Natural gas prices are surging today as Mother Nature finally decided to lend a supporting hand.

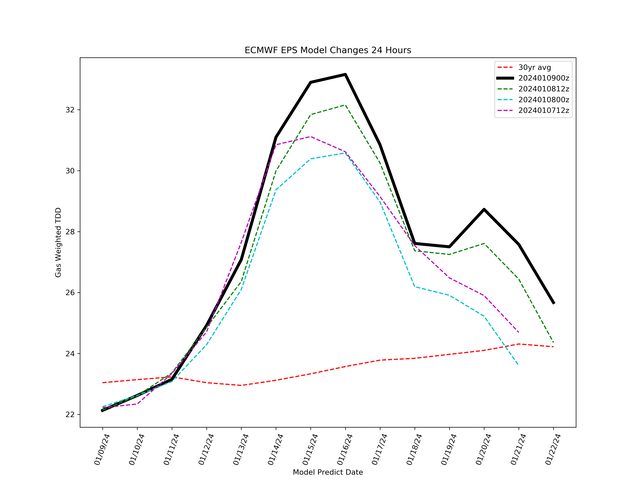

TDDs

HFIRweather.com

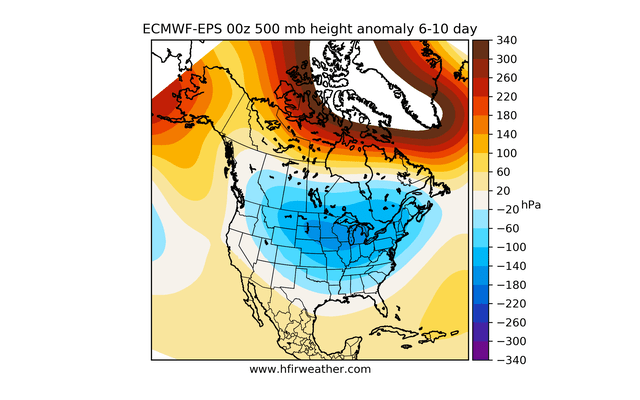

6-10 Day

HFIRweather.com

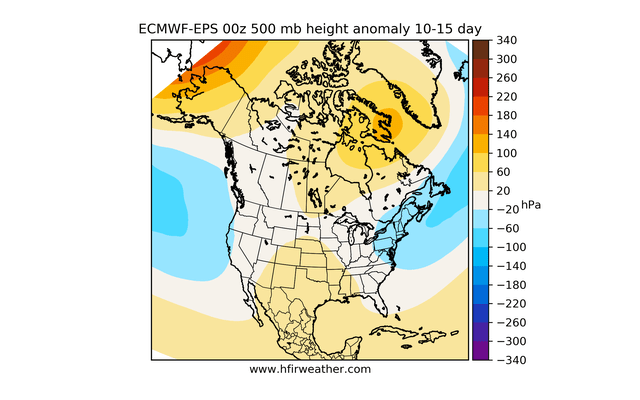

10-15 Day

HFIRweather.com

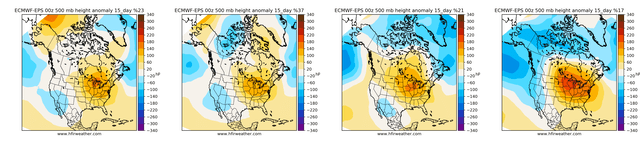

15-Day Cluster

HFIRweather.com

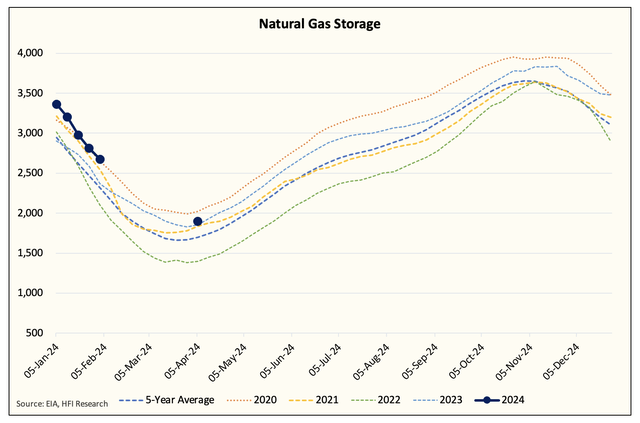

For the natural gas market (NG1:COM), the bearish start to December was not welcomed, but if January had turned out to be warmer than normal, then fundamentally speaking, things would have been very bad (possibly below $2/MMBtu).

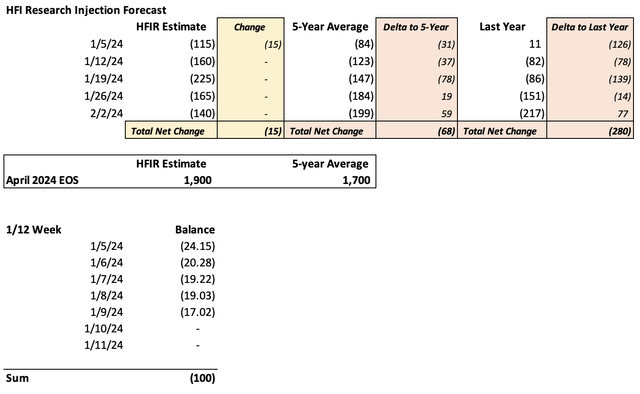

In the latest weather update, the polar vortex we are going to see in the coming 6-10-day range will be enough to push storage draws meaningfully higher. For now, we are seeing -225 Bcf, but this figure is likely to move higher as we see the daily figures come in.

EIA, HFIR

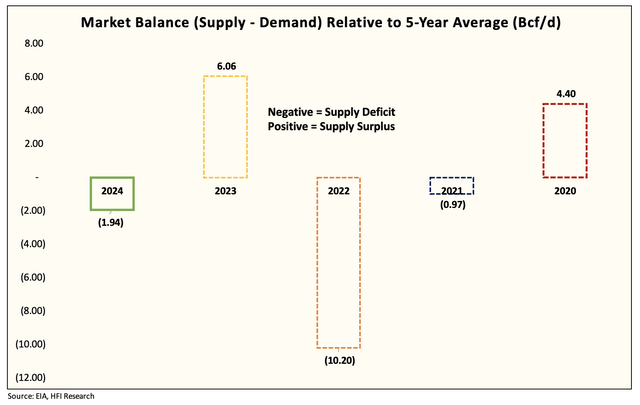

Looking at our storage draw projections, we have total withdrawals ~68 Bcf higher than the 5-year average and 280 Bcf higher than last year. EOS is still pegged at ~1.9 Tcf, with the market currently undersupplied by ~1.94 Bcf/d.

EIA, HFIR

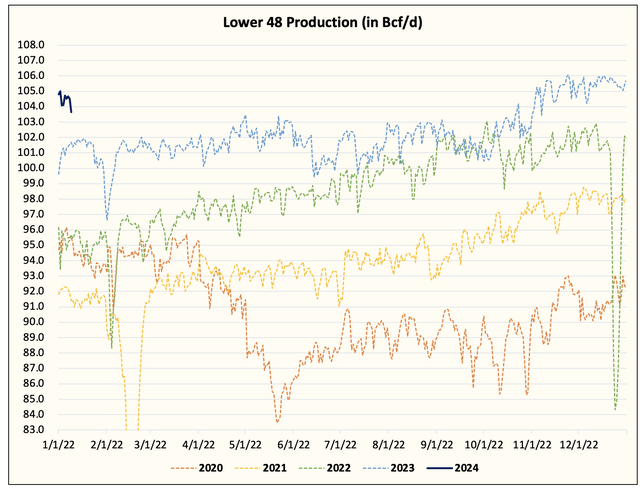

One thing readers should note is that as the cold blast hits, Lower 48 gas production will decline due to production shut-in. In essence, we could see the possibility of supplies surprising to the downside, while demand simultaneously surprises to the upside.

HFIR

For Q1 balances, we expect Lower 48 gas production to average ~104 Bcf/d.

Gun-Shy

Call it battle scars, but when I see natural gas prices surge like this, my instinct is to just wait it out. I’ve never liked trading winter weather patterns, as the volatility is inherently unpredictable. The ECMWF-EPS weather model updates twice daily, and with each update, the amount of changes in heating demand could swing prices by 4-5%. One subscriber used to call it “weather roulette,” and we’ve never had repeated success trading these weather model fluctuations.

From my standpoint, I look at the U.S. gas market as oversupplied still. Taking the weather element aside, we still estimate the U.S. gas market to be ~2 Bcf/d oversupplied. As a result, traders buying up natural gas today are betting that: 1) either the weather models get colder; or 2) there’s more prolonged cold post this cold blast.

Neither of these scenarios is a sound bet, especially considering the run-up in prices today. And even after taking into account the cold weather scenario, we still see the storage situation as being bloated.

EIA, HFIR

However, this does not imply that you start shorting natural gas right away. Polar vortexes tend to intensify as you get closer to the date. In addition, because of the production shut-in, the natural gas cash market could squeeze, resulting in a tailwind for financial prices. It’s always better to wait for the moment the cold hits before thinking about going short.

Helping hand, but more is needed…

For natural gas prices to move sustainably higher, Mother Nature needs to do more of the heavy lifting. While January heating degree days are finally showing up higher than the 10-year average, the trend needs to continue if bulls want to see prices average above $3.

By our estimate, we think natural gas storage needs to fall to ~1.65 Tcf or lower for prices to sustainably average above $3/MMBtu. This means that February will also have to show much colder than normal weather.

Fundamentals, as they are today, are not sufficient enough to keep natural gas prices here. Lower 48 gas production remains far too high, while the real demand drivers for natural gas won’t be here until the end of 2024.

The bulls need more, so all eyes are on the weather models going forward.

Read the full article here