These ideas were presented in a more extensive Newsletter sent out on Monday to subscribers of The Pragmatic Investor.

Thesis Summary

CPI data is coming out on Wednesday, and this will likely be a guiding force in the market.

Consensus, and my own expectation, is that we will see a continued disinflationary move. However, I will also lay out the inflationary thesis.

While I don’t believe inflation will come back soon, it could remain persistent, and “higher for longer” will take its toll on markets and the economy.

What the Market Expects on Wednesday

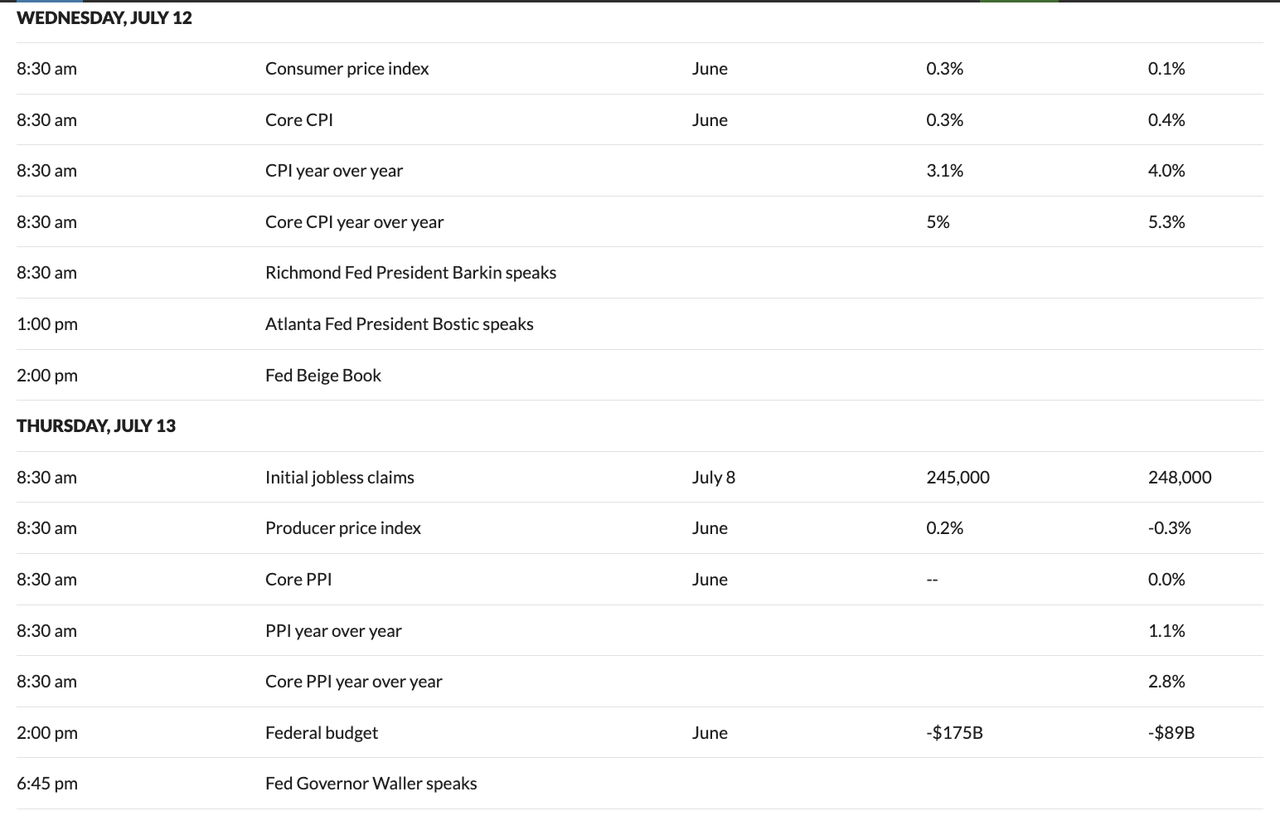

CPI data is coming out on Wednesday, followed by PPI on Thursday:

Economic calendar (Marketwatch)

This week will also feature various talks from Fed officials. Expectations are that the core CPI YoY will come down to 5% from 5.3% in the previous month:

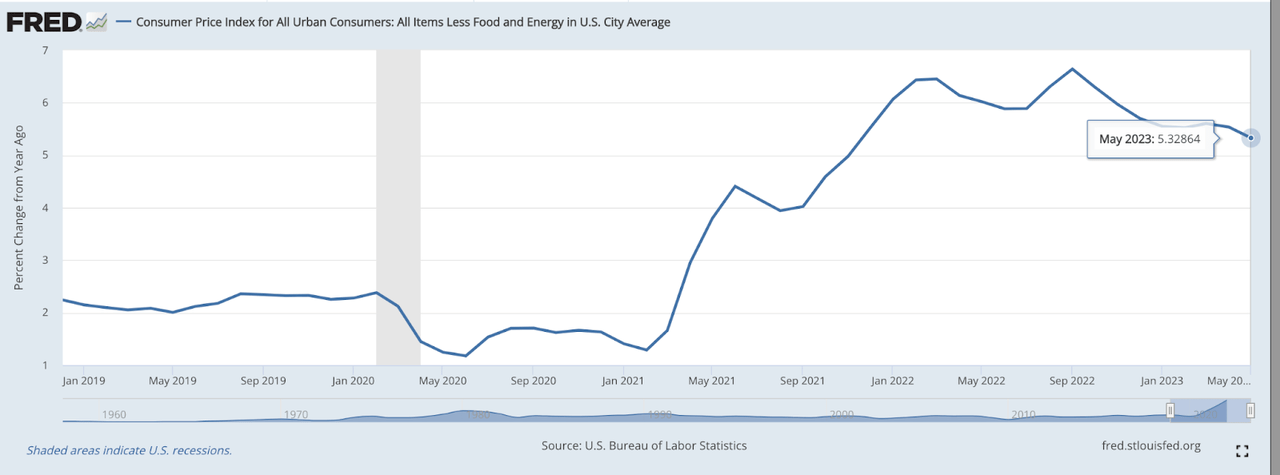

Core CPI (FRED)

As we can see from the graph above, we have been in a clear disinflationary trend since September, which has accompanied a rally in stocks. (At least some stocks)

Odds are at this point that the disinflationary narrative will continue and perhaps even accelerate in light of China’s own inflation and PPI data.

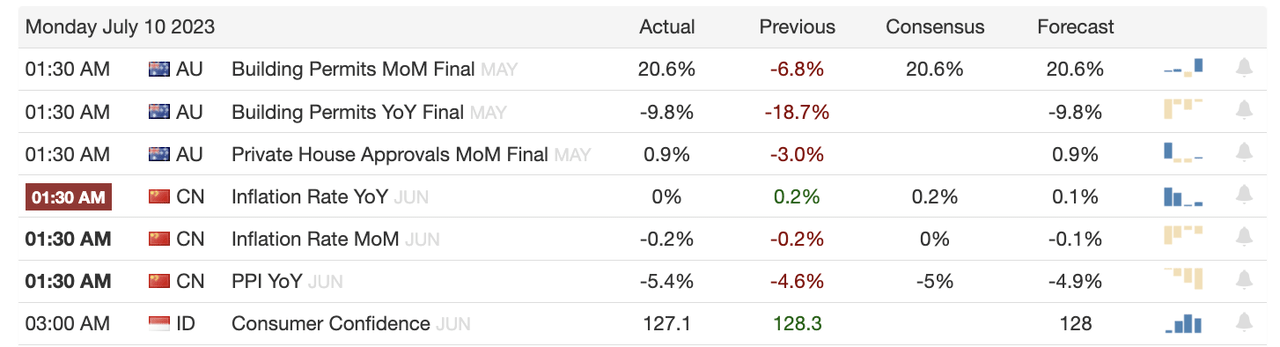

Chinese CPI and PPI (TradingEconomics)

China’s YoY inflation came in at 0%, which was below consensus. YoY PPI was even more of a surprise, down 5.4% versus 5%.

Why does this matter to US investors? Chinese PPI and US inflation have held a steady correlation over the years. In fact, it is arguably a leading indicator.

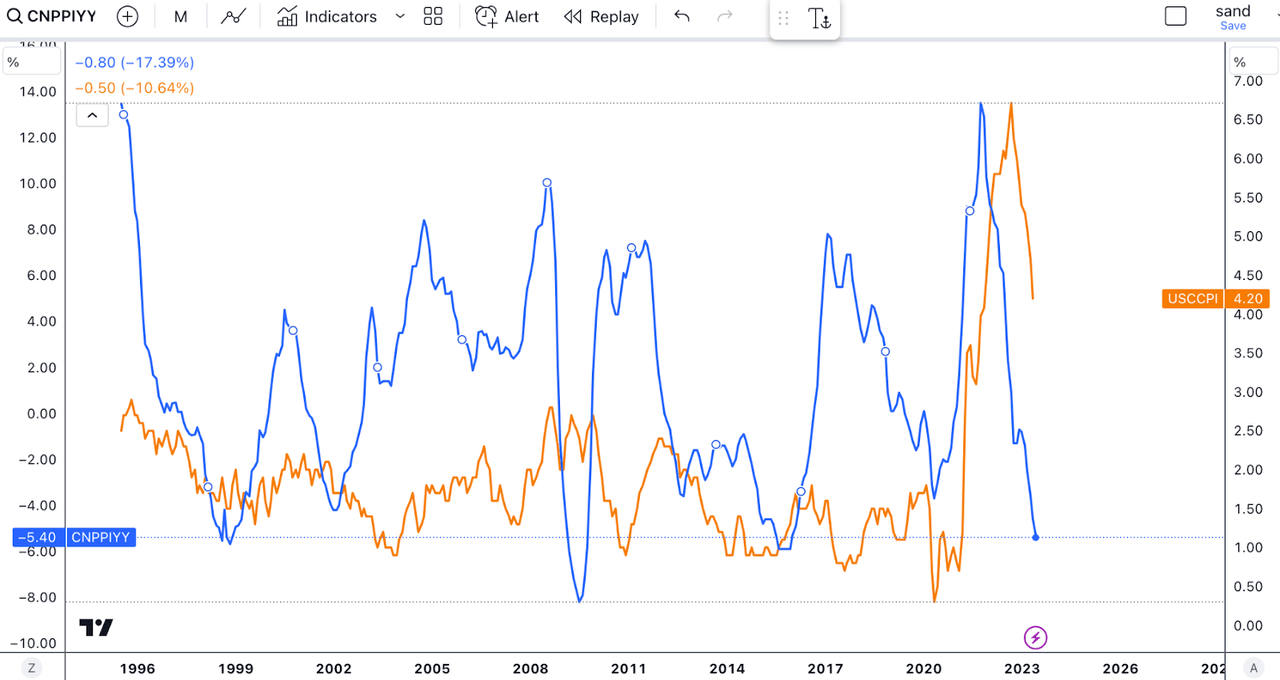

China PPI vs US CPI (TradingView)

Chinese PPI YoY is shown in blue, and US CPI YoY is shown in orange. We can appreciate that US inflation follows the Chinese PPI with a few-month lag. The latter peaked in October of 2021, and US CPI seems to have peaked almost exactly one year later.

Indeed, China might be exporting deflation.

Transitory or Permanent disinflation?

Much like with the inflation debate, we now have camps of economists on both sides. The contrarians at this point believe disinflation is “transitory”, and that inflation will soon come roaring back. It’s hard to see this happening now, but then again, most missed just how fast inflation would come up, and also just how fast it would come back down.

We can’t dismiss this thesis out of hand, and, in my opinion, this boils down to wages.

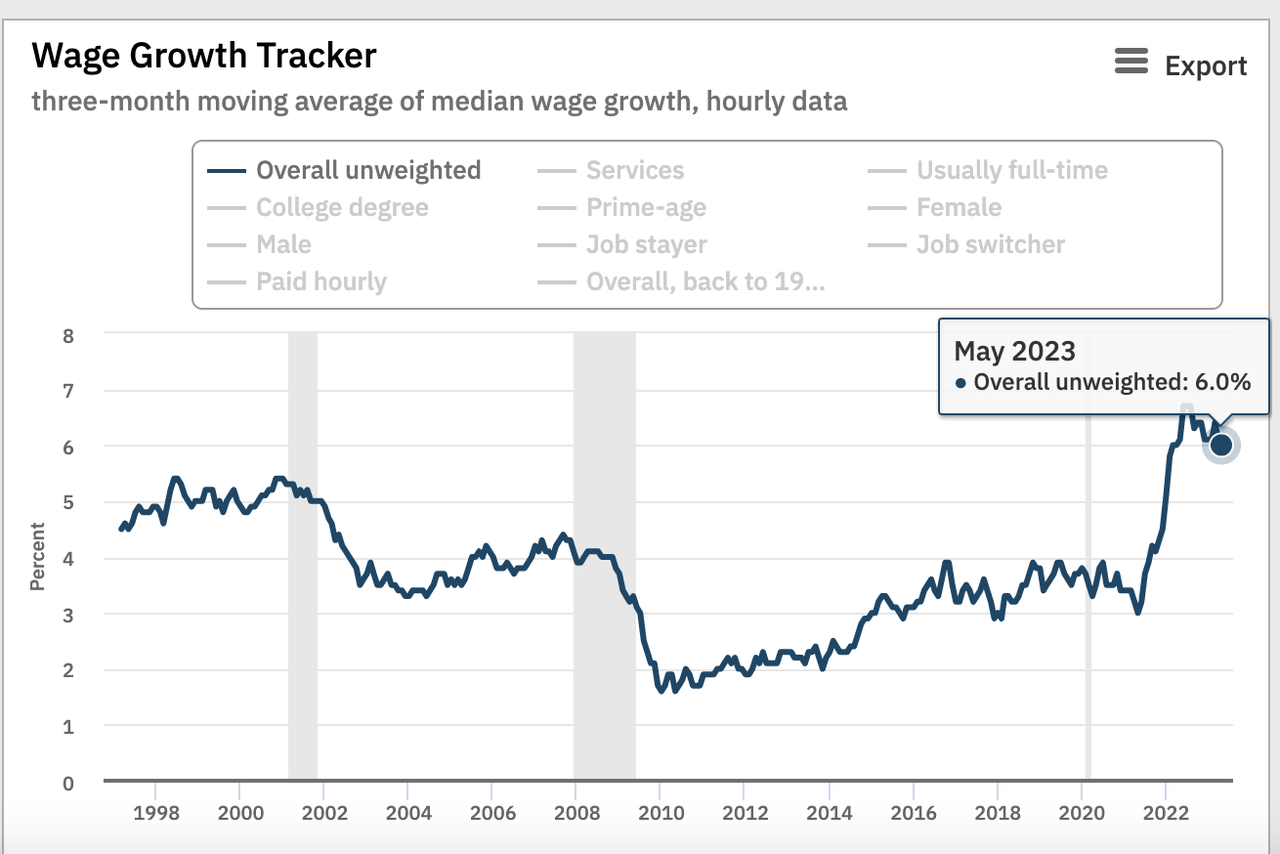

Wage Growth (Atlanta Fed)

Wage growth has tracked inflation in the US quite closely. Now, according to the Atlanta Fed, wages are also trending down with inflation, but what if wages remain resilient? There’s definitely an argument to be made here.

First off, we actually have a precedent coming from the UK.

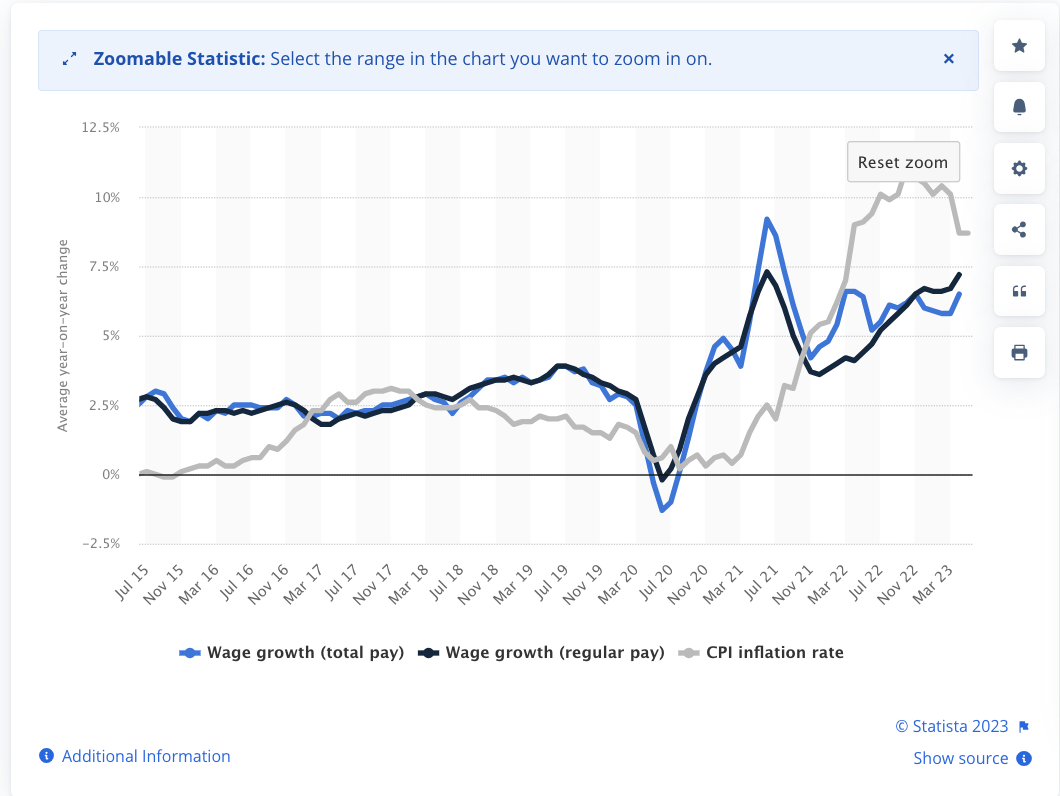

UK wage growth (Statista)

Those that follow international markets will know that the UK has been struggling with stubborn inflation, and this can be attributed, in my opinion, to the stubborn wage growth, which has refused to come down, even as CPI does begin to cool off.

Like the US, the UK has a very tight labour market, and this could prevent wages from coming down. A structurally tight labour market seems to make sense when we think about the amount of “boomers” leaving the workforce. The proportion of retirees to workers is going to keep growing.

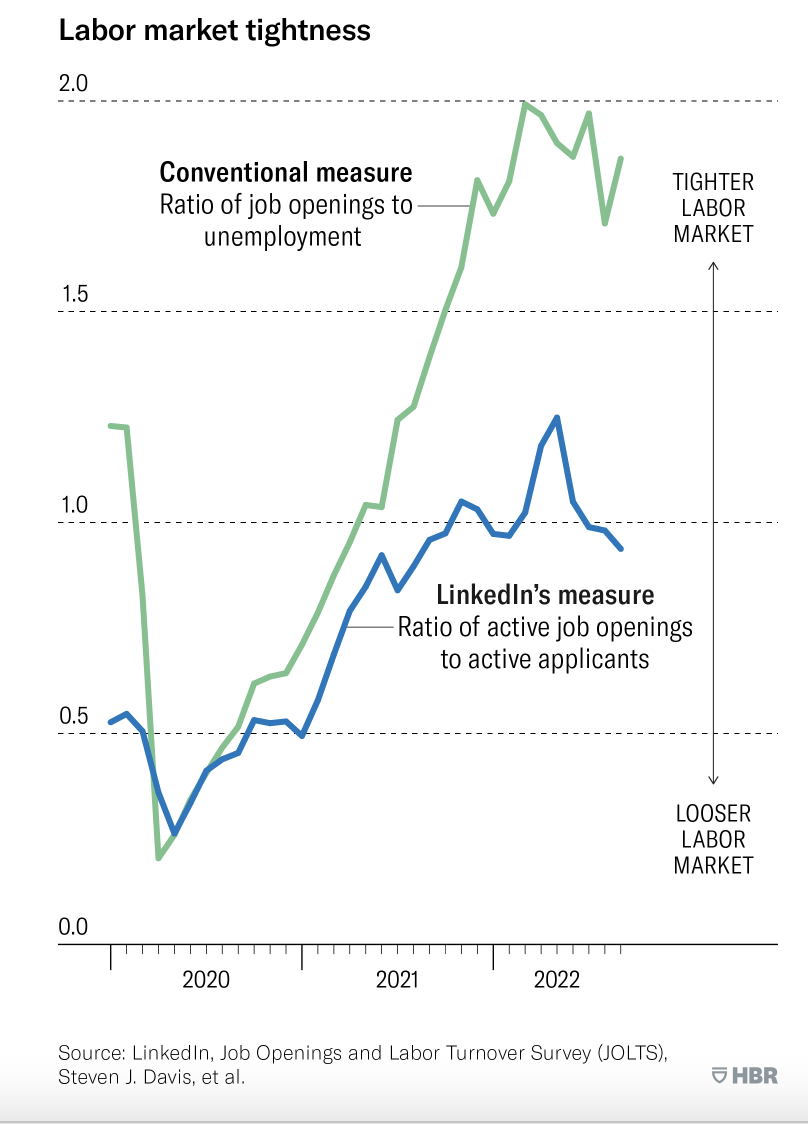

Labour market tightness (HBR)

Interestingly, LinkedIn’s own measure of labour market strength, based on job openings and active applicants, has been trending down.

To the strength of the labour market, I think we could also add a weakening dollar and higher commodity prices to the list of things that could, at the very least, give us a little surprise in the disinflation narrative.

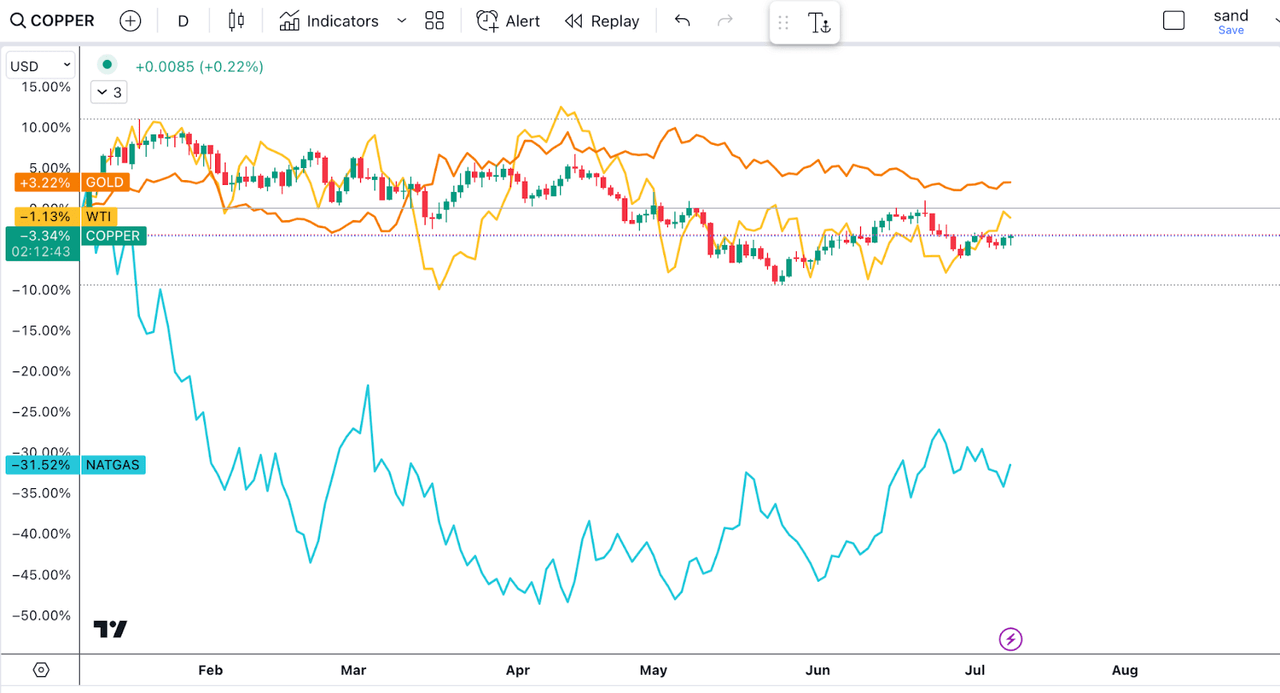

Commodities (Tradingview)

Since the beginning of the year, energy and materials prices have been sliding down. Only Gold (GLD) is up for the year.

The sentiment is so bearish on commodities right now that we could, in fact, see some form of a short squeeze take place:

A recent Standard Chartered Report pointed out that positioning is now at 2020 pandemic levels.

In the report, the analysts highlighted that their crude oil money-manager positioning index, which they said is based on positioning across the four main Brent and WTI contracts as a percentage of open interest relative to five-year extremes, fell 8.5 points week on week to -99.6. This is very similar to positioning at the start of the pandemic in 2020 and following the collapse of SVB, the analysts pointed out in the report.

Source: Rigzone.com

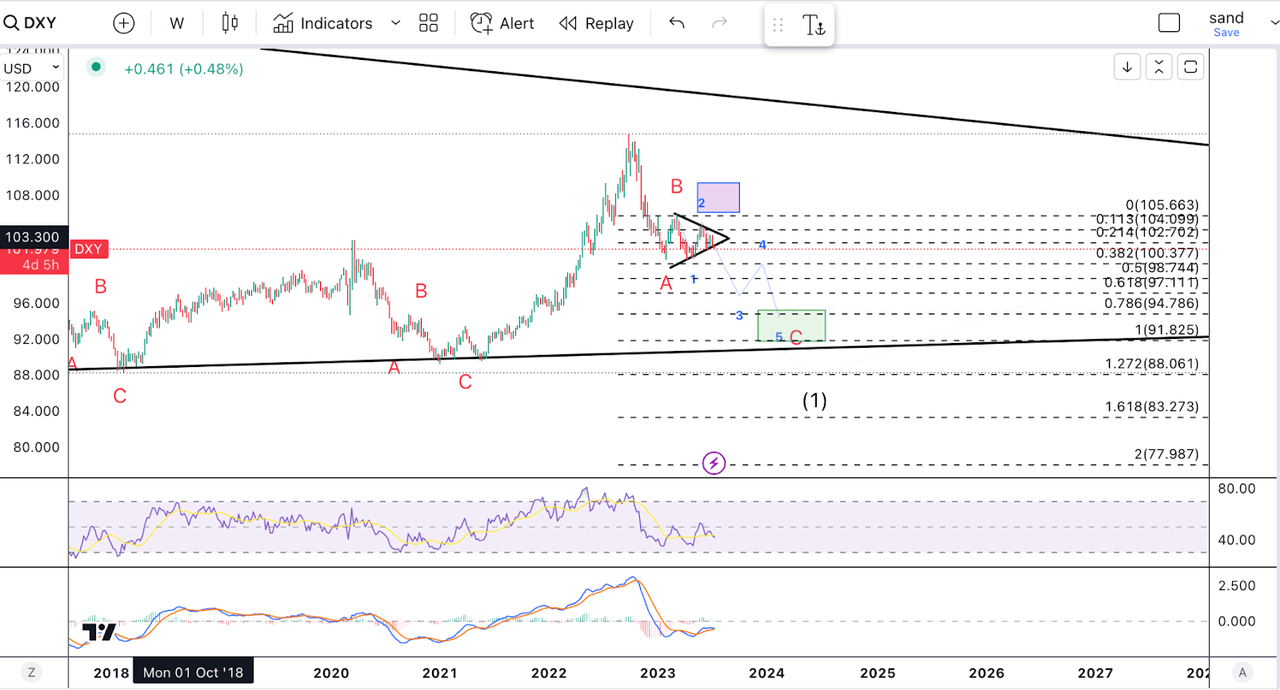

The weakening dollar narrative has been present for some time. Stanley Druckenmiller famously said he was shorting the dollar at the beginning of 2023. While it hasn’t quite dropped yet, though it is down from its peak, this coincides with my own technical outlook on the dollar index (DXY).

DXY (Author’s work)

From a charting perspective, we are completing a triangle, from which we could see a strong breakout to the downside. This would indicate that we are setting up for a C wave down. If this were to be the same length as wave A, then the DXY could land at support, which sits around 91.

Final Thoughts

The stage is set for continued disinflation, but I think within the next few months, we could get an inflationary surprise. However, the trend is now clearly disinflationary, and my biggest fear, long-term, is that Fed overtightening could set us up for a recession and outright deflation in the not-so-distant future. For now, though, the party continues.

Read the full article here