ETF Overview

There is a saying that investors should avoid going into crowded spaces and instead should seek less crowded areas to invest. Mid-cap stocks appear to be an area that is often overlooked, as it only represent about 10% of the total U.S. market. In this article, we will analyze iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH) and see whether it is a good opportunity to invest right now.

Introduction

IJH owns about 400 mid-cap stocks in the United States. The fund seeks to track the S&P Mid-Cap 400 Index. Mid-Cap stocks have experienced significant valuation contraction since 2021. It has also trading at a relatively lower valuation than the S&P 500 index, which tracks large-cap stocks. However, a possible recession may arrive towards the end of 2023 or in early 2024. In such a scenario, we may see even further decline in IJH’s fund price. Therefore, we think investors may want to wait patiently for a better entry point.

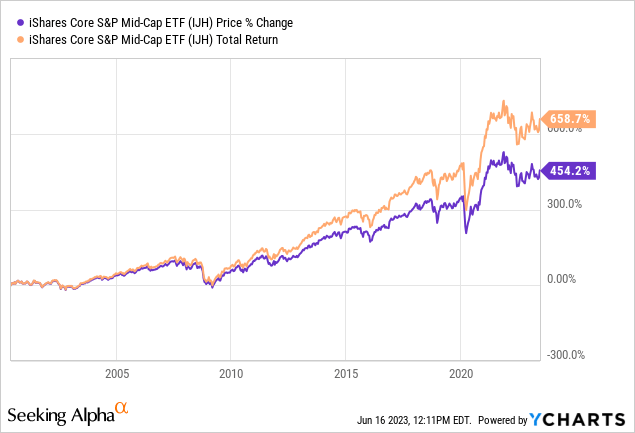

YCharts

Fund Analysis

IJH’s valuation has rebounded in 2023

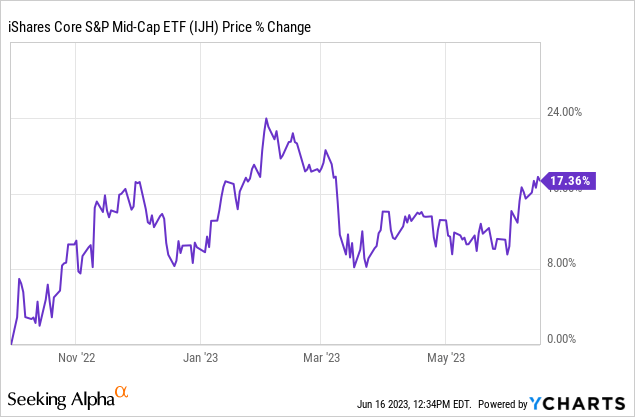

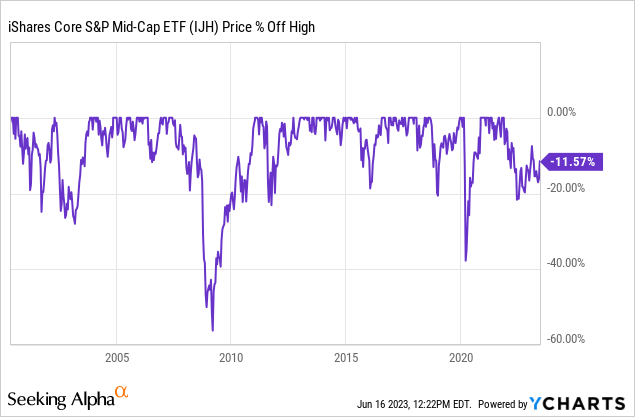

Like the broader market, IJH had an awful year in 2022 due to the Federal Reserve’s aggressive monetary tightening policy to combat persistent inflation. In fact, the fund has delivered a loss of about 23% from the beginning of 2022 to the low reached in October 2022. Fortunately, IJH’s fund price has stabilized and has delivered a positive return of 17.4% since the low in October 2022. However, it has still lost about nearly 12% since the peak reached in 2021.

YCharts

Because of IJH’s significant price decline, its valuation has also been affected. Together with a downward forward earnings revision in the past year due to more pessimistic economic forecast, its forward P/E ratio has declined quite significantly.

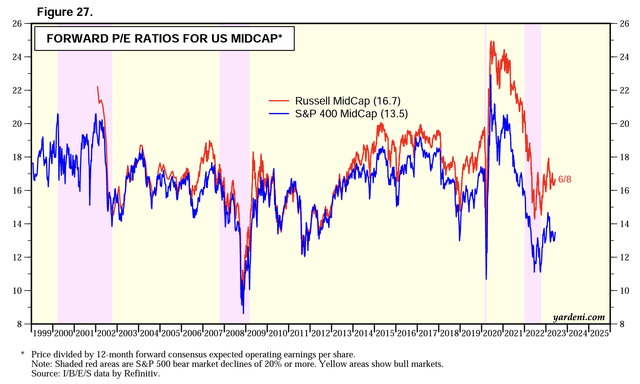

Below is a chart that shows the forward P/E ratios of the S&P 400 Mid-Cap and Russell Mid-Cap indexes. Since IJH tracks the S&P 400 index, we will only look at the S&P 400 index. As can be seen from the chart below, the forward P/E ratio of S&P 400 index has declined from the peak of 23x reached in late 2020 to nearly 11x in October 2022. Although it has since rebounded to 13.5x, its valuation is still towards the low end of the historical range. Therefore, its valuation appears to be quite attractive at the current level.

Yardeni Research

IJH is also trading at a cheaper valuation than the S&P 500 stocks

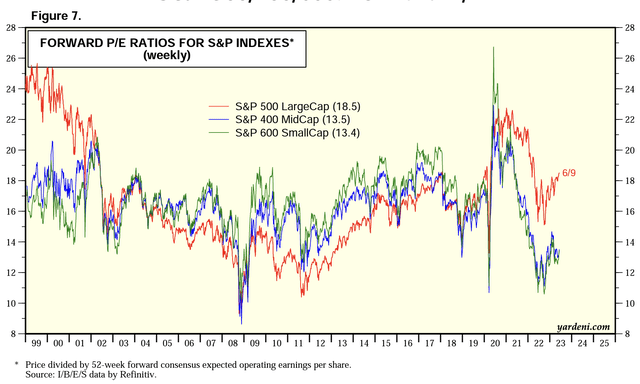

Below is a chart that shows the forward P/E ratios of the S&P 600 SmallCap, S&P 400 MidCap, and S&P 500 LargeCap indexes. As can be seen from the chart below, S&P 500 LargeCap index’s valuation of 18.5x is significantly higher than the S&P 400 MidCap. And S&P 600 SmallCap. Therefore, we think IJH, which tracks the S&P 400 index, is trading at a relatively lower valuation to the S&P 500.

Yardeni Research

However, its growth profile appears to be weaker than its large-cap peer

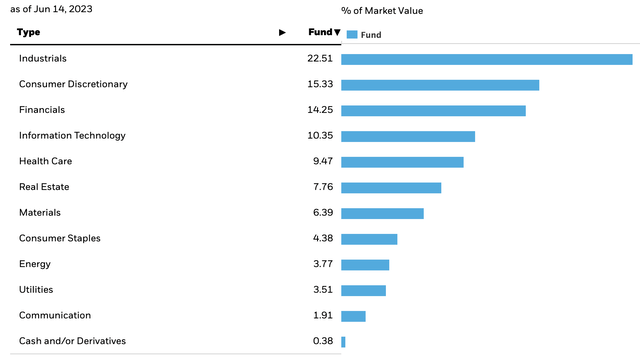

While IJH appears to be trading at a relatively lower valuation than the S&P 500 index, it does not have a large exposure to growth stocks such as technology stocks. As can be seen from the chart below, information technology sector only represent about 10.4% of its total portfolio. In contrast, the information technology sector represents about 28% of the S&P 500 index. Slower growth profile may mean lower returns in the long run. Therefore, it is important to keep in mind this information, especially for investors with a long-term investment horizon.

iShares

Investors should not neglect recession risk

We think it is relatively safe right now to own IJH due to its relatively lower valuation to the S&P 500 index and to its own historical valuation range. However, the biggest risk investors should not neglect is a possible recession. While the U.S. economy appears to be resilient with a strong job market, a recession may not be too far. This is because the Federal Reserve is likely to keep the rate elevated for longer to tame inflation. This may likely tip the economy towards a recession. In fact, we are already seeing some signs such as slower wage growth, and slightly higher unemployment number.

How will IJH’s fund price perform if a recession arrives? We do not know how severe the upcoming recession will be like. But we do know how IJH performed in the past few recessions. Below is a chart that shows how IJH performed from their peak since its inception in May 2000. As can be seen from the chart below, IJH endured a loss of about 38% during the outbreak of 2020 pandemic. It has also declined by over 55% during the Great Recession in 2008/2009. Therefore, it is possible that in the upcoming recession, we will see a decline of at least 30~40% depending on the magnitude of the upcoming recession.

YCharts

Investor Takeaway

IJH is currently trading at an attractive valuation. However, a possible recession may result in more decline in its fund price. Given the fact that we believe a possible recession is still likely, we think investors may want to stay on the sidelines.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here