Investment Thesis

Integra Resources (NYSE:ITRG) is a precious metals development company in the Great Basin, United States. The company has recently merged with Millennial Precious Metals Corp and has some interesting potential catalysts in 2023.

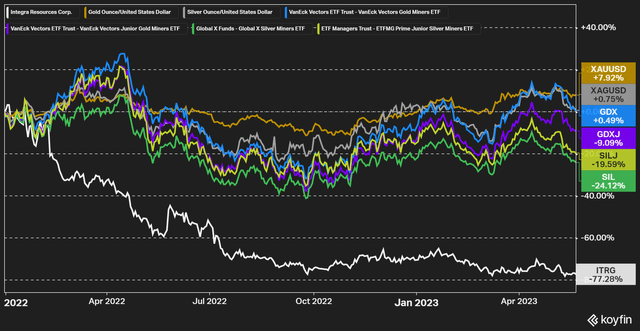

Integra’s stock price has during 2022 and YTD 2023 underperformed drastically, which is due to a few factors.

- The early 2022 pre-feasibility study was released at peak inflation (in construction costs), which certainly didn’t help the stock price.

- Integra did in 2022 try to wait out a better sentiment for its refinancing, which was a bad strategy in retrospect. The market excessively punished the stock price for a good 6 months in anticipation of the capital raise last year.

- The company also used its ATM-program for some cash, although minimally, but that is rarely a good idea in a low-liquidity stock, with a very depressed sentiment.

- Also, development companies have underperformed in general lately, so Integra is far from the only junior developer with a poor stock price performance.

Figure 1 – Source: Koyfin

The underperformance has however led to a very attractive valuation, purely based on DeLamar, and the company has more growth projects following the Millennial merger. So, Integra Resources is an interesting high-risk investment, where the stock has a lot of upside potential if we see sentiment improve for more junior precious metals companies. That said, the company will likely need to refinance in early 2024 again. So, expect further share dilution at unattractive levels unless we see a turnaround in the stock price over the next 6-9 months.

I have covered the company a couple of times before and those articles can be found here.

Recent Activity & Upcoming Catalysts

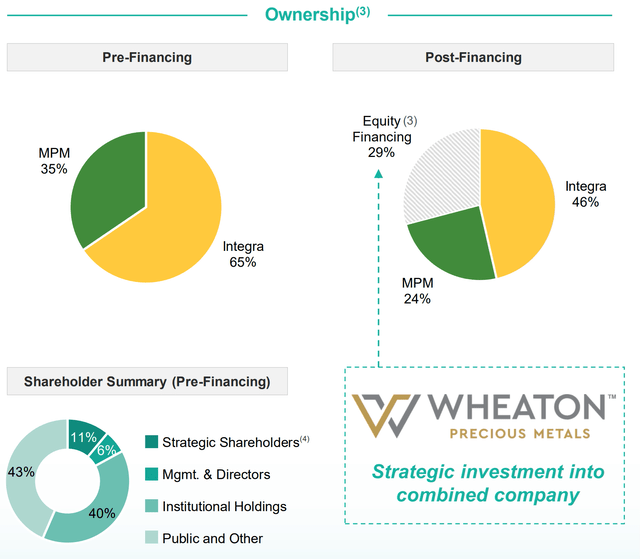

The biggest development in 2023 for Integra Resources has so far been the announced and completed merger with Millennial Precious Metals Corp. The company did also do a larger equity financing in conjunction with the merger, where Wheaton Precious Metals Corp. (WPM) took a C$10.5M position in the combined company. While this is a relatively small amount to Wheaton, it is still a good stamp of approval for Integra Resources.

Effective on the 26th of May 2023, the company is also looking to do a share consolidation where 5 shares become 2.

Figure 2 – Source: Integra Presentation

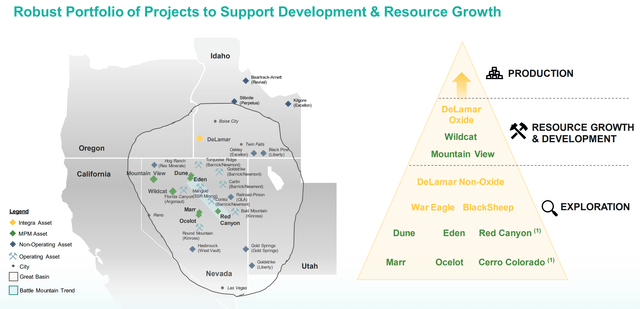

While I do think most of the value for the company is in the form of the DeLamar project, this merger has brought several growth projects to Integra Resources.

Figure 3 – Source: Integra Presentation

Where the Wildcat & Mountain View projects are furthest along, among the assets that came with Millennial Precious Metals. A combined PEA for those two assets is due to be released in Q2-23, which has the potential to be a positive catalyst.

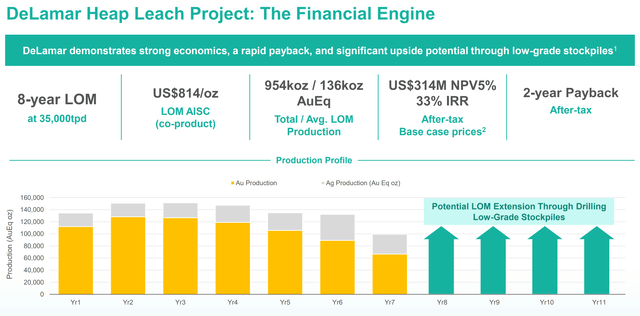

The most significant near-term catalyst for the company is likely the resource update on DeLamar following the stockpile drilling Integra has been doing for the last 9 months. The results have been above expectations according to the company, and I have to agree that they have been very encouraging. We have consistently been seeing around 50 meter intervals with a gold equivalent grade of 0.5 g/t.

A resource update is due to be released in Q2-23 on DeLamar, where we will get more precise estimates for the size and grade of the stockpile material, but the expectation would be for a potential 3-4 years added to the mine plan. The mine plan of operation for DeLamar is presently scheduled to be filed in Q4-23.

Figure 4 – Source: Integra Presentation

Valuation & Conclusion

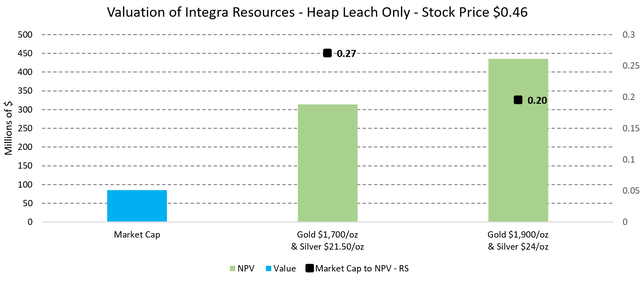

The below chart uses the latest share price together with the fully diluted number of shares post completion of the merger, where the market cap is compared to the NPV of the heap leach material at DeLamar only.

Figure 5 – Source: Integra’s NPV Estimates

While DeLamar is quite a few years from production, a market cap to NPV of 0.2 at current metal price is still very cheap for a low-cost development company in the United States. Keep in mind that this is an extremely conservative valuation due to the following reasons.

- It assumes no value for the sulphide material at DeLamar, which could add roughly 40% to the NPV, if included.

- The valuation also assumes none of Integra’s other projects have any value, which Wildcat & Mountain View will hopefully contradict in the near-term.

- It completely disregards any growth to the NPV from the stockpile drilling, where the drilling is now completed, and we are just waiting for the resource update.

I started to buy Integra Resources about a year ago and I have continued to gradually increase my position. There is no doubt I was very early here, but I continue to think the long-term risk-reward is excellent for Integra Resources.

A very large amount of patience will be required, where I view this as a 2-3 year investment. Further share dilution is a given over that period, which all investors should be aware of, and accept. I certainly hope that future bought deals will be at better levels than the last two, but Integra will continue to be at the mercy of the market as a development company.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and is up 2% in March of 2023.

Sign up!

Read the full article here