JIADE Limited’s IPO Is High Risk

JIADE Limited (JDZG) has filed proposed terms to raise $9.9 million in an IPO of its ordinary shares, according to an SEC F-1 registration statement.

The firm provides education support software and services for adult education institutions in China.

Given the tiny size of the company, its excessive valuation and ongoing and material risks for the firm in China and for U.S. investors, my outlook on the IPO is to Sell (Avoid).

What Does JIADE Limited Do?

Chengdu, China-based JIADE Limited was founded to develop a platform for information and data management in the administration of the entire teaching cycle for adult education in China.

Management is headed by founder, Chairman and CEO Mr. Yuan Li, who has been with the firm since its inception in 2020 and was previously general manager at Charming Education, an adult education company for self-study exams.

The company’s primary offerings include the following:

-

Enrollment consultation

-

Student information collection

-

Enrollment status management

-

Learning progress management

-

Grade inquiry

-

Graduation management

As of Sept. 30, 2023, JIADE has booked fair market value investment of $770,000 from investors.

The firm sells its one-stop integrated platform to educational institutions throughout Sichuan Province.

The company’s clients had more than 20,000 annual student enrollments as of Sept. 30, 2023.

Management seeks to expand its activities into other provinces within China.

Selling expenses as a percentage of total revenue have fallen as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended Sept. 30, 2023 |

2.9% |

|

2022 |

3.2% |

|

2021 |

3.5% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling expense, fell to 11.2x in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended Sept. 30, 2023 |

11.2 |

|

2022 |

16.3 |

(Source – SEC)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

JDZG’s most recent calculation was 123% as of Sept. 30, 2023, so the firm has performed extremely well in this regard, although from a tiny revenue base, per the table below:

|

Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

49% |

|

Operating Margin |

74% |

|

Total |

123% |

(Source – SEC)

What Is JIADE’s Market?

According to a 2019 market research report by ResearchAndMarkets, the overall Chinese education services market is forecast to reach a total value of nearly $573 billion by 2023.

This represents a forecast CAGR of 11.3% from 2018 to 2023.

The main drivers for this expected growth are rising household wealth, growing government spending on education and an increase in urban population requiring further skill development.

Also, there’s a growing demand for online courses, especially as a result of the pandemic and a dual-teacher model in lower-tier cities, which can result in higher course completion rates and student success.

The firm faces strong competition from other companies that compete on a variety of factors:

-

Brand awareness

-

Product pricing

-

Technology support

-

Ease of use

-

Expertise in sales and market

-

Performance track record

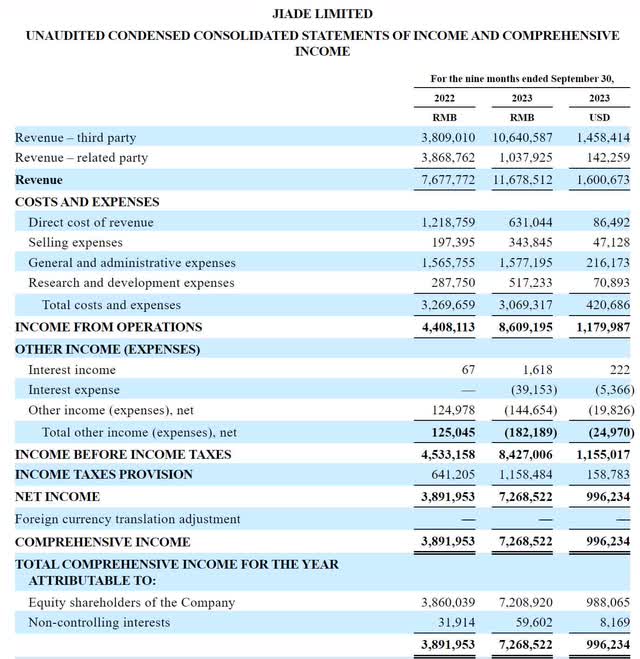

JIADE Limited’s Recent Financial Results

The company’s recent financial results can be summarized as follows:

-

Increasing topline revenue from a tiny base

-

Growing gross profit and gross margin

-

Higher operating profit and cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

SEC

As of Sept. 30, 2023, JIADE had $519,373 in cash and $928,427 in total liabilities.

Free cash flow during the twelve months ending Sept. 30, 2023, was $1.3 million.

JIADE’s IPO Plan

JIADE intends to raise $9.9 million in gross proceeds from an IPO of its ordinary shares, offering $2.2 million at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company also is registering for sale another 2.2 million shares from selling shareholders.

If these shares were to add to the supply of shares on the open market in a concentrated time frame after the IPO, the result could be a material price drop of the stock.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $102 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 9.00%, suggesting the stock will be a “low-float” stock immediately post IPO.

Management says it will use the net proceeds from the IPO as follows:

Approximately 30% for developing our existing business, such as expanding sales and operation teams, diversifying service offerings, and enchanting marketing efforts;

Approximately 40% for acquiring vocational education and training institutions authorized by the PRC government and establishing eight to 10 examination centers. As of the date of this prospectus, we have not entered into any binding agreement for any acquisition or identified any definite acquisition target;

Approximately 12% for investing in technology research and development to develop and update existing and new software; and

The balance to fund working capital and for other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the company is not a party to any material legal proceedings.

The sole listed bookrunner of the IPO is WestPark Capital.

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$109,959,620 |

|

Enterprise Value |

$102,151,431 |

|

Price / Sales |

54.70 |

|

EV / Revenue |

50.81 |

|

EV / EBITDA |

70.94 |

|

Earnings Per Share |

$0.05 |

|

Operating Margin |

71.63% |

|

Net Margin |

61.11% |

|

Float To Outstanding Shares Ratio |

9.00% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Net Free Cash Flow |

$1,312,526 |

|

Free Cash Flow Yield Per Share |

1.19% |

|

Debt / EBITDA Multiple |

0.29 |

|

CapEx Ratio |

454.50 |

|

Revenue Growth Rate |

48.92% |

|

(Glossary Of Terms) |

(Source – SEC)

JIADE Isn’t Ready For U.S. Public Capital Markets

JDZG is seeking U.S. public capital market investment to fund its working capital requirements and its acquisition and expansion plans.

The firm’s financials have produced growing topline revenue, increasing gross profit and gross margin and more operating profit and cash flow from operations.

Free cash flow for the twelve months ending Sept. 30, 2023, was $1.3 million.

However, JIADE’s revenue is still very small, and management hasn’t proven that it can generate meaningful revenue growth.

Selling expenses as a percentage of total revenue have dropped as revenue has increased, so that’s a good early signal, but its Selling efficiency multiple fell to 11.2x in the most recent reporting period, indicating the company is already becoming less efficient in generating incremental revenue.

The firm currently plans to pay no dividends and retain future earnings, if any, for reinvestment into the firm’s growth and working capital needs. This is typical of early-stage companies.

JDZG’s recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow, although this may be pre-IPO window dressing and post-IPO, the company may increase its capex spending materially.

The market opportunity for providing education services in China is large but has been subject to strong regulatory actions in recent years, causing significant dislocations among companies operating in the market.

While large companies have been able to adjust, these unpredictable regulatory actions have generally hurt smaller firms as they do not have the resources to comply.

This has had the effect of favoring larger companies, which may be what Chinese regulatory authorities want, which is to reduce the number of companies they have to oversee, concentrating power in a smaller number of firms the regulators can more effectively control.

Like so many other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC.

The Chinese government may intervene in the company’s business operations or industry at any time and without warning and has a recent history of doing so in certain industries.

Management is seeking an enterprise value/revenue multiple of approximately 51x, which appears extremely high for a firm that produced only $1.6 million in revenue in 2022.

Given the tiny size of the company, its excessive valuation and ongoing and material risks for the firm in China and for U.S. investors, my outlook on the IPO is to Sell (Avoid).

Expected IPO Pricing Date: To be announced.

Read the full article here