Fellow Investors,

With all major indices pulling back to begin 2025, KCA similarly suffered a 7% drawdown in Q1. Half of the drawdown was driven by the bankruptcy of Corsa Coal, which was about a 3.5% headwind for the quarter. Despite the failure of Corsa, we were still able to outperform our benchmark (Russell 2000 TR) and the Nasdaq 100 TR.

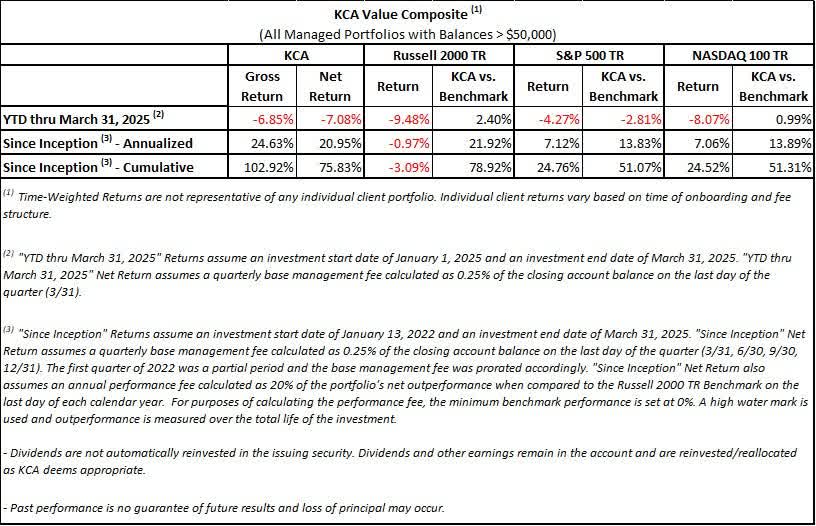

Kingdom Capital Advisors (KCA Value Composite) returned-7.08%(net of fees)in the first quarter, vs. -9.48%for the Russell 2000 TR,-4.27% for the S&P 500 TR, and -8.07% for the NASDAQ 100 TR. As a reminder, returns will vary by account due to rounding, account size, and timing of withdrawals or deposits during the year.

Our top contributors to Q1 returns were Superior Industries (SUP) and Intrepid Potash (IPI). Our largest detractors were Corsa Coal (CRSXF)(OTCQX:CRSXQ), Enviri Corporation (NVRI), and Venator Materials (OTC:VNTRF).

Liberation Day

Q1 was dominated by discussions of tariffs. Investors & international leaders are grappling with Trump’s current administration demonstrating more tariff follow-through than in his first term. With DOGE deployed to reduce the size of the government and Trump seeking to “balance trade,” markets are speculating on the long-term business impacts of these policy changes. The initial market verdict on the levies has been brutal. While macro topics aren’t my favorite, I can’t avoid discussing tariffs in this letter, but I will focus on how they directly impact our holdings.

The most acute pressure point remaining in our portfolio is Superior Industries International (SUP). As expected, they forecasted $160-180m of FY25 EBITDA in their March earnings release, despite anticipated declines in light vehicle production. Tariffs on U.S. autos are unsustainable in their current form. The new levies on Canada, Mexico, China, steel, aluminum, and finished vehicles would drastically raise prices and eliminate automaker profits. Analysis from the firm Wedbush noted this week that moving 10% of the current auto supply chain to the US would take three years and cost over $100B. But what company will undertake even a portion of that move when messaging changes weekly, daily, and hourly? I’m staying with Superior for a few reasons:

-

This administration has been adamant about lowering costs for consumers, which can be accomplished in the auto industry through deregulation and production increases. As they stand, the auto tariffs accomplish the opposite, so I anticipate tariff adjustments, exemptions, etc.

-

The US’s primary geopolitical opponent is China (not Canada or Mexico, I think?), and Superior is well-positioned to take market share as wheel demand moves from China to North America. Mexico was spared any further impacts on “liberation day” and will be a needed partner if we’re going to pull production out of Asia.

-

Protectionism in the EU is killing wheel demand from China (via Morocco), and Superior stands to benefit at their Polish facility.

-

Current tariffs aim to move finished vehicle production to the U.S., not necessarily USMCA-complaint parts. I significantly doubt Superior will face increased competition from suppliers moving inside the US.

If vehicle production drops sharply, Superior will need lender cooperation to amend leverage covenants. Admittedly, continuing to hold this position requires the belief that this administration will not push the auto industry into a multi-year winter. SUP mentioned “advanced negotiations” with TPG to settle their preferred stock on the March earnings call, and I expect this settlement will yield a pleasant surprise for investors. I hope this can be announced in time for Superior to be added to passive indexes on “rank day” (end of April), providing additional flexibility to deal with their debt. The ideal timeline would see Superior settle with TPG, run a sales process, and exit the public markets. Given the employment agreement updates in February, I expect that’s what they’re trying to do.

Our other positions are less sensitive to tariff impacts. Fortunately for Net Lease Office Properties (NLOP), you can’t import suburban office buildings. NLOP is marketing their best asset (on a $/sq ft basis) in Venice Beach, which was announced days before the end of Q1. I expect the Google office to sell for $50m or so, which will be enough to begin distributions to shareholders. NLOP also extended a lease with JP Morgan in Tampa that was previously set to expire, once again extending the runway of assets that were priced with no terminal value. One of the stated goals from recent interviews with Secretary Bessent is to reduce interest rates and deregulate small banks, which we hope will provide the juice NLOP needs to attract new buyers & financing for their remaining buildings.

We love the counter-cyclical exposure of United Natural Foods (UNFI) to grocery trade-down from restaurants. There are two potential tailwinds we believe the market is missing. One is proposed restrictions on SNAP spending on “junk” food, pushing $8B of monthly government assistance towards UNFI’s categories. The other is a looming contract expiration KeHe has with Sprouts Farmers Market, which covers about $2B of annual revenue. UNFI is the backup supplier and could stand to benefit from increased volumes if they can win more of the renewal. Even without these possible catalysts, UNFI is growing volumes and showing their turnaround is gaining steam. As they currently stand, tariffs on food imports and packaging will accelerate food inflation, which is beneficial for UNFI.

In our last letter, we noted Magnera (MAGN) could potentially benefit from tariffs. We were pleased with their February report, after which insiders stepped up and bought shares in the open market, including a $500k purchase from the new CEO. I consider Magnera a well-managed industry leader trading for an attractive valuation in a defensive category, trading for a trough multiple on trough earnings. We were very happy with their rollout as a public company, and we were not alone, as many notable funds have filed ownership of the stock on their latest 13F reports. Of note, we did buy some puts on the XLP ETF tied to this position, as it contains many of Magnera’s end customers. If those businesses weaken, we will have some protection.

Another tariff-exposed position is a.k.a. Brands (AKA), which sources most of their products from China. They issued guidance after initial Chinese tariffs were implemented (20% increase in duties on their products), and they could continue to be vulnerable to trade policy further escalating with China. What isn’t directly subject to trade policy is the continued demand for their trendy products, and even with some headwinds in Australia, they are expecting another year of double-digit US sales growth as they roll out more US stores. Every data feed I’ve checked shows continued acceleration in consumer demand despite fears about consumers at large. We’re planning to visit their flagship store in Vegas this month, so if you see me or Mike sporting some new streetwear in the next few months, you’ll know what happened.

While not an easy decision, we ultimately decided to sell Warrior Met Coal (HCC) during Q1 while we wait for the trade war to die down. China has already directly targeted US coal in their retaliatory tariffs, and with Warrior being 99% export exposed, we think there’s a decent chance met exports get worse before they get better. The US has proposed retaliatory charges on Chinese vessels, in the latest escalation of the direct impacts. Warrior remains the lowest-cost US producer, and we think they weather the storm, and respect how well Management has protected their balance sheet through the development of their new Blue Creek mine. I hope we get a chance to buy back these assets in the future with greater confidence. I think the latest round of tariff announcements will be devastating for the coal industry (as written) and want to wait before adding exposure.

We also reentered Unit Corporation (OTCQX:UNTC), with the price finally dropping back to levels we targeted. This was coupled with a strong increase in natural gas prices, with the curve now fluctuating around the $4 mark. Unit has continued to impress us with their disciplined management of their liquidation, selling forward much of their expected gas production for the year above $4 near the peak of pricing in March. Their drilling rigs continue to generate hefty cash flow, and we estimate the ultimate liquidation value if the business remains around $400m, versus the current ~$200m enterprise value. Tariffs and recession fears have sent oil prices lower, but we’re happy to own a cashed up, sleepy Oklahoma operator with locked-in cash flows.

Other Positioning Updates

Getting zeroed on the Corsa bankruptcy filing was certainly not the start we wanted in 2025. Subsequent court filings have revealed missteps by management and lenders when working to refinance their debt. We were able to attract additional bidders into the auction process who confirmed our belief that the assets had significant potential, but we still fell short of a favorable outcome.

While not that exciting, we have parked cash into two SPACs during Q1, CLBR and OACC. Both trade near cash in trust, limiting their downside, and have some attached optionality. We like having cash exposure with upside in the event the market likes what the SPACs acquire. We expect investors watching Newsmax soar 2,000% after their IPO last week served as a catalyst for people to revisit this space.

A phenomenon like the Newsmax IPO provides a pretty good glimpse of the state of markets in 2025. People are extremely online. Volatility is high. Sometimes at KCA we take advantage of short-term dislocations in stocks, with a couple trades in Q1 that didn’t even last a day. But at a high level, we still think we are best served owning hard assets & businesses trading at a reasonable margin of safety to their intrinsic value. Cash flow doesn’t go out of style. You may have noticed us consolidating the number of positions we owned in Q1. In turbulent times, I think it’s best to keep a smaller number of names in the portfolio that we know best, making it easier to react to rapid news flow.

I remain focused on the small corner of the world where I have influence. Once we have more clarity on trade, I’m excited to pick up other stocks that have been hammered by the uncertainty. But for now, I’m happy to have higher levels of cash to wait it out. While we have generally avoided index-level hedges, we did decide to put some on during the recent phase of volatility. It’s not every day that the President of the US is tweeting videos saying he is intentionally trying to crash the stock market. I don’t pretend to know his end goals, but I am not going to ignore the signals being sent right now about the market at large. I feel good about what we own and feel better knowing we hold some protection against falling indices.

Business Update

We are, as always, extremely grateful to those of you that have referred potential investors to help us grow! While markets are turbulent, we know these are the exact times you all count on us to deliver returns that outperform the broader indices. We continue to publish research online, participate in podcasts, and network with like-minded managers in the quest for our next great investment. Mike and I plan to be in Vegas in a couple weeks for the MicroCapClub/Planet MicroCap combined conference. If you find yourself in the DC or Richmond area, we would love to see you.

Thank you for trusting us to steward your funds wisely. As always, reach out with any questions.

Sincerely,

David Bastian, Chief Investment Officer

|

DISCLOSURES This document is not an offer to invest with Kingdom Capital Advisors, LLC (“KCA” or the “firm”). The statements of the investment objectives are statements of objectives only. They are not projections of expected performance nor guarantees of anticipated investment results. Actual performance and results may vary substantially from the stated objectives. Performance returns are calculated by Morningstar. An investment with the firm involves a high degree of risk and is suitable only for sophisticated investors. Investors should be prepared to suffer losses of their entire investments. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the firm described herein may differ materially from those reflected or contemplated in such forward-looking statements. This document and information contained herein reflects various assumptions, opinions, and projections of Kingdom Capital Advisors, LLC (“Kingdom Capital Advisors” or “KCA”) which is subject to change at any time. KCA does not represent that any opinion or projection will be realized. The analyses, conclusions, and opinions presented in this document are the views of KCA and not those of any third party. The analyses and conclusions of KCA contained in this document are based on publicly available information. KCA recognizes there may be public or non-public information available that could lead others, including the companies discussed herein, to disagree with KCA’s analyses, conclusions, and opinions. Upon request, KCA will furnish a list of all prior securities discussed in our publications within the past twelve months to include the name of each security discussed, the date and nature of each discussion, the market price at that time, the price at which the KCA acted upon the discussion (if at all), and the most recently available market price of each security. Funds managed by KCA may have an investment in the companies discussed in this document. It is possible that KCA may change its opinion regarding the companies at any time for any or no reason. KCA may buy, sell, sell short, cover, change the form of its investment, or completely exit from its investment in the companies at any time for any or no reason. KCA hereby disclaims any duty to provide updates or changes to the analyses contained herein including, without limitation, the manner or type of any KCA investment. Positions reflected in this letter do not represent all of the positions held, purchased, and/or sold, and may represent a small percentage of holdings and/or activity. The S&P 500 TR, Russell 2000 TR, and NASDAQ 100 TR are indices of US equities. They are included for information purposes only and may not be representative of the type of investments made by the firm. The firm’s investments differ materially from these indices. The firm is concentrated in a small number of positions while the indices are diversified. The firm return data provided is unaudited and subject to revision. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws, or any other U.S. or non-U.S. governmental or self-regulatory authority. Any representation to the contrary is unlawful. This information is strictly confidential and may not be reproduced or redistributed in whole or in part. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here