ETF Profile

The iShares MSCI India ETF (BATS:INDA) provides access to 115 large and mid-sized companies based in India. INDA is today the most popular Indian-themed ETF in the market, with an AUM of close to $6bn, which translates to almost 6x the size of the next biggest alternative- The Wisdom Tree India Earnings Fund (EPI).

We are a little perplexed by INDA’s relative popularity because as a structure it does have a few flaws worth noting. Firstly, it isn’t the most stable portfolio around; for context, most portfolios only churn around a third of their holdings every year, but INDA incidentally ended up churning almost its entire portfolio (annual turnover ratio of 95%). This makes the product look more like a trading play rather than a buy-and-hold solution. There’s nothing inherently wrong with having a trading tilt, it’s just that transaction costs and taxes will likely be a lot higher than a portfolio with limited churn

Then, from a cost angle, whilst it offers a better profile than most other options in the Indian space, it certainly isn’t the cheapest option around. In fact its expense ratio of 0.64%, is over 3x higher than the Franklin FTSE India ETF’s (FLIN) corresponding figure.

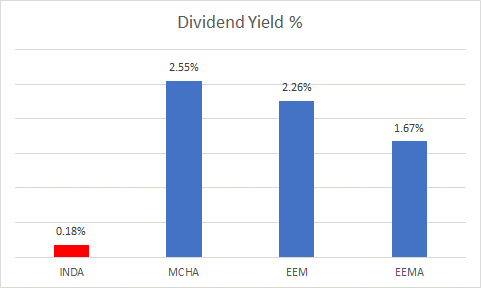

Finally, there’s also a rather sub-par income angle. INDA only offers you a minuscule yield of 0.18%, one of the lowest readings in this space. Besides, if you spread the net to consider China’s flagship ETF-the iShares MSCI China ETF (MCHI) or even more diversified plays such as Emerging Markets Asia (EEMA) or even Emerging Markets (EEM) in general, INDA’s yield comes across as very underwhelming.

Seeking Alpha

Macro Commentary

A couple of days back, the IMF came out with its most recent WEO (World Economic Outlook); one of the highlights of that report was that India saw an upward revision in its GDP estimate for the year (by 0.2%), even as forecasts for EM Asia were maintained at the same place.

For the uninitiated, India is already on course to be the fastest growing major economy, not just this year (the Indian economy will likely contribute one-sixth of the global growth rate), but in FY24 as well where growth is expected to pick up even further to 6.4%.

IMF-WEO July 2023

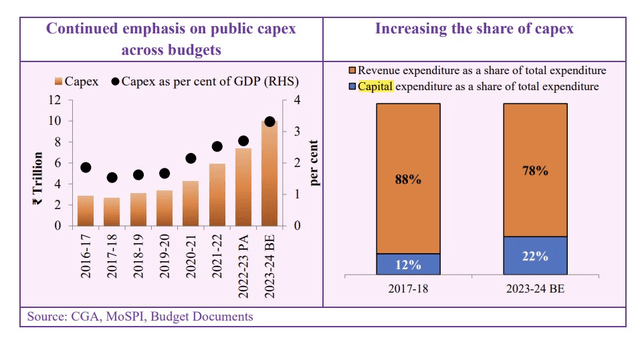

There are a lot of encouraging narratives supporting India’s progress, and the most noteworthy aspect is the alacrity with which the Indian government has stepped up to boost investment outlays. Previously (pre-pandemic), central government CAPEX growth used to hover at only the 8% level, but recently there has been a marked shift in the quantum of capital investment. Last year, it grew by 24%, and this year it is expected to grow at a greater pace of 33% (almost 3x the outlay seen in FY20). When there’s a growing predilection towards capital projects, as opposed to ongoing operating expenses, you know you’re likely to see the multiplier benefits across many years.

Indian Department of Economic Affairs

The financial authorities in India to deserve a great deal of credit, as monetary policy there has been very effective in bringing inflation down to the sub-5% levels. The IMF believes that India will close the year with inflation at levels of 4.9% which is well within the target range of 2-6%. The RBI has paused its rate hiking plans, and it looks increasingly likely that cuts will take place next year.

A prospective rate-cutting regime may not necessarily reflect well on the net interest margin (NIM) profile of Indian banks (this sector has the largest stake in INDA with a weight of 27%), but we think that could help loan growth expansion to be a bit more robust than what was initially expected.

Bank credit growth has a strong correlation with GDP growth, and even though India’s GDP trajectory is more robust than most economies, it will still be a lot lower than what was seen last year (7.2%). Last year credit growth in India came in at 15%, and this year, you would think it would be a bit lower, not only on account of a lower GDP cadence, but also because potentially lower inflation readings may also likely necessitate a lower chunk of working capital loans which make up an important component of the overall loan book.

Closing Thoughts-Valuation And Technical Commentary

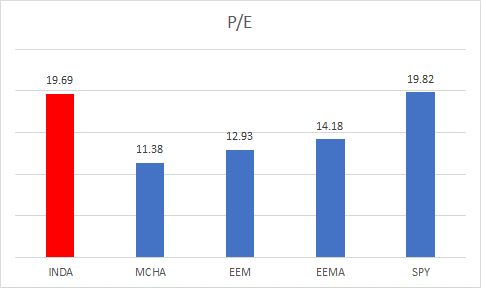

Even though India’s macros look in decent shape compared to the rest of the world, there’s the affordability quotient that ought to be considered. On that front, INDA does not look best placed. One of the allures of diversifying beyond the US and pursuing EM themes is that most options there are available at significant discounts to domestic stocks. Consider that MCHI can be picked up at just 11.4 P/E, a 42% discount to US stocks; How about emerging markets in Asia? Well, you have a 28% discount here at 14 P/E. How about EMs across the board? Once again, a lot cheaper at just 12.9x P/E. It’s only INDA that is currently trading on par with domestic stocks.

Morningstar

Could Indian equities benefit from rotational interest within the broad emerging markets Asia pack? Well, the image below implies that is unlikely to happen, as the INDA: EEMA ratio is now once again trading above the mid-point of the long-term range.

Stockcharts

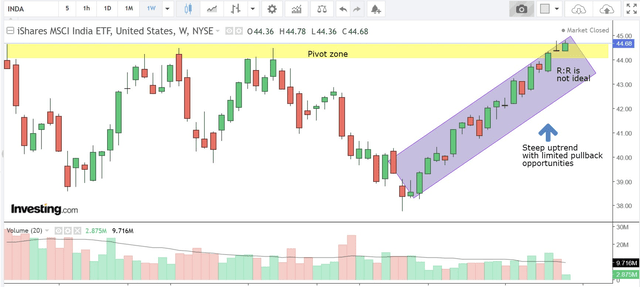

Finally, to close, consider the technical position on INDA’s weekly chart. Since mid-March, the ETF has been on a steep uptrend, offering limited opportunities for a pullback. This gives the impression of a stretched rubber band, which is not ideal. Also, the stock has now reached the sub $45 levels, which has served as a pivot zone in five separate occasions over the past year.

Investing

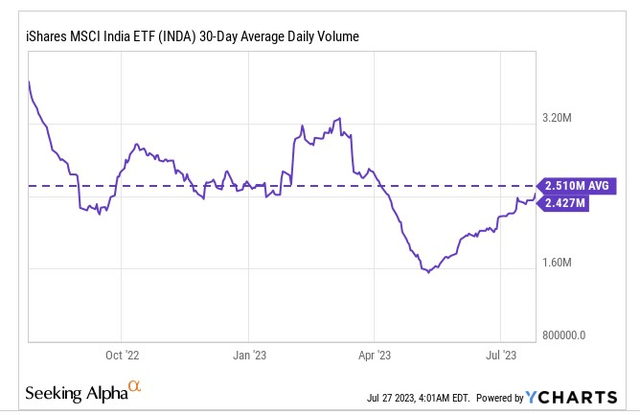

Also consider that the uptrend we’ve seen has taken place on below-average volumes, which doesn’t necessarily make one jump for joy.

YCharts

All things considered, despite a sanguine macro backdrop, we think alpha-generation from current levels may be hard to deliver. INDA is a HOLD.

Read the full article here