Investment Thesis

Impinj (NASDAQ:PI) operates an innovative platform for wirelessly connecting billions of everyday items to the cloud, helping businesses track and analyze physical items to gain operational efficiencies. With leading market share in RAIN RFID technology, a large patent portfolio, and secular growth tailwinds from supply chain digitization, Impinj possesses exciting long-term potential. However, near-term headwinds from weak end-market demand, elevated inventory, and stretched valuations against still-volatile fundamentals lead me to rate PI a hold for now.

Company Deep Dive

Impinj provides cloud-based item connectivity leveraging RAIN RFID technology across its integrated platform spanning endpoint ICs, reader ICs, readers/gateways, and software. This technology enables Impinj’s customers – including retailers, logistics providers, automotive companies, and healthcare systems – to identify, locate, track, authenticate, and engage with the billions of items they manufacture, transport, and sell.

Impinj has shipped over 85 billion RAIN RFID endpoint ICs to date that get embedded by tag partners like Avery Dennison into item tags and labels. Each tiny endpoint IC includes a unique serial number to identify the item, along with extra memory and security features. The endpoint ICs wirelessly connect items to Impinj’s platform, which includes fixed readers and gateways that scan and collect data from the ICs using RFID technology.

Impinj’s platform turns this real-time item connectivity into actionable analytics, alerts, and automation for customers across functions like loss prevention, inventory visibility, shipment verification, conveyor automation and more. The company segments its business into two primary units:

1. Endpoint ICs – This is Impinj’s main chip business focused on endpoint IC sales to tag and inlay partners who produce finished RFID item tags. The billions in endpoint ICs shipped show the significant consumable nature and recurring revenue stream of endpoint ICs as items get restocked and replenished over time.

2. Systems – This includes Impinj’s reader ICs, fixed readers hardware, gateways, and software sold largely through distributors for large-scale deployments. While lumpy quarter-to-quarter, these big deployments represent sticky enterprise-grade solutions once implemented.

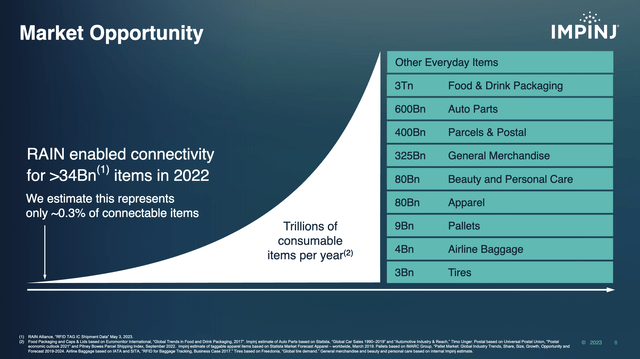

Key end-market exposure today includes retail apparel & footwear and supply chain/logistics, but Impinj is expanding into other verticals including general merchandise, automotive, aviation, healthcare, food and more. Global digitization and automation trends underpin strong tailwinds for item connectivity, while RAIN RFID technology still only penetrates 0.3% of items globally. Impinj sees a >25% CAGR trajectory for RAIN RFID driven by trends like omnichannel retail, loss prevention, supply chain visibility and efficiency.

Market Opportunity (Investor Presentation)

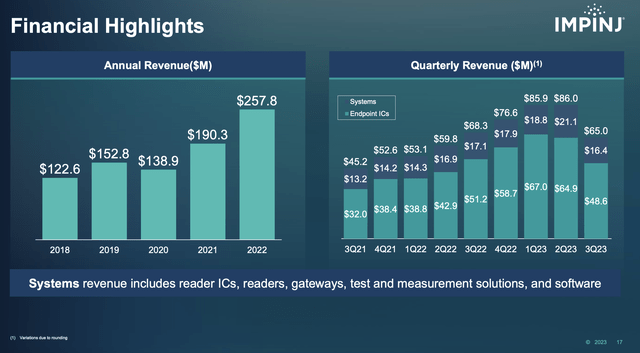

Financial Profile

Impinj maintains a debt-free balance sheet but has been burning cash and swinging to losses in recent quarters. Over the last 12 months, the company generated negative free cash flow of ~$63 million. It also posted net losses of ~$28 million over this stretch from its still-heavy operating expense load. Inventory has likewise ballooned year-over-year from $31.9 million to $106.8 million last quarter, attributed to excess channel stock and safety buffers built given past tightness. Between the inventory build and losses, Impinj’s cash position has dropped to $113 million from over $180 million last year. While still in no danger, the liquidity profile shows a business investing significantly despite volatile demand signals in the near-term.

Q3 results marked a dramatic shift in Impinj’s recent trajectory, which had shown tremendous growth since 2020 coming off COVID impacts. Last quarter saw endpoint IC revenue drop 25% sequentially and systems revenue fall 22% driven by inventory reductions across retail channels and weaker retail spend overall. With total revenues declining 24% and no visibility yet on a demand recovery, Impinj swung to a $15.8 million net loss in Q3 and burned through $28 million in free cash flow.

While Q4 forecasts do call for slight improvement from “inlay partner demand”, expectations remain muted as the company works through the excess inventory situation. Until end-market visibility improves, volatility in financial results and cash burn warrant a neutral view.

Financial Highlights (Investor Presentation)

Valuation

Shares have fallen over 35% from highs to account for weaker fundamentals. Even so, PI still trades at over 8x EV/sales and nearly 140x forward non-GAAP EPS, with no trailing profits. Upside feels limited given stretched multiples and volatility, warranting a neutral stance.

Catalysts

Catalysts that could make me revisit the long case include:

– Strong endpoint IC volume growth exiting this year – Evidence of retail stabilization and restock demand improving – Success ramping large deployments with logistics and general merchandise customers-Material progress resolving excess inventories over the next 6-12 months-Improving margin and cash flow profile from future operating leverage

Risks

Risks that may pressure the stock include:

– Prolonged weak retail and macro conditions affecting end customer demand – Further inventory corrections leading to additional revenue volatility-Lack of progress on key account ramps like UPS logistics deployment-Margin compression from price concessions (if demand slowdown persists)- Litigation outcomes or legal costs negatively impacting earnings

Conclusion

Impinj operates an innovative industry-leading RAIN RFID connectivity platform and maintains exciting secular drivers from supply chain digitization. However, results remain pressured in the near-term from weak retail demand and excess inventories. While valuation has come in, it still seems full against volatile fundamentals. I believe patience is prudent until visibility on end markets and inventories improves, warranting a neutral stance.

Read the full article here