Although I was a little bit early buying into beaten-down KeyCorp (NYSE:KEY) in April, I believe the regional bank still has considerable revaluation potential as the market recovers from the panic sell-off during the first-quarter. KeyCorp’s deposit business was not materially affected by the collapse of Silicon Valley Bank in the first-quarter and the bank has not only more than enough liquidity to ensure that depositors get their money if they wanted to, but shares are now trading at an excessive 8.2% dividend yield… which is the highest in the U.S. regional banking market. Since shares are also trading at a 21% discount to book value, KeyCorp has a very attractive risk profile that is skewed to the upside!

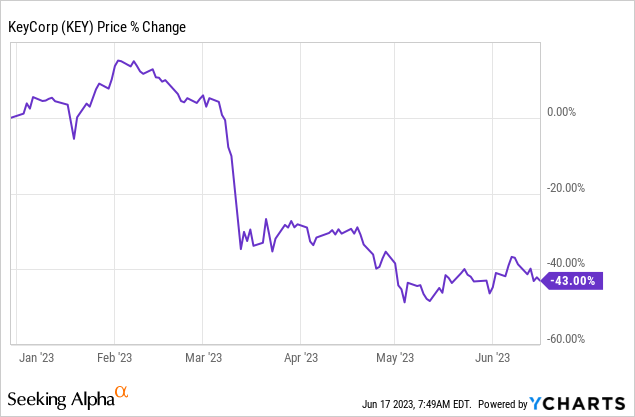

Q1’23 panic sell-off still creates a buying opportunity

I originally bought my first shares of KeyCorp at around $12.60 at the beginning of April… which is when investors were still on edge, and fear and stress levels were extraordinarily high. Since then, shares of KeyCorp have lost approximately 20% of their value.

Although shares are down by about 1/5th, KeyCorp’s strong Q1’23 earnings card, especially regarding its deposit situation, suggests that investors can still find deep value in the regional bank. With shares down 43% since the start of the year and KeyCorp now sporting an enticing 8% dividend yield, I believe KeyCorp continues to represent strong value not only income-oriented investors… in large part because the deposit situation is a lot better than one would think.

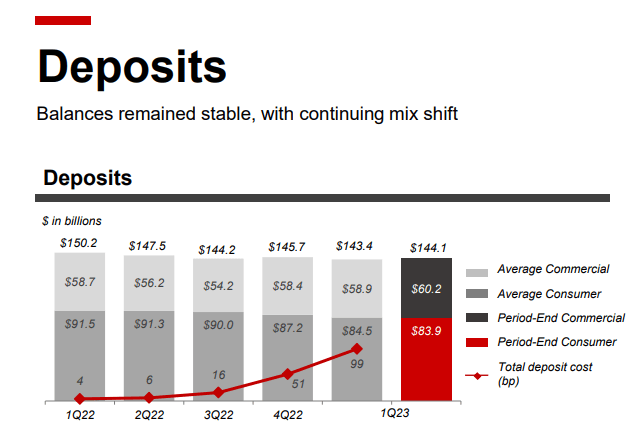

KeyCorp had $145.7B in average deposits at the end of FY 2022 compared to $143.4B in Q1’23, showing a relatively minor decline of 1.6% quarter over quarter. In fact, KeyCorp’s average deposits in the commercial segment increased $500M quarter over quarter to $58.9B in Q1’23. While KeyCorp has seen a deterioration of the deposit environment, just like other regional banks, due to higher interest rates, KeyCorp’s deposit outflows were significantly less than those of other regional banks such as Western Alliance Bancorporation (WAL) or PacWest Bancorp (PACW). These two banks especially have been brutalized by the market due to their exposure to the venture market as well as high percentage of uninsured deposits.

Source: KeyCorp

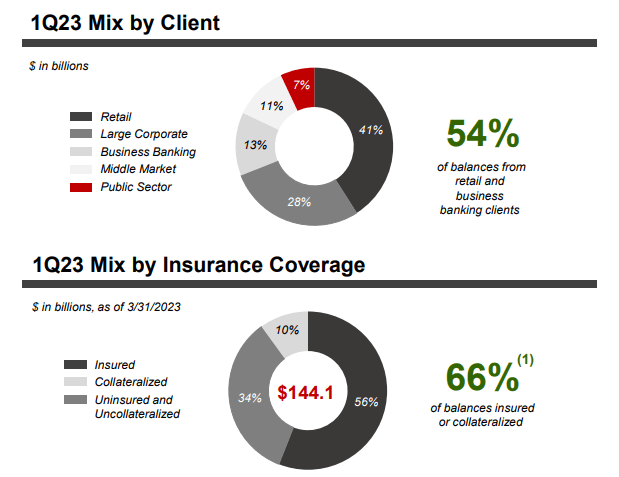

A little more than half of KeyCorp’s deposits come from retail and business clients and approximately 56% of the regional bank’s deposits were insured (meeting the FDIC’s insurance guarantee criteria) at the end of the first-quarter. Adding another 10% in deposits with collateral, insured and collateralized deposits accounted for 66% of total deposits. A total of $49B in deposits were either uninsured or not collateralized in Q1’23, but the bank’s has more than sufficient liquidity to meet all uninsured deposit withdrawal requests.

Source: KeyCorp

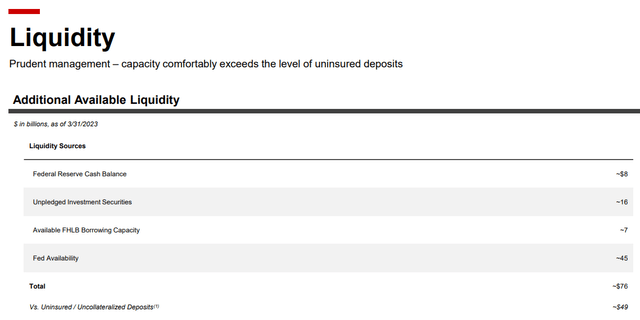

KeyCorp had $76B in liquidity available at the end of the last quarter, the majority ($45B) made available by the Fed. The liquidity-to-uninsured-deposit ratio was 155%, meaning KeyCorp shouldn’t have a problem funding withdrawals even in the case all uninsured deposits were withdrawn at once.

Source: KeyCorp

KeyCorp’s valuation remains depressed, the bank’s 8.2% yield is attractive

KeyCorp is one of the largest banks in the U.S. with total assets of $198B. Despite seeing no major deposit outflows in the first-quarter and having a robust liquidity profile, KeyCorp has not yet recovered from the meltdown of the U.S. financial system in March… which means investors can still buy the bank’s 8.2% dividend yield at a large discount to the bank’s book value.

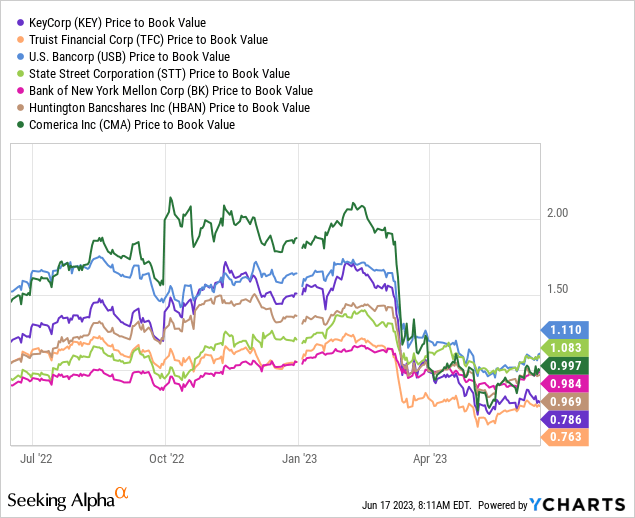

Shares of KeyCorp are priced at a 21% discount to book value. All regional banks in the industry group below have seen huge valuation declines as a result of SVB going out of business. Only Truist Financial (TFC) offers investors a slightly larger discount to book value (24%) than KeyCorp right now and I recently recommended Truist Financial to dividend investors as a buy as well.

Turning to KeyCorp’s dividend.

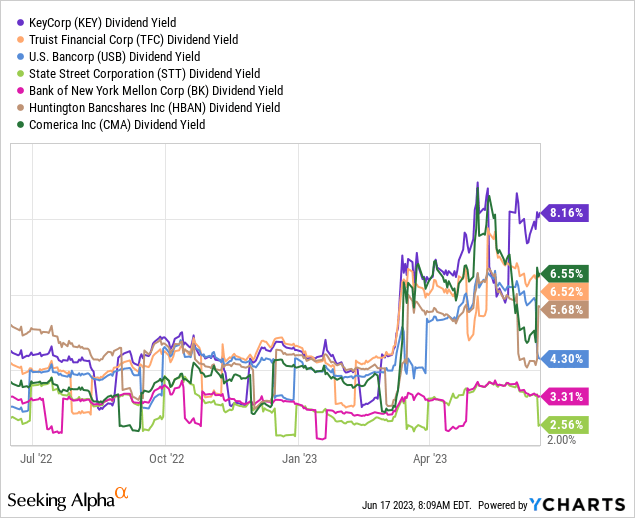

The regional bank raised its dividend 5% just before the financial crisis and currently pays $0.205 per-share quarterly… which calculates to an 8.2% dividend yield. KeyCorp’s dividend yield is by far the highest in the industry group.

Risks with KeyCorp

KeyCorp has not seen major deposit outflows in Q1’23 and attributed the marginal decline of 1.6% Q/Q to clients’ cash sorting efforts due to higher interest rates and a post-pandemic normalization of deposit balances. Slower than expected net interest income growth in a higher-rate world is also a risk factor for KeyCorp. What would change my mind about KeyCorp is if the bank saw deposit outflows (a scenario that I believe is highly unlikely) or was to cut its dividend.

Final thoughts

I believe KeyCorp continues to make an attractive proposition to both income- and non-income oriented investors at this point: KeyCorp offers the highest dividend yield in the industry group and shares currently pay a yield that it twice as high as it was before the financial crisis. The regional banking market has not yet recovered from the March sell-off and, in my opinion, no other sector currently offers as many bargains and dividend opportunities right now. Shares of KeyCorp can be bought for a 21% discount to book value while income-oriented investors can benefit from a very solid 8.2% dividend yield. Since KeyCorp has more than enough liquidity to finance uninsured deposit withdrawals, shares of the regional bank could be set for a major upside revaluation in the second half of the year!

Read the full article here