KBR, Inc. (NYSE:KBR) is a company that specializes in engineering and technology solutions. As the company has had a somewhat turbulent history, and is priced for a good run going forward, I have a sell rating on the stock at the current price.

The Company

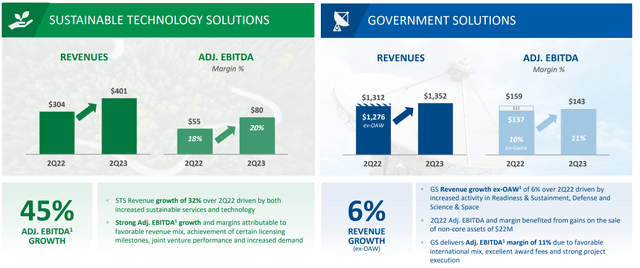

KBR sells different support solutions to governments in the United States, United Kingdom, and Australia. The company also sells various solutions to commercial customers. KBR’s offering includes defense, intelligence, and aviation technologies for government agencies as well as acquisition support, systems engineering, and cyber analytics for commercial customers. Government solutions cover a majority of KBR’s revenues, as in Q2 government solutions represented around 77% of revenues:

KBR’s Segments (KBR Q2 Earnings Presentation)

Although government solutions’ adjusted EBITDA margin is significantly lower than the commercial side’s, I believe the revenue is very valuable as government spending often stays stable through macroeconomic turbulence, unlike the private sector.

Financials

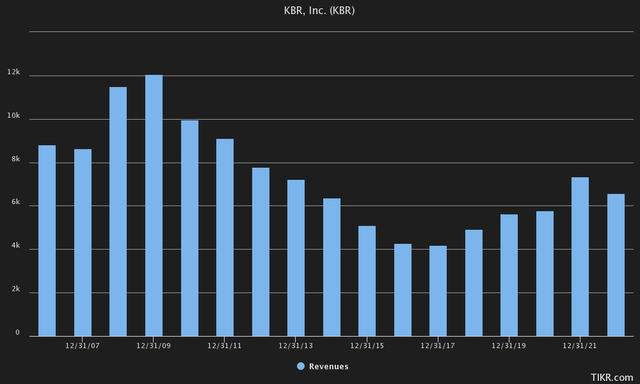

As mentioned, KBR’s financials have seen their fair share of turbulence on the revenue side – the company’s revenues saw a long period of decreases from highs of 2009 to 2017. After that period, KBR has turned its operations around, as growth from 2017 to 2022 has been 9.5 percent annualized:

KBR’s Revenues (Tikr)

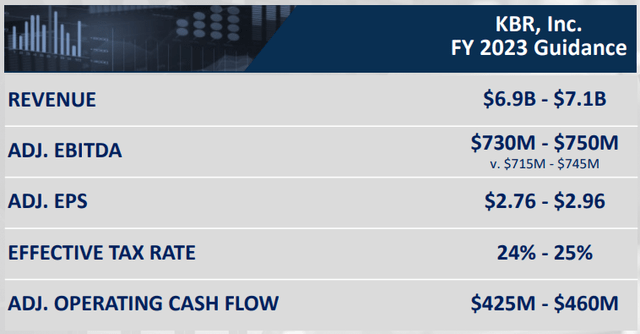

The company is also guiding for a revenue of $6900 million to $7100 million in 2023, where the middle point of the guidance would represent a growth of 6.6%. This growth would still put KBR’s revenues below 2021 levels, as in 2022 the company’s revenues declined by 10.6 percent.

KBR’s Guidance (KBR Q2 Earnings Presentation)

The guidance also has an adjusted EBITDA guidance of $730 million to $750 million – as KBR achieved an adjusted EBITDA figure of $668 million in 2022, the middle point of the guidance would mean an increase of $72 million.

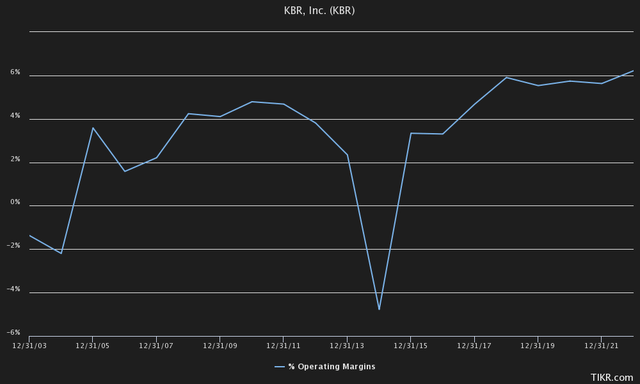

Looking further than just the adjusted EBITDA, KBR achieved an EBIT figure of $408 million in 2022, translating to an operating margin of 6.2%. This margin is well above KBR’s historical average, as the company’s margin has been significantly below current levels for most of its history, with sizable increases in margin happening in 2017 and forward as the company’s revenues achieved growth:

KBR’s Operating Margin (Tikr)

KBR’s margin should continue to climb slightly further in the current year, as adjusted EBITDA is guided to grow over ten percent with only a 6.6% increase in revenues.

The company’s outstanding interest-bearing debts stand at $1,745 million after Q2. This seems to me to be a healthy amount of debt, as the company has a market capitalization of almost $8 billion and healthy cash flows – the company’s operating cash flow from trailing twelve months is $470 million. The debt is in long-term debt, with a portion of $117 million being in current portions of the debt, to be paid off within a year.

KBR has a cash balance of $539 million to offset its debts. This should be a sufficient amount to continue to pay out dividends in the near future, as KBR has a dividend yield of 0.91%. The payout ratio stands at 18.55% – KBR seems to have a very healthy margin to even increase dividends. Although the company’s dividend yield is quite small, the company has been paying out earnings to investors through share buybacks.

Valuation

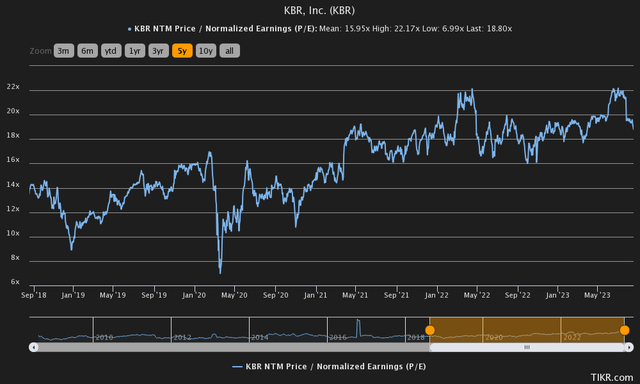

KBR currently trades at a NTM price-to-earnings ratio of 18.80, above its historical level of 15.95 in the past five years:

KBR’s Historical P/E Ratio (Tikr)

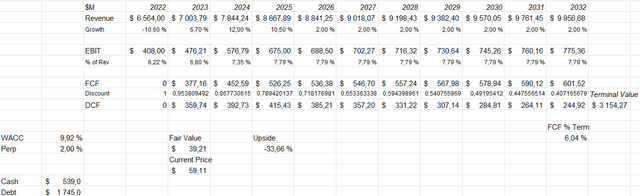

To analyze the valuation further, I constructed a discounted cash flow (“DCF”) model. I estimate the company to achieve a revenue growth of 6.7% in the current year, a tiny bit above the company’s middle point of the guidance. Going further, I expect slightly faster growth as the economy could be in a better position and as revenues jump back from 2022’s slump – in 2024 I have an estimated growth of 12% and in 2025 a growth of 10.5%. Going into 2026 and beyond, I don’t think expecting growth as a base scenario is justified, as KBR has had a turbulent history.

I expect KBR’s operating margin to increase by a small amount, as the company has achieved growing margins for the past years with growth. In the DCF model this is represented by a jump from 6.22% in 2022 into 6.8% in 2023, with the margin stabilizing at 7.79% in 2025 as growth tapers off. These expectations put the estimated fair value of KBR’s stock at $39,21, around 34% below the stock’s current price:

DCF Model of KBR (Author’s Calculation)

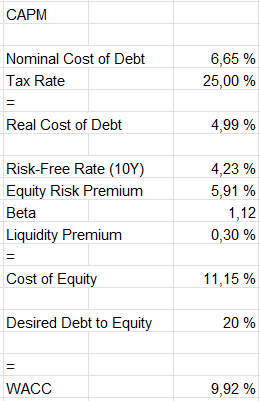

The DCF model utilizes a weighted average cost of capital of 9.92%. This discount rate is derived from a capital asset pricing model with the following assumptions:

CAPM of KBR (Author’s Calculation)

KBR had interest expenses of $29 million. Annualized, this makes an interest rate of 6.65% with the company’s long-term debt balance of $1745 million. Near current levels, I’m expecting KBR’s debt-to-equity ratio to stabilize at around 20%.

On the cost of equity side I use the United States’ 10-year bond yield as the risk-free rate, with the yield being 4.23% at the time of writing. I use Professor Aswath Damodaran’s estimate of 5.91% for the United States’ equity risk premium. Tikr estimates the stock’s beta to be 1.12, used in the model. Finally, I add a liquidity premium of 0.3% to the cost of equity, crafting the figure at 11.15%, and the WACC at 9.92%, which is used in the model.

Takeaway

Although KBR, Inc. has turned its revenues mostly into growth from 2017, I believe investors should be somewhat cautious about the company’s future as revenues had a decline in 2022. As my DCF model has an estimated downside of 34% with estimates that I see as reasonable, I have a sell rating for KBR, Inc. stock at the current price.

Read the full article here