If a company gambles on leverage, it’ll probably go bankrupt on leverage. – Hendrith Vanlon Smith Jr.

The Direxion Daily S&P Biotech Bull 3x Shares ETF (NYSEARCA:LABU) is a 3x leveraged ETF that strives to yield a daily return three times the performance of the S&P Biotechnology Select Industry Index. It pursues this objective by investing in derivatives, such as futures, options, and swaps, of the companies listed in the benchmark index.

Due to the inherent volatility of the biotech sector and the leveraged nature of the fund, LABU’s performance can fluctuate significantly, making it a high-risk investment. During favorable market conditions, it can achieve substantial gains. However, during unfavorable periods, it can suffer significant losses.

LABU’s Structure and Holdings

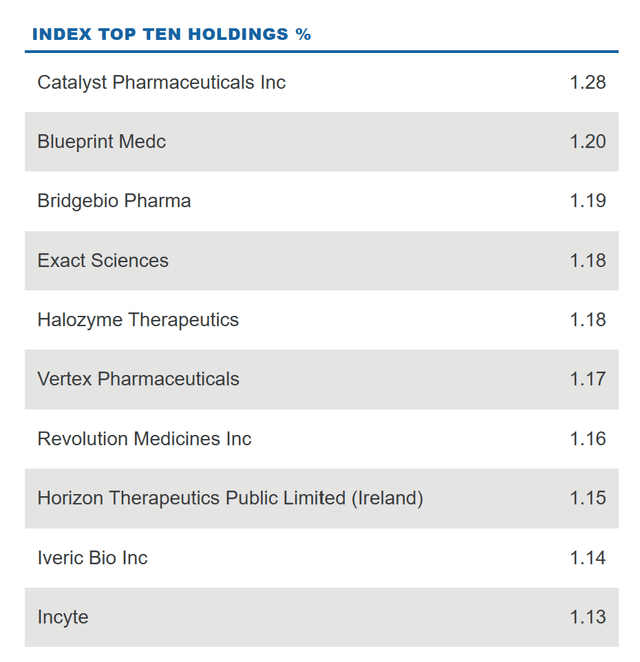

The LABU ETF primarily invests in derivatives, such as futures, options, and swaps, of companies in the biotech and life sciences sectors. It uses the S&P Biotechnology Select Industry Index as its target to magnify daily. Holdings of that index are well diversified, which normally is positive for risk reduction. However idiosyncratic aspects I’d argue for Biotech are higher in general than other sectors and industries of the stock market.

Direxion.com

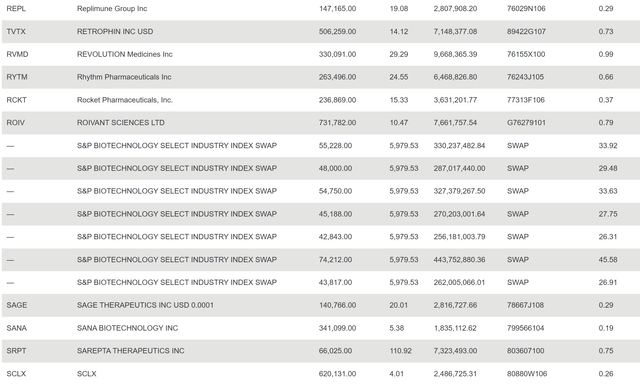

If we look at the holdings of LABU, we see the stock allocations closely match, alongside the added swap exposure for leverage.

Direxion.com

The Volatility of the Biotech Sector

The biotech sector is known for its high volatility. This is due to various factors, including the regulatory environment, the unpredictable nature of drug development, and the sector’s reliance on innovation for growth. As a result, the sector is subject to intense price swings, which can significantly impact leveraged ETFs like LABU.

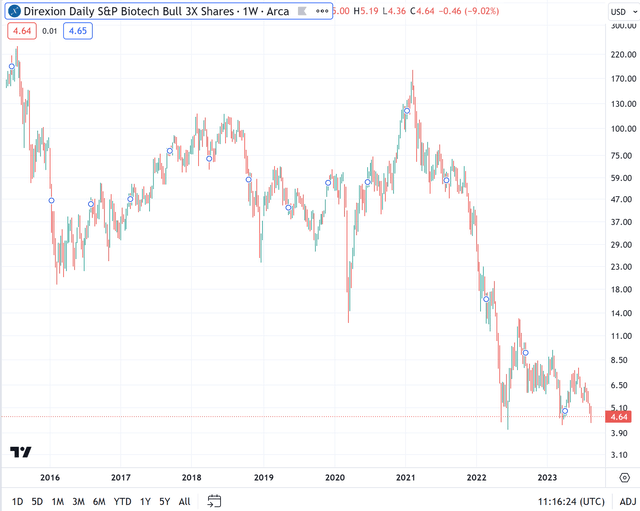

For instance, a single negative clinical trial result or a regulatory setback can cause a biotech company’s stock to plummet. Conversely, a positive development can send the stock soaring. These sudden movements can significantly impact LABU’s performance, as the fund’s value is tied three times to the daily performance of the S&P Biotechnology Select Industry Index. A daily reset leveraged vehicle needs persistent momentum and low volatility to do well. The problem is that the Biotech sector tends to have more spikes rather than streaks in daily trends.

Tradingview.com

The Challenge of Trading LABU

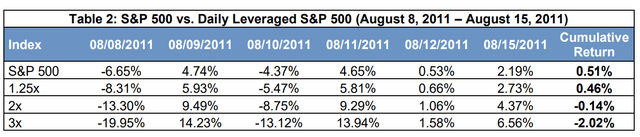

Given the inherent volatility of the biotech sector and the amplified risks of leveraged ETFs, trading LABU in my view is near impossible The fund’s performance is highly dependent on the daily movements of the biotech sector, which can be unpredictable and subject to sudden swings. People significantly underestimate how path dependent leveraged ETFs tend to be. Just because something is in an uptrend doesn’t mean the path couldn’t result in negative returns. 2011 is a good illustration of this as I showed in my research paper Leverage for the Long Run.

Leverage for the Long Run

The Bottom Line

While leveraged ETFs like LABU can offer substantial returns, they also pose significant risks, particularly when trading in the volatile biotech sector. These funds are not suitable for all investors and should be used with caution.

Investors interested in the biotech sector may be better served by non-leveraged ETFs, which can provide exposure to the sector without the amplified risks associated with leverage given how volatility ends up impacting returns over time. Alternatively, investors could consider investing directly in biotech companies, which would allow them to benefit from the sector’s potential growth while avoiding the risks of leveraged trading.

While the potential high returns of LABU can be enticing, investors must be fully aware of the risks involved. Those who are not prepared to actively manage their investments and navigate the volatile biotech sector should consider other investment options.

Keep in mind when it comes to any and every leveraged ETF that a view on the underlying sector/theme matters less than the path and volatility dynamics. Believing in Biotech is a different dynamic than believing in a path of daily returns that benefits a daily reset product with leverage.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here