iShares U.S. Infrastructure ETF (BATS:IFRA) has a twofold investment strategy:

1. Capture investment opportunities in U.S. companies like utilities and railways that operate our infrastructure

2. Own US companies that create and enable construction materials like cement and steel. The two groups are roughly balanced 50/50 here.

Infrastructure: hard to ignore the potential

In a post-Covid world, we have seen continued geographical fragmentation and supply chain redundancy in stark contrast to the post-Cold War era of globalization and just-in-time inventory supremacy. With political and economic tensions continuing to rise between a US/European/UK Kingdom hegemony and the growing alliance of China/Russia/Iran, we expect these trends to continue. In other words, national security trumps lower economic costs.

The US infrastructure has not been meaningfully updated in decades. Forty percent of US roads are considered to be in mediocre or poor condition by the American Society of Civil Engineers. There is an unprecedented need for electric grid construction as the US grid system is currently overtaxed and in need of vast expansion with the electrification of many cars and appliances.

Our country is also in short supply of homes, suggesting the builders represented in IFRA would benefit from infrastructure spending. Quite importantly, utility and industrial companies are poised to benefit from the 2022 Inflation Reduction Act (IRA) which provides decades of tax credits for utility and infrastructure expansion. The US government intends to supplement the costs of the mentioned spending to attempt to keep costs down to the consumer.

IFRA is comprised of around 150 US and a few Canada-based companies with roughly $2.2 billion in assets under management. You could even say IFRA is a subset of S&P 500 (SPY) as roughly 30% of IFRA’s holdings are also in SPY. As the major sectors of IFRA are traditionally mature companies, the ETF also provides a nice 2% dividend yield.

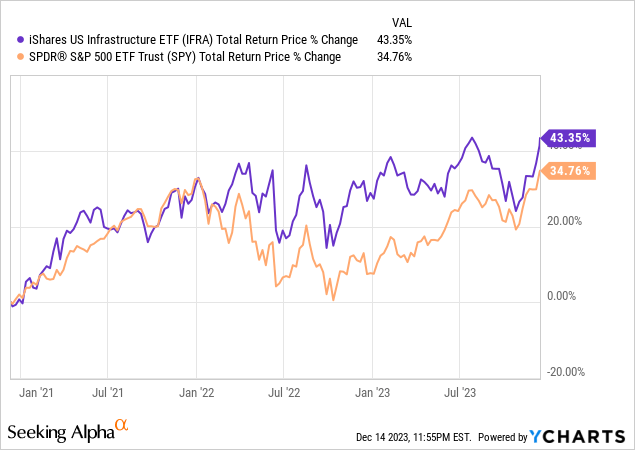

Note in the chart above how IFRA has outperformed SPY over the last three years. However, over the last year IFRA has underperformed SPY potentially indicating it may be ready for a rebound next year, part of a broader market opportunity in the form of a potential rotation away from FAANG stocks and toward many other market segments with a strong fundamental outlook and reasonable valuations.

I think the underperformance this year relates in large part to the last batch of Fed rate cuts, an overhang which this week showed signs of petering out, as Fed Chairman Jerome Powell essentially gave the stock market the bullish narrative it has been yearning for all year.

IFRA has a high weighting to utilities, which are very sensitive to rising rates. Many economists are suggesting the Fed may be done hiking rates and even look towards potential rate easing next year. This would significantly help the company sectors represented in IFRA.

Risks to keep front-of-mind about IFRA

Interest rates can always throw a wrench into this thesis. If the Fed does not decide to pivot to lowering rates or keeps rates higher longer, IFRA may not see a breakout in company infrastructure building. While there is plenty of money targeted by the US government toward infrastructure projects, those don’t all produce earnings immediately.

If inflation remains sticky or inherently higher caused by a new normal of deglobalization, companies in this ETF may see margins and multiples contract. Valuations of this ETF can change significantly with changes in future government regulations, new technologies, or unforeseen macro and political events.

Takeaways

Infrastructure makes a lot of sense for long-term investment, and IFRA does a nice job of capturing the theme. It is a close call, but I land on IFRA as one to watch, but not a table-pounding buy here, and thus a Hold rating. It owns 154 stocks and is equally weighted. I’m all good with equal-weighted ETFs but prefer them to have fewer holdings.

There’s too much dilution here for my tastes. In addition, at a trailing P/E ratio of 18x, I’d need IFRA to be more reasonably priced to overcome my bias against over-diversified ETFs.

Read the full article here