Real estate investment trusts, or REITs, are a popular investment choice for individuals seeking a steady income stream. Among the noteworthy offerings in this space, the JPMorgan Realty Income ETF (NYSEARCA:JPRE) stands out due to its strategic focus on income-generating real estate assets.

Launched on May 2022, JPRE is an exchange-traded fund, or ETF, designed to offer investors access to the real estate industry. The main goal of the fund is to provide steady income to its investors by maintaining a diverse portfolio of income-producing REITs and other securities related to real estate.

JPRE is actively managed and allocates its resources to a broad spectrum of equity and mortgage REITs, incorporating those in the small-cap sector. Moreover, it has the flexibility to invest as much as 15% of its net assets in illiquid holdings.

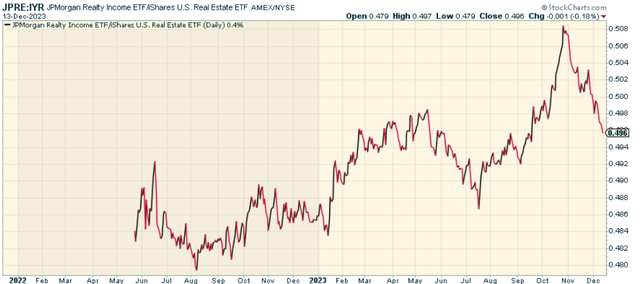

Relative to a broad based ETF like the iShares U.S. Real Estate ETF, it’s outperformed since inception, though recent performance has been challenged.

stockcharts.com

JPRE Holdings: A Closer Look

The JPRE portfolio comprises 33 REITs, which contribute to its primary goal of delivering a regular cash flow through dividends. Top holdings include:

- American Tower Corp REIT (AMT): AMT is a leading independent owner, operator, and developer of multitenant communications real estate.

- Equinix, Inc. REIT (EQIX): EQIX is a global interconnection platform for leading businesses.

- Digital Realty Trust, Inc. (DLR): This REIT focuses on providing data center, colocation, and interconnection solutions.

- Prologis, Inc. REIT (PLD): PLD is a global leader in logistics real estate with a focus on high-barrier, high-growth markets.

- Welltower Inc. (WELL): WELL is an infrastructure provider to the healthcare industry.

The holdings are diversified across various sectors within the real estate industry, enabling the fund to balance risks and returns effectively. There is high concentration risk here though, as the top 5 holdings make up over 40% of the portfolios.

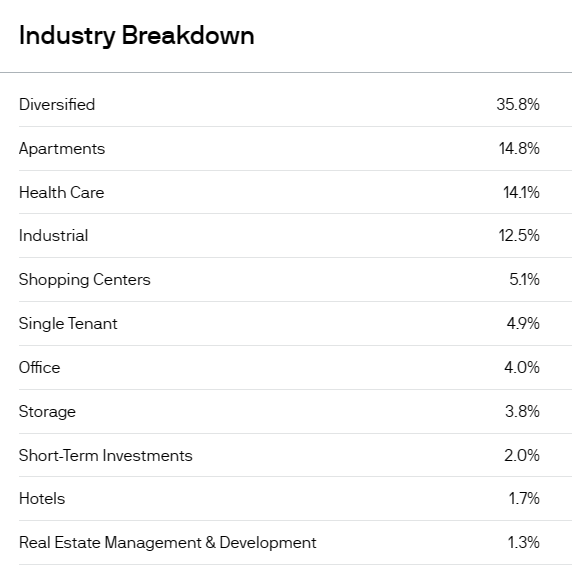

Sector Composition and Weightings

JPRE’s sector composition and weightings reflect a balanced and defensive approach to investing. The fund overweights residential, healthcare, and storage REITs while underweighting retail REITs. This strategy allows JPRE to mitigate potential risks and ensure a steady income flow for its investors. I like that shopping centers is a relatively small percentage of the portfolio alongside office, given ongoing commercial real estate risks out there.

jpmorgan.com

Comparison with Peer ETFs

When compared with other large U.S. real estate ETFs, JPRE stands out due to its active management and focused strategy. Although it charges a higher expense ratio than its peers, its concentrated portfolio and defensive investment approach offer an attractive value proposition for potential investors. This defensive approach might explain relative weakness in November against broader REIT funds, but that’s not necessarily a bad thing in my view.

Pros and Cons of Investing in JPRE

Opting for an investment in JPRE can present numerous benefits. Its focus on yielding a steady income stream makes it a compelling choice for investors seeking regular returns. The diversified nature of its portfolio manages to strike a balance between risks and rewards, offering a certain degree of security to investors.

Nevertheless, it’s essential to note that JPRE investments do come with their own set of challenges. The fund’s performance may be subject to fluctuations due to a variety of dynamics such as shifts in interest rates, the state of the economy, and changes in the real estate market. Additionally, its higher expense ratio (net of 0.5%) compared to index-tracking ETFs may deter some investors.

To Invest or Not to Invest?

JPRE looks promising for a relatively newer REIT fund. Its strategic focus on income-generating REITs, coupled with its diversified portfolio and active management approach, offers potential for steady returns and risk mitigation. I broadly like REITs here given what looks like the end of the interest rate hiking cycle, so this is a fund worth considering if you want defensive exposure with an active tile.

Read the full article here