of interest, but the main risk factor for bonds is constituted by rates. Treasuries were not cheap in 2021. In fact, they were extremely expensive. Valuations were stretched and investors would have done well to sell them at that point, not buy them.

Yield is attractive

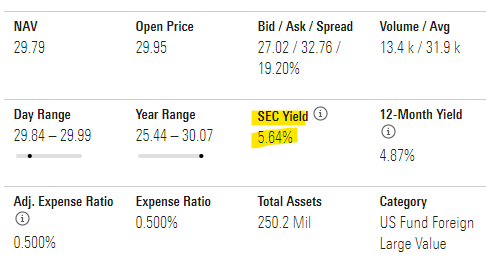

The fund has a very attractive 5.6% 30-day SEC yield:

30-day SEC Yield (Morningstar)

Please note that the Seeking Alpha platform shows the trailing 12 months yield (‘TTM’) which is slightly lower given a rise in the cash flows paid in the past year.

High-yielding large-cap value stocks act in many instances like longer duration bonds. Robust, ‘cash-cow’ business with low growth tend to distribute most of their cash to shareholders in the form of dividends or share repurchases, absent high IRR internal projects. To that end, many of these businesses compete with bonds for investor’s capital. We can see that through the low volatility exhibited by the fund, which has a standard deviation lower than what large U.S. indices produce.

As rates move lower, bond prices and their equivalents will move higher. We think this is the case as well with IDOG. As rates will move lower, the high dividend provided by the fund’s holding will become even more appealing. With a very attractive starting valuation point, all metrics are favorable to new capital being deployed here.

Analytics

- AUM: $0.25 billion.

- Sharpe Ratio: 0.48 (3Y).

- Std. Deviation: 16.5 (3Y).

- Yield: 5.6%.

- Premium/Discount to NAV: 0%.

- Z-Stat: n/a.

- Leverage Ratio: 0%.

- Effective Duration: n/a

- Expense Ratio: 0.5%

- Composition: International Large Cap Equities – High dividend yield

Composition

The ETF aims to replicate the S-Network International Sector Dividend Dogs Index, which, as per its literature, is:

a portfolio of stocks derived from a universe of mainly large capitalization stocks domiciled in developed markets outside the Americas (the “S-Network Developed International Equity 1000 Index”). The IDOGX methodology selects the five stocks in each of the ten GICS sectors that make up the universe which offer the highest dividend yields as of the last trading day of November. The fifty stocks that are selected for inclusion in the portfolio are equally weighted.

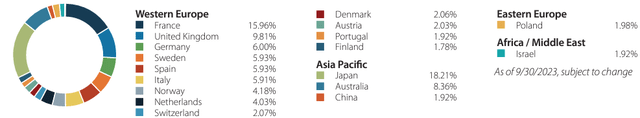

The fund holds international equities:

Country Exposure (Fund Fact Sheet)

The vehicle is well diversified, with no single jurisdiction making up more than 20% of the collateral pool. France has the largest representation, followed by the UK.

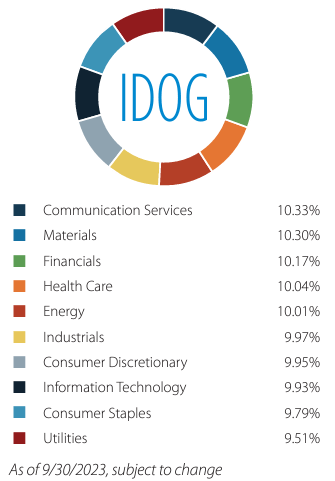

Given its equal weight approach, the sectoral composition is quite similar, and it will even out on the next rebalancing date:

Sectors (Fund Fact Sheet)

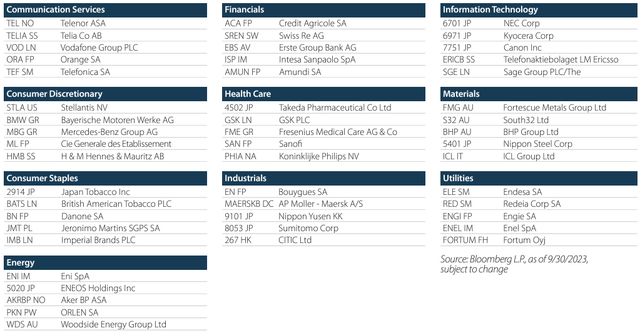

The individual names present in the fund are as follows:

Stocks (Fund Fact Sheet)

Please note the fund holds the equities on local exchanges. For example, British American Tobacco (BTI) is not held via its U.S. ADR, but via its London listed BATS.LN shares. The story is similar for the other holdings, all held via their local exchanges rather than ADRs when the case might arise for dual listing.

Conclusion

IDOG is an equities exchange-traded fund. The vehicle invests in international large-cap equities which pay high dividends. The fund has a 5.6% 30-day SEC yield and attractive valuation metrics. As peak rates take hold and central banks start cutting, IDOG is set to outperform. Starting valuation metrics are very important in today’s environment, with forward returns set to be driven by P/E expansion in many cases. IDOG is an attractive vehicle to express an international peak rates view, coupled with robust starting valuations.

Read the full article here