Thesis

Independent Bank Corp. (NASDAQ:INDB), delivered a decent performance in Q2 2023, registering a GAAP net income of $62.6 million and diluted EPS of $1.42. Key drivers of this performance included increased loan balances, consistent deposit levels, competitive funding costs, and enhanced fee income. However, concerns emerge amidst this performance and this article, therefore, aims to provide a comprehensive analysis of risk factors, and future outlook, to offer a holistic view for existing and potential investors.

Company Overview

Independent Bank Corp., an established bank holding firm founded in 1907, is the parent entity of Rockland Trust Company, an institution that offers an array of commercial banking products and services tailored to individuals and small-to-medium businesses.

Their portfolio of deposit products encompasses the traditional aspects of interest checking, money market, and savings accounts, alongside demand deposits and time certificates of deposit along with commercial and industrial loans, commercial real estate and construction, small business lending, and consumer real estate representing various aspects of their loan portfolio.

Independent Bank Corp’s Q2 2023 Earnings Highlights

With the second quarter of 2023 proving to be a highpoint for Independent Bank Corp., they reported a GAAP net income that soared to $62.6 million, complemented by a diluted EPS of $1.42. All this becomes even more compelling when you consider the drivers behind these gains: a subtle uptick in loan balances, stable-as-a-rock deposit levels, superior funding costs, and a surge in fee income.

This performance translated into commendable returns across the board: a 1.29% return on assets, 8.78% return on average common equity, and a remarkable 13.54% return on tangible common equity. While some losses did occur, they were counterbalanced by a tangible book value that rose by 1.4%.

On the liquidity front, the bank’s proactive borrowings were trimmed from $300 million to a mere $100 million, a strategic maneuver that was in response to the stable deposit environment. Add to that, the bank flexed its muscle by boosting its borrowing capacity, pledging additional securities in Q2. By the quarter’s close, the securities portfolio stood at a sturdy $3 billion, supporting a tangible capital ratio of a solid 9.4%.

Moreover, the bank’s loan activity was on an upward swing, with total loans increasing 1.4% to a hefty $14.1 billion. This growth was largely fueled by the bank’s residential real estate and commercial portfolios. At the close of the quarter, the bank boasted a thriving commercial pipeline valued at $239 million, a testament to its relationship-based lending strategy.

But all isn’t roses and sunshine. One office commercial real estate (CRE) loan slid into nonperforming status, leading to an uptick in the provision for loan loss. Yet, it’s important to note, all other asset quality metrics stayed steady. And in a reassuring show of stability, the bank’s top 20 largest office balances were free of any nonperforming or delinquent loans.

Impressively, fee income saw a notable increase in Q2, sourced by a rise in wealth management fees, loan level derivative swap income, and various other income sources. They also knocked out a new high with assets under management reaching an unprecedented $6.3 billion, an increase of 2.6% over the previous quarter. Additionally, cost discipline was highlighted with a 3.1% reduction in total expenses – totaling $3.1 million less compared with last quarter.

Peering into the future, Independent Bank is forecasting flat loan balances for H2 2023 and projects net interest margin to stabilize between $335 million and $340 million by Q4. According to management, borrowing levels are likely to reflect changes in loan and deposit levels. Meanwhile, provision for loan loss is poised to be shaped largely by the performance of their commercial real estate portfolio in the near term. Lastly, the bank expects a slight uptick in fee income and minimal to no change in non-interest expenses compared to Q2.

Expectations

Independent Bank is currently covered by 3 Wall Street analysts with a “Hold” rating and a modest +4.83% upside price target for the company’s shares.

Seeking Alpha

Performance

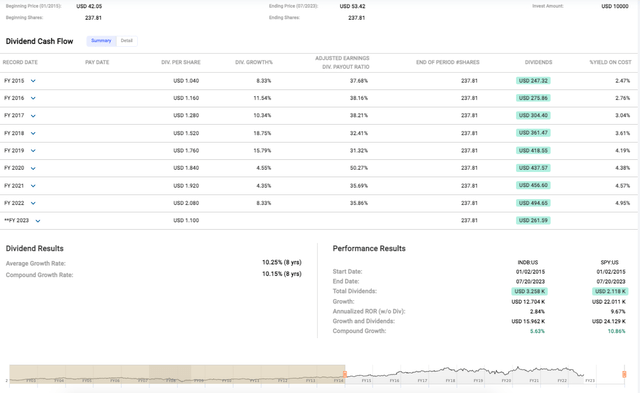

Independent Bank Corp’s shares have shown a slight positive upward trajectory over the medium-term (from 2015 till July 20, 2023), moving from USD 42.05 to USD 53.42. In fact, the annualized return on rate (ROR) sans dividends stands at 2.84%. Although this might not be as impressive as the S&P 500 Index’s figure of 9.67%, it’s important not to hastily dismiss the bank’s performance.

FAST Graphs

With that in mind, the bank’s dividend growth and payout From 2015 to 2023 has demonstrated a much healthier average dividend growth rate of 10.25%, and a compound growth rate slightly shy of that at 10.15%.

Valuation

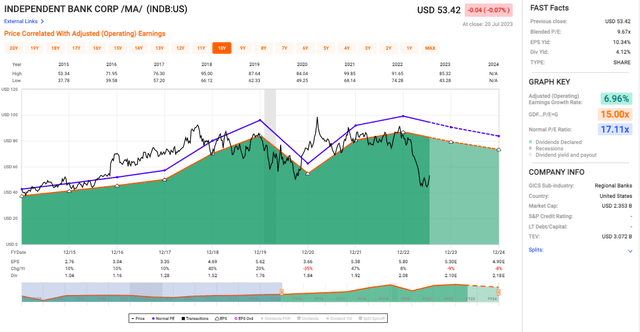

Independent Bank’s blended P/E ratio of 9.67x is significantly lower than its normal P/E ratio of 17.11x (see chart below), suggesting that the bank’s shares are potentially undervalued, given its historical earnings. A lower P/E ratio might usually suggest that the market isn’t optimistic about the company’s earnings growth, but in this case, considering the bank’s steady adjusted operating earnings growth rate of 6.96%, this doesn’t seem to be the case.

FAST Graphs

The EPS Yield is at a high 10.34%. This implies the bank’s earnings per share in relation to its price are relatively strong, and it’s generating a fairly good return on the money invested in it. Lastly, the 4.12% dividend yield might be seen as an attractive aspect for potential investors.

Risks & Headwinds

For starters, according to data from Seeking Alpha, over the last 90 days, there have been no upward revisions for INDB’s forecasted year one (FY1) earnings. This stagnation is disconcerting as it indicates that analysts, on balance, believe that the company’s earnings prospects are not improving. To put this into perspective, the median company in the financial sector has seen at least one upward EPS revision during the same time period.

Seeking Alpha

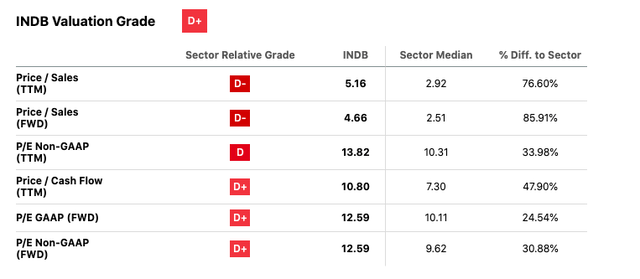

The sector valuation of INDB further cements my concerns. The company’s Price/Sales (FWD) ratio stands at an intimidating 4.66 (see data above), dwarfing the financial sector’s median of 2.51. This discrepancy underscores INDB’s inflated price compared to its peers and might well be an indication of an overvalued stock.

Moving on next with the net interest margin, a contraction of 25 basis points is another red flag that deserves our attention. This deterioration primarily results from heightened wholesale borrowings and escalating deposit costs. Borrowings tend to amplify during turbulent periods or when the bank aims to finance growth or improve its liquidity profile. However, increased wholesale borrowings have a flip side; they can exert pressure on the net interest margins, and in this case, it’s 25 basis points – a registered dent.

What’s more, higher deposit costs are adding to this pressure. As the bank transitions to a more normalized funding profile, deposit costs are expected to increase further, which could further squeeze margins. If this trend continues, the bank’s profitability could be impacted, unless it can find a way to offset these rising costs or improve interest income.

Shifting our focus to the bank’s portfolio, significant unrealized losses reported on the Available-for-Sale (AFS) and held-to-maturity portfolios are concerning. These losses might imply potential issues with the quality or performance of the securities held. A portfolio’s unrealized loss can act as a warning sign that some investments are not performing as expected, potentially foreshadowing future write-downs.

The bank has also reported a migration of $14.2 million loan into nonperforming status. Such an event may be an indication of emerging asset quality issues. This could jeopardize the bank’s profitability if it leads to higher provisioning for bad debts.

In terms of the bank’s loan outlook, the forecast for flat loan balances for the second half of the year could signify an impending slowdown in growth. It’s pivotal to remember that loan growth is one of the primary drivers of a bank’s earnings growth. Hence, the absence of growth in loan balances could impact net interest income and thereby profitability.

Lastly, there is also a layer of uncertainty veiling the bank’s commercial real estate portfolio, particularly concerning the non-owner occupied office portfolio. In a volatile real estate market, this could potentially lead to higher provisions for loan loss, putting a strain on the bank’s earnings.

Final Takeaway

Given Independent Bank Corp’s recent performance, returns, healthy dividend growth, and undervalued P/E ratio, there are a number of strong points in favor of the stock. However, the bank is also facing several challenges such as an overvalued Price/Sales ratio, possible asset quality issues, shrinking net interest margin, and a forecast of flat loan balances. Therefore, I would rate this stock as a “Hold” due to its strengths in past performance and potential for future growth, balanced against the uncertainties and risks associated with potential loan loss provisions, margin compression, and overvaluation compared to sector peers.

Read the full article here