Equities market has emerged as the winning asset class this year, especially led by strong growth in US large tech names. This came as a surprise to many investors who believed in the adverse impacts high interest rates could have had on growth stocks. As US equities edge towards high valuation amid slowing economic growth and persistent inflation, international equities (ex-US) such as iShares Core MSCI EAFE ETF (BATS:IEFA) are often overlooked and they could be a good candidate for portfolio diversification.

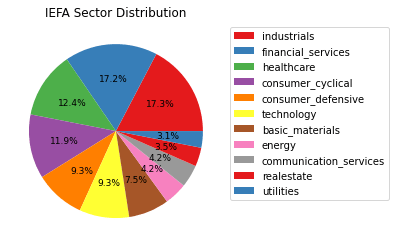

IEFA “seeks to track the investment results of an index composed of large-, mid- and small-capitalization developed market equities, excluding the U.S. and Canada”. As a result, they are very diversified in terms of sector, led by industrials, financial services, and healthcare.

Author, Yahoo Finance

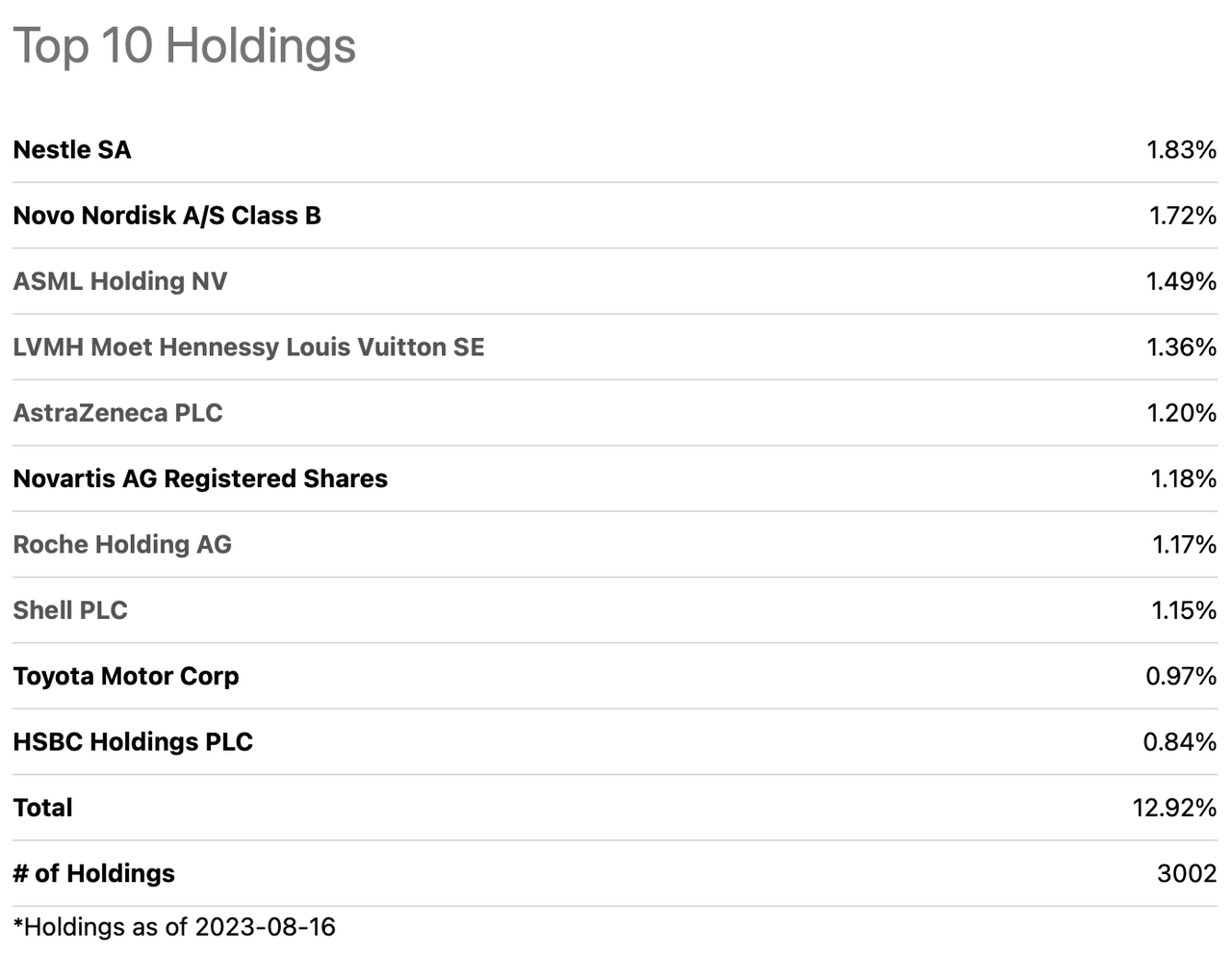

Besides, its top 10 holdings are only taking up ~12% of the total portfolio weight, out of over 3000 stocks included in the fund. They are led by stocks from varying sectors, such as Nestle, ASML, AstraZeneca, and LVMH.

Seeking Alpha

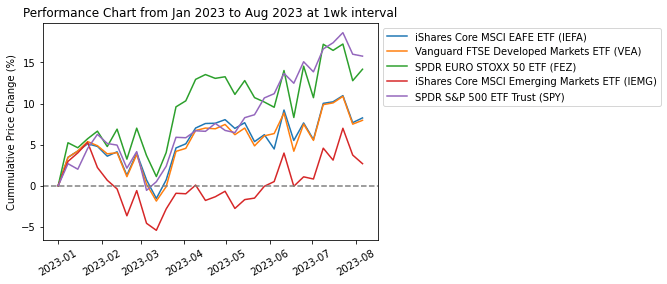

Performance Review

Year-to-date, IEFA performed very similarly to its peer ETF (VEA) which should provide similar exposure, while both underperformed the US and European broad markets, SPY and FEZ, respectively. As a comparison, emerging markets had disappointing performance over the rest, mostly led by underwhelming China re-opening.

Author, Yahoo Finance

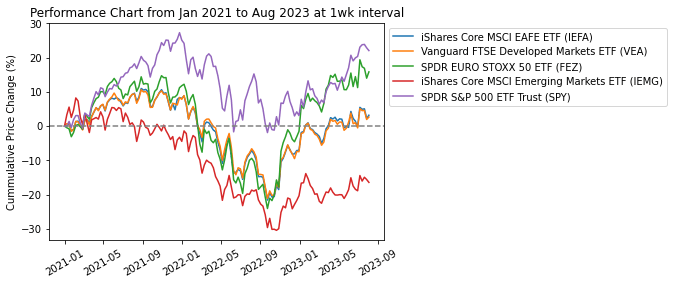

Over the longer period since January 2021, similar trends can be observed. However, SPY leads with a bigger margin while IEMG is significantly lagging behind the rest – indicating that the high risks attributed to EM stocks are actually unworthy.

Author, Yahoo Finance

Risk Analytics

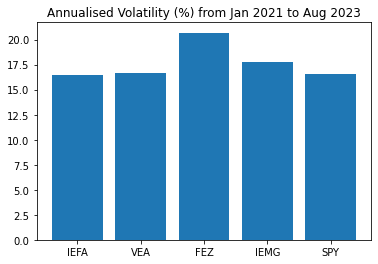

From the risk analytics standpoint, IEFA has a similar risk profile to its peer VEA, as well as the US market SPY. It does have lower risk compared to the European market FEZ and Emerging markets IEMG.

Author, Yahoo Finance

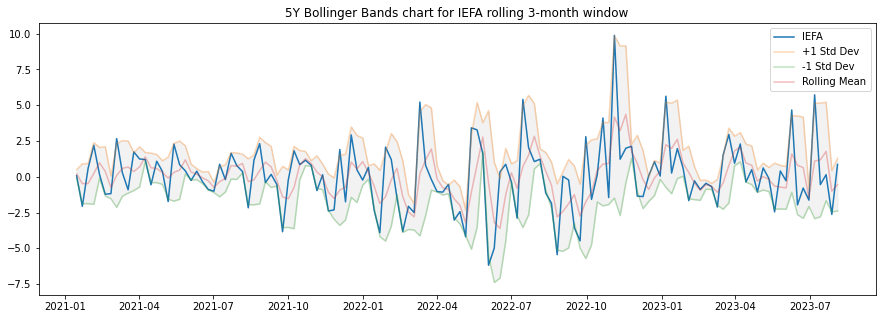

The 5Y Bollinger chart below also visualizes the price volatility of IEFA on a 3-month rolling basis, where it has been trading above the rolling mean – indicating a potential overbought over the recent months.

Author, Yahoo Finance

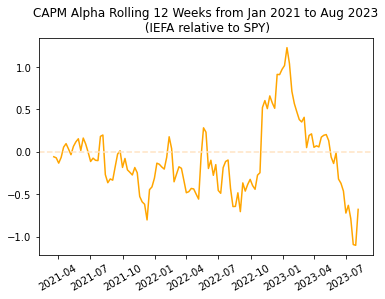

Relative to SPY, IEFA has been underperforming since the start of the year. This is the opposite story as compared to late last year when the US equities market was rough to investors, where IEFA was outperforming SPY.

Author, Yahoo Finance

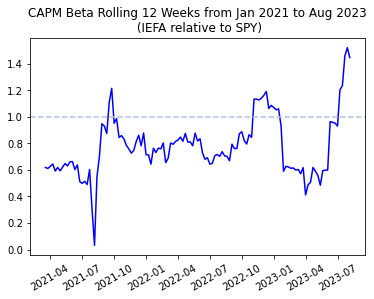

Meanwhile, the rolling-beta chart also demonstrates the high (and growing) volatility of IEFA relative to SPY. It may be difficult for investors to gauge expected returns for such a portfolio where rolling beta varies greatly from 0.6 to 1.4 over this year. Its high beta also signifies that the ex-US strategy has not worked along the risk-return spectrum. High beta to SPY, however, could reaffirm its use to diversify from US exposure which may be useful for some investors.

Author, Yahoo Finance

Peer Analysis

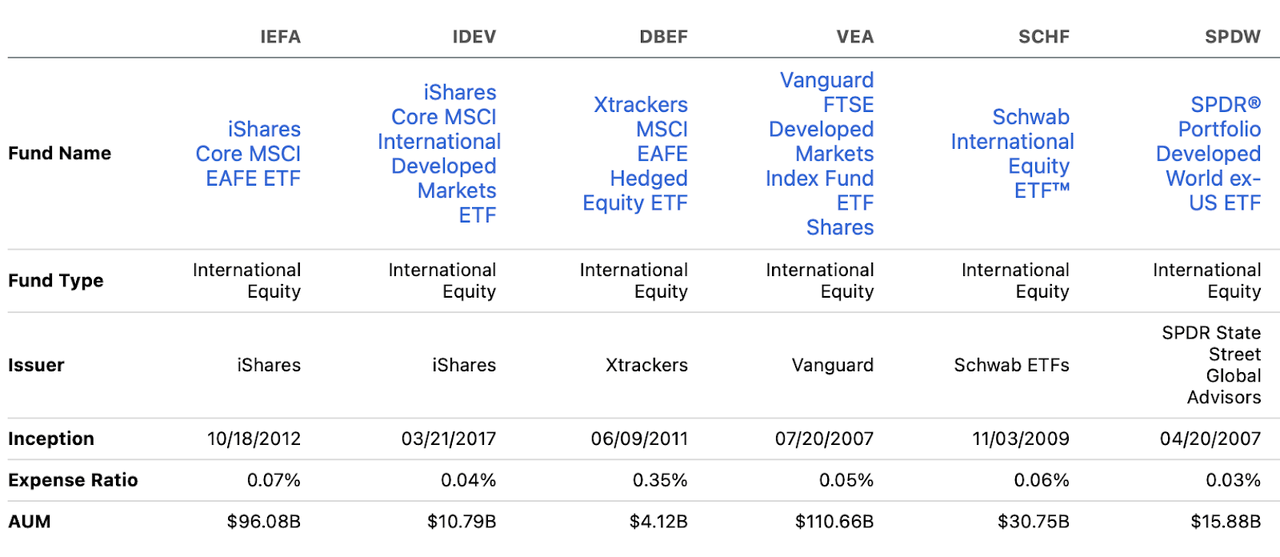

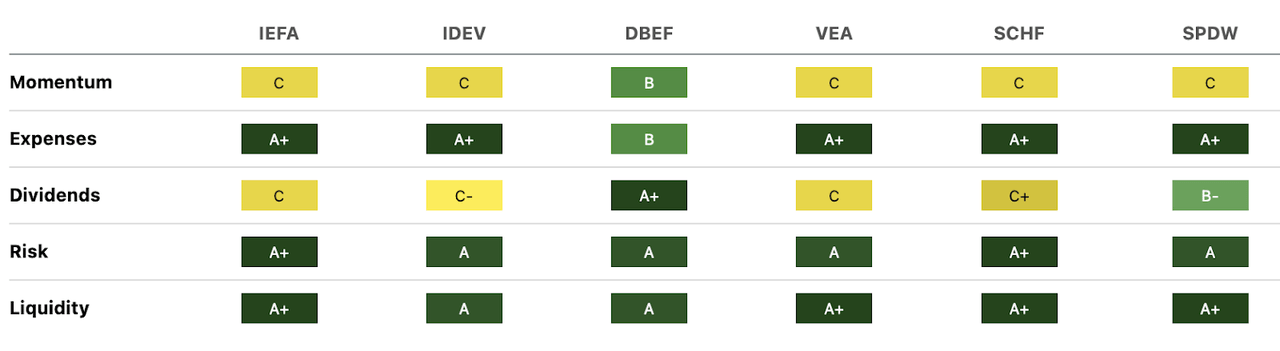

Compared across its peer ETFs which provide similar developed markets ex-US strategies, most of them have very low expense ratio – hence costs actually do not differentiate them much. Meanwhile, their performances have also been highly correlated and similar. IEFA is one of the largest funds in this range, alongside VEA.

Seeking Alpha

The more significant difference comes from dividend distributions, where DBEF does a better job than the rest, while IEFA has a pretty similar dividend yield than most of its other peers at 2.46%. IEFA also has a P/E ratio of 13x, which is slightly higher than the industry average at 10.3x but remains much lower than SPY at roughly 23x.

Seeking Alpha

Conclusion

In short, I believe that US equities are overvalued, and international equities may demonstrate strengths in the coming months as investors shift in risk appetite with the cooling down of AI frenzy and the broad realization of living with persistent inflation and high rates. However, given that international equities have not performed as well over the recent years, there may need to be further catalysts in this space to drive up performance.

Read the full article here