Foreword

This article is based on a June 29, 2023 list of high-yield large-cap stocks published by DogsOfTheDow.com entitled,

Highest Dividend Paying Large-Cap Stocks

Yields for those top big dog 50 were all greater than 3.8% in early May. In late May the minimum yield was at 4.49% and June bottomed out at 5.9%!

“The advantage of focusing on large-cap stocks is that these companies tend to be less volatile and also tend to have more resources (e.g. strong management, access to credit, etc.) to maintain their dividend payments over the long-term.”

-Dogs of the Dow

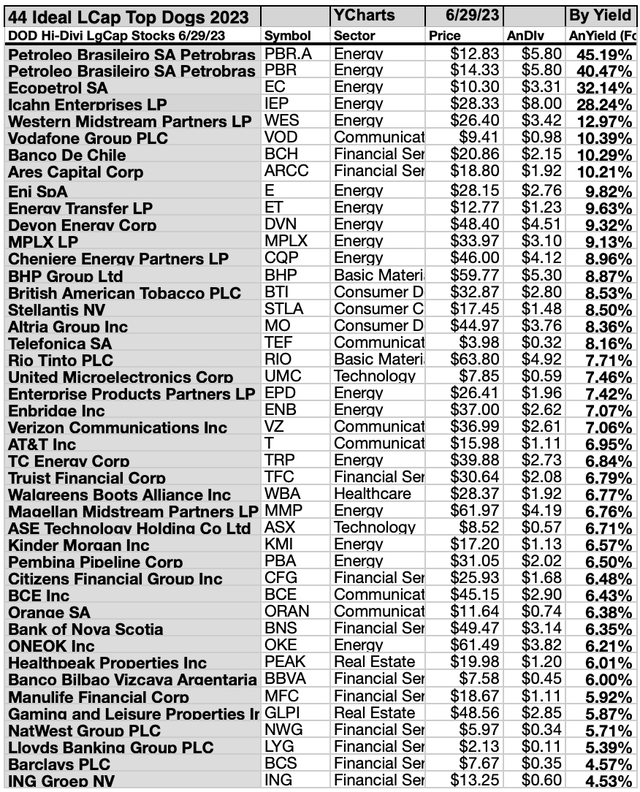

Any collection of stocks is more clearly understood when subjected to this yield-based (dog catcher) analysis, these high-dividend large -cap stocks are perfect for the dogcatcher process. Below is June 29 data for 50 dividend paying stocks including 44 living up to the dogcatcher ‘ideal’ in this one-source collection.

The Ides of March 2020 plunge in the stock market took its toll on stocks over three and one quarter years ago. However, sudden recovery in prices after the plunge by these fifty dividend stocks made the possibility of owning productive dividend shares from this collection more remote for first-time investors.

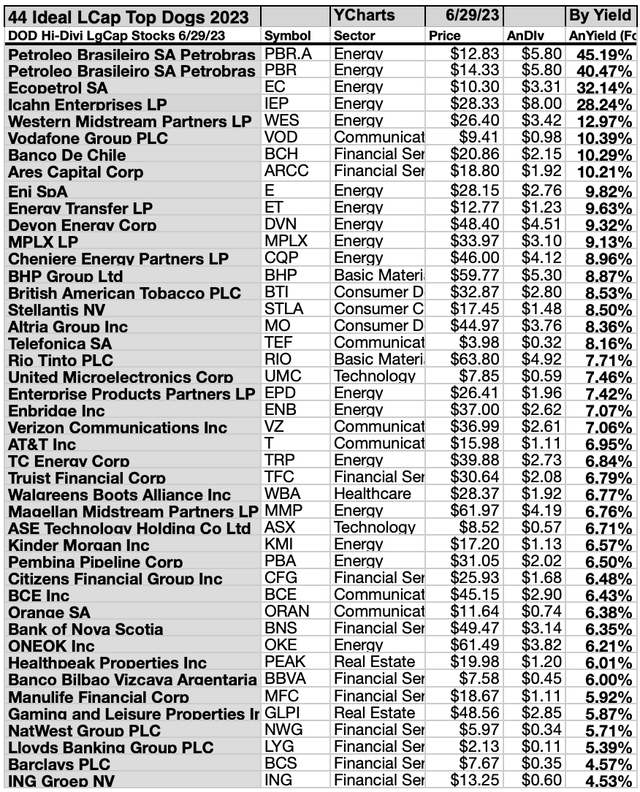

July, 2023 shows a glimmer of light from forty-four large-cap and high-yield stocks emerging as dogcatcher ideal candidates. They are:

Source: DogsoftheDow.com/YCharts.com

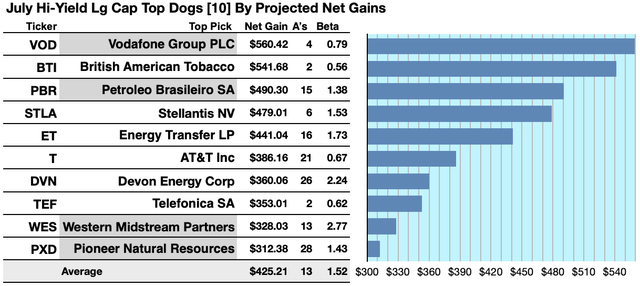

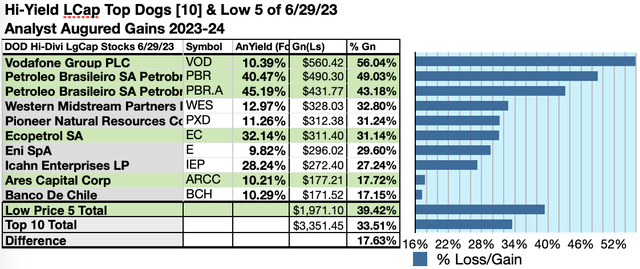

Actionable Conclusions (1-10): Brokers Estimated Top-Ten July High-Dividend Large-Cap Stocks Might Net 31.24% to 56.04% Net Gains By 2024

Four of the top-yield high-dividend large-cap Stocks (tinted in the chart below) were also the top gainers for the coming year based on analyst 1-year targets. Thus, the top yield dog strategy for this group, as graded by analyst estimates for this month, proved 40% accurate.

Estimated dividend-returns from $1000 invested in each of the highest-yielding stocks and their aggregate one-year analyst median-target prices, as reported by YCharts, created the 2023-24 data points. (However, one year target-prices by lone analysts were not counted.) The resulting ten probable best profit-generating highest-dividend large-cap stocks projected to July, 2024, by that reckoning, were:

Source: YCharts.com

Vodafone Group PLC (VOD) netted $560.42based on estimates from 4 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 21% less than the market as a whole.

British American Tobacco PLC (BTI) netted $541.68 based on the median of target estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 44% less than the market as a whole.

Petróleo Brasileiro SA Petrobras (PBR) netted $490.30 based on the median of target prices estimated by 15 analysts, plus estimated dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 38% greater than the market as a whole.

Stellantis NV (STLA) netted $479.01 based on estimates from 6 analysts, plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 53% greater than the market as a whole.

Energy Transfer LP (ET) netted $441.03 based on the median of target price estimates from 16 analysts plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 73% greater than the market as a whole.

AT&T Inc (T) netted $386.16 based on the median of target estimates from 21 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 33% less than the market as a whole.

Devon Energy Corp (DVN) netted $360.06 based on dividends plus a median target price estimate from 26 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 124% greater than the market as a whole.

Telefonica SA (TEF) netted $353.01 based on the median of target estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 38% less than the market as a whole.

Western Midstream Partners (WES) netted $328.03 based on the median of target estimates from 13 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 177% greater than the market as a whole.

Pioneer Natural Resources (PXD) netted $312.38 based on the median of target estimates from 28 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 43% over the market as a whole.

The average net-gain in dividend and price was 42.52% on $10k invested as $1k in each of these ten high-dividend large-cap stocks. This gain estimate was subject to average risk/volatility 37% greater than the market as a whole.

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More specifically, these are, in fact, best called, “underdogs”.

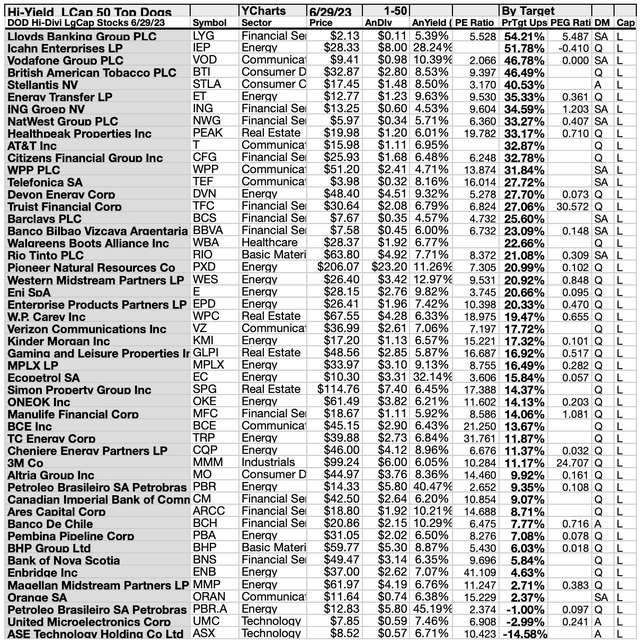

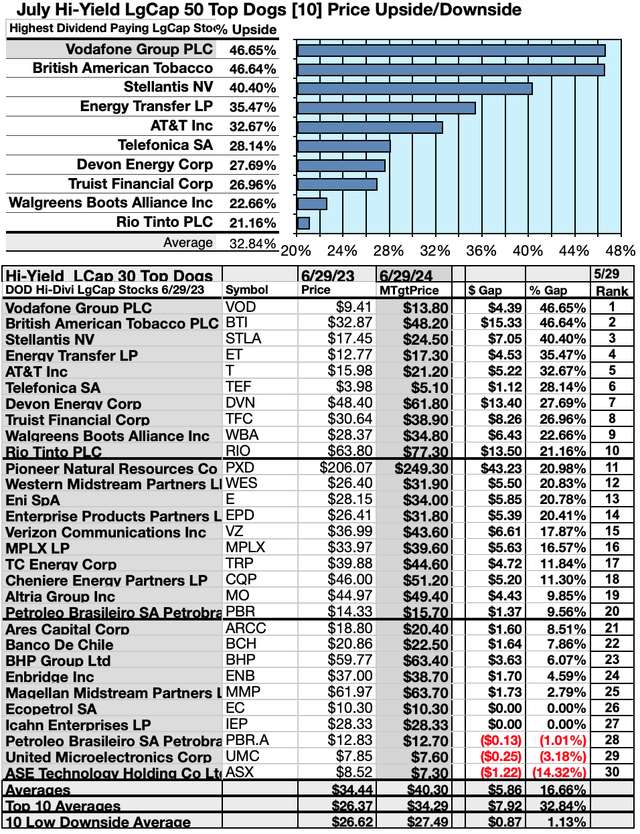

Top 50 High-Dividend Large-Cap June Stock Picks By Broker Targets

Source: YCharts.com

This list of broker-estimated upside (or downside) for stock prices provides a scale of market popularity. Note: no broker coverage or one broker coverage produced a zero score on the above scale. This scale can be taken as an emotional component as opposed to the strictly monetary and objective dividend/price yield-driven report below. As noted above, these scores may also be taken as contrarian.

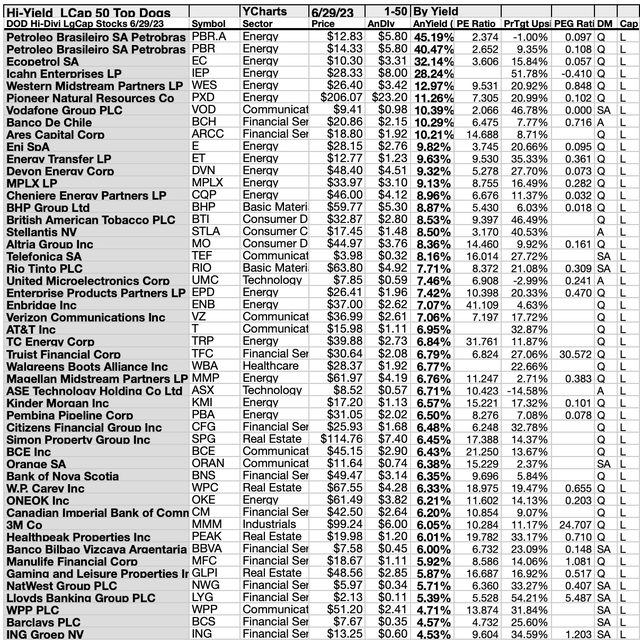

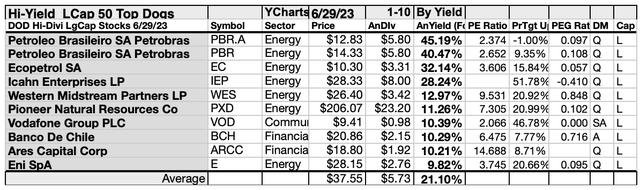

Top 50 High-Dividend Large-Cap July Stock Picks By Yield

Source: YCharts.com

Actionable Conclusions (11-20): Ten Top Stocks By Yield Are The July Dogs of High-Dividend Large-Cap Collection

Top ten High-Dividend Large-Cap Stocks selected 6/29/23 by yield represented just three of eleven Morningstar sectors.

First place was secured by the first of seven energy outfits, Petroleo Brasileiro SA Pertobras [1][2]. The others placed third through sixth, and tenth: Ecopetrol SA (EC) [3]; Icahn Enterprises LP (IEP) [4]; Western Midstream Partners [5]; Pioneer Natural Resources Co [6]; Eni SpA (E) [10].

Finally, seventh place went to the lone communication services member, Vodafone Group PLC; and eight and ninth places were taken by the two financial services representatives in the top ten, Banco De Chile (BCH) [8], and Ares Capital Corp (ARCC) [9], to complete the top ten Dogs of the high-dividend large-cap collection for July.

Source: YCharts.com

Actionable Conclusions: (21-30) Ten High-Dividend Large-Cap Stocks Showed 21.16% to 46.65% Upsides To July, 2024, With (31) Three -1.01% to 14.32% Losers

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig-out bargains.

Analysts Estimated A 17.63% Advantage For 5 Highest Yield, Lowest Priced of Top-Ten High-Dividend Large-Cap Stocks To July, 2023

Ten top high-dividend large-cap stocks were culled by yield for this monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

Source: YCharts.com

As noted above, top-ten high-dividend large-cap stocks selected 6/29/23, showing the highest dividend yields, represented three of eleven sectors in the Morningstar scheme.

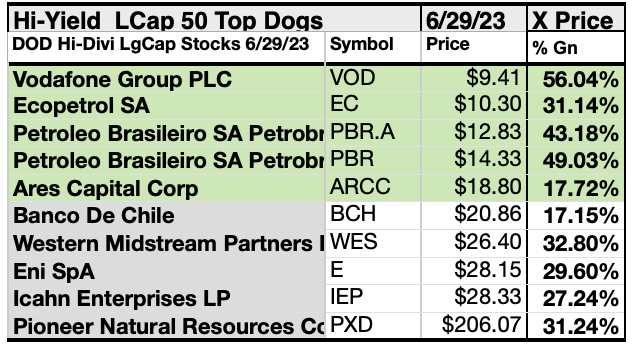

Actionable Conclusions: Analysts Estimated The 5 Lowest-Priced Of Ten High-Yield Large-Cap Stocks (33) Delivering 39.42% Vs. (34) 33.51% Net Gains by All Ten by July 2024

Source: YCharts.com

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten high-dividend large-cap stocks by yield were predicted by analyst 1-year targets to deliver 17.63% more gain than $5,000 invested as $.5k in all ten. The very lowest-priced high-dividend large-cap top-yield stock, Vodafone Group PLC, was projected to deliver the best net gain of 56.04%.

Source: YCharts.com

The five lowest-priced top-yield high-dividend large cap stocks for June 29 were: Vodafone Group PLC; Ecopetrol SA; Petróleo Brasileiro SA Petrobras [2]; Ares Capital Corp, with prices ranging from $9.41 to $18.80

Five higher-priced top-yield high-dividend large cap stocks for June 29 were: Banco De Chile; Western Midstream Partners; Eni SpA; Icahn Enterprises LP; Pioneer Natural Resources Co, whose prices ranged from $20.86 to $206.07.

This distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 15% to 85% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

If somehow you missed the suggestion of the forty-four stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

Source: YCharts.com

In the current market advance, dividends from $1K invested in the forty-four stocks listed above met or exceeded their single share prices as of 5/29/23.

As we are over three and one quarter years past the 2020 Ides of March dip, the time to snap up some of those forty-four top yield high-dividend large-cap stocks is now… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your holdings.)

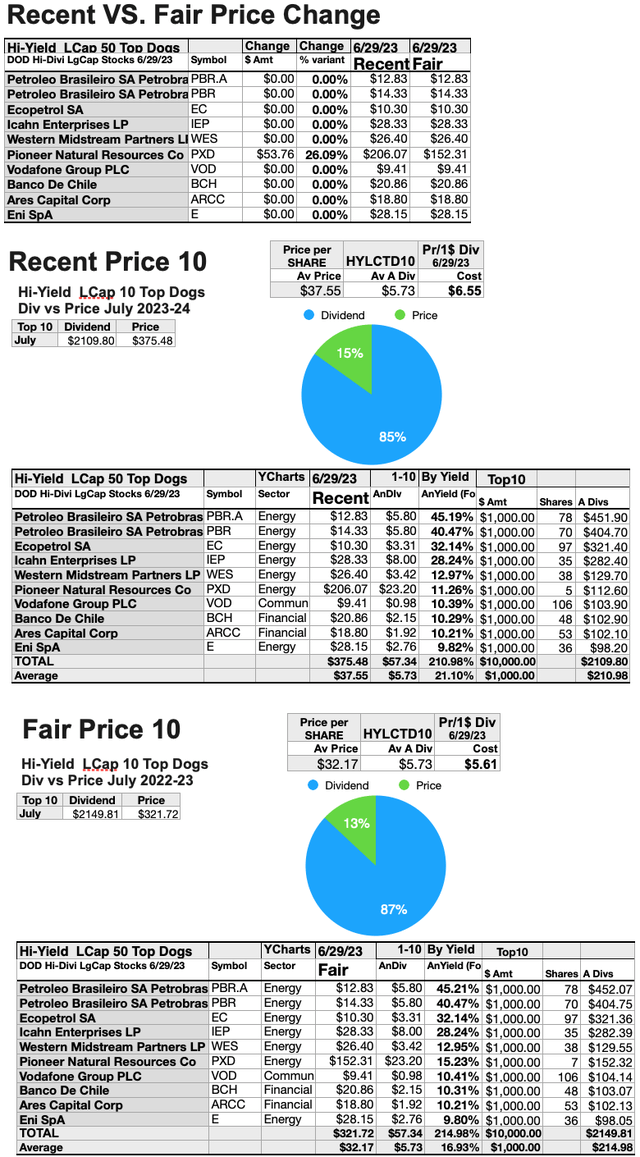

Recent vs Fair Top Ten High-Dividend Large-Cap Stock Prices

Since nine of the top-ten high- dividend large-cap stocks are priced less than the annual dividends paid out from a $1K investment, the following top chart shows the dollar and percentage shift required for the lone dog at recent prices to create break-even pricing for all ten. Starting with the dollar and percent variants to all ten top dogs conforming to (but not exceeding) the dogcatcher ideal in the top chart, the recent prices are documented in the middle chart and the fair prices revealed in the bottom chart.

Source: YCharts.com

The top chart is an indicator of how low the one non-ideal stock must adjust to become fair-priced. Which means conforming the standard of dividends from $1K invested exceeding the current single share price.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your 2023 top-yield high-dividend large cap stock purchase or sale research process. These were not recommendations.

Read the full article here