Summary

Readers may find my previous coverage via this link. My previous rating was a hold rating, as I believed Kohl’s Corporation (NYSE:KSS) was undergoing a challenging phase that would cause its near-term performance to be soft. The weak revenue performance and gross margin contraction in 2Q23 were telling signs of weakness. I am revising my buy rating for KSS as I now shift focus to a possible recovery in FY25, wherein I expect KSS to grow in line with historical growth rates and EBITDA margins to expand back to 12%.

Financials/Valuation

KSS 3Q23 net sales declined by 5.2% to $3.84 billion. The decline was mainly driven by a same-store sales [SSS] decline of 5.5%. That said, the retail gross margin saw 38.9%, which was better than I expected as KSS benefited from lower freight costs, digital shipping costs, and its strategy of offering more value products. KSS also reported an EBIT margin of 4.1% or an absolute EBIT figure of $157 million.

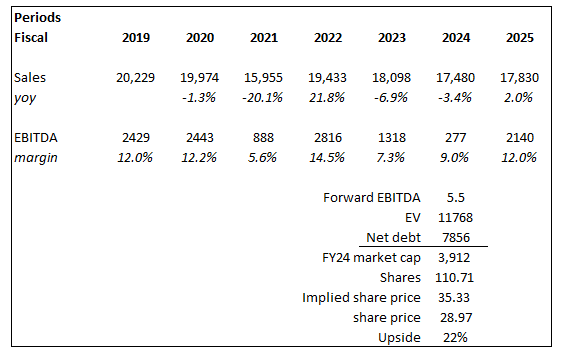

Based on author’s own math

Given the debt level of KSS, I think a forward EBITDA valuation model might be better. Based on my view of the business, KSS should see sales growth trending in a positive direction as it exits FY25. The reason I say this is because KSS will see multiple growth tailwinds in FY24, and as the economy recovers (inflation has come down and rates are expected to be cut in FY24), growth should start to move towards KSS’s historical growth of low single-digits in FY25. Earnings margins should follow a similar trend, improving to 12% in FY25, tracking towards the KSS historical profile. I am not assuming any improvement in forward EBITDA (which KSS is trading at its historical average of 5.5x today), as I am not expecting KSS businesses to perform a lot better than they did historically. KSS is also trading pretty much in line with peers like Dillard’s, Nordstrom, and Macy’s, which on average are trading at 5.2x forward EBITDA and are expected to grow in line with KSS.

Comments

While KSS net sales growth appears to have worsened in 3Q23, making it the 3rd consecutive quarter of accelerating declines, I believe this trend may be nearing its end. In my opinion, 3Q23 performance was not reflective of KSS’s actual business performance as the warmer weather during late September and into October weighed on demand for seasonal products, particularly in stores. Despite this, there were multiple data points released by KSS that suggest emerging recovery strength. In the beauty category, for example, KSS recorded a total growth of over 70% and a growth of over 30% in comparable sales. Notably, this is an increase from 2Q23, which, in my opinion, strongly suggests heightened awareness and shopping frequency. Importantly, the strength wasn’t due to just one product; rather, the whole range—fragrances, skincare, and makeup—supported the strong trend.

The way I see it, KSS is well positioned to see growth acceleration in 4Q23, given that it is a festive season that will likely see more gifting. KSS’s strength in the beauty category fits well into this gifting theme, and management has taken the necessary steps to ensure they can capture a load of demand. When it comes to beauty, Sephora stores are offering a far wider variety of gift sets and are opening 50% more doors than last year. In addition, this year, there is a considerable expansion of the gifting section at the front of stores, and half of the gifting assortment is new. In-store arrangements are specifically set up this way to attract more buyers. There will also be a wider selection in the Home Décor & Impulse category.

Aside from the Beauty and Gifting theme, organically, KSS has also seen improvements in its polished casuals across men’s and women’s. The strength was fueled by KSS’s elevated casual and dressy lines, which have been doing well with important brands like Nine West, Lauren Conrad, Eddie Bauer, and Draper James. For its trendier Juniors category, management is planning to use market brands with shorter lead times compared to private selections. I believe this strategy is a wise one to recover the brand strength, especially with 4Q23 being a festive season, as KSS needs to ensure it has enough SKUs (brands that consumers are familiar with) to capture the festive season demand. On the other hand, there is still more to be done as the overall apparel and footwear assortments continue to underperform. Nonetheless, one by one, management has shown that they can reignite the trend in its categories, and I will continue to monitor progress.

Looking further ahead into FY24, I believe there are visible tailwinds that should drive net sales growth. Taking a step back and looking at the business performance so far (YTD FY23), the weakness in SSS sales (down 4.9%) was largely due to the 500bps comp sales headwind from KSS’s digital sales, which was due to a proactive reduction in online-only promotions and in-store promotions. In essence, the weak SSS sales this year were self-inflicted and do not represent a structural weakness in the business (i.e., as the economy recovers and KSS reinvests in promotion again, sales are likely to recover too). In any case, KSS has swallowed the pain in FY23, and in FY24, these headwinds are not going to be there anymore. Both the digital and in-store promotion-related headwinds will lapse beginning in 1Q24. In FY24, KSS is also going to benefit from the improvements it made in the dressy and elevated casual categories and in its trend-forward juniors category. KSS’s inventory position is also much better today, as it has reduced inventory by 13%. With less inventory on the balance sheet, it gives KSS more flexibility and logistical space to chase trends and quickly react to changes in demand. This should also translate to a better gross margin moving forward, as KSS will not need to offer as much markdown as before.

Risk & conclusion

The effects of a pullback in promotion might be more structural and impactful than I expected. Especially in the current consumer spending climate – consumers leaning towards more value goods – pulling promotion might lead to lesser traffic in the near term. This would impact the timing of growth recovery.

In conclusion, I am upgrading my rating from hold to buy as I shift focus towards a potential recovery in FY25. Despite recent challenges in net sales, indicators of emerging strength in key categories. The December festive season and strategic initiatives should position KSS for growth acceleration in 4Q23. Also, considering the imminent lapsing of promotion-related headwinds in FY24 and favorable tailwinds, I expect sales and margins to recover back to historical levels.

Read the full article here