Small caps are where the money is to be made in investing. Having said that, you have to pick the right ones. Even if you do that, you still have to pick them at the right price.

Insteel Industries (NYSE:IIIN) is a producer of steel rod products and similar goods intended primarily for non-residential construction. It is a cash-generative business with no debt and years of positive results. Yet, I’m going to argue why this just isn’t at the right price, making it a SELL. I’ll also share some observations about its unique dividend and the recent buybacks.

History

Origins

The company was founded in 1953 in Mount Airy, North Carolina, initially working in ready-mix concrete. They moved into steel wires (these support concrete structures) in 1974. In the years that followed, they divested their concrete segments and focused more squarely on steel wire and concrete-reinforcing products, typically through opportune acquisitions.

Previous Decade (2014 – Present)

The company acquired American Spring Wire Corporation in 2014 for $33.9m, which had facilities in Texas and Georgia. In 2020, they acquired Strand Tech Manufacturing for $19.4m, which had a single facility in South Carolina that it elected to close, consolidating its assets to its existing sites.

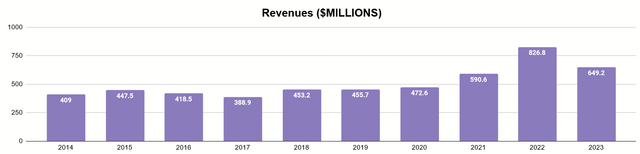

Coming out of the Great Recession, we can see this period marked a steady rise in revenues. 2014’s revenues were $409m, rising to $649m by 2023.

Author’s display of 10K data

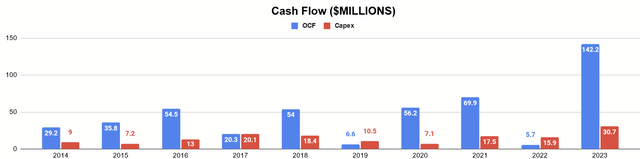

Broken down further, we can see how operating cash flows and capex fluctuated across this period as well.

Author’s display of 10K data

These numbers naturally fluctuate much more. OCF was as high as $142m in 2023 and as low as 6.6m in 2019. Capex is also variable but is generally much less than OCF.

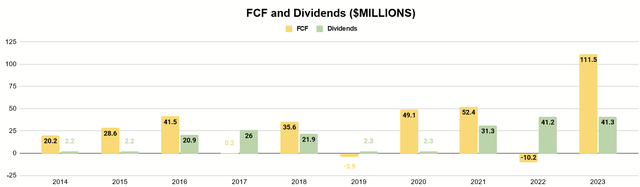

Author’s display of 10K data

Thus, when we get down to brass tacks, free cash flow is usually positive, with its negative years only being minor. A significant amount of excess cash flow is distributed as dividends, sometimes even when FCF is negative, but they typically are working from a reserve of accumulated cash at that point. We also see that dividends are not consistent. Let’s take a look at that.

Seeking Alpha

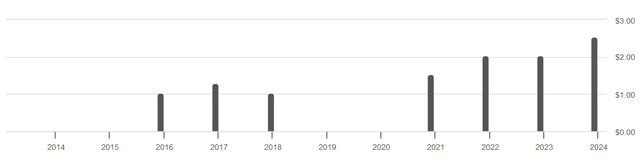

The chart shows that dividends are declared opportunistically, distributing a minimum of $2.2m in cash as regular, quarterly dividends, with the rest being considered being a special dividend distributed annually. For 2023, this amounted to quarterly dividends of $0.03 per share and an annual special dividend of $2.50.

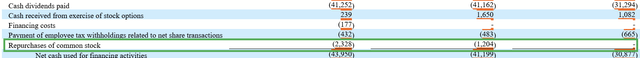

More recently, the company has started repurchasing shares in 2022 and 2023.

2023 10K

These have occurred on the higher end of the company’s historical stock price.

Seeking Alpha

The cash spent for buybacks has only been a small portion of cash flows, and it remains to be seen if this will be a pattern.

Operations

Products

Insteel manufactures and sells steel wire products used for reinforcement of concrete in construction. You’ve probably seen these in films or even news footage of demolished buildings.

These rods give concrete structures more tensile strength, allowing the mostly brittle material to resist cracks and fragmentation over time. They are therefore a primary ingredient in construction and consistently in demand.

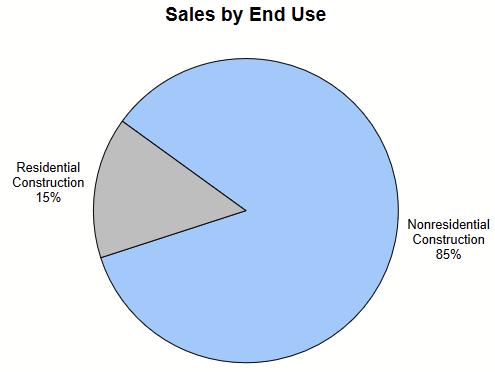

Insteel classifies its products as either welded wire reinforcement (WWR) or prestressed concrete strand (PC Strand). These products have a variety of uses, with WWR typically being for smaller objects and PC Strand for larger things, often pieces of infrastructure.

FY 2023 Company Presentation

Over the last decade (per their 10Ks), non-residential construction has accounted for 85% of sales, meaning that these trends more directly affect the company’s financial results.

Strategy

The company’s stated strategy over the last decade has been:

- Achieving leadership position in its market

- Operating as the lowest cost producer in its industry

- Pursuing growth opportunities in its core business

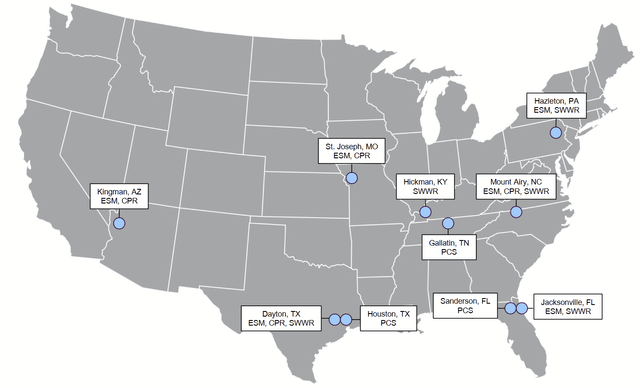

The company has the following facilities where it manufactures its goods.

FY 2023 Company Presentation

In their 2023 Form 10K, they indicate the following:

Headquartered in Mount Airy, North Carolina, we operate ten manufacturing facilities that are all located in the U.S. in close proximity to our customers and raw material suppliers. Our growth strategy is focused on organic opportunities as well as strategic acquisitions in existing or related markets that leverage our infrastructure and core competencies in the manufacture and marketing of concrete reinforcing products.

Given their geographic spread (as well as how they were able to dismantle and completely integrate STM’s South Carolina operations in 2020), they seem to following through on this strategy rather plainly and painlessly. Their other acquisition in the last ten years being back in 2014, these appear to be during lulls in the cycle when there is a chance to pick up a smaller business rather inexpensively.

Besides acquisitions that easily integrate into their network of facilities, the company sees opportunities to adjust its product line as well, shifting more toward engineered structural mesh (ESM), part of its WWR segment, as these are gaining popularity for their cost-saving benefits to customers. Regarding its customers, the company reported in 2023:

We did not have any single customers that represented 10% or more of our net sales in fiscal years 2023, 2022 or 2021. The loss of a single customer or a few customers would not have a material adverse impact on our business.

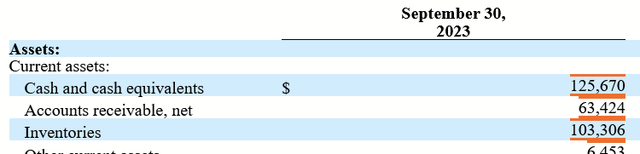

Balance Sheet

The company’s debt is almost always zero, and it finances its acquisitions with its own cash. Knowing that it is cyclical, it prefers not to encumber itself with debt that may be a struggle to repay at the wrong time.

2023 Form 10K

The company is currently holding about $125m in cash, positioning it well to cover capex for the foreseeable future in the event that operating cash flows dip into the negatives or to make the incremental acquisitions that may arise.

Valuation

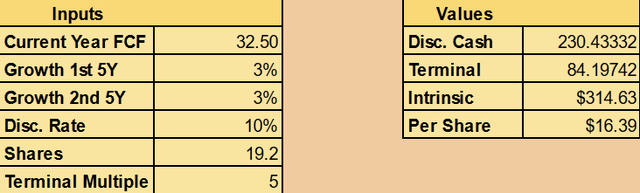

This business is a cyclical but one with a long history. Based on that data, I can determine what its average annual free cash flow (operating cash flows less capex) is. For the years 2014 – 2023, that comes out to $32.5m. With that, I can calculate its intrinsic value using a Discounted Cash Flow analysis. I’ll work with these assumptions, which I’ll elaborate in the next section.

- 3% average annual growth the next decade

- Terminal multiple of 5 since this is a slow grower

Author’s calculation based on 10K data

For a 10% discount rate, that gets us an intrinsic value per share of $16.39. With its current cash balance, it also has net cash value of $6.55 per share. How the company will use this cash balance is not altogether certain, and I’ll elaborate more in the next section. Either way, with the current share price over $30, I believe the company to be overvalued.

A Look to the Future

With that valuation, I’ll discuss the possible developments in the future, as well as other factors and risks to consider when using that valuation as a guide for entry and exit prices.

Growth

Its lack of long-term debt suggests that the company does not feel that enough cash-rich growth opportunities exist to be worth the risk of default and jeopardizing shareholders. As such, average growth in the low single digits seems the most optimistic here, given that it can make easy acquisitions with its cash cushion whenever a great opportunity presents itself. Similarly, its growth from ESM sales down the road should be considered as well. In my view, 3% is reasonable and in proportion to the company’s abilities.

Steel Cycle

Prices of things like iron and steel have a major impact on their margins and thus what free cash flow will be in any year. The company has not struggled much making sales, reporting in every 10K since 2014 that their Q4 inventory is almost completely sold within Q1 of the following year. As such, they have shown that they can accumulate and sell inventory in a quick, adaptive manner that does not leave them holding the bag. From there, I believe it’s a matter of noting the cycle and where the share price falls within it.

tradingeconomics.com

As we can see, the price of steel isn’t at all-time highs, but it can be much, much lower. Additionally, we can see that shares of IIIN are trading at some of the highest they have ever traded. Even if this business isn’t at risk of going bankrupt with its debt-free balance sheet, a higher price does mean long-term returns are going to be lower.

Dividends

With dividends following this cycle, folks buying it because they are seeing yields of over 7% pop up need to be aware (from the charts I posted above) that these are special dividends paid when the company has no further intentions for that cash. Folks who bought IIIN during the COVID crash for just over $8 have since received $8 in dividends, while also seeing the share price rise 4x. It’s a great return there but mainly because they bought in during the plunge.

Buybacks

A newer development that may prove to be an area of concern is the buybacks that started over the last couple of years. While these have not accounted for more than $3m a year, they are occurring at the higher end of the stock price, indicating lower returns on capital. If the company continues to find itself cash-rich, it’s much better off to wait for the stock price to plunge again while collecting interest on the elevated rates in the meantime.

My concern is therefore that heightened levels of buybacks at these prices will destroy shareholder value over time and should be monitored carefully, especially with the large cash position the company has that may be tempting to spend on shares.

Conclusion

Insteel Industries is a well-run business whose balance sheet and cash flows have proved durable and sturdy throughout the steel and construction cycles. With a diverse base of customers across the United States, no debt, and a pile of cash to give it options in the years to come, I believe it’s an investment that doesn’t bear the risk of going to zero for the long-term investor.

That said, as a cyclical and a stock with a tempting special dividend, it may have the illusion of being a good income investment. I think its dividend should be a secondary concern, and investors will be better served using the cyclical nature of this stock to buy it at a significant discount to its intrinsic value and then selling when it shoots above that. Those who bought a few years ago have been given an excellent opportunity to do so at about $34 as I write this, which is why I think IIIN is a SELL.

Read the full article here