Investment Thesis

IonQ (NYSE:IONQ) is a leading company in the field of quantum computing, harnessing the power of quantum physics to revolutionize computation.

IonQ sells access to several quantum computers via three main cloud providers.

Yesterday, IONQ announced that it was going to double its bookings from 2022 to 2023. Here I break down what this means, both the good and the bad aspects of the announcement.

On balance, I’m bullish on this stock, but I am mindful of its very hyped up valuation already.

Revenue Growth Rates Will Get Boosted

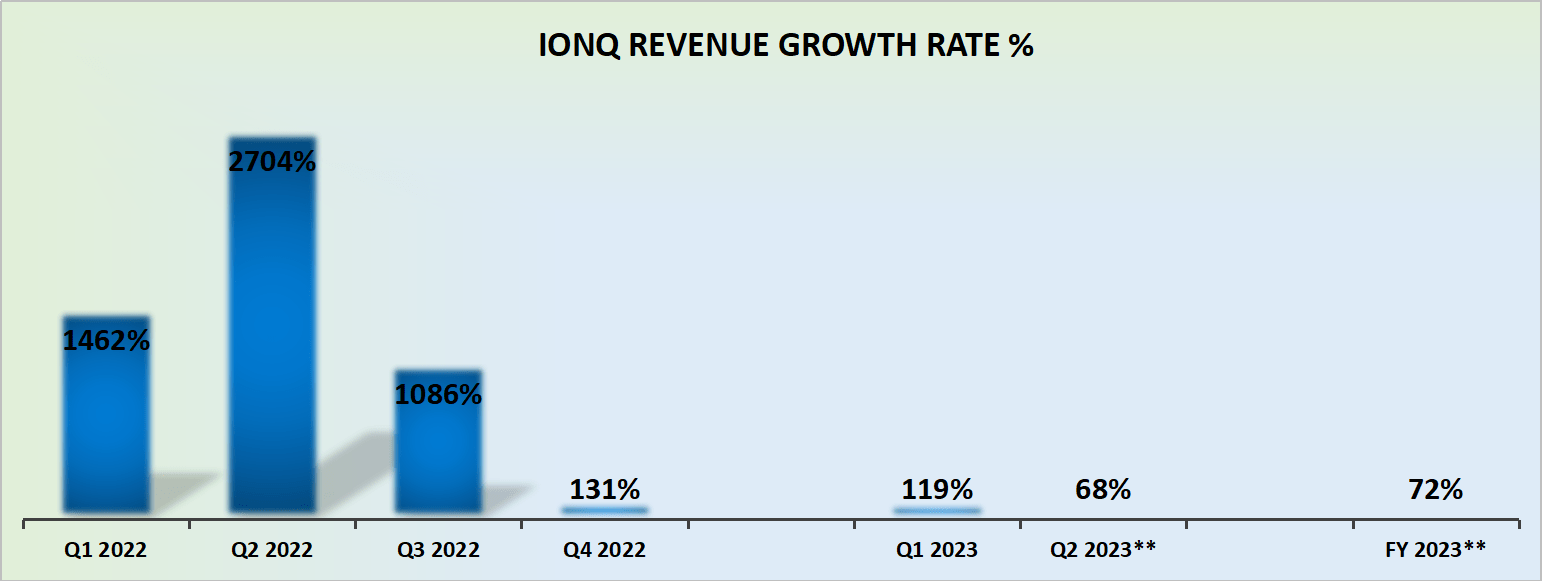

IONQ revenue growth rates

In my previous analysis last month, I highlighted the following graph. What you see above is that at the midpoint of last year, IonQ was growing its revenues at 10x growth rates, but looking ahead to Q2 of this year, its growth rates point to a comparatively paltry 68% y/y growth.

This has significant implications for investors. It meant that if we presumed H1 2023 was growing at about 94% y/y and the whole of 2023 was expected to grow at 72% CAGR, this would mean that the second half of 2023 would see a significant amount of further deceleration.

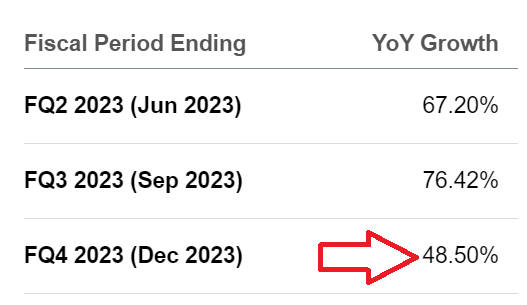

SA Premium

To put this more concretely, analysts expect that Q4 2023 would be growing at less than 50%.

In other words, the expectation here was that Q1 grew by triple digits, while Q4 was expecting its growth rates to be approximately half of the pace recorded in Q1 2023.

And by extension, this was going to mean that in all likelihood in 2024, IonQ wasn’t going to grow its revenues at higher than 50% CAGR.

However, yesterday IonQ noted that its booking for 2023 is going to double relative to 2022. So allow me to put this in context.

Bookings are a leading indicator of a company’s revenue growth rates. For a fast-growing company, the single best metric one could hope to see is rapid growth in bookings. But importantly, investors want to see bookings that are growing faster than revenue growth rates. That’s really key. Why?

Because it means that there’s more revenue to be recorded over time. What you absolutely don’t want, is for revenue growth rates to be meaningfully higher than bookings.

This means that the company is running through its order book, and hasn’t got a fresh pipeline of work to charge. And it follows, that there’s a lull in revenues coming. Again, that’s not commensurate with a growth story.

Next, let’s add some tangible figures:

- IonQ’s bookings in 2022 were $25 million

- IonQ’s revenues in 2022 were $11 million

Prior to yesterday’s update, these were the figures investors expected:

- IonQ’s bookings for 2023 to be $42 million at the high end

- IonQ’s revenues to be $19 million at the high end in 2023

Again, in both years you see a healthy booking figure significantly above its revenue figures.

Then, yesterday IonQ stated this:

- IonQ’s bookings for 2023 are to reach $50 million at the midpoint

IonQ hasn’t upwards revised its 2023 revenue guidance. But I believe that when it reports its Q2 results in August, IonQ will upwards revise its guidance further. Essentially, IonQ wants to leave some good news for when it reports its Q2 results.

Further Details on New Contract

IonQ’s deal is a partnership with European QuantumBasel to jointly establish a European quantum data center.

The problem here is that IonQ is to bring to the partnership its #AQ 35 and #AQ 64 hardware. And as I discussed in my prior analysis, IonQ only just reached its technical target of 29 algorithmic qubits (#AQ).

Meaning that #AQ 35 is still not been reached. So, it’s difficult to book revenues for something that doesn’t exist yet.

To echo that statement, consider what IonQ states in the press release yesterday:

the Company is not increasing its expectations for 2023 recognized revenue

That being said, bookings are a leading indicator of revenue growth rates that will arrive in time. What investors at this juncture want to see is the growth in bookings and the growth in the size of the opportunity.

The Bottom Line

It’s difficult to make the case that investors’ expectations are not already sky-high. Case in point, looking out to 2024, assuming IonQ’s revenues next year grow by 100% y/y, this would mean that the stock is priced at about 50x forward revenues. That’s an incredibly richly valued stock. Making the stock prone to significant volatility if investors sour up on paying up for high-growth names.

IonQ offers access to its quantum computers through major cloud providers. Yesterday, IONQ announced its intention to double bookings from 2022 to 2023, and here I discuss both the positive and negative aspects of this news.

In conclusion, I’m bullish on this stock.

Read the full article here