The iShares MSCI Thailand ETF (NYSEARCA:THD) is an exposure to the Thai markets, which have been performing really quite badly over the last 365 days. We think that while GDP has been under pressure, the Thai macroeconomic situation is really quite alright, and that there is space for the planned fiscal stimulus. We don’t see much Baht downside as the economy is being tackled fiscally, not monetarily. However, we think that the markets remain a bit expensive demonstrated by THD’s PE ratio at almost 14x, despite substantial energy exposures which are being priced late-in-the-cycle in other markets. Frictions in maintaining THD, leading to a 0.59% expense ratio also helps us pass on this.

THD Breakdown

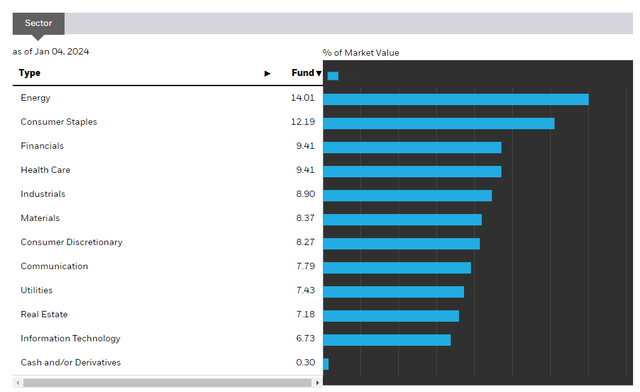

The sectoral breakdown is useful:

THD Sectors (iShares.com)

Energy is 14% of the portfolio, and the other big categories are consumer staples and financials. There is a relatively even weight between the various allocations, likely owed to a smaller tech component in the economy, where tech often dramatically skews allocations due to relatively rich multiples afforded to companies in those sectors.

As said, PE is around 14x and the expense ratio is 0.59%. Expense ratios are unsurprisingly high here due to frictions with getting involved in Thai stocks. Flipping the 14x gives us an earnings yield at around 7%, which is alright relative to local rates in Thailand at 2.5% on a risk-free basis. However, considering the large energy weighting, where E&P companies easily trade at PEs around 6-10x, it implies somewhat more meaningful multiples in the remaining exposures, which seems odd given the Thai economic situation.

Update on Thailand’s Economy

The long story short is that while things like tourism are doing quite well and picking up, the GDP figures are looking rather dull, and the Thai stock market has been one of the worst performing in the world.

They did some rate hiking, but it’s been quite modest relative to the rest of the world, up from around 0% to 2.5%, and they actually don’t have much inflation at all. It falls below western peers and is continuing to come down MoM.

There is a pretty meaningful airdrop of money coming in for low-income Thais designed to kickstart consumption a little bit, not very different from the stimulus checks used in the US. Our opinion is that the country can more than afford this given debt to GDP ratios and a net-export economy. Indeed, even the Baht is staying pretty strong despite the fact that this will be an inflationary effect and a hit to government finances, likely because both will be of little importance considering current inflation rates and the healthy state of public finances.

Bottom Line

We don’t think that the situation in the Thai economy is particularly concerning, but we are still not thrilled with valuations of THD. GDP growth is pretty low, at less than 2% currently, yet the consumption-related exposures have an implied valuation of around 14.5x, assuming a fair multiple of 10x for the energy exposures, which is on the generous side. There is also a meaningful export exposure to China which is bereft of the vigour of recovery. Then there’s also the quite high multiple associated with THD. In all, it’s not especially compelling at the moment.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here