What’s New

Christmas came early in December for investors as bond yields continued to fall and equities delivered positive returns to close out a particularly strong year.

The month was largely a continuation of trends that started the previous month, with the market continuing to price in a soft landing for inflation and the economy.

By this, we mean a scenario in which the Fed sustainably defeats inflation without causing significant economic pain, and then begins the process of cutting interest rates.

The implied outcome is one in which markets can keep moving higher because earnings stay supported by economic growth and multiples can expand on falling rates.

Falling sovereign rates were driven in large part by the market pricing in additional rate cuts during 2024. We entered the month of December with investors pricing in between four and five rate cuts from the Fed and ended the month at six.

This would certainly represent a material easing of financial conditions, but we would continue to caution that such an aggressive rate-cutting cycle is unlikely against a backdrop of continued economic strength and benign inflationary pressures.

To the extent that we did see rate cuts of a similar magnitude, it would likely be in response to a rapid deterioration in economic or financial conditions.

Nevertheless, continued economic strength and easing financial conditions supported not only a move higher in equities, but something of a rotation under the surface.

Whereas large cap equities – in particular the Magnificent 7 – dominated returns throughout the year, we have started to see small caps play catch-up.

Thus, while the S&P 500, Dow Jones Industrial Average, and NASDAQ returned 4.5%, 4.9%, and 5.6%, respectively in December, the Russell 2000 returned a whopping 12.2%.

For reference, the Russell 2000 is comprised of much smaller companies and is generally thought of as being more reflective of economic conditions.

Sector performance was somewhat reflective of this rotation as well, with sectors including Real Estate, Consumer Discretionary, Financials, and Industrials delivering strong returns during the month (though Health Care – a more traditionally defensive sector – was also a very strong performer).

Moving into the new year, we continue to remain concerned about the balance between risk and reward in equity markets.

We find it unlikely that we end up in such a Goldilocks scenario whereby the Fed can aggressively cut rates against a backdrop of a strong economy and weak inflation.

As such, we continue to be cautious in our positioning while selectively seeking out investment opportunities.

Our Perspective

We have been adamant that a soft landing is unlikely as we progress through the economic cycle. Historical evidence suggests that the Fed has never brought inflation down from the levels we’ve seen without causing significant economic hardship.

Should the Fed begin cutting rates aggressively next year, we believe it is more likely than not that it will be in response to an adverse economic outcome or exogenous shock. Earnings would likely be hit hard by the economic slowdown driving the Fed to cut.

Given the above, the market is likely going to have to reprice its outlook with higher yields, rising uncertainties, and weaker earnings.

While the market is typically forward-looking, recessions tend not to be priced into the market until their arrival is imminent.

With that in mind, we are placing an emphasis on risk management and have adopted a defensive position strategy in our core portfolios.

How 2023 Set the Stage for 2024

It was once said that there are years where decades happen, and 2023 certainly felt that way

From crises averted to ongoing geopolitical turmoil, falling inflation to a resilient economy, rate hikes to the anticipation of rate cuts, it’s almost easy to forget just how much we saw this year.

As 2024 comes into view, let’s take stock of the more important developments we saw through 2023 – and what they could mean moving forward. Read the five influences in How 2023 Set the Stage for 2024.

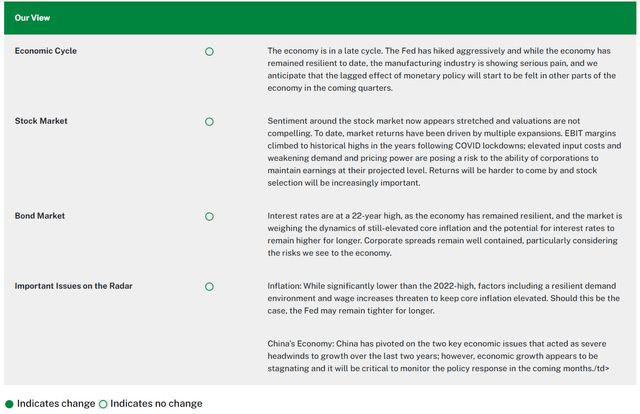

Our View

Source: Wall Street Journal. Bloomberg.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here