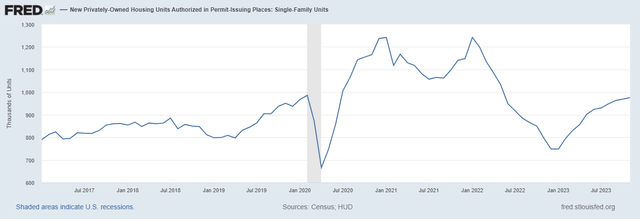

For several months, I noticed that building permits did not reflect the dour mood implied by the Housing Market Index (HMI) published by the National Association of Home Builders (NAHB). The HMI reflects builder sentiment and, until November’s 3-point rise, it declined sharply for four straight months. Yet, permits to build single-family housing rose sequentially every month after January, 2023. To me, it looked like builders were anticipating a large need to build in the future.

Building permits for single-family homes have been robust for all of 2023 (U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Authorized in Permit-Issuing Places: Single-Family Units [PERMIT1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PERMIT1, December 19, 2023.)

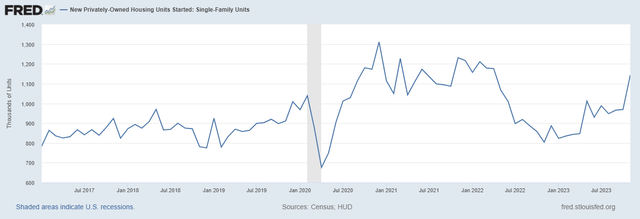

While permits appear to be flattening out right at the pre-pandemic peak, the countertrend of rising permits this year foresaw an eventual jump in housing starts, almost like a pent-up supply of housing starts. November’s single family starts are back to the middle of the 18-month range preceding the Federal Reserve’s launch of monetary tightening. November’s one-month surge was the highest percentage rise since the surge in May which occurred two months before the HMI peaked for the year.

Housing starts for single-family homes surged in November. (U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Single-Family Units [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, December 19, 2023.)

The rush to start homes is likely in anticipation of a robust spring selling season in 2024 made promising by declining mortgage rates and a resilient job market. Indeed, the HMI component measuring future sales expectations, SF Detached Next Six Months (Seasonally Adjusted), surged six points in December.

While the NAHB is cautious about the positive turn in starts data, I am optimistic that over the next few months this momentum will continue into the spring selling season. From the NAHB’s report on starts: “some skepticism should be adopted with the November data. It is possible that the strong reading, the best on a seasonally adjusted basis in more than a year, will be revised lower. It is also possible some acceleration of construction activity occurred in November, perhaps resulting in a lower reading for December.” Even with this caution, the NAHB projects a 4% annual increase in starts for 2024.

Implications for the Seasonal Strength in the Stocks of Home Builders

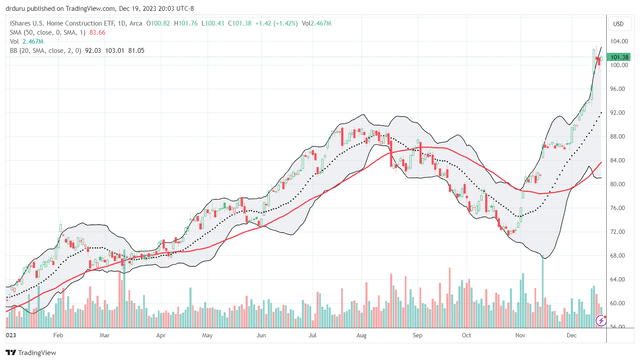

When I identified the start of the seasonal strength in the stocks of home builders, I did not have anything like the current surge in mind. Since the time of writing, the iShares U.S. Home Construction ETF (BATS:ITB) is up almost 40% while the S&P 500 (SPY) is up 11.5% since October 19. This kind of out-performance is extreme and seems unsustainable for even the period of seasonal strength. Accordingly, I closed out all but a few core shares of ITB and KB Home (KBH). Four months ago I made a modest case for Tri Point Homes (TPH) to print new all-time highs after a post-earnings pullback. The subsequent selling allowed me to add cheaper shares. Last week TPH hit my price target. It feels far too early in the season to take profits, but I am not comfortable with the current extremes in price action.

The iShares U.S. Home Construction ETF (ITB) fought through monetary tightening to achieve a stellar performance in 2023. (TradingView.com)

So Now What?

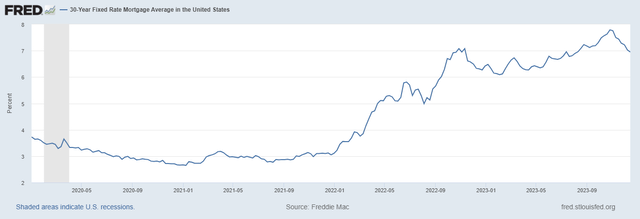

It is very possible home builders just continue to rally. The animal spirits brought on by the Federal Reserve’s declaration of the death of inflation are clearly quite strong. The stock market is even ignoring the vain attempts of some members of the Federal Reserve to walk back the current rate cut euphoria. Moreover, the catch-up trades that are lifting beaten up stocks should maintain a generally bullish bias and keep the current rate-sensitive winners levitating. For now, I am content to wait on home builders during these stretched short-term overbought conditions. On the other hand, the trading rules for this period of seasonal strength direct me to buy whatever dips the market offers. I just have no case to make for an imminent dip except to speculate that last week’s gap higher and run-up will “eventually” reverse. If housing data continues to improve on the tailwinds of falling mortgage rates, then I fully expect the rally in builders to remain aloft.

Mortgage rates look like they have peaked for this cycle now that they dipped below the prior peak. Lower rates are providing a major tailwind for builders. (Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, December 19, 2023.)

Be careful out there!

Read the full article here