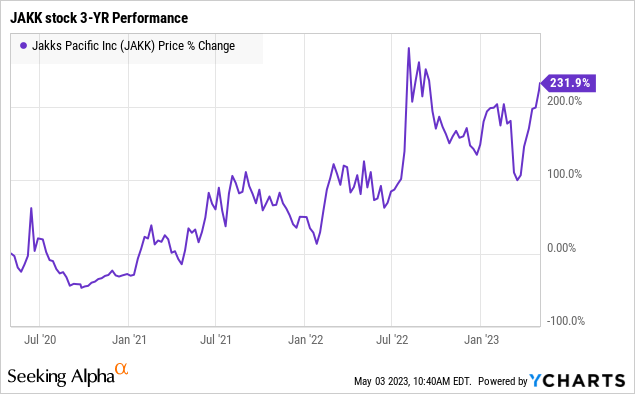

JAKKS Pacific, Inc. (NASDAQ:JAKK) is making some noise with shares up more than 35% thus far in 2023. The toy maker has delivered impressive growth in recent years benefiting from several licensing deals with major global brands and companies like The Walt Disney Company (DIS) and Nintendo Co., Ltd. (OTCPK:NTDOY).

Indeed, headlines of the new “Super Mario Brothers” movie breaking box office records highlight the attraction of JAKK, well-positioned to capture a boom in demand for related merchandise. That was our angle when we last covered the stock last December noting several bullish catalysts.

In many ways, the setup has evolved even better than we could have predicted, with the Super Mario movie evolving into a global phenomenon. The company’s latest quarterly report included just the start of what management expects to be an “extremely strong” year for sales. In our view, Jakks has more upside with a path for shares to make a new all-time high supported by overall solid fundamentals.

JAKK’s Earnings Recap

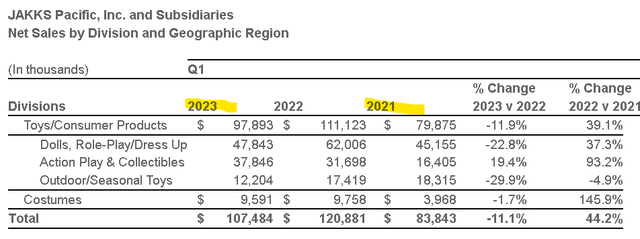

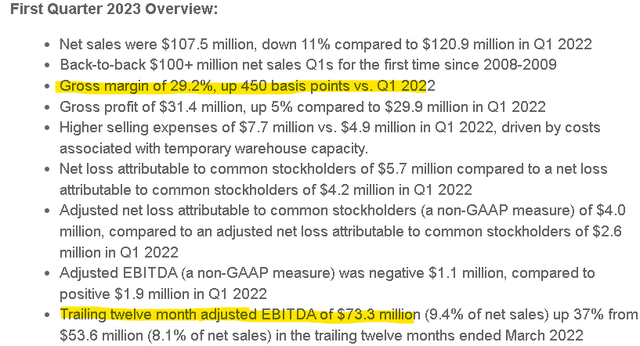

The company reported its Q1 earnings on April 27th. Revenue of $108 million, declined by -11% year-over-year, although it beat the consensus estimate by $1.5 million. There was also a GAAP EPS loss of -$0.58, compared to -$0.43 in the period last year.

The context here for the declines is the seasonal nature of the business with sales peaking into the annual holiday shopping season. The period last year in early 2022 left a tough benchmark considering the strength of the economy at the time, in what was an exceptional quarter for the company. For context, Q1 sales this year are still up more than 28% on a two-year stacked basis.

source: company IR

We mentioned the Nintendo partnership, which the company consolidates into the “Action Play & Collectibles” segment within toys. Management has called the relationship with Nintendo to distribute exclusive toys, “a cornerstone” of this segment. This group has been a strong point with sales up 19% in Q1, compared to a slowdown in other “Dolls” and “Outdoor/Seasonal” items.

The company notes that products specific to the Super Mario movie went on retailers’ shelves only at the end of February, with the results this quarter covering just a limited period since the movie premiere. The plan is to make preparations for a broader global rollout of more new products later this year. For reference, international sales represent about 20% of the business outside of North America.

A favorable development has been the trend in margins, with Jakks’ seeing lower supply chain disruptions and lower logistical costs. The gross margin at 29.2% climbed by 450 basis points from 24.7% in Q1 2022, with management citing “drastically reduced shipping and import-related costs”. On the other hand, SG&A as a percentage of revenue has climbed based on the company’s expansion efforts including higher headcount.

The financial metric that best summarizes the improved financial position overall is the adjusted EBITDA for the trailing twelve months at $73 million, up 37% compared to $54 million in the period last year. The expectation is for continued profitability and positive free cash flow on an annual basis going forward.

Finally, we can bring up Jakks’ robust balance sheet. The company ended the quarter with $38 million in cash against $29 million in financial debt.

source: company IR

Is JAKK A Good Stock?

There’s a lot to like about Jakks Pacific which has cemented itself among the top tier of global toy makers, building on a reputation of high-quality products. What we like about the stock is that there are several growth drivers which can balance concerns of global macro headwinds.

In the near term, the Super Mario Bros. movie can be seen as a windfall for Jakks, with the reach of the franchise exceeding expectations, making some of its toys must-have products for that particular audience.

Retailers, as Jakks direct customers, seeing the franchise interest now will likely start making larger orders for the rest of the year, adding to the company’s earnings potential. The understanding here is that the merchandising impact typically follows a path over many quarters and even years.

Comments by management suggest the company intends to seize on the opportunity. From the conference call:

A related piece of exciting news is the reaction to the new Super Mario Bros. movie. As you likely have read, the film had the biggest box office opening of any animated film in history… which is simply amazing.

Film specific product was on shelf at the end of February, and March sell-through has been very, very impressive, both for the product as well as our evergreen year-round Nintendo business. We have planned the total Nintendo business, movie and classic to be extremely strong this year.

We are working extremely close with our customers around the globe to ensure that they prioritize this opportunity in the second half in light of the film’s off-the-chart performance, as well as preparing for the streaming launch.

The Super Mario movie will leave theaters but simply transition into a lifecycle on streaming, with the potential for sequel films. It’s also worth noting a dedicated theme park at “Universal Studios Hollywood” operated by Comcast Corporation (CMCSA) has recently opened. Simply put, Jakks Pacific finds itself at the center of one of the largest media properties in the world and stands to benefit from its growing popularity.

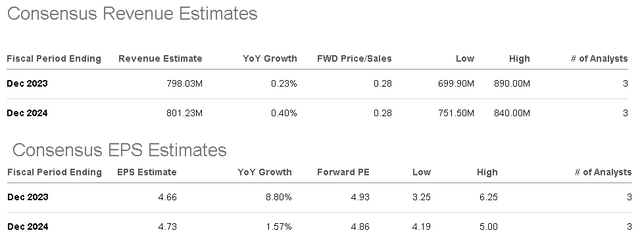

The bullish case for the stock at this point is simply that the earnings momentum can evolve even stronger into the second half of the year and surpass expectations. According to current estimates, the market is forecasting just flat top-line growth for 2023 and 2024 while EPS climb by 9% and 2% each year. We see an upside to these figures, which appear too conservative in our opinion.

Seeking Alpha

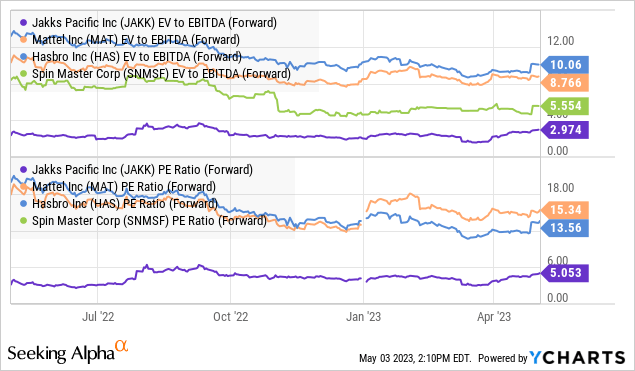

In terms of valuation, Jakks Pacific continues to trade at a deep discount compared to peers like Mattel, Inc. (MAT), Hasbro, Inc. (HAS), and Spin Master Corp. (OTCPK:SNMSF) across several earnings multiples. JAKK trading at a 5x forward P/E is just one-third the 15x multiple commanded by MAT, for example.

One explanation considers the difference in each company’s profile, with Jakks sort of dependent on its licensing agreements. This is in contrast to companies like Mattel and Hasbro which have a larger proprietary brand portfolio. It appears the market values MAT and HAS more richly as they are able to generate higher margins.

On the other hand, the licensing arrangements and the more than 10-year partnership with Nintendo could also be viewed as a strength considering it provides Jakks the flexibility to more quickly respond to market trends.

JAKK’s Price Forecast

We reiterate a bullish view on JAKK with an updated price target of $30.00 representing a 6.5x multiple on the current consensus 2023 EPS. The way we see it playing out is that the next few quarters of results have the potential to outperform expectations, in part driven by the success of the Super Mario Bros. movie merchandise. A string of revisions to full-year estimates higher can add upside momentum to the stock.

As it relates to risks, a deeper deterioration to the global economy would likely undermine the sales environment for toys. Monitoring points for the next few quarters include the gross margin level along with updates on the Nintendo merchandising strength. As long as shares remain above ~$17.50, the bulls will stay in control in our opinion.

Seeking Alpha

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here